Real estate sector has key role in making Vietnamese cities more liveable

As urbanization proceeds at a scorching pace in Vietnam, liveability in Vietnamese cities has become a matter of concern that real estate firms should help address. They should work with various stakeholders towards more thoughtful decisions to create more vibrant and purposeful urban spaces, write analysts with consultancy firm Avison Young Vietnam.

Avison Young Vietnam CEO David Jackson

Ties with a market or a region greatly impact the interest of city residents in supporting, developing or reimagining their surroundings for further growth and improvement.

For people to come, stay, or even return to a city, it must provide them with direct and indirect values, of which the highest one is improved quality of life. A liveable city meets the collective needs, desires and interests of personal development (including job opportunities), income, safety, health and well-being. In so doing, it engenders positive emotions and connections – a sense of belonging that inspires residents to support the larger community in the long term.

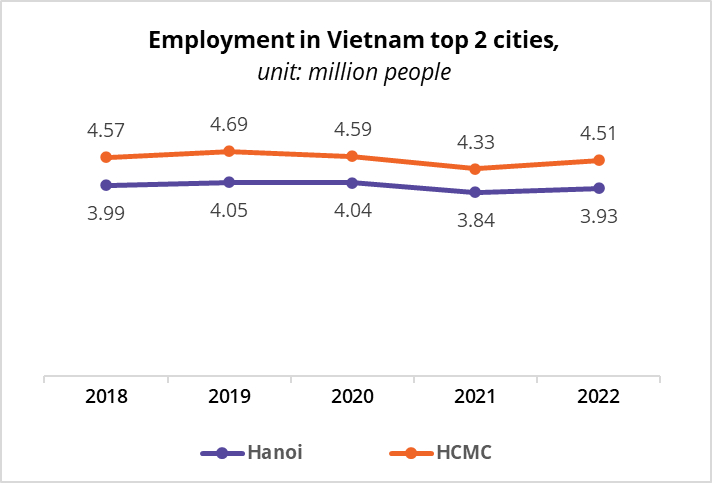

Ho Chi Minh City was recently ranked the top residence of choice for Vietnamese people (PAPI 2023, UNDP), making it the most liveable city in the country, in a sense. The city has long been one of the most popular destinations for internal migration, a key economic hub that attracts generations from across the country. Among the top reasons for this are abundant career opportunities, better public services and less natural disasters.

Ho Chi Minh City and Hanoi are two cities that offer the highest number of job opportunities in Vietnam. Source: Statistical Yearbook of Vietnam 2022.

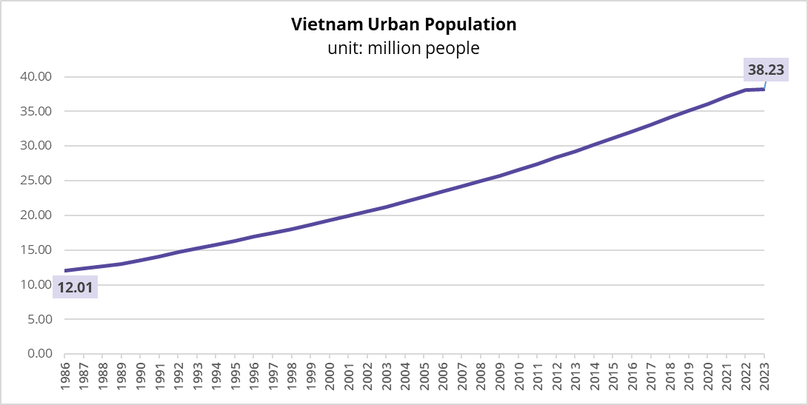

The tremendous growth of HCMC reflects the bigger picture of economic development in Vietnam since 1990s. In just a few decades, Vietnam has witnessed a massive acceleration of urbanization. More and more people are moving to cities and by the end of 2023 almost 40% of the country’s population of more than 100.3 million people were urban residents. It has been estimated that by 2030, over 45% of the country's population will live in cities.

While people’s quality of life has improved significantly, the surge in urban population is exerting a lot of pressure on municipal administrations and impacting the liveability of major cities.

Source: World Bank, General Statistics Office of Vietnam.

The city’s population had topped 9 million by end-2023 and is estimated to exceed 16.8 million by 2040 by municipal authorities. This growth has given rise to multiple challenges including housing shortages, traffic congestion, pollution, overcrowded public schools, overloaded medical clinics and hospitals as well as a lack of public recreational spaces and green areas

HCMC is not the only city that’s expanding rapidly and facing attendant challenges. Many cities around the world are in the same boat.

Egypt’s Greater Cairo Region, for example, saw its population reach more than 22 million last year from just circa 6 million residents in 1965 (JICA, 2008). This is predicted to double by 2050. Overpopulated Cairo has been mentioned as an uncomfortable city where residents living with a constant feeling of stress and struggle to complete any task, no matter how small.

In China, the proportion of urban population has exploded from about 19.39% in 1980 to nearly 66.16% in 2023. Air and water pollution are among common problems faced by almost all metropolitan areas in the country

Inevitable challenges

Despite all the problems, urbanization is inevitable and it is estimated that by 2030, over 60% of the world population will be living in cities. This phenomenon will be accompanied by developments that create liveability challenges, including infrastructure deficits, over-stretched public services, environmental degradation, increased vulnerabilities to disasters and climate change, unequal access and affordability.

The myriad of problems has generated calls for the revitalization of cities across the globe towards making them more engaging, inclusive and liveable. One way to do this is making “social value creation” a priority.

"When a city is built for the stakeholders it serves, it will attract various residents and visitors – all critical for a successful economy. And in advancing this approach, real estate firms can play an active role," said David Jackson, principal and CEO of Avison Young Vietnam.

Real estate is a crucial connector between the development of a city and the health and wealth of its people. When looking at the role of real estate firms in liveable cities through the ‘social value’ lens, we can determine what ‘good’ looks like for the unique demographic that lives within a set region, shaping the landscape of the city around collective wants, needs and desires.

This often expands beyond the capital value of real estate assets and includes support, services, and meaningful cultural infrastructure that not only meet needs but also generate emotional connections for residents.

“Because it is the people who drive the economic recovery and development of cities. For people to develop strong bonds with a place and become a part of the community, there needs to be reasons for them to feel inspired,” said Jackson.

My Dinh-Me Tri urban complex developed by SJ Group in Hanoi. Photo courtesy of SJ Group,

How it works

Experiences from cities like major cities around the world, like Seattle, New York, Vancouver, Bristol and London show how the real estate sector can play a more active role in creating spaces for community engagement, contributing thereby to the liveability of cities.

Activating ‘in-between spaces’

Given limited urban land and space, smart and practical ways have to be found to utilize space across the built environment. Activating the “in-between spaces”, or transitional spaces such as entrances, lobbies and courtyards helps connect the public realm to the often private or exclusionary environment within buildings. This activation creates new user experiences and opportunities for more community interaction.

Open courtyards within private residential developments and pedestrianized alleyways offer examples of functional in-between spaces. Courtyards can house social infrastructure such as seating areas and playgrounds, creating spaces for both residents and community members to interact.

At HopeWorks Station near Seattle (Washington state), a public inner courtyard provides outdoor seating and recreation space forthe development’s 65 affordable housing units as well as the surrounding community.

In Vancouver (Canada), Alley Oop serves as a reimagined laneway – or alleyway – with cafe seating, local artwork and a community basketball hoop. Alley Oop’s design was derived from a community engagement process that highlighted the need for recreational space in downtown Vancouver.

Temporary interventions

Temporary interventions can be utilized to introduce urban activity and influence permanent solutions. These serve as test runs to find out if an approach will fit the needs of stakeholders and prove cohesive.

In New York city, an Open Restaurant program introduced to provide expanded permits for outdoor dining during the pandemic laid the groundwork for a permanent initiative.

The success of outdoor dining and continued demand for permits motivated Mayor Eric Adams to introduce the Dining Out NYC program and permanently change the fabric of the city’s public realm.

Self-proliferating ecosystem

Providing opportunities for local businesses and SMEs fosters economic diversity and resilience. These opportunities could take various shapes including retail spaces of various sizes, flexible offices and affordable workplaces. Incubators for entrepreneurs nurture innovation and creativity within the local economy. Engine Shed at Bristol Temple Meads (UK) is an innovation hub that provides workspace, business support, and professional development opportunities for entrepreneurs.

Rents in city centres are unaffordable for small businesses and facilitating their work can help maintain diversity and authenticity of the urban core. In 2021, the Greater London Authority introduced the expectation that all London boroughs incorporate affordable workspace policies into their development plans. In response, boroughs are taking different approaches to creating such spaces with several introducing a requirement for developments over a certain size to provide a proportion below market rents.

In 2022, there was 7,144 sqm of operational workspace with an estimated further delivery of 3,258 sqm. One affordable co-working space, SPACE4 (London, UK), reported over 100 regular users. Maintaining the affordability of workspaces is important not only for economic growth but, for economic diversification and local job creation as smaller local businesses often spend more in the local supply chain and employ locally.

Revitalizing cities and making them more liveable through a social value lens and designing solutions around the needs and interests of people will improve the performance of all commercial assets. Social value creation is a collective effort, and it is challenging, but it will pay off in the long run.

"For private developers, diversification and revitalization for real estate are harder to achieve than just profit goals. A change in strategy means a change in how resources are allocated – whether it is space, money, time or people. However, each real estate decision should be seen as an opportunity to lead towards values that improve cities and communities, as also their liveability," said Jackson.

- Read More

Vietnam’s 11-month FDI disbursement highest in 5 years

Vietnam recorded $23.6 billion in implemented foreign direct investment (FDI) capital in the first 11 months of the year, up 8.9% year-on-year and marking a 5-year record high.

Economy - Sun, December 7, 2025 | 12:25 pm GMT+7

Vietnam's State Capital Investment Corp subsidiary to sell entire Vinamilk stake

SCIC Investment Co. Ltd (SIC), a subsidiary of Vietnam’s State Capital Investment Corporation (SCIC), has registered to sell its entire holding in Vinamilk (HoSE: VNM), the country's leading dairy producer.

Companies - Sun, December 7, 2025 | 9:00 am GMT+7

Vietnam's agri major Hoang Anh Gia Lai returns to property sector with $22.5 mln complex project

Hoang Anh Gia Lai (HAGL), chaired by entrepreneur Doan Nguyen Duc, is re-entering the real estate sector with a high-rise trade and residential complex worth over VND591.7 billion ($22.45 million) in Gia Lai province, central Vietnam.

Real Estate - Sun, December 7, 2025 | 8:00 am GMT+7

ThaiBev urged to participate more deeply in Vietnam's sustainable value chains

ThaiBev, the largest beverage maker in Thailand, should engage more deeply in the sustainable value chains in Vietnam instead of merely considering the country a consumption market, said Minister of Industry and Trade Nguyen Hong Dien.

Industries - Sat, December 6, 2025 | 4:13 pm GMT+7

Thaco inks deal with Hyundai Rotem to make locomotives, carriages for urban metro, high-speed railway projects

Vietnamese conglomerate Thaco has signed a strategic cooperation agreement with South Korea’s Hyundai Rotem to localize the production of locomotives and carriages for urban metro and high-speed railway projects.

Industries - Sat, December 6, 2025 | 3:53 pm GMT+7

France’s Biocodex signs strategic partnership with Vietnam pharmacy chain Pharmacity

French pharmaceutical group Biocodex has signed a strategic partnership with foreign-invested drugstore chain Pharmacity, located across Vietnam, to expand distribution of its health products in the Southeast Asian country.

Companies - Sat, December 6, 2025 | 3:28 pm GMT+7

KraneShares lists Vietnam stock-focused ETF on New York Stock Exchange

KraneShares, a leading global asset manager, has listed its newly-launched KraneShares Dragon Capital Vietnam Growth Index ETF (Ticker: KPHO) on the New York Stock Exchange, the firm said in a release on Thursday.

Finance - Sat, December 6, 2025 | 12:18 pm GMT+7

Dragon Capital's fund manager DCVFM to register over 31 mln shares on UpCoM

Dragon Capital Vietfund Management JSC (DCVFM), a subsidiary of Vietnam-focused asset manager Dragon Capital Group, plans to register all 31.2 million outstanding shares on the unlisted public companies market (UPCoM).

Finance - Sat, December 6, 2025 | 9:08 am GMT+7

HCMC to commence 5 flagship infrastructure projects

Ho Chi Minh City, the country’s southern economic hub, is preparing to kick off five landmark projects between December 2025 and January 2026 as part of celebrations for the 14th National Party Congress, according to the municipal People’s Committee.

Infrastructure - Sat, December 6, 2025 | 8:59 am GMT+7

Vietnam’s market status upgrade to boost bank stocks as foreign inflows rise

Vietnam’s reclassification to "secondary emerging" market status is expected to attract billions of U.S. dollars from global passive and active funds, raising expectations that banking stocks, which dominate market capitalization and liquidity, will be among the first beneficiaries.

Finance - Fri, December 5, 2025 | 9:20 pm GMT+7

Notification: Shares issuance to pay dividend

The board of directors of Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank) announced the issuance of shares to pay dividends from the remaining profits of 2021, 2022, and the 2009-2016 period.

Companies - Fri, December 5, 2025 | 8:38 pm GMT+7

Japan's Asahi Life to acquire Hanoi-based MVI Life for estimated $194 mln

Japanese life insurer Asahi Life has reached a deal to acquire Vietnamese counterpart MVI Life, expanding its presence in the Southeast Asian country as a new life insurer.

Finance - Fri, December 5, 2025 | 8:31 pm GMT+7

Vingroup proposes $3.96 bln sea-crossing bridge-road project linking HCMC's Can Gio with Vung Tau

Vingroup, Vietnam's biggest listed company by market capitalization, has submitted a document asking Ho Chi Minh City authorities to appraise its pre-feasibility study for a sea-crossing bridge-road project connecting Can Gio and Vung Tau.

Infrastructure - Fri, December 5, 2025 | 3:03 pm GMT+7

Galvanized steel major Ton Dong A files for HCMC bourse listing

Ho Chi Minh City Stock Exchange (HoSE) has received an application from Ton Dong A, a leading galvanized steel manufacturer in Vietnam, to list 149 million shares (code: GDA), with a par-value-based listing value of VND1.49 trillion ($56.55 million).

Companies - Fri, December 5, 2025 | 1:41 pm GMT+7

Japan’s Kokuyo to acquire Vietnam's leading stationery maker Thien Long for $178 mln

Japan’s Kokuyo has announced a plan to acquire Vietnam's major stationery manufacturer Thien Long Group (HoSE: TLG) for up to JPY27.6 billion ($178.2 million), as the Japanese office-supplies giant expands its footprint in Southeast Asia.

Companies - Fri, December 5, 2025 | 1:02 pm GMT+7

Billions of new Big 4 bank shares set to hit Vietnam market as government pushes for capital hikes

Vietnam’s Big 4 banks which are state-controlled, including Vietcombank, VietinBank, BIDV, and Agribank, are preparing to issue tens of billions of new shares as stock dividends, following a government directive to accelerate charter-capital expansion.

Banking - Fri, December 5, 2025 | 12:56 pm GMT+7

- Travel

-

Vietnam's tour operator Vietravel announces full exit from Vietravel Airlines

-

Impressive Standard Chartered Hanoi Marathon Heritage Race 2025

-

Nguyen Hong Hai wins 'Investors' golden heart' golf tournament 2025

-

140 players compete at “Investors’ golden heart” golf tournament

-

‘Investors’ golden heart’ golf tournament to tee off on Saturday

-

Vietnam, Hong Kong Aircraft Engineering sign deal on aircraft maintenance hub at northern airport