Vietnam's property market strongly performs in 2024 on solid fundamentals: Knight Frank

Vietnam's real estate market made a strong performance in 2024 across the office, ready-built factories/warehouses, and apartment segments thanks to solid fundamentals, write Knight Frank analysts.

A property project built by Hoa Binh Construction Group. Photo courtesy of Thanh Nien (Young People) newspaper.

Vietnam stands as one of the top three emerging regional markets in 2025, alongside India and Indonesia, in terms of industrial and investment growth.

The country demonstrates strong potential for foreign direct investment (FDI), driven by its strategic location, favorable demographics, and open policies. Supported by solid fundamentals, Vietnam's property market delivered a strong performance in 2024 across offices, ready-built factories/warehouses, and apartments.

Office market

In 2024, Vietnam’s office market surged with net absorption exceeding 160,000 square meters, the highest in five years, fueled by robust expansions in IT, technology and finance. This rebound contained a clear “flight to quality” as newly completed, green-certified buildings in Ho Chi Minh City and Hanoi captured large-scale transactions.

HCMC welcomed over 118,000 m2 of new supply, primarily in prime District 1 locations such as The Nexus, Riverfront Financial Centre, ThaiSquare The Merit, and e.town 6 in Tan Binh district.

Meanwhile, Hanoi recorded nearly 87,000 m2 of new space, attracting strong interest during pre-leases thanks to high construction quality and competitive terms. Although average asking rents remained elevated in both cities, landlords offered more flexible policies, including rent-free periods and discounted rates over fixed terms.

Over the next two years, major pipeline projects like Marina Central Tower, Lotus Tower (both HCMC), and Tien Bo Plaza (Hanoi) will further boost supply.

Grade A developments in HCMC will remain concentrated in District 1, reinforcing its status as a premier socio-economic hub. Meanwhile, Hanoi continues shifting premium supply westward in line with its vision of creating a new business center by 2035.

“2024 was a record year, with many significant contracts successfully completed. In 2025, leasing activities are expected to grow steadily in both HCMC and Hanoi. Buildings will actively enhance their leasing plans, focusing on competitive pricing, better services, and enticing leasing terms to meet tenant needs and ensure sustained demand.” said Leo Nguyen, senior director, occupier strategy & solutions, Knight Frank Vietnam.

Ready-built factory/warehouse market

Vietnam’s advantageous location and cost competitiveness have solidified its role as a key “China-plus-one” destination, especially since the U.S.-China trade war in 2018. Over the past six years, Vietnam’s RBF/RBW market has doubled its total supply from 6.6 million m2 in 2018 to over 15.6 million m2 in 2024, largely driven by institutional developers such as BW, SLP, Frasers, Cainiao, and KCN Vietnam.

Bac Ninh and Hai Phong remain prominent industrial hubs in the North, with new supply such as BW Thuan Thanh 3B – Phase 1, Industrial Center Yen Phong 2C – Phase 1, BW ESR Nam Dinh Vu, and SLP Park Bac Ninh.

In the South, Dong Nai and Long An continue to be hot spots, highlighted by KCN Ho Nai, KCN Phu An Thanh, BW Xuyen A, and SLP Park Long Hau. Modern facilities with higher quality specifications pushed up overall asking rents in 2024, and the rental gap between North and South narrowed significantly.

Occupancy rates in both regions averaged above 80% in 2024, buoyed by e-commerce expansion and manufacturing inflows from Chinese and European SMEs. Looking ahead, ESG-compliant properties and hybrid products are likely to gain momentum, while land availability, competitive rents, and ongoing infrastructure upgrades pave the way for Tier-2 markets such as Ha Nam, Bac Giang, Vinh Phuc, and Binh Phuoc to grow further.

“Demand for ready-built warehouses and factories in 2025 will remain strong, driven by the shift of manufacturing from China and government support for manufacturing and trade to achieve 8% GDP growth,” said Son Hoang, valuation and advisory associate director, Knight Frank Vietnam.

Apartment market

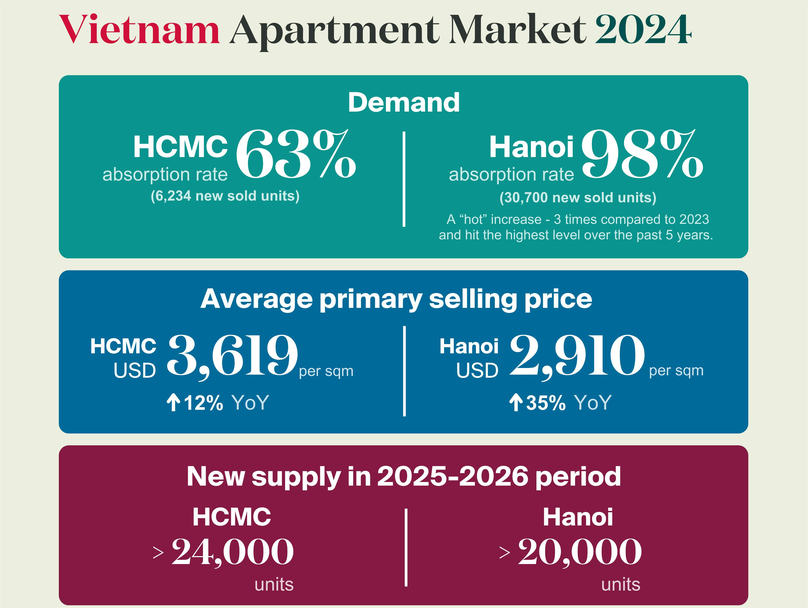

The Hanoi apartment market burgeoned in 2024, with 27,268 new units representing a three-fold increase in new supply from 2023. The West (Nam Tu Liem district) and the East (Gia Lam district) dominated with nearly 24,300 units, mainly from township projects, which accounted for more than 80% of the total new supply.

In contrast, tightening credit control on real estate, bond fraud, and legal struggles in 2023-2024 continued to delay new apartment developments in HCMC, with only 4,888 new units in 2024, down 58% year-over-year. Thu Duc city (the East) led market supply, with more than 2,400 units.

After hitting its lowest point in 2023, HCMC apartment demand indicated slight signs of recovery with an absorption rate of 63%, equivalent to 6,234 sold units. Demand showed a positive sales volume in Thu Duc city (the East), with nearly 4,200 units, contributing 67% of total yearly units sold.

In contrast to the HCMC market, Hanoi apartment demand experienced a sharp increase, with a 98% absorption rate, translating into more than 30,700 units sold. This represents three times the sales volume of 2023 and the highest level achieved over the past five years.

Demand mainly came from township projects located in the West (Nam Tu Liem district) and the East (Gia Lam district), which accounted for 87% of total sales volume, equivalent to more than 15,800 and 10,700 units sold, respectively.

In 2024, HCMC’s average primary price stayed around $3,619 per m2, up 12% year-over-year, while Hanoi’s price shortened the gap to HCMC, with a robust year-over-year increase of 35%, reaching $2,910 per m2.

In the 2025-2026 period, HCMC is projected to welcome more than 24,000 units, with nearly 8,600 units in 2025 and 15,400 units in 2026. Meanwhile, Hanoi is expected to have more than 20,000 units each year, mainly from township projects.

“Integrated townships are redefining modern living with an optimal mix of international-quality products and extensive amenities. These townships dominated the market in 2024 and are expected to account for nearly half of the city's future supply over the next 5-7 years,” noted Son Hoang.

- Read More

Vingroup reports strong performance in 9 months

Vietnam’s leading private conglomerate Vingroup (HoSE: VIC) recorded consolidated net revenue of VND169.61 trillion ($6.45 billion) in the first nine months of 2025, up 34% year-on-year, reflecting strong momentum across its core business segments.

Companies - Sat, November 1, 2025 | 12:04 pm GMT+7

Vietnam’s tech unicorn VNG books 30% profit surge in Q3 on strong gaming business

Vietnamese tech unicorn VNG Corp (UPCoM: VNZ) posted a 30% year-on-year increase in operating profit to VND263 billion ($10 million) in Q3, supported by cost controls and strong performance in its gaming and payment businesses.

Companies - Sat, November 1, 2025 | 10:02 am GMT+7

Vietnam's e-commerce sales soars 34% in Jan-Sept on stronger demand

Sales on four e-commerce platforms in Vietnam - Shopee, TikTok Shop, Lazada, and Tiki - hit VND305.9 trillion ($11.62 billion) in the first nine months of 2025, up 34.4% year-on-year, according to new data from analytics firm Metric.

Economy - Sat, November 1, 2025 | 9:35 am GMT+7

Vietnam's famous actress Truong Ngoc Anh detained for 'property appropriation'

Truong Ngoc Anh, former chairwoman of Dat Rong Real Estate JSC and one of the most famous actresses in Vietnam, has been accused of abusing trust to appropriate thousands of taels of gold and tens of billions of dong (VND10 billion = $380,000).

Society - Fri, October 31, 2025 | 10:53 pm GMT+7

Vietnam's dairy giant Vinamilk reaps $95 mln in Q3 post-tax profit

Vinamilk recorded consolidated post-tax profit of VND2.51 trillion ($95.42 million) in Q3, up 4.5% year-on-year, according to a company release.

Companies - Fri, October 31, 2025 | 10:17 pm GMT+7

EVNNPT, northern Vietnam province Son La to speed up power transmission projects

Son La province will coordinate closely with National Power Transmission Corporation (EVNNPT) to accelerate construction of key power transmission projects aimed at supporting regional and local socio-economic development.

Companies - Fri, October 31, 2025 | 9:40 pm GMT+7

Carlsberg Vietnam donates $57,000 to support central cities Hue, Danang after historic floods

As central Vietnam endures one of the most devastating floods in recent decades, Carlsberg Vietnam has swiftly contributed VND1.5 billion ($57,000) to support relief and recovery efforts in Hue and Danang, two localities hardest hit by the historic rainfall and landslides.

Companies - Fri, October 31, 2025 | 9:37 pm GMT+7

HDBank makes $563 mln pre-tax profit in 9 months

HDBank (HoSE: HDB) recorded consolidated profit before tax of VND14.8 trillion ($562.53 million) for the first nine months of the year, up 17% increase year-on-year.

Companies - Fri, October 31, 2025 | 8:27 pm GMT+7

Vietnam needs more clean energy, highly-skilled labor to capture semiconductor investment wave: exec

Vietnam is well prepared in terms of infrastructure, but to capture the semiconductor investment wave, it must address the challenges of clean energy and highly-skilled labor, said Tran Tan Sy, deputy CEO of KN Holdings, a leading multi-sector group in Vietnam.

Industries - Fri, October 31, 2025 | 4:39 pm GMT+7

Vietnam-China joint venture breaks ground on $319 mln auto plant in northern Vietnam

Vietnamese conglomerate Geleximco Group and China’s Chery Automobile on Thursday held a groundbreaking ceremony for their GEL-O&J automobile plant in Hung Yen province.

Industries - Fri, October 31, 2025 | 3:53 pm GMT+7

MUFG Bank signs its first sustainability-linked loan deal in Vietnam’s agriculture sector

Japan's MUFG Bank, Ltd. (MUFG) has signed a sustainability-linked loan (SLL) agreement with Angimex-Kitoku, an An Giang province-based Vietnam-Japan joint venture company specializing in rice cultivation, production, and processing.

Banking - Fri, October 31, 2025 | 3:29 pm GMT+7

Vietnam, UK elevate ties to comprehensive strategic partnership, outline 6 cooperation pillars

Vietnam and the UK have established a Comprehensive Strategic Partnership, outlining six key pillars of cooperation, including economic, trade, investment, and finance collaboration.

Economy - Fri, October 31, 2025 | 1:19 pm GMT+7

Central Vietnam hub Danang seeks private investment for urban railways

With plans for 16 urban railway lines spanning over 200 kilometers, Danang is prioritizing private investment to develop a modern public transport-oriented urban model.

Infrastructure - Fri, October 31, 2025 | 12:02 pm GMT+7

FPT Retail profit more than doubles in Q3 as deposits surge

FPT Digital Retail JSC (HoSE: FRT), a subsidiary of Vietnam’s FPT Corporation, reported strong Q3 results, with net revenue rising 26.3% year-on-year to VND13,110 billion ($497.9 million) and post-tax profit up 61% to VND266 billion ($10.1 million).

Companies - Fri, October 31, 2025 | 8:57 am GMT+7

Geleximco-led consortium wins approval for $870 mln urban project in central Vietnam

A consortium led by conglomerate Geleximco Group has received approval to develop a long-delayed urban complex in Gia Lai province, with total investment capital estimated at VND21.95 trillion ($834 million).

Real Estate - Fri, October 31, 2025 | 8:26 am GMT+7

Singapore seeks 'renewable fuel', nuclear ties

Singapore must be ready to support all promising pathways, from established technologies to novel options, in its bid to transition its fossil fuel-based energy sector to one that is clean yet affordable, said Minister-in-charge of Energy and Science and Technology Tan See Leng on Monday.

Southeast Asia - Thu, October 30, 2025 | 7:41 pm GMT+7