Insight into Vietnam's Decree 58 on renewable and new energy

The Vietnamese government's newly-issued Decree No. 58/2025/ND-CP on renewable and new energy provides detailed guidance on a couple of the most pressing topics such as self-produced and self-consumed energy, as well as offshore wind energy. Senior partner Anh Dang and associate Giang Tran of Vilaf law firm offer an insight into this decree.

A view of the solar farm of Trungnam Solar Power in Thuan Bac district, Ninh Thuan province, central Vietnam. Photo courtesy of Trungnam Group.

Promptly following the issuance of the Electricity Law 2024, the Prime Minister tasked the Ministry of Industry and Trade (MoIT) with working alongside relevant authorities to develop draft decrees for the new law’s implementation. These draft decrees attracted considerable public attention.

In early March 2025, the Vietnamese Government officially issued several key guiding decrees, including Decree No. 58/2025/ND-CP (Decree 58) on renewable and new energy (Decree 58), which offers detailed guidance on a couple of the most pressing topics such as self-produced and self-consumed energy, as well as offshore wind energy.

Decree 58 took immediate effect, and replaced Decree No. 135/2024/ND-CP dated October 22, 2024 on self-produced and consumed rooftop solar, on its issuance date.

1. Overall policy in development of renewable energy and “new energy”

The Electricity Law 2024 defines “renewable energy” (RE) as electricity generated from one or more of following sources: solar, wind, ocean, geothermal, hydropower, biomass, waste-to-energy, and other RE forms defined by laws.

Meanwhile, “new energy” (NE) is defined as electricity generated from hydrogen or ammonia produced from solar, wind, ocean, or geothermal energy, along with other NE forms defined by laws.

Guiding the Electricity Law 2024, Decree 58 outlines key policies regarding the development of RE and NE as follows:

- Investment policy decision (IPD): IPD from the Prime Minister shall be required for an RE or NE project using inter-regional sea areas within, or using sea areas beyond, the 6 nautical miles from the average lowest astronomical tide (“đường mép nước biển thấp nhất” in Vietnamese) (over many years).

- Mandatory demolition: Following project termination under the Electricity Law 2024, the maximum timeline for the demolition of wind and solar power plants is:

(i) For plants built on land: 3 years for those categorized as a class-A project under the Public Investment Law or 2 years for others; or

(ii) For plants built at sea: 5 years for those categorized as a class-A project under the Public Investment Law or 3 years for others.

- Reporting requirement: Depending on the project type (e.g., solar, wind, biomass, waste-to-energy, or other energy types), Decree 58 specifies the particular data on primary energy source parameters (if any) and electricity production statistics that relevant investors are obligated to collect and report (on an annual basis) to the MoIT and provincial Department of Industry and Trade (DoIT).

For instance, investors of solar power projects must report on their projects’ total number of sunshine hours in the week (hours), average solar radiation energy density per week (W/m²), total solar radiation energy per week (kWh/m²), and electricity production statistics per week (kWh).

This reporting requirement is to enable the authorities to assess the potential for RE and NE development and to conduct, among others, investigations and forecasts for the operation of the electricity system and other purposes imposed at laws.

Concerning the statutory reporting timeline, projects with IPDs approved by the provincial People’s Committee must report to the relevant provincial DoIT by January 15 every year, while projects with IPDs approved by the Prime Minister or the National Assembly must report to the MOIT by the same deadline.

2. Investment incentives

Given that RE and NE are identified by the Electricity Law 2024 as priority investment sectors, Decree 58 outlines specific RE and NE projects eligible for investment incentives, along with the applicable incentives.

- For NE projects: Decree 58 clarifies that NE projects that are eligible to incentives provided in Article 23.2 of Electricity Law 2024 must be the one that (A) producing electricity from 100% green hydrogen, 100% green ammonia, or 100% mixture of green hydrogen and green ammonia, (B) exporting to the national power system, and (C) being the first project of each type [by the investor].

Furthermore, Decree 58 provides more details on the incentives imposed in Article 23.2 of Electricity Law 2024 that an eligible NE project can enjoy:

(i) Sea area usage fee: Exemption during basic construction period but not exceeding 3 years; and 50% reduction up to 9 years after the exemption period;

(ii) Land use fee or rent: Exemption during basic construction period but not exceeding 3 years from the construction commencement date; and Exemption/reduction after the exemption period is according to laws on investment and land;

(iii) Minimum contractual electricity offtake: 70% during the loan principal repayment period but not exceeding 12 years (unless otherwise agreed). Please be noted that this incentive does not apply if the project fails to meet the minimum offtake due to project-related issues, load demand, or technical conditions.

- For offshore wind projects: Decree 58 clarifies that only an offshore wind project meeting the following conditions shall be entitled to the investment incentives outlined in Article 26.3 of Electricity Law 2024: (A) having been granted with an IPD before January 1, 2031 and (B) having capacity falling within 6,000 MW approved in the power development plan in case supplying electricity for the national power system. Furthermore, Decree 58 provides more details on the incentives imposed in Article 26.3 of Electricity Law 2024 that an eligible offshore wind project can enjoy:

(i) Sea area usage fee: Exemption during basic construction period but not exceeding 3 years; and 50% reduction up to 12 years after the above exemption period;

(ii) Land use fee or rent: Same as those applicable to the eligible NE project as discussed above;

(iii) Minimum contractual electricity offtake: 80% during the loan principal repayment period but not exceeding 15 years (unless otherwise agreed). Exemption of this incentive is the same as in the case of the eligible NE project as discussed above.

Decree 58 also provides that for offshore wind project granted with IPD after December 31, 2030, the applicable incentives shall be in accordance with the prevailing regulations at that time (i.e. after December 31, 2030).

For RE projects: Any RE projects that (A) installing energy storage system and (B) connected to the national power system are prioritized for dispatch during peak hours of the power system as per regulations, except self-generated and self-consumed energy.

For completeness, it should be noted that because the production of RE, clean energy, and waste-to-energy are generally provided as “sectors into which investment are encouraged or specially encouraged” under Decree No. 31/2021/ND-CP dated March 26, 2021 guiding the Investment Law 2020, other than the incentives specified in Decree 58 (as discussed above), RE and NE projects may be additionally entitled to other investment incentives outlined in the Investment Law 2020, such as exemption or reduction of corporate income tax and other tax incentives in accordance with tax laws.

Anh Dang, a senior partner at Vilaf law firm. Photo courtesy of the law firm.

3. Self-produced and self-consumed energy from RE and NE

Decree 58 stipulates certain principles for development of self-produced and self-consumed energy from RE and NE (except from rooftop solar system (RTS), which is discussed further in Section 4 below).

- Sale of electricity surplus: Except for self-produced and self-consumed RTS, electricity surplus from other self-produced and self-consumed sources can be sold up to 10% of actual generation output to EVN or its subsidiaries (collectively, EVN Entity) at (i) the average price according to the annual avoided cost tariffs issued by the MoIT (for small-scale plants) or (ii) the average electricity market price of the preceding year, as announced by the National Electricity System and Market Operator (NSMO), less service charges, but must not exceed the ceiling price applicable to the specific energy type.

- Compliance requirements: The development of self-produced and self-consumed projects must comply with regulations on investment, construction, land, environmental protection, and fire fighting and prevention (FPF). Developers are prohibited from importing used electrical equipment for projects that sell surplus electricity to the national grid. Grid-connected projects must also adhere to additional requirements for grid operation management.

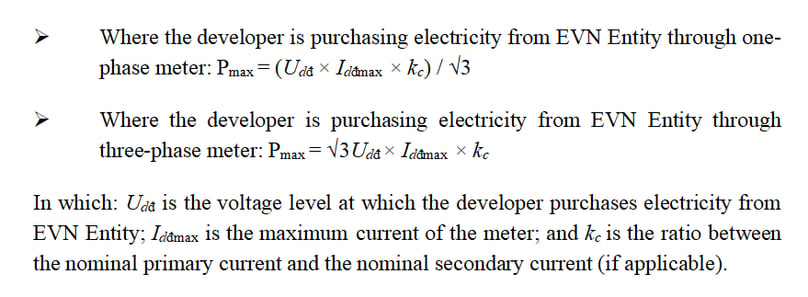

- Capacity requirements: In general, the capacity of self-produced and self-consumed RE and NE projects must (i) comply with the power and grid development plans at both national and provincial level (except for those exempted from development plan requirements under Article 10.5 of Electricity Law 2024) and (ii) suitable with electricity load conditions (installation of storage system is encouraged). However, the installed capacity of a self-produced and self-consumed project must not exceed the Pmax, which is calculated as follows:

- Development procedures: Developers/investors must notify the provincial DoIT and the relevant electricity utility before commencing development and construction of both off-grid and grid-connected self-produced and self-consumed RE or NE projects.

For grid-connected projects without surplus electricity sales, developers/investors must coordinate and agree with the relevant electricity utility on the connecting point and investment boundaries and, depending on the project scale, developers/investors must also comply with additional technical, control, and survey requirements.

For grid-connected projects that sell surplus electricity, in addition to the requirements for projects without surplus sales, developers must enter into a metering agreement with the electricity utility and obtain an Electricity Operation Permit as required by laws.

Tran Huong Giang, associate at Vilaf law firm. Photo courtesy of the company.

4. Self-produced and self-consumed rooftop solar system

Regulations on self-produced and self-consumed RTS imposed under Decree 58 have replaced Decree 135/2024 on the same subject.

- Sale of electricity surplus: While the sale of electricity surplus is not available to off-grid RTS, only following grid-connect RTS projects are eligible for surplus sales to EVN Entity:

(i) Projects falling within the development capacity in the national and provincial-level power development plans;

(ii) Projects installed on residential houses having installed capacity of less than 100 kW and connected to EVN Entity’s power grid; or

(iii) Projects installed on buildings in mountainous areas, border regions, or islands with access to the power grid, but not yet connected to or integrated with the national power system.

The total electricity surplus sold to EVN Entity must not exceed 20% of the total generation output (including battery storage output), which is calculated according to the formula imposed in Decree 58, at the average electricity market price of the preceding year, as announced by the National Electricity System and Market Operator, but must not exceed the ceiling price of ground-mounted solar power. The power purchase agreement for sale of electricity surplus in this case is 5 years at maximum, subject to renewals, and must comply with the model form attached to Decree 58.

Similar to old Decree 135/2024, RTS installed on public assets are prohibited from sales and purchase of electricity surplus, while the 20% limits on surplus sale is not applicable to mountainous areas, border regions, or islands not yet connected to the national power systems.

- Compliance requirements: Similar to the development of self-produced and self-consumed projects in general, RTS projects must also comply with the relevant regulations on investment, construction, land, environmental protection, and fire fighting and prevention.

Self-produced and self-consumed RTS installed on residential houses by households with a capacity of less than 100 kW that sell electricity surplus to the national grid are exempt from or not required to adjust their business registration certificates.

- Development procedures: Depending on the type of self-produced and self-consumed RTS project, the pre-notification procedure or registration procedure with the provincial DoIT and other authorities shall apply.

(i) Pre-notification with the provincial DoIT, electricity units, and the authorities managing the construction and fire fighting and prevention shall be applicable to (A) all off-grid self-produced and self-consumed RTS, (B) grid-connected residential RTS projects having installed capacity of less than 100 kW, or (C) other grid-connected RTS projects having installed capacity of less than 1,000 kW without registration for surplus sale; or

(ii) Registration for a Development Registration Certificate with the provincial DoIT shall be applicable to the following types of grid-connected RTS projects: (A) projects having installed capacity of 1,000 kW or more; (B) projects having installed capacity of less than 1,000 kW with registration for surplus sale (except residential projects having capacity of less than 100 kW); or (C) projects having installed capacity of less than 1,000 kW without surplus sale but wish to apply for the Development Registration Certificate. Please be noted that the total capacity of projects mentioned in (A) and (B) must not exceed the total capacity allocated to each province or municipality pursuant to the power development plan

- Transitional provisions: According to Decree 58:

(i) Owners of RTS sources, which are developed before January 1, 2021 and selling electricity surplus to EVN Entity are not allowed to increase the capacity outlined in relevant power purchase agreements.

(ii) RTS projects, which are developed from January 1, 2021 to March 3, 2025 but developers have not implemented procedures under Decree 135/2024, must comply with Decree 58.

(iii) Any applications for Development Registration Certificates submitted before March 3 2025 will be processed in accordance with Decree 135/2024.

Hywind Tampen offshore wind farm that supplies electricity to Equinor’s oil and gas fields Snorre and Gullfaks in the Norwegian North Sea. Photo courtesy of the company.

5. Offshore Wind

Decree 58 clarifies that the Prime Minister shall approve the Investment policy decision in conjunction with the investor for implementing an offshore wind power project in the case where: (i) a wholly state-owned enterprise (WSOE) proposes to implement the project either directly or through a single-member limited liability company owned by the WSOE, or (ii) if the capital and experience requirements are met, a joint venture where more than 50% of the charter capital or total voting shares are held by a WSOE or a single-member limited liability company owned by the WSOE.

Additionally, Decree 58 provides detailed guidance on selecting the entity responsible for conducting surveys or implementing offshore wind projects. Specifically regarding foreign investment, the decree has removed many restrictions on foreign investors compared to the draft version of December 2024. To be more specific:

- Conditions for implementing offshore wind power projects: Under Decree 58, foreign investors and foreign-invested enterprises as specified in Article 23.1 of the Investment Law 2020 when participating in the implementation of investment or bidding for offshore wind power projects, must meet below conditions:

(i) Having experience in investing to develop at least one offshore wind power project in Vietnam or another foreign country. This condition is also applied to other domestic investors;

(ii) Having the contributed capital accounted for at least 15% of the total investment capital, and the equity capital accounted for at least 20% of the contributed capital. The similar condition is also applied to other domestic investors, except that applicable ratios are 5% and 20%, respectively;

(iii) At least 5% of the charter capital or total voting shares of the relevant project company must be held by (A) a state enterprise or (B) an enterprise with more than 50% of its charter capital total voting shares held by WSOE. This condition is much more favorable than the previous draft, which limits foreign ownership in a project company to below 65% only;

(iv) Having written agreement from the Ministry of Defense, the Ministry of Public Security, and the Ministry of Foreign Affair; and

(v) Committing to use domestic labor, goods, and services from local suppliers during the investment, construction, and operation phases, on the basis of ensuring competitiveness in terms of price, quality, progress, and availability.

- Conditions for transfer: Repeating the Electricity Law 2024, Decree 58 mandates any project or share/capital contribution transfer in offshore wind projects that involve foreign investors and foreign-invested enterprises as specified in Article 23.1 of the Investment Law 2020 must be approved in writing by competent authorities.

Decree 58 additionally requires that for any transfer prior to the target project’s commercial operation date, the transferee must satisfy all criteria and conditions applicable to a foreign investor applied to implement a new offshore wind power project, while for any transfer on or after the commercial operation date, the transferee must satisfy the conditions in items (iii) and (v) above.

Conclusion

Decree 58 provides essential guidance for the development of RE and NE projects in Vietnam, aligning with the overarching goals of the Electricity Law 2024. Additionally, the decree’s more flexible approach to foreign investment fosters greater participation in Vietnam’s energy sector.

However, as the Vietnamese Government is in the process of amending the National Power Development Plan of 2021-2030 (with a vision toward 2050) (known as PDP8) and its detailed implementation plan, it is expected that, despite the provisions of Decree 58, investors and stakeholders should remain attentive to the upcoming PDP8 amendments before making any official investment decisions.

- Read More

VAFIE, Hung Yen province authority accompany taxpayers

The Vietnam's Association of Foreign Invested Enterprises (VAFIE) and Hung Yen province's tax authority on Tuesday held a workshop on corporate tax policy updates and key notes on 2025 corporate income tax filings.

Companies - Wed, November 26, 2025 | 8:15 pm GMT+7

Thailand’s Super Energy earns $81 mln in Jan-Sep revenue from Vietnam

Super Energy Corporation, a Thai renewable-energy developer, recorded about THB2.62 billion ($81.28 million) in revenue from its Vietnam operations in the first nine months of 2025, according to its Q3 earnings report.

Companies - Wed, November 26, 2025 | 4:51 pm GMT+7

Turning point of Vietnam's fund management industry: exec

Vietnam’s asset management industry is entering a pivotal phase as the country seeks to diversify capital flows and strengthen long-term funding, said Lu Hui Hung, CEO of Phu Hung Fund Management, citing the Ministry of Finance's recently issued Decision 3168.

Finance - Wed, November 26, 2025 | 4:42 pm GMT+7

Gelex Infrastructure okayed to launch IPO of 100 mln shares

Gelex Infrastructure JSC has received approval from the State Securities Commission of Vietnam to proceed with an initial public offering of 100 million shares, the company said.

Companies - Wed, November 26, 2025 | 3:52 pm GMT+7

Seven young PV Gas employees selected for Petrovietnam’s 'Outstanding Youth 2025' program

Seven young employees of PetroVietnam Gas (PV Gas) have been selected for Petrovietnam’s “Outstanding Youth 2025” program, an initiative aimed at identifying and developing high-potential talent across the state energy group.

Companies - Wed, November 26, 2025 | 3:01 pm GMT+7

Deep C Industrial Zones in northern Vietnam draws three new projects worth over $242 mln

Deep C Industrial Zones in Quang Ninh province has secured three new investment projects with combined registered capital of about VND6.38 trillion ($242 million), reinforcing its position as an attractive destination for manufacturing and logistics.

Industries - Wed, November 26, 2025 | 1:58 pm GMT+7

Billionaire Pham Nhat Vuong's son takes helm at VinMetal as Vingroup pledges support for loss-making steel producer Pomina

Vingroup, Vietnam's biggest listed company by market cap, said its steel subsidiary VinMetal will provide Pomina Steel with a zero-interest working capital loan for up to two years, helping the troubled steelmaker stabilize operations and restore cash flow.

Companies - Wed, November 26, 2025 | 12:38 pm GMT+7

HAGL chairman says he sold 'everything possible' to save the company

Hoang Anh Gia Lai (HAGL) has successfully restructured with its debt reduced from VND36 trillion ($1.37 billion) to over VND6 trillion ($227.5 million), now focusing on developing raw material areas to gain scale advantages.

Companies - Wed, November 26, 2025 | 8:18 am GMT+7

Vingroup subsidiary VinMetal may acquire loss-making steel producer Pomina: broker

Ho Chi Minh City Securities (HSC) analysts said a potential acquisition of steel manufacturer Pomina could be a strategic move that allows VinMetal to gain a faster foothold in the steel industry by using Pomina’s existing construction steel capacity.

Companies - Tue, November 25, 2025 | 8:05 pm GMT+7

Vingroup plans $38 mln bond issuance to restructure debt

Vingroup (HoSE: VIC), Vietnam’s largest listed company by market cap, plans to issue VND1 trillion ($37.91 million) in bonds via private placement as it seeks to restructure debt.

Companies - Tue, November 25, 2025 | 3:52 pm GMT+7

Vietnam gov't proposes minimum $379 mln charter capital for offshore wind developers

The Vietnamese government has proposed that offshore wind power developers have a minimum charter capital of VND10 trillion ($379 million) each, according to a draft resolution designed to ease bottlenecks in the country’s 2026-2030 energy development plan.

Energy - Tue, November 25, 2025 | 3:41 pm GMT+7

Petrovietnam arm to venture into CO2 transportation, seabed minerals, geothermal

PVEP, the upstream arm of state giant Petrovietnam, plans to expand into new fields such as CO2 transportation and disposal (carbon capture, utilization, and storage), coal gas and underground mineral research, seabed minerals, and geothermal.

Industries - Tue, November 25, 2025 | 3:08 pm GMT+7

MB successfully closes landmark $500 mln inaugural green term loan facility agreement

Military Commercial Joint Stock Bank (MB) on Monday announced the successful closing of its three-year $500 million inaugural Green Term Loan Facility Agreement, marking a significant milestone in the bank’s sustainable financing journey.

Banking - Tue, November 25, 2025 | 2:17 pm GMT+7

Impact of rising exchange rates in Vietnam

Mirae Asset Securities analysts offer an insight into the impact of rising exchange rates on companies in Vietnam in a report dated November 21.

Economy - Tue, November 25, 2025 | 1:35 pm GMT+7

Vietnam's industrial park developers post strong earnings as tenant demand rebounds

Vietnam’s industrial real estate sector is showing stronger earnings and improving demand, with foreign tenants resuming lease negotiations after U.S. tariff policies became clearer, according to a brokerage report.

Industrial real estate - Tue, November 25, 2025 | 11:07 am GMT+7

Vietnamese export stocks under the radar despite strong earnings

Investor caution over tariff risks and the slowdown of major economies has prevented Vietnamese export stocks from making a strong price recovery.

Finance - Tue, November 25, 2025 | 8:44 am GMT+7

- Travel

-

Impressive Standard Chartered Hanoi Marathon Heritage Race 2025

-

Nguyen Hong Hai wins 'Investors' golden heart' golf tournament 2025

-

140 players compete at “Investors’ golden heart” golf tournament

-

‘Investors’ golden heart’ golf tournament to tee off on Saturday

-

Vietnam, Hong Kong Aircraft Engineering sign deal on aircraft maintenance hub at northern airport

-

Sun Group gets nod for $375 mln inland waterway tourism project in central Vietnam