Improved information transparency, corporate governance key to Vietnam bond market boost: expert

Multiple solutions including improved information transparency and corporate governance should be synchronously implemented to unlock the potential of Vietnam’s corporate bond market, writes Assoc. Prof., Dr. Tran Viet Dung, director of the Research Institute under the Hanoi-based Banking Academy of Vietnam.

He says this can contribute to increasing the corporate bond market value to 20% of the national GDP by 2025 and 30% by 2030.

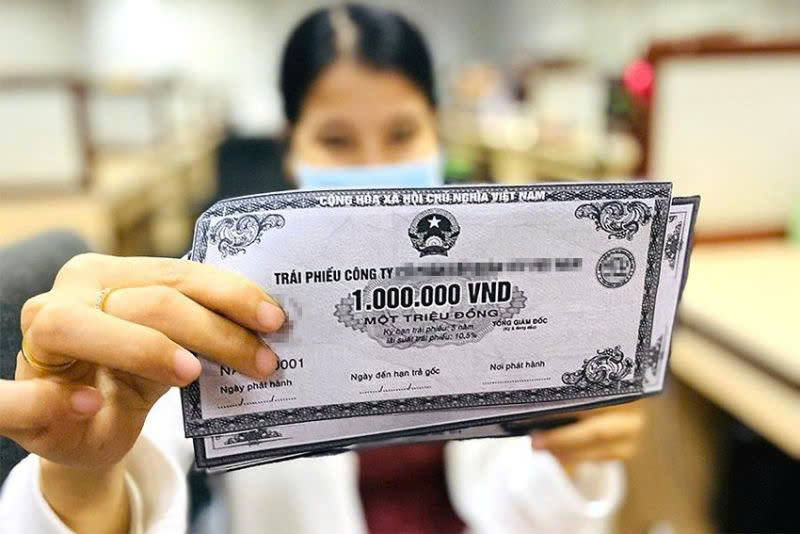

The value of corporate bonds issued in Q2/2024 hits VND91.22 trillion ($3.63 billion). Photo courtesy of the government's news portal.

There were many bright spots for the Vietnamese corporate bond market in June and the first six months of 2024, according to a Vietnam bond market report for Q2/2024 by the Vietnam Bond Association (VBMA) and the latest report by the Vietnam Investor Services (VIS Rating). However, there were many difficulties and challenges that need to be addressed.

The VBMA report showed that nearly VND67.8 trillion ($2.7 billion) of corporate bonds reached maturity in Q2/2024. Meanwhile, the value of corporate bonds issued in the quarter skyrocketed 138% year-on-year to VND91.22 trillion ($3.63 billion) a majority of them from the banking group at VND68.55 trillion, accounting for 75% of the total value.

Meanwhile, the VIS report said that in June, the total value of new bonds issued reached VND69 trillion ($2.75 billion), more than double the VND29 trillion in the preceding month. Most of the new issuances in June and in the first half came mainly from the banking sector.

This showed that bond issuance activities were much more vibrant in Q2 compared to the previous quarter and the surge came from the banking and real estate groups. The reason could be improved credit activities and the need to offset the amount of maturing bonds.

However, the domestic corporate bond market has not developed to its potential. Its size is just 11.2% of GDP, quite modest compared to other countries in the region like Malaysia (53.6%) and Thailand (26.7%).

Outstanding corporate bonds now account for about 8.4% of the total outstanding credit in the whole economy, down 0.5 percentage points from the end of 2023. The figure at the end of Q2 decreased slightly by 3% compared to the end of 2023 to over VND1,170 trillion ($46.56 billion).

The value of bonds with late interest and principal payments in Q2 hit VND11.36 trillion ($452 million), up slightly from Q1. Real estate bonds accounted for the lion’s share, 63%, of the bonds seeing late payment. This has been the case since November 2022.

The fact that most of the new issuances in June and the first half came mainly from the banking sector also reflected the fact that corporate bond issuance activities still faced many difficulties. There was almost no issuance by enterprises in the manufacturing, consumer goods or services sectors.

In the secondary market, the majority of transactions were made by the banking group. Among the top 10 issuers with the most traded bonds in the second quarter, six were from this sector.

Solution orientations

It can be seen that the capital demand for business development in Vietnam is very large. The government has also set a target of increasing the size of the bond market to 20% of GDP by 2025 and 30% by 2030. To unlock this potential, it is necessary to synchronously and comprehensively implement several solutions.

Firstly, Vietnam should complete the required legal framework and enhance market supervision capacity; and continue to perfect legal regulations on issuance, trading and management of corporate bonds, ensuring consistency and transparency. At the same time, it is necessary to strengthen the supervision and risk management capacity of state management agencies, thereby minimizing violations and protecting the rights of investors.

Secondly, the government needs to create favorable conditions and operating environments that help companies improve their business performance, thus making bonds issued by them more attractive.

Thirdly, information transparency and strengthen corporate governance should be improved. Enterprises need to fully, promptly and accurately disclose information related to their operations, business results and investment projects, thereby enhancing investor confidence.

At the same time, they should strengthen their governance capacity and apply modern governance standards to improve operational efficiency and minimize risks.

It is also possible to establish a rating culture for the bond market. Credit rating will bring greater transparency to the market and create stronger liquidity. This will serve as a foundation for building investor confidence while ensuring long-term sustainability of the corporate bond market.

Fourthly, Vietnam needs to diversify the types of corporate bonds issued in the market. In addition to issuing bonds to raise capital for production and business activities, it is necessary to encourage companies to issue other kinds of bonds like green bonds, asset-backed bonds and convertible bonds. This will create diverse choices for investors and boost market development.

Fifthly, there is a need to build and develop a system of professional financial intermediaries comprising consulting companies, investment funds and underwriting companies to support enterprises in the process of issuing bonds. At the same time, it is necessary to promote the participation of large financial institutions like banks, insurance companies and pension funds in the corporate bond market.

Finally, it is necessary to continue to promote communications and raise awareness of various issues among stakeholders. This will help businesses better understand the opportunities and benefits of issuing bonds and encourage investors to participate in the market fully and effectively.

In sum, synchronous implementation of the above solutions can unleash the growth potential of the corporate bond market in Vietnam, making it an effective capital mobilization channel for businesses while generating attractive investment opportunities for investors.

To promote efforts to remove bottlenecks and unlock its potential, The Investor is organizing a workshop on the sustainable and professional development of Vietnam’s corporate bond market in Hanoi on Friday, August 16.

Leaders of various ministries, agencies and associations as well as economists, representatives from commercial banks, securities firms, listed companies, international organizations, and credit rating institutions will participate in this event.

- Read More

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

The first passenger flights touched down at Long Thanh International Airport in Dong Nai province on Friday morning, marking the inaugural civil aviation operation at Vietnam’s largest airport.

Economy - Fri, December 19, 2025 | 2:07 pm GMT+7

Vingroup starts work on $35.2 bln Olympic Sports Urban Area on Hanoi outskirts

Vingroup (HoSE: VIC), Vietnam's leading private conglomerate, on Friday broke ground on its 9,171-hectare Olympic Sports Urban Area project in Hanoi, which is expected to become a new growth engine for the southern part of the capital in the next decade.

Real Estate - Fri, December 19, 2025 | 1:59 pm GMT+7

Vietnam telecom giant VNPT establishes AI company

State-owned Vietnam Posts and Telecommunications Group (VNPT) on Thursday launched subsidiary VNPT AI, aiming to bring Vietnamese AI products to international markets.

Companies - Fri, December 19, 2025 | 11:50 am GMT+7

Quang Ngai Sugar develops sugar, biomass power projects worth $179 mln in central Vietnam

Quang Ngai Sugar JSC (UPCom: QNS), a top sugar producer in Vietnam, will simultaneously hold groundbreaking or inauguration ceremonies on Friday for three projects worth over VND4.7 trillion ($178.5 million) in Gia Lai province.

Companies - Fri, December 19, 2025 | 8:05 am GMT+7

Vietnam defeat Thailand to win men’s football gold at SEA Games 33

After conceding two goals in just over 30 minutes, Vietnam reversed the situation to finally beat host nation Thailand 3-2 in the men’s football final of the 33rd SEA Games.

Society - Thu, December 18, 2025 | 10:43 pm GMT+7

Sun Group to commence construction on 5 landmark projects worth $5.7 bln

Sun Group is scheduled to start construction of five large-scale projects across Vietnam’s three regions on Friday, with a total investment of nearly $5.7 billion.

Companies - Thu, December 18, 2025 | 8:39 pm GMT+7

Unpaid credit card balances in Singapore hit record high in 10 years

Singapore's credit card debt has exceeded SGD9.07 billion (about $7 billion) in 2025's third quarter, a 10-year high that was last seen in 2014.

Southeast Asia - Thu, December 18, 2025 | 7:54 pm GMT+7

Thailand, Japan deepen transport, infrastructure cooperation

Thai Deputy Prime Minister and Minister of Transport Phiphat Ratchakitprakarn has met with Japanese Ambassador Otaka Masato to advance cooperation in Thailand’s transportation and infrastructure projects.

Southeast Asia - Thu, December 18, 2025 | 7:50 pm GMT+7

Masan's FMCG arm MCH to list on HCMC bourse at $8 per share, valuation tops $8.6 bln

Masan Consumer Corporation (UpCoM: MCH), the fast-moving consumer goods arm of Vietnam’s Masan Group, will officially debut on the Ho Chi Minh City Stock Exchange (HoSE) on December 25, with a reference price set at VND212,800 ($8.08) per share.

Companies - Thu, December 18, 2025 | 4:57 pm GMT+7

Sun Group-led consortium to build $616 mln Red River bridge in Hanoi

Hanoi authorities have approved a consortium led by Sun Group as the investor for the Tran Hung Dao bridge project, with a total investment estimated at VND16.27 trillion ($616.14 million).

Infrastructure - Thu, December 18, 2025 | 3:26 pm GMT+7

Shinhan Bank Vietnam accompanies SMEs in promoting cashless payments

With modern, secure and convenient payment solutions designed to meet the specific needs of businesses, particularly the SME segment, Shinhan Bank Vietnam continues to accompany enterprises in building a modern corporate image and keeping pace with the digital economy.

Banking - Thu, December 18, 2025 | 2:10 pm GMT+7

JC&C to divest 4.6% stake at Vietnam's dairy giant Vinamilk to F&N for $228 mln

Singapore-listed Jardine Cycle & Carriage Limited (JC&C) has announced the sale of more than 96 million shares, or a 4.6% stake, in Vietnam’s dairy giant Vinamilk (HoSE: VNM) to F&N Dairy Investments Pte. Ltd., part of the Fraser and Neave (F&N) group controlled by Thai billionaire Charoen Sirivadhanabhakdi.

Companies - Thu, December 18, 2025 | 1:36 pm GMT+7

Siemens to supply high-speed trains, key railway systems to Vingroup's subsidiary VinSpeed

Siemens Mobility on Wednesday signed a comprehensive strategic cooperation and high-speed railway technology transfer agreement with VinSpeed, a unit of Vietnam’s Vingroup, to supply high-speed trains and key railway systems for planned rail projects in Vietnam.

Companies - Thu, December 18, 2025 | 1:24 pm GMT+7

Hanoi administration to raise over $52 mln from Thuong Dinh Footwear divestment

Hanoi’s municipal government is set to raise nearly VND1.38 trillion ($52.35 million) from the sale of its entire 68.67% stake in Thuong Dinh Footwear Company - a major footwear producer in Vietnam, after two individual investors agreed to buy all shares on offer at a price far above market levels.

Companies - Thu, December 18, 2025 | 10:01 am GMT+7

Sony Music to acquire 49% stake at Vietnam's YeaH1 subsidiary

Sony Music Entertainment Hong Kong Ltd. will invest in a unit of YeaH1 (HoSE: YEG), a leading media entertainment technology group in Vietnam, through a private placement, acquiring a 49% stake and reducing YeaH1’s ownership to 49.88%.

Companies - Thu, December 18, 2025 | 8:34 am GMT+7

Honda Vietnam expands biz registration to cover electric vehicles, charging, battery swapping

Honda Vietnam (HVN) has formally expanded its registered business lines to include electric vehicles, charging infrastructure, and battery-swapping services, marking its most comprehensive step into the electric mobility ecosystem to date.

Companies - Wed, December 17, 2025 | 5:16 pm GMT+7

- Consulting

-

Vietnam M&A 2025: Opportunities reshaped by disciplined capital

-

VN-Index rises 3.1% in Nov, Finnish fund PYN Elite records -5.8%

-

Mind the gap

-

The generation game: Adapting to an aging population

-

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas

-

Powering growth from within