Vietnam real estate 2024: a year in review

As positive signals become more evident, now is the time to restart capital flows into real estate transactions in Vietnam and embrace the new growth cycle, write Avison Young Vietnam analysts.

A corner of Nha Be district, Ho Chi Minh City, southern Vietnam. Photo courtesy of Thanh Nien (Young People) newspaper.

Globally, 2024 marks a year of significant changes: over 50 countries held elections, Fed cut rates, and Donald Trump won the presidency the second time.

In Vietnam, August 1 became a landmark date as three real estate-related laws took effect, four months earlier than planned. While market activity seemed sluggish, the underway shifts in macro-economy and geo-politics would have a profound impact on the real estate market in the coming time.

Below are five key trends shaping the Vietnam’s real estate market in 2024.

Residential segment on recovery track amid supply imbalances

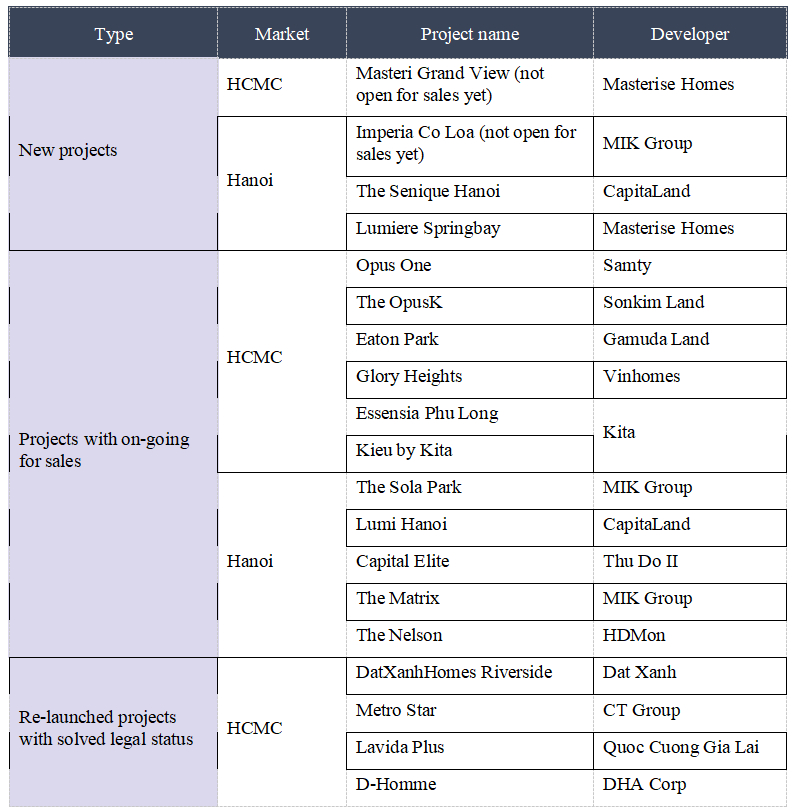

In 2024, the housing market performed better than last year, driven by new apartment supply in the second half of the year, mainly high-end properties.

In Ho Chi Minh City, most new developments were from high-end segment onwards, prices reached VND72-142 million ($2,830-5,590) per square meters. Property prices of re-launched projects also went up.

In Hanoi, housing prices surged in early 2024 and continued rising throughout the year. Units priced at VND70 million/sqm became more common in Q3, and primary prices rose by 2-4% quarter-on-quarter in Q4.

Some projects introduced and open for sales in HCMC and Hanoi at year-end.

Supply in the mid-range segment continued to be limited in both HCMC and Hanoi. Apartments at affordable prices of below VND38 million ($1,500)/sqm nearly disappeared.

As prices kept going up, the housing market moved further away from intrinsic value and posed liquidity risks. The gap between market offerings and homebuyers’ needs and affordability was widening.

Meanwhile, obstacles remained in developing reasonable-priced housing. Policies and credit incentives for social housing were insufficient, while investment, leasing and purchasing processes remained complex.

Yet, there are opportunities for a more balanced market. Building more budget-friendly commercial projects and social housing in suburban or new urban areas with ample undeveloped land banks and lower development costs offers a solution to sustainable growth. Following this trend, some affordable projects have been launched recently in HCMC's Binh Chanh district, Binh Duong province, and Dong Nai province.

New land banks for residential development will soon be available as HCMC aims to build 11 TOD compact urban areas and auction 22 land plots around metro stations. For developers, rising capital costs create a new “puzzle” where securing the land plots and balancing costs, prices, and product segmentation are critical to ensuring liquidity and operational efficiency.

New opportunities arising in industrial real estate

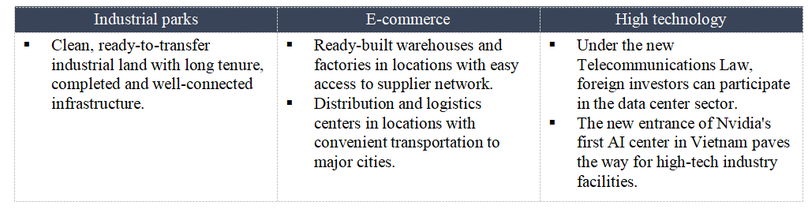

The industrial real estate segment remained the market’s top performer in 2024, with rising rents, growing supply, and high occupancy rates. This growth was primarily driven by FDI in manufacturing, fueled by supply chain diversification and the China+1 strategy.

In major and tier-1 markets, industrial land rents increased by 2-5% per quarter. New supply was expected to increase as numerous industrial park projects received licenses or began construction nationwide. Industrial and logistics (I&L) properties continued to attract significant interest from foreign investors, leading real estate transactions in Vietnam throughout 2024.

In the short term, the economic, trade, and geopolitical fluctuations associated with Donald Trump’s new policies may temporarily affect foreign investment and exports. However, due to its strategic location, relative political stability, competitive costs, and improving investment environments, Vietnam still has potential to become the next global manufacturing hub if seizing this opportunity.

Demand is expected to grow in these types of industrial property:

More completed legal framework in real estate, strengthened market sentiment

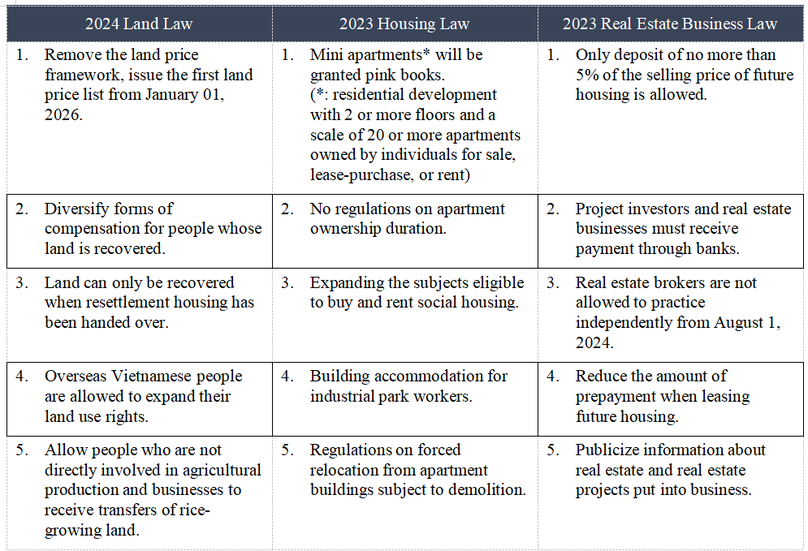

2024 marked a turning point for Vietnam’s legal system with the implementation of the 2024 Land Law, the 2023 Housing Law, and the 2023 Real Estate Business Law. These changes and adjustments were widely praised for their transparency, clarity, and fairness, encouraging professionalism in brokerage and transactions, and laying a sound foundation for a more sustainable real estate market.

The new laws addressed four key matters:

1. Transactions covering various real estate types and products, including completed works and off-the-plan projects.

2. Requirements on incorporation, financial capabilities and the obtainment of Land Use Rights Certificate for various investors and developers.

3. Requirements on contract and planning in the purchase and sale of Land Use Rights.

4. Eligibility and conditions for transferring real estate projects.

Some notable new points include:

However, businesses, investors, and people are looking for more detailed guidance on implementing these laws to fully realize the law’s potential.

Irreversible sustainability trend, ESG criteria shaping new projects

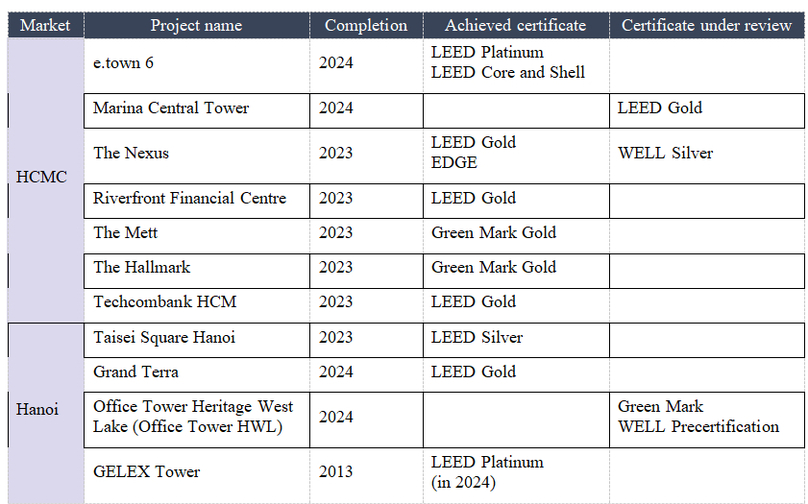

Over the past few years, most new office buildings in HCMC and Hanoi aimed for green certifications. Not only increasing in quantity, green offices were also expanding geographically. In HCMC, green offices are expected to develop in adjacent, vibrant and fast-growing areas such as District 4, District 7, Tan Binh district and Thu Duc city.

New office buildings with green certifications in HCMC and Hanoi in the past 2 years.

Industrial real estate has also been embracing sustainability. Notable green-certified projects recently included Hitachi Energy’s transformers factory in Bac Ninh (achieved LEED Gold), Mitsubishi Estate Group's Logicross Hai Phong ready-buit warehouse (aiming for EDGE Advanced certified) and the Lego Vietnam factory in Binh Duong (aiming for LEED Gold for the manufacturing plant, and LEED platinum for the office).

Developers such as BW Industrial, Fraser Property, KCN Vietnam and most recently Sembcorp are pursuing modern, sustainable industrial park infrastructure.

Rising market demand drives investment decisions in green buildings in Vietnam. For investors, projects resilient to environmental and climate risks and contributing positively to society hold higher value and better asset valuations. Green-certified or ESG-compliant properties are also more appealing for partnerships and capital investments, becoming key consideration in M&A transactions.

Sharp rise in foreign investment in real estate sector despite global slowdown

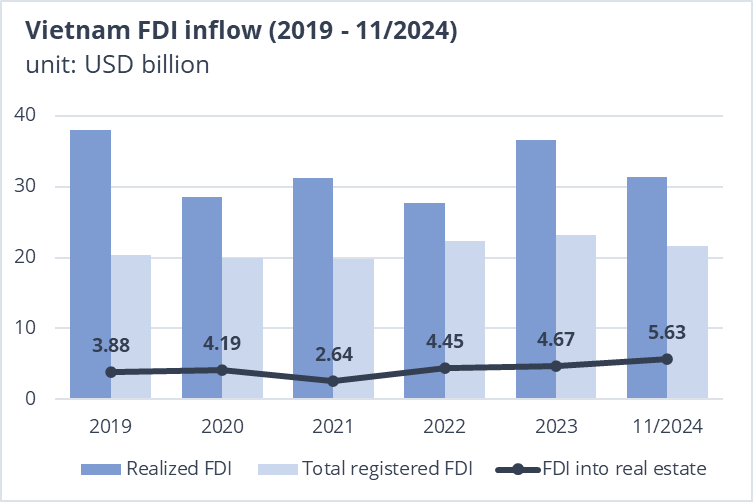

In 2024, global FDI slowed, and Vietnam followed suit, with registered FDI capital reaching $31.38 billion by November - up just 1% year-on-year.

This modest growth reflected the same trend as Vietnam had economic openess and global FDI flows had declined for two consecutive years (2022-2023) due to macroeconomic instability and geopolitical tensions.

Despite this, foreign investor confidence in Vietnam remained strong, and they continued to implement licensed or approved projects. Realized FDI reached $21.68 billion in the first 11 months of 2024, a 7.1% increase year-on-year. With continued disbursements, total committed FDI for 2024 is projected to surpass last year’s figures, potentially setting a record for the 2019-2024 period.

While global manufacturing activities has not yet recovered (registered FDI to Vietnam’s manufacturing sector down 8.7% compared to the same period last year) and the world’s major real estate markets remained sluggish, the Vietnam’s real estate sector saw impressive growth in FDI. Accumulated registered FDI in real estate surged 89.1% year-on-year, reaching $5.63 billion by November.

This robust FDI inflow highlights Vietnam’s increasing appeal to foreign investors. Not only are they driven by favorable policies, investment environment, a growing population, rapid urbanization, investors also see demand outpacing supply across sectors such as industrial and logistics (I&L), housing, offices, and retail. Improvements in legal frameworks and infrastructure development in 2024 have further enhanced the real estate market’s attractiveness.

David Jackson, principal and CEO, Avison Young Vietnam. Photo courtesy of the company.

Looking at the five real estate trends above, David Jackson - principal and CEO, Avison Young Vietnam said: “Significant changes in 2024 in terms of policies, investment trends, and the business landscape give us many reasons to stay optimistic for the Vietnam’s real estate market. As positive signals become more evident, now is the time to restart capital flows into real estate transactions in Vietnam and embrace the new growth cycle.”

- Read More

Indonesia eyes trilateral data-center tie-up with Singapore, Malaysia

Indonesia is in talks with Singapore and Malaysia to develop a cross-border data-center network linked to its Green Super Grid.

Southeast Asia - Fri, November 28, 2025 | 9:57 pm GMT+7

Malaysia’s export growth expected to slow in 2026

Despite Malaysia’s trade growth in October 2025 surpassing expectations, with both exports and imports reaching record levels, economists warned that the country’s export expansion may slow in 2026.

Southeast Asia - Fri, November 28, 2025 | 9:53 pm GMT+7

Singapore promotes methanol use for bunkering

The Maritime and Port Authority of Singapore (MPA) will issue licences to supply methanol as marine fuel in the Port of Singapore from January 1, 2026, following the Call for Applications launched in March 2025.

Southeast Asia - Fri, November 28, 2025 | 9:46 pm GMT+7

Vietnam's tour operator Vietravel announces full exit from Vietravel Airlines

Vietravel, one of Vietnam’s largest tour operators, will divest its entire stake in Vietravel Airlines by year-end, drawing a close to its turbulent venture into aviation during five years.

Travel - Fri, November 28, 2025 | 9:22 pm GMT+7

VinSpeed, Thaco vie for investment role in North-South high-speed railway

Several major Vietnamese companies, including Vingroup subsidiary VinSpeed and automaker Thaco, are vying for a role in Vietnam’s gigantic North-South high-speed railway project.

Infrastructure - Fri, November 28, 2025 | 5:14 pm GMT+7

Finnish fund PYN Elite raises VN-Index forecast to 3,200 points

PYN Elite (Finland), one of the largest foreign funds in the Vietnamese stock market, has revised up its forecast for the benchmark VN-Index to 3,200 points, much higher than the 1,690.99 recorded on Friday.

Finance - Fri, November 28, 2025 | 4:49 pm GMT+7

Mind the gap

Without stronger digital and physical networks, global productivity will falter at precisely the moment the world needs new engines of growth, writes Benjamin Hung, president, International, Standard Chartered.

Consulting - Fri, November 28, 2025 | 3:49 pm GMT+7

Alliance claiming $100 bln investment for trans-Vietnam high-speed railway 'uncontactable'

An alliance between Mekolor, a relatively unknown Vietnamese company, and American entity Great USA, which claimed it could mobilize $100 billion for the North-South high-speed railway project, could not be contacted, said standing Deputy Prime Minister Nguyen Hoa Binh.

Infrastructure - Fri, November 28, 2025 | 3:19 pm GMT+7

Mitsui eyes new opportunites in Vietnam's energy sector, projects related to carbon emission reduction

Mitsui & Co., Ltd. plans to expand its investment in Vietnam in the energy sector and projects related to carbon emission reduction, president and CEO Kenichi Hori told Prime Minister Pham Minh Chinh at a Thursday meeting in Hanoi.

Industries - Fri, November 28, 2025 | 2:39 pm GMT+7

Russian heavyweight Zarubezhneft seeks to build energy center in Vietnam

Zarubezhneft, a wholly state-owned oil & gas group of Russia, wants to develop an energy center in Vietnam, as it seeks to expand into other fields including energy and minerals.

Energy - Fri, November 28, 2025 | 1:08 pm GMT+7

Carlsberg Vietnam accelerates its path toward net-zero emission in production by 2028 with stronger renewable-energy commitments

As Vietnam advances toward its 2050 net-zero vision, businesses are expected to play a decisive role in enabling the country’s green transition. At the Green Economy Forum 2025, Carlsberg Vietnam shared how a long-standing FDI enterprise is reshaping its operations and energy strategy to align with Vietnam’s sustainability goals.

Companies - Fri, November 28, 2025 | 11:52 am GMT+7

PV Power says profit may fall in 2026 despite higher output due to extreme weather

PV Power (HoSE: POW), a subsidiary of state-owned energy giant Petrovietnam, expects electricity output to rise next year, but says profit may decline from this year’s strong results due to increasingly erratic weather conditions.

Companies - Fri, November 28, 2025 | 9:00 am GMT+7

Decoding the attraction of 'A.I Real Combat' contest broadcast on Vietnam Television

Vietnam’s first national artificial intelligence competition, 'A.I Thực chiến' (A.I Real Combat), aired its opening round at 8 p.m. Wednesday on state broadcaster VTV2, with a rebroadcast on VTV3 two days later.

Companies - Thu, November 27, 2025 | 8:17 pm GMT+7

Foxconn Industrial Internet’s Vietnam revenue jumps 83% on automation, digitalization: CEO

Foxconn Industrial Internet (FII), a unit of Taiwanese electronics giant Foxconn, saw revenue from its new-technology applications in Vietnam rise 83% in the past fiscal year while headcount increased only 20%, driven by automation and digitalization.

Companies - Thu, November 27, 2025 | 4:56 pm GMT+7

SHB bank sees development drivers from capital-raising strategy, opportunities to attract foreign inflows

The upcoming capital-hike strategy is expected to position Saigon-Hanoi Bank (SHB) among the Top 4 private banks in Vietnam by charter capital, helping the lender maintain its competitive advantage via robust capital strength.

Banking - Thu, November 27, 2025 | 4:33 pm GMT+7

Vietnam's consumer finance major F88 launches first public bond issuance with 10% annual coupon

F88, a leading consumer finance company in Vietnam, has received regulatory approval for its first public bond issuance, offering a fixed annual coupon of 10% - a level seen as attractive amid low bank deposit rates and softer corporate bond yields.

Companies - Thu, November 27, 2025 | 4:16 pm GMT+7

- Travel

-

Vietnam's tour operator Vietravel announces full exit from Vietravel Airlines

-

Impressive Standard Chartered Hanoi Marathon Heritage Race 2025

-

Nguyen Hong Hai wins 'Investors' golden heart' golf tournament 2025

-

140 players compete at “Investors’ golden heart” golf tournament

-

‘Investors’ golden heart’ golf tournament to tee off on Saturday

-

Vietnam, Hong Kong Aircraft Engineering sign deal on aircraft maintenance hub at northern airport