Fed rate cuts, upgrading efforts to lure foreign investors back into Vietnam stock market: VinaCapital

The U.S. Fed’s rate cut cycle and the Vietnamese government’s fresh efforts to upgrade the local stock market status are likely to bring foreign investors back into the stock market next year, according to VinaCapital.

A branch of Smart Invest Securities in Hanoi. Photo by The Investor/ Trong Hieu.

Foreign investors net sold VND66.17 trillion ($2.62 billion) worth of Vietnamese stocks on the Ho Chi Minh Stock Exchange in the first nine months of this year, partly because of concerns about Vietnam's “political transition” and local currency depreciation, the Vietnam-focused fund management firm said in a report last week.

“The latter has now essentially been resolved, and the Fed’s rate cuts should put downward pressure on the value of the U.S. dollar, which is typically good for emerging markets,” VinaCapital commented.

In addition, some progress has been made recently in upgrading Vietnam’s status from a frontier market to a proper emerging market by FTSE thanks in part to new government measures that align the functioning of financial markets more closely in line with international norms.

“All of these factors are likely to act as catalysts that will entice foreign investors back into the stock market next year,” said the fund manager.

Appealing Vietnamese stock market

The transition of Vietnam's GDP growth from being driven by external factors in 2024 to being driven by domestic factors in 2025 will be good for the stock market because the vast majority of Vietnam’s exports are produced by FDI companies that are not listed on the local stock market.

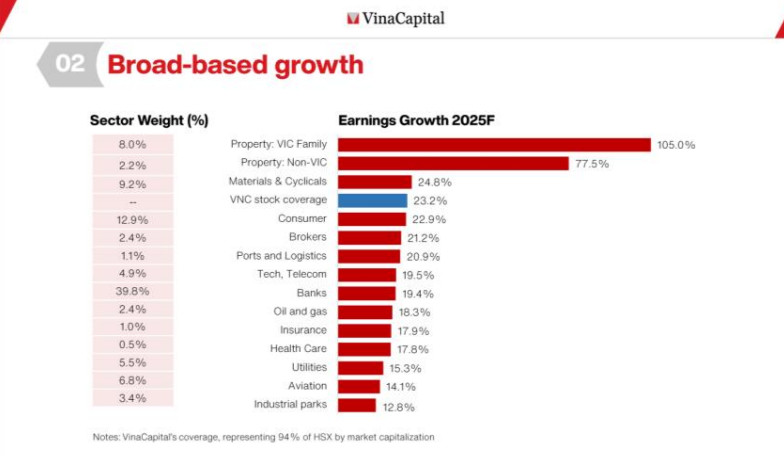

“For this and other reasons, we expect VN-Index EPS (earnings per share) growth to accelerate from 18% in 2024 to 23% in 2025,” VinaCapital analysts said.

Source: VinaCapital. Legend: VIC - ticker of Vingroup, VNC - VinaCapital.

The expected surge in real estate earnings in the chart above links closely with their expectation for an expected pickup in real estate development activity.

They noted that earnings quality in Vietnam is high, as evidenced by an expected 16% market-wide return on equity (ROE) next year, despite Vietnam’s net debt-to-equity (D/E) only being around 24%.

Both these two metrics compare favorably with Vietnam’s Emerging Market ASEAN peer stock markets (Thailand, Malaysia, Indonesia, the Philippines). The aggregate ROEs of those markets range from circa 10-14%, while the net D/E ratios of these stock markets range from 50-100%.

Furthermore, Vietnam’s circa 10x forward P/E valuation is about 25% cheaper than those of its regional peers and the analysts expect 17% CAGR (compound annual growth rate) earnings growth over 2023-2025 versus circa 3-13% earnings growth for the four peers.

The 10.1x P/E valuation of Vietnam’s stock market is also very low compared to its historical norm; the market has only traded at this low valuation level once in the last 10 years, during the Covid-19 pandemic.

- Read More

Thai dairy brand Betagen to build first plant in Vietnam

Betagen, a famous Thai dairy brand, plans to build its first manufacturing plant in Vietnam, located in the southern province of Dong Nai.

Industries - Tue, November 18, 2025 | 8:49 am GMT+7

Banks dominate Vietnam's Q3 earnings season, Novaland posts biggest loss

Banks accounted for more than half of the 20 most profitable listed companies in Vietnam’s Q3/2025 earnings season, while property developer Novaland recorded the largest loss.

Finance - Tue, November 18, 2025 | 8:24 am GMT+7

Highlands Coffee posts strongest quarterly earnings in 2 years on robust same-store sales

Highlands Coffee, Vietnam’s largest coffee chain, delivered its best quarterly performance in two years, with Q3 EBITDA exceeding PHP666 million ($11.27 million), parent company Jollibee Foods Corporation (JFC) said in its latest earnings report.

Companies - Mon, November 17, 2025 | 10:21 pm GMT+7

Hong Kong firm Dynamic Invest Group acquires 5% stake in Vingroup-backed VinEnergo

VinEnergo, an energy company backed by Vingroup chairman Pham Nhat Vuong, has added a new foreign shareholder after Hong Kong–based Dynamic Invest Group Ltd. acquired a 5% stake, according to a regulatory filing on Saturday.

Companies - Mon, November 17, 2025 | 9:52 pm GMT+7

Thai giant CP’s Q3 Vietnam revenue drops 20% as hog prices slump

Thailand’s Charoen Pokphand Foods PCL (CPF) reported a sharp downturn in its Vietnam business in Q3, making the country its only major market to contract.

Companies - Mon, November 17, 2025 | 4:16 pm GMT+7

Surging demand for gas turbines tightens supply chains, extends lead times: Siemens Energy

Demand for gas turbines is rising rapidly, especially in regions with a surge in data center development, tightening supply chains and extending lead times - factors that investors must closely track during project preparation, according to Siemens Energy.

Companies - Mon, November 17, 2025 | 1:34 pm GMT+7

Novaland completes first phase of restructuring, targets 'returning to growth' from 2027

Novaland, a leading real estate developer in Vietnam, said it has completed the first phase of its multi-year restructuring plan and aims to finish the entire program by end-2026, positioning the company to return to growth from 2027.

Companies - Mon, November 17, 2025 | 12:26 pm GMT+7

Vietnam's property developer Regal Group to list shares on HCMC bourse in Q4

Regal Group JSC, a property developer based in the central city of Danang, has applied to list its 200 million RGG shares on the Ho Chi Minh City Stock Exchange (HoSE) in Q4/2025.

Real Estate - Mon, November 17, 2025 | 10:52 am GMT+7

Vietnam's upstream oil & gas stocks surge on project momentum, regulatory easing

Stocks of Vietnam’s upstream oil and gas companies have surged in recent weeks, boosted by rising exploration activity and new rules that accelerate project approvals, while midstream and downstream players face pressure from falling crude prices.

Companies - Mon, November 17, 2025 | 8:57 am GMT+7

Indonesia to turn Bali into Asia’s next medical tourism hotspot

Indonesia is stepping up efforts to reduce the number of citizens seeking treatment abroad and turn Bali into Asia’s leading medical tourism hotspot.

Southeast Asia - Sun, November 16, 2025 | 9:05 pm GMT+7

Malaysia aims to become Southeast Asia’s AI, EV hub

Malaysia is shifting into high gear as it positions itself to become Southeast Asia’s leading hub for smart, sustainable mobility, powered by breakthroughs in electric vehicles (EVs), artificial intelligence (AI), and advanced manufacturing.

Southeast Asia - Sun, November 16, 2025 | 9:00 pm GMT+7

108 foreign investors hold 26.8% stake in Vietnam's industrial giant Thaco

Vietnam’s industrial conglomerate Truong Hai Group (Thaco) has reported a charter capital of VND30.51 trillion ($1.16 billion), with domestic private capital accounting for 73.2% and 108 foreign investors holding the remaining 26.8% stake.

Companies - Sun, November 16, 2025 | 4:42 pm GMT+7

Vietnam the most important manufacturing hub of Chinese electronics giant Luxshare-ICT: exec

Major Chinese electronics manufacturer Luxshare-ICT will expand its operations in Vietnam by rolling out large science-technology and innovation projects in the northern province of Bac Ninh and other localities, its vice chairman Wang Laisheng said on Saturday.

Companies - Sun, November 16, 2025 | 2:46 pm GMT+7

Sweden’s Syre reinforces $1 bln textile recycling plant in Vietnam with Nike deal

A strategic deal with U.S. sportswear giant Nike is expected to consolidate Swedish recycling start-up Syre's plans to roll out a global network of textile-to-textile recycling facilities, beginning with a $1 billion plant in Vietnam.

Industries - Sun, November 16, 2025 | 8:00 am GMT+7

Vietnam plans roadmap to allow short selling under stock market upgrade program

Vietnam’s Ministry of Finance has outlined a plan to introduce short selling and securities lending on a controlled basis as part of its broader effort to upgrade the country’s stock market from frontier to secondary emerging status.

Finance - Sat, November 15, 2025 | 8:01 pm GMT+7

Vietnam's first LNG power plants to begin commercial operation in Nov-Dec

Nhon Trach 3 and 4, Vietnam’s first LNG-fired power plants, are expected to begin commercial operations at the end of 2025, according to authorities in the southern province of Dong Nai.

Energy - Sat, November 15, 2025 | 3:42 pm GMT+7

- Consulting

-

The generation game: Adapting to an aging population

-

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas

-

Powering growth from within

-

Key factors helping firms export to demanding markets: DH Foods exec

-

Vietnam corporate earnings to be driven by credit expansion, trading activity, property recovery

-

Vietnam's International Financial Center ambition can unlock new wave of innovation