Vietnam’s energy transition requires industry-wide collaboration: YCP Solidiance

Vietnam’s efforts to drive its renewable energy development are gaining momentum but big challenges are along the way, requiring better collaboration between key players, according to a new report by YCP Solidiance.

Renewable energy is a crucial focus for Vietnam, as the country balances rapid economic growth with reducing its environmental impact, and is seeking to reach carbon neutrality by 2050.

Therefore, the Vietnamese government’s energy policy is at the center of the industry, and major corporations have also incorporated climate change and sustainability into their operations.

The fast-expanding road to net-zero carbon emissions by 2050 is still long and full of challenges, Asia-focused advisory and management consulting firm YCP Solidiance said in its “The Current Energy Transition in Vietnam” 2023 report.

With challenges in the market, the collaboration between key players – both from the government and private sector levels – will be key. “Developers and investors must collaborate closely with central and provincial agencies. And the government must ensure that innovative systems and regulations are geared at stimulating and advancing the growth of sustainable energy sources,” the study said.

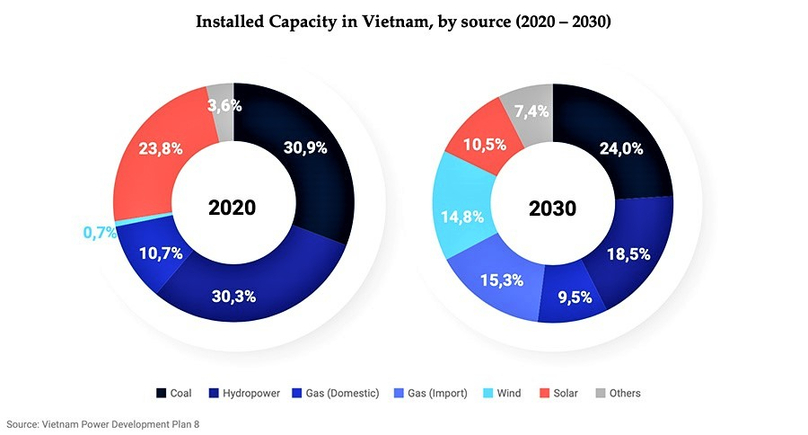

Currently, coal power represents approximately half of all electricity generation in Vietnam, with renewable sources only at 5%. While coal will continue its growth in the near future, all recent drafts of the Power Development Plan 8 (PDP VIII) aim to reduce its percentage share in the energy mix through the growth of renewable sources such as wind and solar, according to the consultancy.

In the draft plan, the use of coal will drop to around 24% in 2030. Notably, YCP Solidiance researchers predicted that wind power will see the largest jump in market share, from hardly non-existent today to 15% by 2030. Meanwhile, solar energy will see its cut drop from 24% to around 10%.

Gas

The consultants also zoomed in on three specific segments of the energy mix: liquefied natural gas, or LNG, wind power, and energy storage, such as pumped hydro and battery storage.

LNG generating capacity is forecasted to reach 39 gigawatts by 2030 and 46 GW by 2045. Wind will by then have hit a generating capacity of 120 GW.

For LNG, Vietnam enjoys a strategic geographical location and a convenient transportation route, with many deep-water ports and existing gas infrastructure systems available for use. Therefore, YCP Solidiance described the rapid short-term growth of LNG as understandable and feasible.

Several LNG power projects are in the advanced stages of development. However, the reliance on imported LNG, and its volatility in price, poses a risk to energy security and project viability, the report said.

American energy corporation AES officially received in-principle approval for its 2.25 GW Son My 2 combined cycle gas turbine power plant in the south-central province of Binh Thuan on February 5, with an investment of $1.8 billion.

Wind

YCP Solidiance said that Vietnam, with a long coastline stretching over 3,200 kilometers and a large range in geography, has the potential for wind generation up to 512 GW – Southeast Asia’s highest.

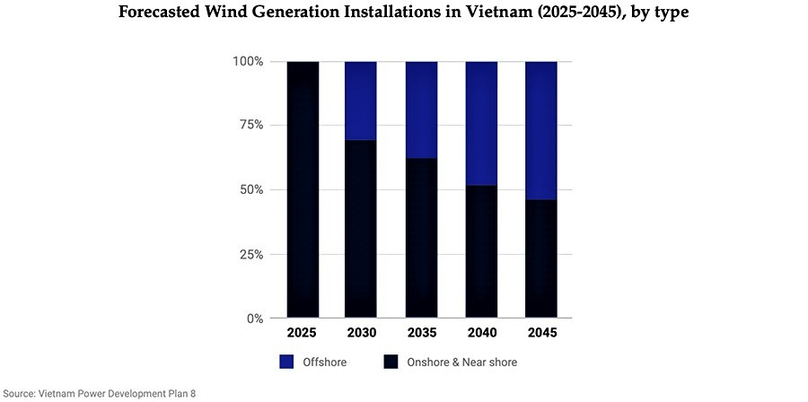

Vietnam has to date no offshore wind installations operating, but it is planned that about 30% of all wind installations will be offshore by 2035 and 54% by 2045.

The report wrote, “Despite higher initial capital requirements, investment costs, and technical complexity, offshore wind offers an opportunity to add large amounts of capacity with a higher level of reliability and stability to the grid compared to solar and onshore wind.”

An operational BIM Group wind farm in Ninh Thuan province, south-central Vietnam. Photo courtesy of BIM.

The provinces of Binh Thuan, Ninh Thuan, Khanh Hoa, Phu Yen, and Binh Dinh on the central coast are forecasted to have the highest offshore wind potential nationwide. Danish fund management company Copenhagen Infrastructure Partners (CIP) and its arm Copenhagen Offshore Partners (COP) are currently investing up to $10.5 billion in developing the 3.5 GW La Gan offshore wind project in Binh Thuan. The project is seen as Vietnam’s largest offshore wind farm.

Earlier this March, the Asian Development Bank and Monsoon Wind Power Company Ltd. signed a $692.55 million non-recourse project financing package to build a 600 MG wind power plant in the Lao provinces of Sekong and Attapeu to export electricity to neighboring Vietnam. Comprising 133 wind turbines, the project will be the largest wind power plant in Southeast Asia and the first in Laos.

Energy storage

Energy storage In Vietnam, pumped hydro and battery technologies are currently the most feasible solutions, the report said. Pumped hydro can connect to solar and wind installations to generate electricity for later use, while battery storage is limited to small-scale or distributed generation settings.

The two sources are forecast to account for around 11% of total renewable energy output in 2045, with energy storage rising more than 5%, said the study. The YCP Solidiance researchers warned that the road to successful energy storage is long. “There are barriers in technology, financial feasibility, procedures for registration, and policy regulation and guidance.”

“There is currently no official regulatory mechanism on energy storage technology. Moreover, the current high investment in energy storage makes it financially infeasible to integrate it into the existing renewable energy projects.”

In the country, VinES Energy Solutions of Vietnam’s largest conglomerate Vingroup and China-based global battery maker Gotion High-Tech started construction of their $275 million battery factory in the central province of Ha Tinh’s Vung Ang Economic Zone last November. The factory is designed to annually produce 30 million lithium iron phosphate (LFP) battery cells, which will be used for EVs and energy storage systems.

VinES in December 2021 started constructing a battery manufacturing and packaging plant also in Vung Ang like the new VinES-Gotion plant. The facility, of VinES’s own, is making lithium batteries for VinFast’s electric cars and buses.

- Read More

Vietnam's Petrosetco estimates 2025 net profit rises 46% to over $12 mln

PetroVietnam General Services Corporation (Petrosetco) expects its net profit to reach VD322 billion ($12.23 million) in 2025, up 46% year-on-year and exceeding the company's full-year target by 32%.

Companies - Mon, December 22, 2025 | 11:50 am GMT+7

Vietnam's 13th Party Central Committee convenes 15th meeting

The 15th meeting of Vietnam's 13th Party Central Committee opened in Hanoi on Monday.

Politics - Mon, December 22, 2025 | 11:13 am GMT+7

Duc Giang Chemical chairman’s family loses $129 mln in a week as shares plunge

Shares of Vietnam’s Duc Giang Chemical Group JSC (DGC) fell sharply last week (December 15-19), wiping nearly VND3.4 trillion ($129.2 million) off the stock-based wealth of the family of chairman Dao Huu Huyen.

Companies - Mon, December 22, 2025 | 6:58 am GMT+7

Vietnam launches International Financial Center, pledges 'special process' to resolve investor hurdles

Vietnam on Sunday announced the establishment of its International Financial Center (IFC), with Prime Minister Pham Minh Chinh pledging to fast-track the resolution of investor difficulties through a “special process”.

Economy - Sun, December 21, 2025 | 9:18 pm GMT+7

The new target for VN-Index is 3,200: Finnish fund PYN Elite

The earnings growth of listed companies in Vietnam will continue to support equity prices in 2026. According to the consensus forecast, a market P/E of 10.0 for 2026 looks very attractive, writes Petri Deryng, portfolio manager at Finnish fund PYN Elite.

Consulting - Sun, December 21, 2025 | 6:33 pm GMT+7

Mastering AI key to Vietnam’s leap beyond middle-income trap: FPT chairman

Mastering and innovating technology is no longer optional but the sole path for Vietnam to escape the middle-income trap and rise alongside global powers, said tech giant FPT Corporation chairman Truong Gia Binh.

Economy - Sun, December 21, 2025 | 2:33 pm GMT+7

Vietnam among world’s top 15 countries by im-export value: ministry

Vietnam’s import-export turnover is expected to reach $920 billion for the first time in 2025, placing the country among the world’s top 15 by trade value, according to the Ministry of Industry and Trade (MoIT).

Economy - Sun, December 21, 2025 | 11:07 am GMT+7

Dung Quat oil refinery operator BSR targets 187% net profit growth in 2026

Binh Son Refining and Petrochemical JSC (HoSE: BSR), operator of Dung Quat - Vietnam’s first oil refinery, expects net profit to surge in 2026, supported by stable oil price assumptions and a major investment plan to expand and upgrade its core refining assets.

Companies - Sun, December 21, 2025 | 8:00 am GMT+7

Dragon Capital-managed VEIL plans trio of 10% tender offers

Vietnam Enterprise Investments Limited (VEIL), the largest foreign-managed equity fund in Vietnam, has announced a tender offer for up to 10% of its issued share capital, with the option to conduct up to two additional tenders over the next year.

Finance - Sat, December 20, 2025 | 11:19 pm GMT+7

Vingroup builds development hubs across multiple sectors

With the groundbreaking and inauguration of 11 large-scale projects on Friday, Vingroup (HoSE: VIC), Vietnam's biggest listed company by market cap, reinforces its role as a pioneering private enterprise in urban development, infrastructure, energy, and industry.

Investing - Sat, December 20, 2025 | 6:32 pm GMT+7

Kinh Bac breaks ground on $437 mln industrial park in northern Vietnam province Thai Nguyen

Kinh Bac City Development Holding Corp (HoSE: KBC) on Friday broke ground on the VND11.5 trillion ($437.06 million) Phu Binh Industrial Park project in Thai Nguyen province.

Industrial real estate - Sat, December 20, 2025 | 5:46 pm GMT+7

Construction giant Fecon starts work on Hanoi metro line, northern Vietnam rail link

Fecon, a leading Vietnamese construction group, on Friday broke ground on two major rail projects: a metro line in Hanoi and a strategic railway linking the capital city with northern localities.

Infrastructure - Sat, December 20, 2025 | 2:08 pm GMT+7

SJ Group to build smart urban area in western Hanoi to bolster Hoa Lac High-tech Park

Vietnam's leading developer SJ Group JSC is outlining plans for its over 1,200-hectare Tien Xuan Smart Urban Area project in Hanoi, which is expected to be a residential and service hub of the Hoa Lac science and technology city.

Real Estate - Sat, December 20, 2025 | 10:36 am GMT+7

Indonesia to deepen role in global semiconductor supply chain

Indonesia is rolling out efforts to identify opportunities and map its natural resources to support the semiconductor industry, as part of a broader strategy to build domestic industrial capacity.

Southeast Asia - Sat, December 20, 2025 | 9:36 am GMT+7

Indonesia to stop rice imports next year

Indonesia will not import rice for either consumption or industrial use next year, citing sufficient domestic production, according to a government official.

Southeast Asia - Sat, December 20, 2025 | 8:00 am GMT+7

Northern Vietnam port city Hai Phong charts sustainable growth path for free trade zone

The establishment of Hai Phong Free Trade Zone (FTZ) is a strategic direction that will elevate the role and position of Vietnam in general and Hai Phong in particular within the global value chain, heard a conference held in the northern port city last week.

Economy - Fri, December 19, 2025 | 8:12 pm GMT+7