Bond issuers can extend payment terms by 2 years

A new decree from the Vietnamese government on corporate bond private placements allows issuers to extend their bond maturities by up to two years and pay principal and interest with assets other than cash.

Decree 08, effective from Sunday March 5, specifies many new points about responsibilities of bond issuers.

It allows extending the term of bonds by up to two years, while issuers cannot do so at all under the old Decree 65.

In case bondholders do not agree to such a change, issuers "must negotiate with the bondholders to ensure the latter's interests".

If negotiations do not reach expected results, issuers must fulfill their obligations to bondholders according to their previously announced bond issuance plan.

For bonds offered domestically, if issuers cannot fully and timely pay principal and interest in Vietnamese dong according to the previously announced plan, they can negotiate with bondholders to pay with other assets.

This must ensure that the bondholders must approve and the issuers must disclose unusual information and be responsible for the legal status of the assets used for payment.

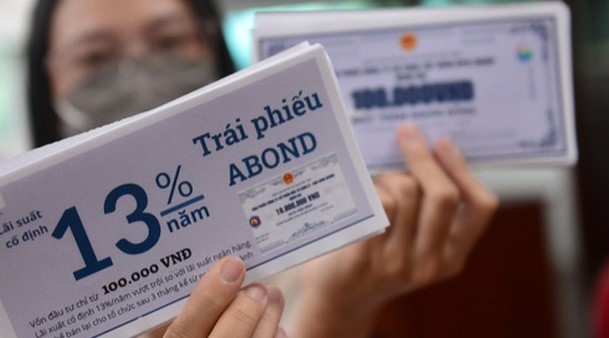

The local corporate bond market experienced a hot growth period in 2020 and 2021. Photo courtesy of Youth newspaper.

The newly-issued decree also suspends the Decree 65 regulation on defining individuals' status as "professional securities investors".

According to the old rule, in order to buy private placement corporate bonds, individual investors need to hold a securities portfolio, excluding margin loan value, worth at least VND2 billion ($84,300) in 180 days.

The old rule that required bond distribution time to not exceed 30 days since the announcement of the offering is no longer in effect, until December 31, 2023. This allows issuers to have more time to find investors, increasing the likelihood of success for the offering.

Decree 65, issued in mid-September 2022, is an amended and supplemented version of Decree 153, which was released at the end of 2020 with an aim to tighten the market after a period of hot growth and many disturbances.

Decree 65 has more constraints in terms of investor status, issuance purposes, and principles for using bond proceeds. For example, companies can only issue bonds to carry out investment projects and restructure their own debts, and must clearly state the purposes to investors when issuing.

The local corporate bond market experienced a hot growth period in 2020 and 2021, with issuance values of nearly VND462 trillion ($19.47 billion) and VND658 trillion ($27.73 billion), respectively, according to Vietnam Bond Market Association (VBMA) data.

The growth of this fundraising channel was driven by the surging demand of companies for capital, especially real estate developers and banks, and the demand of people for yields higher than bank deposit rates.

However, after the arrests related to violations in bond issuance and improper use of proceeds by several major real estate developers in the middle of last year, the bond market came to a sudden halt.

The issuance volume in 2022 was only VND255 trillion ($10.75 billion). In January this year, the market only had one successful issuance with value of VND110 billion ($4.64 million).

Meanwhile, bond maturity pressure is rising because issuing companies have liquidity problems and cannot issue new bonds to restructure their debts.

Top securities broker VNDirect estimated the maturity value of corporate bonds this year is nearly VND273 trillion ($11.51 billion), mainly in the second and third quarters.

A series of corporate issuers, especially real estate developers, have reported their failures to fulfil their obligations to pay principal and interest. Many individual investors are looking to sell bonds at a 14-17% discount to get cash back.

- Read More

SJ Group to build smart urban area in western Hanoi to bolster Hoa Lac High-tech Park

Vietnam's leading developer SJ Group JSC is outlining plans for its over 1,200-hectare Tien Xuan Smart Urban Area project in Hanoi, which is expected to be a residential and service hub of the Hoa Lac science and technology city.

Real Estate - Sat, December 20, 2025 | 10:36 am GMT+7

Indonesia to deepen role in global semiconductor supply chain

Indonesia is rolling out efforts to identify opportunities and map its natural resources to support the semiconductor industry, as part of a broader strategy to build domestic industrial capacity.

Southeast Asia - Sat, December 20, 2025 | 9:36 am GMT+7

Indonesia to stop rice imports next year

Indonesia will not import rice for either consumption or industrial use next year, citing sufficient domestic production, according to a government official.

Southeast Asia - Sat, December 20, 2025 | 8:00 am GMT+7

Northern Vietnam port city Hai Phong charts sustainable growth path for free trade zone

The establishment of Hai Phong Free Trade Zone (FTZ) is a strategic direction that will elevate the role and position of Vietnam in general and Hai Phong in particular within the global value chain, heard a conference held in the northern port city last week.

Economy - Fri, December 19, 2025 | 8:12 pm GMT+7

Construction begins on $32.5 bln Red River Scenic Boulevard project in Hanoi

The gigantic project Red River Scenic Boulevard, with a preliminary investment of about VND855 trillion ($32.49 billion) in Phu Thuong ward, Hanoi, broke ground on Friday.

Real Estate - Fri, December 19, 2025 | 4:57 pm GMT+7

Major Vietnamese groups kick off mega projects in south-central Vietnam

Vingroup, BIN Corporation, Hoa Phat, and FPT simultaneously broke ground on large-scale projects in south-central Vietnam on Friday, raising expectations for new national growth momentum in the coming period.

Economy - Fri, December 19, 2025 | 4:36 pm GMT+7

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

The first passenger flights touched down at Long Thanh International Airport in Dong Nai province on Friday morning, marking the inaugural civil aviation operation at Vietnam’s largest airport.

Economy - Fri, December 19, 2025 | 2:07 pm GMT+7

Vingroup starts work on $35.2 bln Olympic Sports Urban Area on Hanoi outskirts

Vingroup (HoSE: VIC), Vietnam's leading private conglomerate, on Friday broke ground on its 9,171-hectare Olympic Sports Urban Area project in Hanoi, which is expected to become a new growth engine for the southern part of the capital in the next decade.

Real Estate - Fri, December 19, 2025 | 1:59 pm GMT+7

Vietnam telecom giant VNPT establishes AI company

State-owned Vietnam Posts and Telecommunications Group (VNPT) on Thursday launched subsidiary VNPT AI, aiming to bring Vietnamese AI products to international markets.

Companies - Fri, December 19, 2025 | 11:50 am GMT+7

Quang Ngai Sugar develops sugar, biomass power projects worth $179 mln in central Vietnam

Quang Ngai Sugar JSC (UPCom: QNS), a top sugar producer in Vietnam, will simultaneously hold groundbreaking or inauguration ceremonies on Friday for three projects worth over VND4.7 trillion ($178.5 million) in Gia Lai province.

Companies - Fri, December 19, 2025 | 8:05 am GMT+7

Vietnam defeat Thailand to win men’s football gold at SEA Games 33

After conceding two goals in just over 30 minutes, Vietnam reversed the situation to finally beat host nation Thailand 3-2 in the men’s football final of the 33rd SEA Games.

Travel - Thu, December 18, 2025 | 10:43 pm GMT+7

Sun Group to commence construction on 5 landmark projects worth $5.7 bln

Sun Group is scheduled to start construction of five large-scale projects across Vietnam’s three regions on Friday, with a total investment of nearly $5.7 billion.

Companies - Thu, December 18, 2025 | 8:39 pm GMT+7

Unpaid credit card balances in Singapore hit record high in 10 years

Singapore's credit card debt has exceeded SGD9.07 billion (about $7 billion) in 2025's third quarter, a 10-year high that was last seen in 2014.

Southeast Asia - Thu, December 18, 2025 | 7:54 pm GMT+7

Thailand, Japan deepen transport, infrastructure cooperation

Thai Deputy Prime Minister and Minister of Transport Phiphat Ratchakitprakarn has met with Japanese Ambassador Otaka Masato to advance cooperation in Thailand’s transportation and infrastructure projects.

Southeast Asia - Thu, December 18, 2025 | 7:50 pm GMT+7

Masan's FMCG arm MCH to list on HCMC bourse at $8 per share, valuation tops $8.6 bln

Masan Consumer Corporation (UpCoM: MCH), the fast-moving consumer goods arm of Vietnam’s Masan Group, will officially debut on the Ho Chi Minh City Stock Exchange (HoSE) on December 25, with a reference price set at VND212,800 ($8.08) per share.

Companies - Thu, December 18, 2025 | 4:57 pm GMT+7

Sun Group-led consortium to build $616 mln Red River bridge in Hanoi

Hanoi authorities have approved a consortium led by Sun Group as the investor for the Tran Hung Dao bridge project, with a total investment estimated at VND16.27 trillion ($616.14 million).

Infrastructure - Thu, December 18, 2025 | 3:26 pm GMT+7