How Jardine Matheson expands footprint in Vietnam

From a quiet financial investment in 2008, Jardine Matheson, a diversified, Asia-focused investment company based in Bermuda, has steadily expanded its influence in Vietnam, one of Southeast Asia’s fastest-growing economies.

Logo of Jardine Matheson. Photo courtesy of the company.

Strategic stake in Thaco

Jardine Matheson began its journey with Truong Hai Auto Corporation (Thaco) in July 2008, when its Singapore-based subsidiary Jardine Cycle & Carriage Limited (JC&C) acquired a 20% stake in the Vietnamese company for $77 million, valuing Thaco at $385 million at the time.

In 2019, JC&C raised its ownership to 26.6%, the current level, by purchasing 30.3 million additional shares at VND128,500 ($4.93) per share, totaling VND3.9 trillion ($170 million). The deal catapulted Thaco’s valuation to around $9 billion.

JC&C deepened the partnership further in 2023 by investing another VND8.68 trillion (about $350 million) through 60-month convertible bonds. When the bonds mature on November 14, 2028, JC&C will have the option to require Thaco to repurchase all or part of them, starting from the release of the company’s audited consolidated financial statements for 2027.

While the conversion price remains undisclosed, Thaco chairman Tran Ba Duong recently revealed in a shareholder letter that the agreed valuation for conversion is 20 times Thaco’s 2027 consolidated earnings.

Thaco's multi-purpose mechanical complex. Photo courtesy of the group.

Thaco is one of the largest private multi-sector conglomerates in Vietnam. Its business involves automobiles, agriculture, investment-construction, commerce-service, logistics, and supporting-mechanics.

The group recently proposed to invest in a North-South high-speed railway project in Vietnam, following a similar proposal from heavyweight Vingroup.

In a proposal submitted to Prime Minister Pham Minh Chinh on May 26, Thaco said that of the $61.35 billion in investment capital, 20% will come from its equity and the remaining from foreign and domestic loans. The cost does not include compensation and resettlement expenditures, which belong to a seperate project handled by the State.

From trade in China to conglomerate powerhouse

Jardine, Matheson & Co was founded in 1832 by two Scotsmen, initially as a trading company in Guangzhou, China. The company moved its headquarters to Hong Kong in 1944 and has since evolved into one of Asia’s largest conglomerates.

Today, Jardine Matheson’s portfolio spans multiple sectors: automotive, construction, energy, mining, finance, real estate, retail, food & beverage, and hospitality. Its core markets include China, Indonesia, Singapore, and Vietnam.

Deepening Roots in Vietnam

In addition to its stake in Thaco, JC&C has invested in several Vietnamese listed companies like holding a 41.4% interest in Refrigeration Electrical Engineering Corporation (REE) and 10.6% in dairy giant Vinamilk. JC&C was also a significant shareholder in Asia Commercial Bank (ACB) until it exited in late 2017.

According to JC&C’s 2024 annual report, its investments in Thaco, REE, and Vinamilk together contributed $102.8 million in underlying profit, with Thaco being the largest contributor at 38%, followed by Vinamilk (33%) and REE (29%).

Broader Southeast Asia portfolio

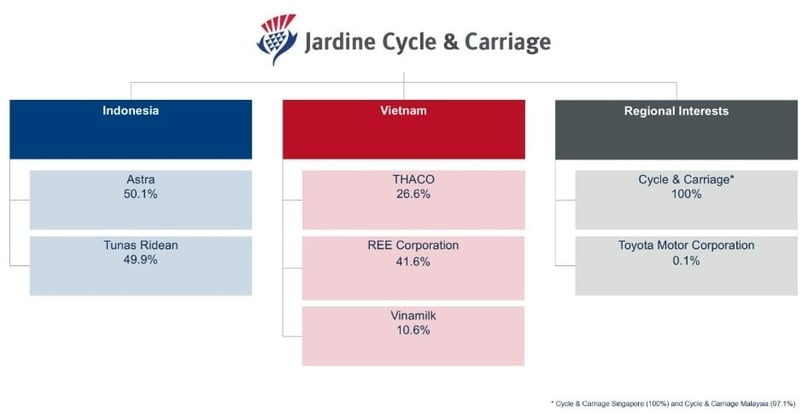

In Indonesia, JC&C owns stakes in Astra, a sprawling multi-industry group, and Tunas Ridean, a major vehicle distributor. It also owns Cycle & Carriage, which operates vehicle distribution networks in Singapore and Malaysia, and holds a 0.1% stake in Toyota Motor Corporation globally.

Investment portfolio of Jardine Cycle & Carriage in Southeast Asia. Source: JC&C.

By market, Indonesia contributed 87% of JC&C’s 2024 underlying profit ($1.1 billion), followed by Vietnam at 9%, with other countries accounting for the remaining 4%.

By sector, the automobile sector led the way with 35% of underlying profits, followed by industrial equipment and mining (30.4%) and financial services (20.9%). Other segments contributed between 1.3% and 5%.

In 2024, JC&C recorded $22.3 billion in revenue, unchanged from 2023, and $2.55 billion in after-tax profit, down 14.3% year-on-year.

As of March 2025, Jardine Strategic Singapore Pte Ltd - a fully owned subsidiary of Jardine Matheson Holdings - had held 84.99% of JC&C’s shares. Other institutional shareholders include Citibank Nominees Singapore Pte Ltd, HSBC (Singapore) Nominees Pte Ltd, Raffles Nominees (Pte.) Limited, and DBS Nominees (Private) Limited.

Moving beyond finance: F&B, retail, and high-end real estate

Jardine Matheson’s presence in Vietnam extends far beyond financial investments.

In food & beverage, Jardine Restaurant Group (JRG) - a division of Jardine Pacific - owns 25% of KFC Vietnam, one of the country’s leading fast-food chains. JRG also operates Pizza Hut outlets under a franchise model.

The office building at 63 Ly Thai To street, Hanoi. Photo courtesy of Propertyplus.

Maxim’s Caterers, 50% owned by Dairy Farm (another Jardine entity), is the franchise partner for Starbucks in Vietnam. Founded in 2000 in Hong Kong, Maxim’s also represents Starbucks in Cambodia, Hong Kong, Macau, and Singapore.

In retail, Dairy Farm has invested in health and personal care chains Guardian and Giant. Guardian Vietnam operates 99 stores in major cities like Ho Chi Minh City, Hanoi, and Da Nang, offering over 500 international brands.

In the premium real estate sector, through Hongkong Land, Jardine Matheson owns two office buildings in central Hanoi: 63 Ly Thai To Building and Central Building at 31 Hai Ba Trung street.

In 2015, Hongkong Land partnered with SonKim Land to co-develop The Nassim, a luxury residential project in Thao Dien, District 2, Ho Chi Minh City. The development features 238 upscale apartments and penthouses.

Later in 2017, Hongkong Land became the partner of local infrastructure developer CII in developing Thu Thiem River Park, a high-end project with 1,140 apartments and a planned investment of over $400 million, in the Thu Thiem new urban area. Jardine exited the project less than a year after the announcement.

- Read More

New chapter for electronics major Viettronics after Geleximco takeover

Shares of Vietnam Electronics and Informatics Corp, or Viettronics (HoSE: VEC) - long inactive and trading mostly between VND8,000-9,000 ($0.34) apiece for many years - have surged more than sevenfold over the past 11 months, rising to VND60,700 ($2.3) on Wednesday.

Companies - Thu, December 4, 2025 | 9:23 am GMT+7

Central Vietnam hub Danang faces infrastructure challenges as high-rise buildings rise along Han river

A wave of new high-rise projects along the Han River is making Danang’s urban planning and management increasingly challenging, forcing the central city to rethink strategies to ease the pressure on its urban core.

Real Estate - Thu, December 4, 2025 | 9:02 am GMT+7

Vietnam's livestock major GreenFeed reaps $65 mln in H1 profit, outpacing major rivals

GreenFeed Vietnam, a leading livestock company in the country, posted VND1.72 trillion ($65.07 million) in H1 after-tax profit, 2.5 times higher than the same period last year.

Companies - Wed, December 3, 2025 | 9:00 pm GMT+7

Eight EVNNPT employees receive Vietnam General Confederation of Labor innovation award

The Vietnam General Confederation of Labor (VGCL) has awarded its annual Creative Labor Certificate to 24 members of Vietnam Electricity's trade union, including eight employees from subsidiary National Power Transmission Corporation (EVNNPT).

Companies - Wed, December 3, 2025 | 8:42 pm GMT+7

Profit of Samsung’s 4 major Vietnam factories up 4.5% in Jan-Sept

Four major factories of Samsung Electronics in Vietnam posted a total profit of KRW4.37 trillion ($2.98 billion) in the first nine months of 2025, up 4.51% year-on-year, according to the South Korean conglomerate’s Q3 consolidated earnings statements.

Companies - Wed, December 3, 2025 | 4:52 pm GMT+7

Vietnam approves expanded list of strategic energy projects to meet rising power demand

Prime Minister Pham Minh Chinh has approved a sweeping update to the country’s portfolio of national important and priority energy projects, marking one of the most comprehensive revisions to the sector’s development roadmap in recent years.

Energy - Wed, December 3, 2025 | 3:53 pm GMT+7

Vietnam Education Publishing House pledges $758,300 in textbooks for students in flood-hit areas

Vietnam Education Publishing House (VEPH) has pledged up to VND20 billion ($758,292) this year to provide textbooks for students in the areas stricken by typhoons, floods, and poor economic conditions.

Companies - Wed, December 3, 2025 | 12:23 pm GMT+7

International awards solidify PVI's position as top non-life insurer in Asia

PVI Insurance, the only non-life insurance company in Vietnam, has won two categories at the Insurance Asia News (IAN) Awards for Excellence 2025: General Insurer of the Year and Underwriting Initiative of the Year.

Companies - Wed, December 3, 2025 | 11:58 am GMT+7

Foxconn aims to produce unmanned aerial vehicles, Xbox consoles in northern Vietnam province Bac Ninh

Fushan Technology (Vietnam) LLC, a subsidiary of Taiwan-based electronics giant Foxconn, plans to add unmanned aerial vehicles (UAVs) and Xbox gaming consoles to its production portfolio under a VND8,354 billion ($316.74 million) project in Bac Ninh province.

Industries - Wed, December 3, 2025 | 11:24 am GMT+7

Three port majors bid for $1.8 bln Lien Chieu container terminal project

Three consortia have submitted bids for the $1.8 billion Lien Chieu container terminal project in Danang, all of them leading companies in global shipping and port operations, a local official said.

Infrastructure - Wed, December 3, 2025 | 9:04 am GMT+7

Vietnam's billionaire Pham Nhat Vuong rises to Southeast Asia’s second richest

Pham Nhat Vuong, chairman of Vingroup (HoSE: VIC), Vietnam’s largest listed company by market cap, added $1.2 billion to his net worth in a single day, bringing it to $24.7 billion, according to Forbes data as of Tuesday.

Economy - Wed, December 3, 2025 | 8:39 am GMT+7

Malaysia forecasts 4.3-4.7% economic growth in 2026

Malaysia’s economy is expected to maintain steady growth in 2026 despite persistent global uncertainties, according to economic experts.

Southeast Asia - Tue, December 2, 2025 | 9:59 pm GMT+7

Vietnam drafts rules to upgrade professional standards for securities practitioners

Vietnam’s securities regulator has proposed amendments to licensing rules aimed at improving the quality and oversight of market professionals, including shifting from paper-based to electronic practising certificates and recognizing certain international qualifications.

Finance - Tue, December 2, 2025 | 8:57 pm GMT+7

EVF General Finance JSC labor union holds congress, sets priorities for 2025-2030 term

The labor union of EVF General Finance Joint Stock Company (EVF) recently held its sixth congress for the 2025-2030 term, outlining key tasks to strengthen worker representation and support the company’s development.

Companies - Tue, December 2, 2025 | 8:15 pm GMT+7

Hoa Phat Agriculture to maintain annual cash dividends after listing

Hoa Phat Group said its agriculture arm will continue paying annual cash dividends after listing, as its investment needs through 2030 amount to only about VND1.5 trillion ($56.87 million), funded by IPO proceeds and depreciation, leaving room to distribute profits to shareholders.

Companies - Tue, December 2, 2025 | 5:41 pm GMT+7

Elon Musk company close to securing pilot licence for Starlink satellite internet services in Vietnam: official

The U.S.'s SpaceX is preparing to resubmit its application for a pilot licence to provide Starlink satellite internet services in Vietnam, after addressing several issues raised by regulators.

Industries - Tue, December 2, 2025 | 4:44 pm GMT+7