Real estate M&A deals hit $1.5 bln in 9 months

Property services company Cushman & Wakefield provides an overview of merger and acquisition (M&A) deals in Vietnam's real estate sector this year as the economy is getting back on track.

The Covid-19 outbreak caused great disruptions to the Vietnamese property market in the year 2020 to 2021. However, production and business activities have since gradually regained growth momentum, and the government's policy to push socio-economic recovery and development has shown positive effects since the beginning of this year.

Cushman & Wakefield estimated that the real estate M&A deals published in the first nine months of the year reached more than $1.5 billion, mainly recorded in the office, industrial, residential and hotel sectors in key cities like Ho Chi Minh City, Hanoi, Binh Duong, and Dong Nai.

M&A deals

Demand for operating office buildings in the city center area is still on the rise. In the first month of 2022, CapitaLand Development successfully transferred the Grade-A office building Capital Place in Hanoi's center for $550 million, setting a new record in transaction value of office buildings in the capital city.

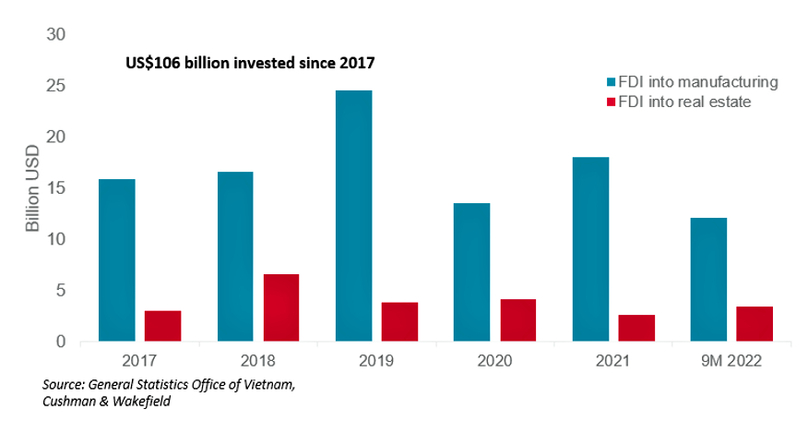

The supply of Grade A and B office space is still limited in HCMC and Hanoi, totaling almost 3 million square meters. Growing FDI inflows have fueled demand for this sector, as office properties which have been put into operation and can generate steady profit streams continue to be the type of asset foreign investors search for.

In the residential sector, Keppel Land signed an agreement to buy 49% shares in three land plots in the Bac An Khanh Urban Area in Hanoi's Hoai Duc district of Phu Long Real Estate Joint Stock Company for about $119 million, to develop a housing project that will include 1,020 apartments and 240 shophouses. Keppel Land also announced that they are conducting divestment in a 30-hectare housing project in HCMC.

Gamuda Land is in the process to buy a 5.6 hectares development land plot in Binh Duong new city, priced at almost $54 million.

The Ascott Limited announced a $9.45 million investment for a 90% stake in the Somerset Central TD Hai Phong City, a serviced apartment project of Thuy Duong Investment JSC, located in Le Hong Phong street, Hai Phong city. Ascott will take control of the development of the 132 serviced apartments in the building.

U.S. investment fund Warburg Pincus announced a $250 million investment into Novaland, in order to increase the land bank and develop Novaland's existing projects in strategic locations, taking advantage of the gradually improved infrastructure in the south.

Two foreign capital investment funds VinaCapital and Dragon Capital announced an investment of $103 million in Hung Thinh Land.

The market also witnessed a transfer deal of the Kenton Node project from Tai Nguyen to Novaland. The project was then renamed Grand Sentosa, with more than 1,640 apartments in HCMC.

Another notable deal is Masterise Homes acquiring Saigon Binh An project; its name was then changed to The Global City with an area of 117 hectares, located within proximity of the Long Thanh-Dau Giay Expressway.

Investors continue to have an optimistic view of the industrial real estate market, with an increase in the number of investors who seek to buy land funds or factories in industrial zones.

In early 2022, GLP announced the establishment of GLP Vietnam Development Partners I with a total investment value of $1.1 billion into six logistics center projects with a total area of up to 900,000 sqm.

Mapletree Investments transferred three logistics projects to Mapletree Logistics Trust for $95.9 million. Logos Property Services and Manulife Financial have invested more than $80 million in a 116,000 sqm logistics project in Dau Giay Industrial Park, Dong Nai province.

BW Industrial revealed the acquisition of approximately 74,000 sqm of land in Bac Tien Phong Industrial Park in Quang Ninh province, developed by DEEP C.

CapitaLand Development disclosed the signing of a memorandum of understanding on investment cooperation with the People's Committee of Bac Giang province for the development of a $1 billion, 400-hectare urban-industrial-logistics project.

Among notable deals is the purchase of six logistics projects by Boustead Singapore from Khai Toan Joint Stock Company in industrial parks in Dong Nai and Bac Ninh, at $84.2 million.

Apart from traditional asset types, in June, an investment transaction into a data center was announced by Gaw Capital Partners, based in Hong Kong. This is a tier-3 data center with an area of 6,056 sqm in the HCMC High Tech Park.

From our observation, a majority of transactions were made by experienced investors who are well-versed in the volatility and demand pattern of the market and continuously look for good profit margins or portfolio expansion in the region.

These deals were in negotiation during the pandemic and achieved agreement in 2022, which explains the surge in recorded deals in the first nine months of the year.

Market slowdown

However, since October, property M&A market activities have slowed down due to recent allegations related to multiple real estate and stock companies, amidst tightened bank credit flow and restrained bond issuance.

This has led to foreign investors taking a more conservative approach, especially institutional investors, financial institutions, and new entrants to the market. Some investors have pressed the 'pause' button to restructure their investment strategy to adapt to the new situation. While these investors are still well-funded, new major investments will be paused for the time being, except for ongoing deals.

The real estate market typically goes through four stages before forming a new cycle. The stages can be described as follows: Recovery, Expansion, Hyper-supply, and Recession.

It seems that Vietnam has had a growth spurt in recent years and is now showing signs of slowing down. But it can also be said that the real estate market is going through a strong purification period to head towards a more sustainable and healthy development.

Skyscrapers in Hanoi. Photo by The Investor/Trong Hieu.

Looking back at a similar period in the previous cycle around March 2008, the market was overheated in 2007, coupled with the impact of the global financial and economic recession, financial and monetary tools seemingly could not be controlled when the lending rate increases continuously, at times up to 25%, and inflation peaked at 23%.

The real estate market fell into a recession cycle and the FDI flow also froze. This capital inflow started to recover in late 2013 and early 2014. And since then, buyers have had access to more affordable credit, low inflation, and high economic growth that contributed to Vietnam’s ranking as one of the fastest-growing economies in the ASEAN region.

Real estate is cycle-based, and every cycle will have its waves. Like the repeating seasons, real estate moves in patterns that you can observe and predict. One who understands this model will be able to seize the opportunities available in each period. It must be noted, just like nature, the real estate cycles can sometimes become unstable, as influenced by domestic and international macroeconomic factors. The real challenge for investors is how to succeed in a market that moves at its own pace.

However, there are grounds to believe that real estate investment capital flows will improve in the last months of 2022, thanks to a series of related reforms in management policy, notably Decree No. 65/2022/ND-CP which allows enterprises to issue bonds to implement investment programs and projects, and to restructure their own debts.

Looking back over the past 32 years, Vietnam has gone through four cycles of market development, and many have started to question what the future of the real estate market will look like.

At a property market forum conducted by Cushman & Wakefield in October, most experts were optimistic that the property market would continue to stay strong, and the reforms of regulations for real estate from the government are needed to position Vietnam as a major economy full of potential.

- Read More

Vietnam's garment giant Vinatex posts second-highest profit in 30 years despite trade headwinds

Vietnam National Textile and Garment Group (Vinatex), the country's top garment maker, expects consolidated profit to reach VND1,355 billion ($51.5 million) in 2025, the second-highest result in its 30-year history, despite mounting global trade and cost pressures on the industry.

Companies - Wed, December 24, 2025 | 5:03 pm GMT+7

Finding a new balance

The State Bank of Vietnam's proactive and flexible monetary policy in 2026 is expected to maintain market operations within a stable range. For businesses, particularly those in the external sector, it remains essential to proactively hedge against exchange rate and interest rate risks to protect their bottom line, writes Vu Binh Minh, associate director, FX Trading, MSS, HSBC Vietnam.

Consulting - Wed, December 24, 2025 | 4:47 pm GMT+7

Thai giant Central Retail sells Vietnam electronics business to Pico for $36 mln

Thailand’s Central Retail has announced the sale of its Vietnamese electronics retail business to local retailer Pico Holdings JSC for nearly THB1.14 billion ($36 million), as it sharpens its focus on core businesses in the country.

Companies - Wed, December 24, 2025 | 2:00 pm GMT+7

What should investors reasonably expect from IPO stocks?

Experience from both Vietnam and global markets shows that initial public offering (IPO) stocks rarely deliver immediate gains. However, investors who select companies with solid fundamentals and maintain a long-term holding strategy can be rewarded for their patience.

Finance - Wed, December 24, 2025 | 10:45 am GMT+7

Vingroup completes $325 mln overseas bond issuance

Vingroup, Vietnam's biggest listed company by market capitalization, has completed its international issuance of bonds totaling $325 million, with a 5-year maturity, and listed on Austria's Vienna Stock Exchange.

Finance - Wed, December 24, 2025 | 10:17 am GMT+7

Vietnam's public investment-linked stocks seen benefiting in 2026

Capital flows in 2026 are expected to favor sectors that stand to benefit from Vietnam’s public investment drive, including infrastructure, energy, and construction, market experts said.

Finance - Wed, December 24, 2025 | 9:33 am GMT+7

High gold prices to drive prices of property, goods in Vietnam: Sunhouse chairman

In a scenario where gold prices remain elevated in Vietnam, the real estate market is likely to follow suit, pushing income levels higher and driving up prices across other goods, said Nguyen Xuan Phu, chairman of Sunhouse, a leading home appliance manufacturer, while outlining his 2026-2030 forecast.

Economy - Wed, December 24, 2025 | 8:00 am GMT+7

Malaysia’s economy grows robustly in 2025: IMF

Malaysia has shown notable resilience amid global trade tensions and policy uncertainty, with its economy growing at a healthy pace this year, supported by strong domestic consumption and investment, solid employment growth, and a global upcycle in the technology sector, according to Masahiro Nozaki, Mission Chief for Malaysia at the International Monetary Fund (IMF).

Southeast Asia - Tue, December 23, 2025 | 10:07 pm GMT+7

Indonesia to stop rice imports next year

Indonesia will not import rice for either consumption or industrial use next year, citing sufficient domestic production, according to a government official.

Southeast Asia - Tue, December 23, 2025 | 10:04 pm GMT+7

Indonesia faces challenge of balancing wages, labor costs

Indonesia plans to raise minimum wages by about 5-7% in 2026 under a new formula signed into law by President Prabowo Subianto, a move that could test the country’s cost competitiveness in Southeast Asia.

Southeast Asia - Tue, December 23, 2025 | 10:00 pm GMT+7

Philippines extends sugar import ban

The Philippine Government has decided to extend its ban on sugar imports until the end of December 2026, as domestic supply has improved.

Southeast Asia - Tue, December 23, 2025 | 9:56 pm GMT+7

Duc Giang Chemical stock comes under heavy selling pressure as bottom-fishing shares return

DGC shares of Duc Giang Chemical Group JSC (DGC) closed Tuesday at VND71,600 apiece, down 4% from Monday which saw a 6.27% increase after four sessions of sharp declines last week.

Companies - Tue, December 23, 2025 | 9:49 pm GMT+7

Hanoi clears zoning for major mall project after Aeon exit, Thaco arm steps in

Hanoi authorities have approved a detailed zoning plan for an 8.03-hectare mixed-use site in Hoang Mai district, paving the way for a shopping mall-led development after Japan’s Aeon withdrew and a unit of Vietnam’s Thaco Group moved in.

Real Estate - Tue, December 23, 2025 | 5:05 pm GMT+7

Viettel Commerce partners with China’s Dreame Technology to expand home appliance ecosystem in Vietnam

Viettel Commerce and Import-Export Co. Ltd., one of the core pillars in trade and logistics of the military-run telecom giant Viettel, has signed a strategic cooperation agreement with China-based Dreame Technology, a global high-end technology brand, in Hanoi.

Companies - Tue, December 23, 2025 | 3:38 pm GMT+7

Former LPBank chairman becomes acting Sacombank CEO

Former chairman of Vietnamese private lender LPBank Nguyen Duc Thuy on Tuesday assumed the role of acting CEO at Sacombank, immediately after completing the handover at LPBank.

Banking - Tue, December 23, 2025 | 3:30 pm GMT+7

Workforce shortages accelerate global demand for integrated facility management

Labor shortages and rising expectations for operational performance are prompting many businesses to reassess traditional management models, write Savills Vietnam analysts.

Consulting - Tue, December 23, 2025 | 3:00 pm GMT+7