No ‘clear evidence’ of Vietnam’s role as trade vehicle for Chinese exports to US: IMF

The International Monetary Fund has said it found no clear evidence of Vietnam’s role as a one-stop trade vehicle in facilitating Chinese exports to the U.S., amid the idea of Vietnam benefiting from trade tensions between the world’s two largest economies.

Hai Phong port in Hai Phong city, northern Vietnam. Photo courtesy of Hai Phong Maritime Port Authority.

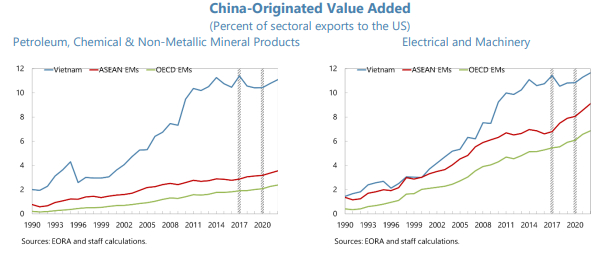

To test whether Vietnam has been used as a one-stop trade vehicle, i.e., imports from China are repackaged and exported to the U.S. without additional domestic value added, the IMF looked at the backward trade linkage with China in Vietnam’s exports to the U.S., i.e., how much China-originated value added is embedded in Vietnam’s exports to the U.S.

If there was a faster-growing share of China-originated value added in Vietnam’s exports to the U.S. compared to its peers, it would indicate some evidence of a trade vehicle role, said the fund in the conclusions on its 2024 Article IV consultation.

Vietnam’s backward trade integration with China preceded 2018. The share of China-originated value added in Vietnam’s total exports to the U.S. has increased at a faster pace than its ASEAN and OECD emerging market peers since 2000.

However, this backward linkage decelerated during 2018-2022, growing slower than its peers, suggesting no clear evidence of Vietnam serving as a trade vehicle. Vietnam has also taken measures to avoid being used to reroute Chinese goods to the U.S. to circumvent trade barriers, the IMF affirmed.

Notably, ASEAN emerging markets except Vietnam saw their backward linkage with China growing faster since 2021.

At the sectoral level, there is limited evidence of trade rerouting through Vietnam in certain strategic sectors, albeit not broad-based. For example, Vietnam saw an accelerated growth of backward linkages with China in petroleum, chemical, and nonmetallic mineral products since 2021 while, instead, a slower growth than ASEAN peers in electrical and machinery products.

Source: Vietnam: 2024 Article IV consultation, IMF.

If Vietnam served as a vehicle country for Chinese exporters to circumvent U.S. tariffs, one would expect similar rising trends in Chinese exports to Vietnam and U.S. imports from Vietnam specifically in strategic sectors affected by tariffs. But sectoral trade flows do not reveal clear evidence of a one-way street.

The fund elaborated that U.S. sourcing of strategic inputs from Vietnam accelerated during 2018-2022 and has stabilized since. The pace of this increase matched the rise in its overall market share in U.S. imports.

But Vietnam’s market share in these strategic sectors has not yet climbed above its overall market share in U.S. imports despite U.S. tariffs on China’s strategic sectors.

Looking at China, the share of Chinese exports to Vietnam in strategic sectors has stabilized since 2020. At the same time, China has increasingly imported strategic goods from Vietnam; its sourcing from Vietnam rose almost threefold from 2% in 2017 to 6% in 2023.

Combining these trends suggests that strategic exports from China to Vietnam cannot merely be attributed to rerouting trade to the U.S, the IMF analysis found.

Instead, China may have been increasingly exporting to Vietnam in strategic sectors as part of Vietnam’s increasing integration into the Chinese supply chain (e.g., China moves production to Vietnam, possibly due to lower labor costs, and imports back for further processing or final demand).

In conclusion, the IMF analysis found that in terms of aggregate and sectoral trade flows, China’s export share to Vietnam and the U.S. import share from Vietnam have increased in lockstep, and so has China’s import share from Vietnam. These trends span also strategic sectors, but only accelerated during 2018-2022, and have ebbed since.

Regarding content of Vietnamese exports, domestic value added in Vietnam’s exports to the U.S. has increased, especially in strategic sectors, while China-originated value added has remained flat in all but some strategic sectors since 2017.

- Read More

Vietnam blockchain firm Hyra partners with AHT Tech to expand AI capabilities

Hyra Holdings, a Vietnam-based blockchain and artificial intelligence company, has entered a strategic partnership with technology services provider AHT Tech, aiming to scale its AI ecosystem while aligning operations with international security and compliance standards.

Companies - Tue, December 16, 2025 | 3:14 pm GMT+7

Vietnam’s first LNG power plants may incur $38 mln loss in 2026: broker

Vietnam’s first LNG-to-power plants, Nhon Trach 3 and Nhon Trach 4, are expected to post a combined loss of VND1 trillion ($37.98 million) in 2026, their first full year of commercial operations, predicted Vietcap Securities.

Energy - Tue, December 16, 2025 | 3:06 pm GMT+7

Many Vietnamese stocks are trading at deeply discounted valuations: brokerage exec

Nguyen Duy Hung, chairman of Vietnam’s leading brokerage SSI Securities, said many stocks on the local market are "trading at very low valuations", as recent gains in the benchmark index have been driven by only a handful of large-cap names.

Finance - Tue, December 16, 2025 | 2:53 pm GMT+7

FPT forms specialized board to build core capabilities with expansion into rail tech

Vietnam's leading technology corporation FPT (HoSE: FPT) has set up a strategic technology steering committee, underscoring its push to master core technologies including rail-related solutions, and build a high-quality talent base to support long-term competitiveness.

Companies - Tue, December 16, 2025 | 2:05 pm GMT+7

Hanoi approves $32.5 bln Red River scenic boulevard project

Hanoi has approved a massive urban redevelopment project along the Red River which would transform the city’s riverbanks into a new ecological, economic and cultural space, local authorities said.

Real Estate - Tue, December 16, 2025 | 9:00 am GMT+7

Hanoi police extradite ‘Mr Hunter’ Le Khac Ngo back to Vietnam

Hanoi police have extradited Le Khac Ngo, known as “Mr Hunter”, from the Philippines to Vietnam, authorities said on Friday.

Society - Tue, December 16, 2025 | 8:00 am GMT+7

Malaysia eyes AI-driven energy future

Malaysia needs to modernize its power systems to build a low-carbon economy that is competitive, inclusive and resilient, said Deputy Prime Minister Datuk Seri Fadillah Yusof at the Global AI, Digital and Green Economy Summit 2025, which opened on Monday.

Southeast Asia - Mon, December 15, 2025 | 11:47 pm GMT+7

Vingroup’s mega project contributes over $1 bln in land-use fees, land lease to HCMC’s 11-month budget

A mega urban project by Vietnam’s leading private conglomerate Vingroup (HoSE: VIC) contributed VND27.36 trillion ($1.04 billion) to Ho Chi Minh City’s budget revenue in the first 11 months of this year, the local government said.

Real Estate - Mon, December 15, 2025 | 5:35 pm GMT+7

Vietnam PM says Long Thanh airport should anchor aviation-led growth

Vietnam must use the Long Thanh International Airport as a hub to develop an aviation economy and ecosystem, creating a new growth pole rather than merely operating an airport, said Prime Minister Pham Minh Chinh.

Economy - Mon, December 15, 2025 | 5:03 pm GMT+7

Vietnam introduces new policy to attract electronics 'eagles'

Vietnam’s Ministry of Science and Technology has issued a circular setting criteria for enterprises engaged in electronics manufacturing projects to qualify for tax incentives, aiming to lure more global electronics giants.

Economy - Mon, December 15, 2025 | 4:24 pm GMT+7

HCMC-based developer Phat Dat unveils six new projects in 2026 amid stock plunge

Phat Dat Real Estate Development Corporation (HoSE: PDR), a major real estate developer in Ho Chi Minh City, has announced plans to launch six new projects in 2026, setting targets of nearly VND44.85 trillion ($1.7 billion) in revenue and over VND11.81 trillion ($448.9 million) in after-tax profit for the 2026-2030 period.

Real Estate - Mon, December 15, 2025 | 2:00 pm GMT+7

Vietnam’s first LNG-fueled power plants inaugurated

Nhon Trach 3 and 4, Vietnam’s first LNG-fired power plants, were inaugurated on Sunday and are scheduled for commercial operations in early 2026.

Energy - Mon, December 15, 2025 | 11:36 am GMT+7

Vingroup to build world-class stadium in Hanoi

Vingroup (HoSE: VIC), Vietnam's biggest listed company by market cap, has proposed building a 135,000-seat stadium at its planned Olympic sports urban area in Hanoi, potentially ranking as the world’s second-largest stadium in terms of capacity.

Real Estate - Mon, December 15, 2025 | 8:00 am GMT+7

Gia Binh International Airport set to become new driver of national growth

Vietnam’s aviation sector is entering a pivotal period as many national infrastructure projects move into accelerated implementation.

Companies - Sun, December 14, 2025 | 7:57 pm GMT+7

Life insurer AIA shows interest in Vietnam’s international financial center

Mark Tucker, independent non-executive chairman of Hong Kong-based life insurer AIA Group, expressed interest in the development of an international financial center (IFC) in Vietnam at a meeting with Deputy Prime Minister Ho Duc Phoc in Hanoi last Friday.

Finance - Sun, December 14, 2025 | 3:00 pm GMT+7

Vietnam at development crossroads as capital market lags: Dragon Capital exec

Vietnam is entering a critical phase of its next development cycle but risks missing a historic opportunity unless it rapidly deepens its capital markets, said an executive at Vietnam-focused asset manager Dragon Capital.

Finance - Sun, December 14, 2025 | 9:32 am GMT+7