Vietnam's booming logistics sector still has room for growth

VinaCapital’s chief economist Michael Kokalari explains why investors should pay close attention to various opportunities in Vietnam’s logistics industry.

Vietnam has one of the fastest-growing logistics sectors in the world, but the sector is still highly fragmented, which presents attractive investment opportunities for private equity firms and other well-capitalized investors with “on the ground” expertise helping local businesses accelerate their revenues and earnings by adopting international best practices.

The industry has grown 14-16% annually in recent years, according to the Vietnam Logistics Business Association (VLBA), and total logistics expenditures in Vietnam are equivalent to over 20% of GDP, which is among the highest in the world - because of the industry’s innumerable inefficiencies. For example, three-quarters of Vietnam's freight volume passes through just six of the country's 75 seaports.

The rapid growth of Vietnam’s logistics sector growth is sustainable because of: 1) the ongoing expansion of the country’s manufacturing sector – driven by the manufacturing of high-tech products, and 2) the continued growth of the country’s middle class.

Regarding the former, Vietnam’s manufacturing sector currently accounts for just over 20% of the country’s economy but this figure reached above 30% for other “Asian Tiger” economies. That continued FDI investment inflows – which have helped fund the build-out of Vietnam’s industrial base for – are essentially ensured for years to come, partly because Vietnam is a beneficiary of the nascent “friend-shoring” phenomenon, which we discussed in this report, and which is part-and-parcel of the broader “China + 1” effort of multinational companies to diversify some of their production outside of China (ie. to Vietnam, India, Mexico, etc.)

Finally, the ongoing growth of Vietnam’s middle class also presents numerous investment opportunities, especially in niches such as cold-chain logistics - because of greater demand for fresh food and certain perishable pharmaceutical products - and in e-commerce beneficiaries such as last-mile delivery services. Further to that last point, e-commerce in Vietnam is growing by more than 25% annually, and the Vietnamese government targets a much bigger role for e-commerce for the country’s economy going forward – which is likely to lead to a regulatory environment that is especially favorable for “last mile” and other logistics firms.

A port in the Cai Mep-Thi Vai port cluster in Ba Ria-Vung Tau province, southern Vietnam. Photo courtesy of Ba Ria-Vung Tau newspaper.

Overview of Vietnam’s logistics industry

Vietnam’s logistics industry is comprised of foreign and local firms, but local firms are essentially absent from the international shipping business (there are over 1,600 registered ships in Vietnam - but only 3% of those ships are proper container ships) - with the exception of the handling and delivery of goods overland across Vietnam’s northern border with China (although this conduit represents a small portion of the goods that flow in and out of Vietnam). The industry’s biggest challenge is increasing the quality and reliability of its services – but these problems can be addressed by replicating best practices from other logistics markets.

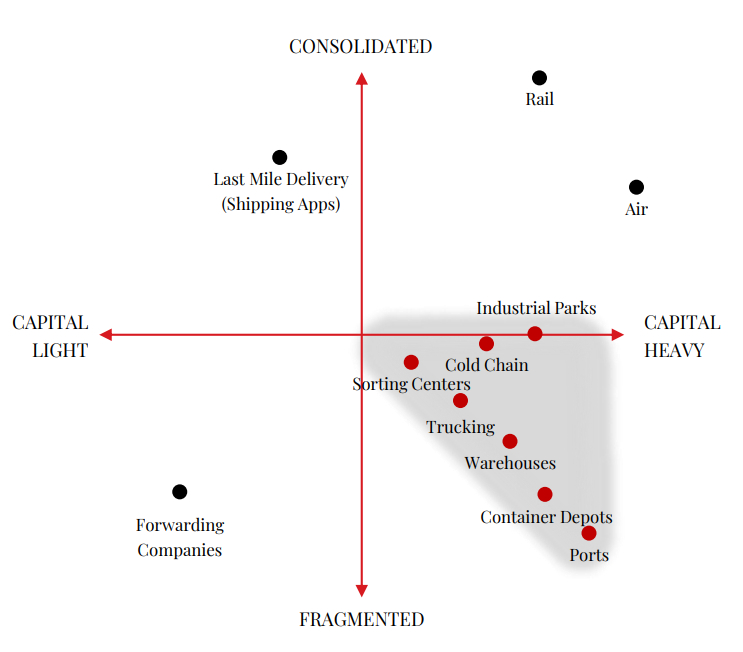

In order to analyze the investment opportunities in the sector, we’ve partitioned the industry into capital-intensive versus “capital-light” businesses, and into segments of the industry that are highly fragmented, versus those that are highly concentrated, as can be seen above, and we note that the domestic logistics industry is comprised mostly of micro-to-small companies.

The businesses in Vietnam’s logistics sector most in need of investment are those that are capital intensive, and in segments of the industry that are highly fragmented. For example, transportation firms account for about two-thirds of the total enterprises in Vietnam’s logistics industry, but over 80% of trucking firms in Vietnam have a fleet size of fewer than five trucks, and it’s estimated that for about 70% of the deliveries trucks in Vietnam make, the trucks returns to their home base empty.

Furthermore, middlemen get paid an estimated 30% commission on the final service fees that those trucking companies earn. Even in cold storage transport, which is considered to be one of the most promising segments of Vietnam’s logistics industry, and which is dominated by foreign-invested firms, is estimated that 70% of firms have less than 10 trucks.

In our view, some very compelling opportunities for local firms stem from the fact that sophisticated foreign customers are willing to pay premium prices for reliable logistics services, and that middle-class customers’ demand for products and services that entail high-quality logistics is soaring (ie. online shopping with home delivery, demand for perishable foods & medicines, etc).

Additionally, the long-term investment returns generated from those companies will be augmented by the fact that Vietnamese logistics operators that have sufficient scale and are professionally managed will experience falling costs over time, as bottlenecks stemming from Vietnam’s infrastructure and other issues are eventually addressed.

We also expect attractive investment returns for logistics firms that are beneficiaries of increased high-tech manufacturing in Vietnam and from the ongoing growth of Vietnam’s emerging middle class.

The growth of high-tech manufacturing entails increased demand for higher value-added logistics services such as bonded warehouses for the consolidation of relatively high-value goods (compared to garments & footwear, for example), before those products are exported. Also, the input materials for the production of consumer electronics are typically very valuable, so customs clearance and freight forwarding activities entailed in handling those items necessarily must be of much higher precision and specification than that entailed in handling textiles and yarn for garment production, for example.

Finally, we see three potential investment strategies: 1) invest in leading logistics companies, to aggressively grow their assets into an integrated platform that offers clients economies of scale, 2) identify particular assets which need capital for upgrading or can be re-purposed, and drive new business by increasing efficiencies, and 3) M&A / consolidation. The adoption of best international practices – such as digitization – together with capital injections are critical to all of these strategies, although capital injections are particularly essential if the investors’ strategy is to grow the capacity of the target firm – by adding more trucks, for example, or additional cranes/heavy equipment in port/warehouse businesses.

Attractive segments

One attractive niche in Vietnam’s logistics industry is the customs clearance business, in which brokers with good relationships with the proper officials can expedite the clearance of goods in and out of the country by assuring compliance with complex regulations.

Most of Vietnam’s 800+ freight forwarding companies provide customs clearance services, according to the VLBA, but we believe firms that can bundle customs clearance services as part of a “core carrier” relationship, are capable of satisfying all of the shipping/logistics needs of high tech manufacturing firms can enjoy enhanced pricing power in exchange for providing premium logistics services to those firms.

Further to that last point, high-quality logistics are essential to the handling of high-value consumer electronics items, but logistics costs account for just over 1% of the final price of those items (versus circa 30% for agriculture products like rice, for example). The combination of customers’ high sensitivity to quality, together with the low contribution of logistics services to the total costs of consumer electronics producers equates to enhanced pricing power for integrated logistics firms that are able to service the needs of those demanding customers, by providing what is known in the industry as “Third Party Logistics Services (3PL)”

The vast majority of logistics handling done by local firms in Vietnam can be characterized as “First Party Logistics (1PL)”, or “Second Party Logistics (2PL)”, which essentially facilitates the direct shipment of products from one point to another, but the global logistics industry is increasingly moving towards the so-called “3PL” model in which Logistics Service Providers (LSP), provide not only transportation & warehousing services, but additional value-added services such as inventory management, picking & packing, and RFID tracking.

The larger firms in Vietnam’s logistics industry are primarily state-owned enterprises (SOEs), so although those firms may have the financial resources to begin providing 3PL services, they typically do not have the flexibility and/or management capability.

Summary

Vietnam has one of the fastest-growing logistics sectors in the world, and that growth is expected to continue for years to come, driven by the continued expansion of the country’s manufacturing sector (especially high-tech manufacturing), and by the continued growth of the country’s middle-class, which in turn is driving high growth in the logistics-intensive e-commerce business, as well as demand for perishable food and other products.

The industry is fragmented and inefficient, which when combined with its high growth is a recipe for attractive investment returns. In our view, the most attractive businesses to invest in are those that are capital-intensive and are in particularly fragmented segments of the industry.

- Read More

Malaysia eyes AI-driven energy future

Malaysia needs to modernize its power systems to build a low-carbon economy that is competitive, inclusive and resilient, said Deputy Prime Minister Datuk Seri Fadillah Yusof at the Global AI, Digital and Green Economy Summit 2025, which opened on Monday.

Southeast Asia - Mon, December 15, 2025 | 11:47 pm GMT+7

Vingroup’s mega project contributes over $1 bln in land-use fees, land lease to HCMC’s 11-month budget

A mega urban project by Vietnam’s leading private conglomerate Vingroup (HoSE: VIC) contributed VND27.36 trillion ($1.04 billion) to Ho Chi Minh City’s budget revenue in the first 11 months of this year, the local government said.

Real Estate - Mon, December 15, 2025 | 5:35 pm GMT+7

Vietnam PM says Long Thanh airport should anchor aviation-led growth

Vietnam must use the Long Thanh International Airport as a hub to develop an aviation economy and ecosystem, creating a new growth pole rather than merely operating an airport, said Prime Minister Pham Minh Chinh.

Economy - Mon, December 15, 2025 | 5:03 pm GMT+7

Vietnam introduces new policy to attract electronics 'eagles'

Vietnam’s Ministry of Science and Technology has issued a circular setting criteria for enterprises engaged in electronics manufacturing projects to qualify for tax incentives, aiming to lure more global electronics giants.

Economy - Mon, December 15, 2025 | 4:24 pm GMT+7

HCMC-based developer Phat Dat unveils six new projects in 2026 amid stock plunge

Phat Dat Real Estate Development Corporation (HoSE: PDR), a major real estate developer in Ho Chi Minh City, has announced plans to launch six new projects in 2026, setting targets of nearly VND44.85 trillion ($1.7 billion) in revenue and over VND11.81 trillion ($448.9 million) in after-tax profit for the 2026-2030 period.

Real Estate - Mon, December 15, 2025 | 2:00 pm GMT+7

Vietnam’s first LNG-fueled power plants inaugurated

Nhon Trach 3 and 4, Vietnam’s first LNG-fired power plants, were inaugurated on Sunday and are scheduled for commercial operations in early 2026.

Energy - Mon, December 15, 2025 | 11:36 am GMT+7

Vingroup to build world-class stadium in Hanoi

Vingroup (HoSE: VIC), Vietnam's biggest listed company by market cap, has proposed building a 135,000-seat stadium at its planned Olympic sports urban area in Hanoi, potentially ranking as the world’s second-largest stadium in terms of capacity.

Real Estate - Mon, December 15, 2025 | 8:00 am GMT+7

Gia Binh International Airport set to become new driver of national growth

Vietnam’s aviation sector is entering a pivotal period as many national infrastructure projects move into accelerated implementation.

Companies - Sun, December 14, 2025 | 7:57 pm GMT+7

Life insurer AIA shows interest in Vietnam’s international financial center

Mark Tucker, independent non-executive chairman of Hong Kong-based life insurer AIA Group, expressed interest in the development of an international financial center (IFC) in Vietnam at a meeting with Deputy Prime Minister Ho Duc Phoc in Hanoi last Friday.

Finance - Sun, December 14, 2025 | 3:00 pm GMT+7

Vietnam at development crossroads as capital market lags: Dragon Capital exec

Vietnam is entering a critical phase of its next development cycle but risks missing a historic opportunity unless it rapidly deepens its capital markets, said an executive at Vietnam-focused asset manager Dragon Capital.

Finance - Sun, December 14, 2025 | 9:32 am GMT+7

Venture capital, private equity investments in Vietnam drop 35% to $2.3 bln in 2024: report

Total venture capital (VC) and private equity (PE) investment in Vietnam fell 35% year-on-year to $2.3 billion in 2024, as investors turned more cautious amid tighter global financial conditions and heightened scrutiny of valuations, according to a newly-released report by the Ministry of Science and Technology.

Economy - Sun, December 14, 2025 | 8:00 am GMT+7

Free trade zone to create new momentum for HCMC’s breakthrough development

Breakthrough mechanisms for the Ho Chi Minh City Free Trade Zone (FTZ) are expected to help the city attract high-quality investment in finance, trade, and services, promote exports and industrial development, boost R&D, and draw high-caliber human resources.

Economy - Sat, December 13, 2025 | 11:15 pm GMT+7

Central Vietnam province green-lights $1.59 bln LNG power project

Authorities of Quang Tri province in central Vietnam have granted in-principle approval for a 1,500MW LNG-fired power project, with state utility Vietnam Electricity (EVN) as the investor.

Energy - Sat, December 13, 2025 | 5:20 pm GMT+7

Mobile World approves IPO, listing plan for consumer electronics retail subsidiary

The board of directors of Mobile World Investment Corporation (HoSE: MWG), a leading retailer in Vietnam, has okayed a plan for subsidiary Dien May Xanh Investment JSC (DMX) to conduct an IPO and stock market listing.

Companies - Sat, December 13, 2025 | 11:57 am GMT+7

Central Vietnam city okays $114 mln industrial park project VSIP seeks to develop

The Hue city People’s Committee has granted in-principle approval for the La Son Industrial Park - Zone 1 project, with total investment capital of over VND3 trillion ($114 million).

Industrial real estate - Sat, December 13, 2025 | 9:54 am GMT+7

Hanoi opens bid for $286 mln waste-to-energy project at its largest landfill

Hanoi is seeking investors for a major waste-to-energy project that will excavate and incinerate the entire volume of buried waste at Nam Son, the capital’s largest landfill, in an effort to rehabilitate the area and address long-standing pollution.

Infrastructure - Fri, December 12, 2025 | 9:22 pm GMT+7

- Travel

-

Techcombank HCMC International Marathon affirms global standing

-

Vietnam's tour operator Vietravel announces full exit from Vietravel Airlines

-

Impressive Standard Chartered Hanoi Marathon Heritage Race 2025

-

Nguyen Hong Hai wins 'Investors' golden heart' golf tournament 2025

-

140 players compete at “Investors’ golden heart” golf tournament

-

‘Investors’ golden heart’ golf tournament to tee off on Saturday