More data center investment to be poured into Vietnam: Cushman & Wakefield

Vietnam is an ideal destination for data center investment and the country is expected to see further interest from international investors, according to consultancy firm Cushman & Wakefield.

Inside a data center in Ho Chi Minh City, southern Vietnam. Photo courtesy of Saigon Times.

A key factor enhancing the country’s investment appeal is its liberalized regulatory environment.

“Vietnam’s recently introduced policy change allowing foreign investors to acquire land, and to own and operate data centers without a local partner, has demonstrated the Government’s commitment to boosting digital infrastructure across the country,” said head of insights and analysis for Cushman & Wakefield’s Asia Pacific Data Centre Group, Pritesh Swamy.

“Data centers have been classified as “high-priority technology” for development and investment, and we expect to see further interest from international investors in the months to come,” he said.

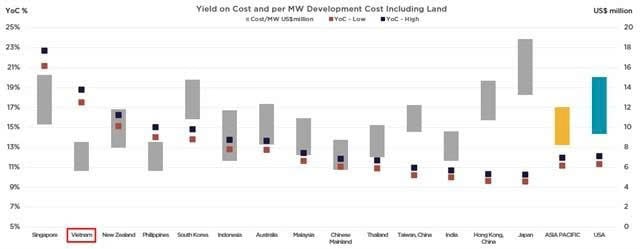

Vietnam is rapidly emerging as a strategic destination in the Asia-Pacific data center investment landscape, with a yield-on-cost second only to Singapore.

The Cushman & Wakefield Asia Pacific Data Centre Investment Landscape report found the yield-on-cost for data center investments in Vietnam to be in the range of 17.5% to 18.8%, behind Singapore’s 21% to 23%.

This positions the Southeast Asian country as one of the most attractive emerging markets, driven by surging demand, competitive development costs, and proactive government support, the company said.

The average development cost - including construction and land costs - per megawatt (MW) of data center capacity in Vietnam is approximately $7.1 million. This is significantly below the regional average of $10.1 million/MW and nearly half the cost of development in Japan, which is the region’s most expensive market at $16.1 million/MW.

By 2030, the total capital expenditure requirement for planned data center projects in the country is estimated at $755 million.

While this figure is modest compared to major markets such as Japan ($47 billion), Australia ($21 billion), or Malaysia and India ($20 billion each), it underscores the market’s early-stage growth and high return potential.

Vietnam’s current capitalization rate ranges from 7% to 8%, well above the regional average of 5.8%, offering an attractive risk premium for forward-looking investors.

Furthermore, Vietnam’s infrastructure shortfall is part of a broader regional trend, highlighting robust demand amid constrained supply. The Asia-Pacific region averages over 350,000 people per MW of colocation capacity, several times higher than the U.S.

In Vietnam, this figure exceeds 1.77 million people per MW, among the highest in the region. Even if all under-construction and planned projects are completed by 2030, the country would still face a significant shortfall, with a projected density of 692,563 people per MW.

Yield-on-cost and per MW development cost including land, 2025. Photo courtesy of Cushman & Wakefield.

According to Cushman & Wakefield, Vietnam’s macroeconomic fundamentals further support the sector’s growth. Although the country has yet to reach a $1 trillion GDP like some regional peers, it is among the fastest-growing economies, with strong breakout potential.

Cushman & Wakefield’s analysis shows that markets with GDPs under $1 trillion - including Vietnam, the Philippines, Thailand, Taiwan (China), and New Zealand - account for 7% of regional GDP but only 5% of total data center capacity, indicating substantial headroom for expansion.

- Read More

Cash returns to Vietnamese stock market, but analysts urge caution

Vietnam’s stock market staged a sharp rebound on Tuesday, snapping a five-session losing streak as cash returned to the market, but analysts cautioned that short-term risks remain.

Finance - Wed, December 17, 2025 | 9:36 am GMT+7

'Passion fruit king' Nafoods expands fruit processing investment in central Vietnam

Nafoods Group, one of Vietnam’s largest passion fruit processors, has raised the total investment for its high-tech fruit processing complex in Gia Lai province to VND744 billion ($28.24 million).

Industries - Wed, December 17, 2025 | 8:56 am GMT+7

Japan's Igarashi Reizo builds $24 mln cold storage project in southern Vietnam

Igarashi Reizo, a more than 100-year-old Japanese company specializing in cold storage services, has broken ground for a cold and dry warehouse complex in Tay Ninh province.

Industries - Wed, December 17, 2025 | 8:00 am GMT+7

Which beach in Vietnam boasts the Pantone - 'color of the year 2026'?

As soon as the Pantone Color Institute unveiled “Cloud Dancer” as the Color of the Year 2026, travel lovers quickly made the connection to Kem Beach – the iconic beach in Phu Quoc famed for its rare, velvety-white sand, soft and distinctive in texture.

Travel - Tue, December 16, 2025 | 8:46 pm GMT+7

Unprecedented national milestone in 65 years: Vietnam welcomes 20 millionth international visitor

From 10 million international arrivals in 2016 to 20 million in 2025, Vietnam’s tourism sector has doubled in scale in less than a decade. This historic milestone, officially recorded in Phu Quoc, reflects the exceptional growth momentum and substantial development potential of Vietnam’s tourism industry in a new phase.

Travel - Tue, December 16, 2025 | 8:28 pm GMT+7

Vietnam charges businessman ‘Shark Binh’ with additional tax evasion offence

Vietnamese police have brought additional charges against Nguyen Hoa Binh, widely known as “Shark Binh”, accusing him of tax evasion linked to the operations of fintech firm Vimo Technology JSC, authorities said on Monday.

Society - Tue, December 16, 2025 | 4:33 pm GMT+7

Vietnam blockchain firm Hyra partners with AHT Tech to expand AI capabilities

Hyra Holdings, a Vietnam-based blockchain and artificial intelligence company, has entered a strategic partnership with technology services provider AHT Tech, aiming to scale its AI ecosystem while aligning operations with international security and compliance standards.

Companies - Tue, December 16, 2025 | 3:14 pm GMT+7

Vietnam’s first LNG power plants may incur $38 mln loss in 2026: broker

Vietnam’s first LNG-to-power plants, Nhon Trach 3 and Nhon Trach 4, are expected to post a combined loss of VND1 trillion ($37.98 million) in 2026, their first full year of commercial operations, predicted Vietcap Securities.

Energy - Tue, December 16, 2025 | 3:06 pm GMT+7

Many Vietnamese stocks are trading at deeply discounted valuations: brokerage exec

Nguyen Duy Hung, chairman of Vietnam’s leading brokerage SSI Securities, said many stocks on the local market are "trading at very low valuations", as recent gains in the benchmark index have been driven by only a handful of large-cap names.

Finance - Tue, December 16, 2025 | 2:53 pm GMT+7

FPT forms specialized board to build core capabilities with expansion into rail tech

Vietnam's leading technology corporation FPT (HoSE: FPT) has set up a strategic technology steering committee, underscoring its push to master core technologies including rail-related solutions, and build a high-quality talent base to support long-term competitiveness.

Companies - Tue, December 16, 2025 | 2:05 pm GMT+7

Hanoi approves $32.5 bln Red River scenic boulevard project

Hanoi has approved a massive urban redevelopment project along the Red River which would transform the city’s riverbanks into a new ecological, economic and cultural space, local authorities said.

Real Estate - Tue, December 16, 2025 | 9:00 am GMT+7

Hanoi police extradite ‘Mr Hunter’ Le Khac Ngo back to Vietnam

Hanoi police have extradited Le Khac Ngo, known as “Mr Hunter”, from the Philippines to Vietnam, authorities said on Friday.

Society - Tue, December 16, 2025 | 8:00 am GMT+7

Malaysia eyes AI-driven energy future

Malaysia needs to modernize its power systems to build a low-carbon economy that is competitive, inclusive and resilient, said Deputy Prime Minister Datuk Seri Fadillah Yusof at the Global AI, Digital and Green Economy Summit 2025, which opened on Monday.

Southeast Asia - Mon, December 15, 2025 | 11:47 pm GMT+7

Vingroup’s mega project contributes over $1 bln in land-use fees, land lease to HCMC’s 11-month budget

A mega urban project by Vietnam’s leading private conglomerate Vingroup (HoSE: VIC) contributed VND27.36 trillion ($1.04 billion) to Ho Chi Minh City’s budget revenue in the first 11 months of this year, the local government said.

Real Estate - Mon, December 15, 2025 | 5:35 pm GMT+7

Vietnam PM says Long Thanh airport should anchor aviation-led growth

Vietnam must use the Long Thanh International Airport as a hub to develop an aviation economy and ecosystem, creating a new growth pole rather than merely operating an airport, said Prime Minister Pham Minh Chinh.

Economy - Mon, December 15, 2025 | 5:03 pm GMT+7

Vietnam introduces new policy to attract electronics 'eagles'

Vietnam’s Ministry of Science and Technology has issued a circular setting criteria for enterprises engaged in electronics manufacturing projects to qualify for tax incentives, aiming to lure more global electronics giants.

Economy - Mon, December 15, 2025 | 4:24 pm GMT+7