62% of Vietnam consumers cut non-essential spending: PwC

Vietnamese consumers have drastically adjusted their spending behaviors, with 62% in a new PwC survey “holding back” on non-essential spending amid the globally rising cost of living.

Notably, 54% of consumers Vietnamese expect to spend less on luxury products, according to the 2023 PwC Consumer Insights Survey in Vietnam.

A shopper at a Win store of retailer WinCommerce of Masan Group in Vietnam. Photo courtesy of Masan.

The survey also found consumers expect to reduce their expenditure across multiple categories over the next six months. Industries including luxury and premium products, travel, and consumer electronics expect to see the greatest portion of consumer spending reductions over the next six months, whereas groceries are expected to decline the least.

“As the global economy faces challenges and societies adapt to the new normal, consumer spending habits are shifting. Consumers are reducing their spending, shifting between digital and physical spaces, and prioritizing trustworthy products and companies,” said Jonathan Ooi, partner, deals leader, PwC Vietnam.

“Business leaders must closely monitor these trends and adapt accordingly to remain competitive in the constantly evolving market," he said.

In the current economic climate, Vietnamese consumers are more cautious in their spending habits.

According to the PwC survey, 42% of Vietnamese consumers expect to spend less on travel and 38% on electronics. The least reported planned spending reduction is on groceries – only 18% of domestic consumers plan to cut their spending on groceries, compared to 24% of global consumers.

In another finding, “phygital” – the concept of using technology to bridge the digital world with the physical world – is now a thing.

Online shopping is increasingly the go-to for Vietnamese consumers, with 64% of consumers anticipating an increase in their frequency of online purchases, and the majority of consumers expect an increase in omnichannel experience (delivery, collection and click-and-collect). However, physical shopping remains key to product quality assurance and in-store experience.

Furthermore, in-office work is the norm again, and this is particularly so in Vietnam.

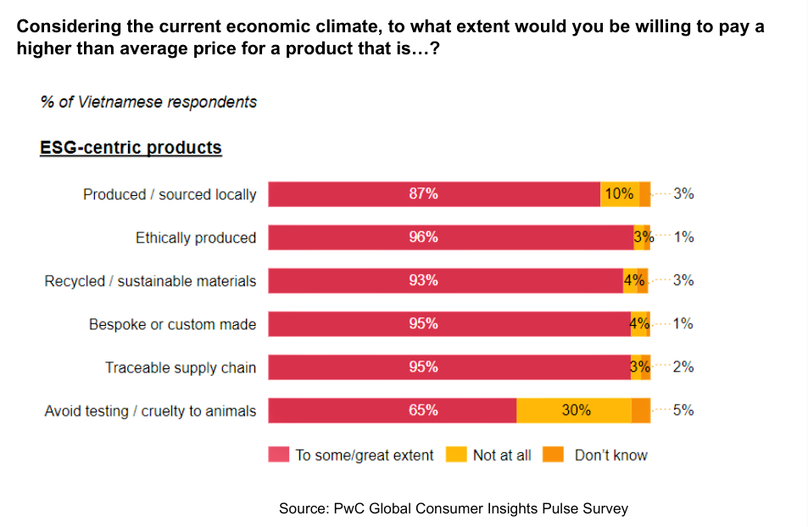

Vietnamese consumers are willing to pay more for products with sustainability cues.

Sustainable products are in-demand from consumers, the report says. Despite a planned spending reduction and a challenging economic environment, consumers say they are still willing to pay more for sustainable product types. Overwhelmingly, 96% of Vietnamese respondents will pay more for products by companies with a reputation for ethical practices, bespoke or custom-made products (95%), or those with traceable supply chains (95%).

- Read More

Southern Vietnan port establishes strategic partnership with Japan’s Port of Kobe

Long An International Port in Vietnam’s southern province of Tay Ninh and Japan’s Port of Kobe on Monday signed an MoU establishing a strategic port partnership which is expected to boost trade flows, cut logistics costs, and deliver greater benefits to businesses across the region.

Companies - Wed, November 19, 2025 | 10:14 am GMT+7

Thaco's agri arm seeks to expand $44 mln cattle project in central Vietnam

Truong Hai Agriculture JSC (Thaco Agri), the agriculture arm of conglomerate Thaco, looks to aggressively expand its flagship cattle farming project in the central Vietnam province of Gia Lai.

Industries - Wed, November 19, 2025 | 9:56 am GMT+7

Japan food major Acecook eyes new plant in southern Vietnam

Acecook, a leading instant noodle maker with 13 plants operating in Vietnam, is studying a new project in the southern province of Tay Ninh.

Industries - Wed, November 19, 2025 | 9:39 am GMT+7

Vietnam’s largest Aeon Mall to take shape in Dong Nai province

Authorities of Dong Nai province, a manufacturing hub in southern Vietnam, on Monday awarded an investment registration certificate to Japanese-invested Aeon Mall Vietnam Co., Ltd. for its Aeon Mall Bien Hoa project.

Industries - Tue, November 18, 2025 | 8:17 pm GMT+7

Police propose prosecuting Egroup CEO Nguyen Ngoc Thuy for fraud, bribery

Vietnam’s Ministry of Public Security has proposed prosecuting Nguyen Ngoc Thuy, chairman and CEO of Hanoi-based education group Egroup, along with 28 others, for fraud to appropriate property, giving bribes, and receiving bribes.

Society - Tue, November 18, 2025 | 4:01 pm GMT+7

Singapore-backed VSIP eyes large urban-industrial complex in southern Vietnam

A consortium involving VSIP, a joint venture between local developer Becamex IDC and Singapore’s Sembcorp, plans a large-scale urban-industrial development named the "Moc Bai Xuyen A complex along the Tay Ninh-Binh Duong economic corridor in southern Vietnam.

Industrial real estate - Tue, November 18, 2025 | 2:38 pm GMT+7

Aircraft maintenance giant Haeco to set up $360 mln complex in northern Vietnam

Hong Kong-based Haeco Group, Vietnam's Sun Group, and some other partners plan to invest $360 million in an aircraft maintenance, repair and overhaul (MRO) complex at Van Don International Airport in Quang Ninh province - home to UNESCO-recognized natural heritage site Ha Long Bay.

Industries - Tue, November 18, 2025 | 2:13 pm GMT+7

Thai firm opens 20,000-sqm shopping center in central Vietnam hub

MM Mega Market Vietnam (MMVN), a subsidiary of Thailand's TCC Group, on Monday opened its MM Supercenter Danang, a 20,000 sqm commercial complex with total investment capital of $20 million, in Danang city.

Real Estate - Tue, November 18, 2025 | 12:20 pm GMT+7

Vietnam PM asks Kuwait fund to expand investment in manufacturing, logistics, renewable energy

Prime Minister Pham Minh Chinh on Monday called on the Kuwait Fund for Arab Economic Development (KFAED) to strengthen cooperation with Vietnam, particularly in the areas of industrial production, logistics, renewable energy, green economy, and the Halal ecosystem.

Economy - Tue, November 18, 2025 | 11:53 am GMT+7

Thai dairy brand Betagen to build first plant in Vietnam

Betagen, a famous Thai dairy brand, plans to build its first manufacturing plant in Vietnam, located in the southern province of Dong Nai.

Industries - Tue, November 18, 2025 | 8:49 am GMT+7

Banks dominate Vietnam's Q3 earnings season, Novaland posts biggest loss

Banks accounted for more than half of the 20 most profitable listed companies in Vietnam’s Q3/2025 earnings season, while property developer Novaland recorded the largest loss.

Finance - Tue, November 18, 2025 | 8:24 am GMT+7

Highlands Coffee posts strongest quarterly earnings in 2 years on robust same-store sales

Highlands Coffee, Vietnam’s largest coffee chain, delivered its best quarterly performance in two years, with Q3 EBITDA exceeding PHP666 million ($11.27 million), parent company Jollibee Foods Corporation (JFC) said in its latest earnings report.

Companies - Mon, November 17, 2025 | 10:21 pm GMT+7

Hong Kong firm Dynamic Invest Group acquires 5% stake in Vingroup-backed VinEnergo

VinEnergo, an energy company backed by Vingroup chairman Pham Nhat Vuong, has added a new foreign shareholder after Hong Kong–based Dynamic Invest Group Ltd. acquired a 5% stake, according to a regulatory filing on Saturday.

Companies - Mon, November 17, 2025 | 9:52 pm GMT+7

Thai giant CP’s Q3 Vietnam revenue drops 20% as hog prices slump

Thailand’s Charoen Pokphand Foods PCL (CPF) reported a sharp downturn in its Vietnam business in Q3, making the country its only major market to contract.

Companies - Mon, November 17, 2025 | 4:16 pm GMT+7

Surging demand for gas turbines tightens supply chains, extends lead times: Siemens Energy

Demand for gas turbines is rising rapidly, especially in regions with a surge in data center development, tightening supply chains and extending lead times - factors that investors must closely track during project preparation, according to Siemens Energy.

Companies - Mon, November 17, 2025 | 1:34 pm GMT+7

Novaland completes first phase of restructuring, targets 'returning to growth' from 2027

Novaland, a leading real estate developer in Vietnam, said it has completed the first phase of its multi-year restructuring plan and aims to finish the entire program by end-2026, positioning the company to return to growth from 2027.

Companies - Mon, November 17, 2025 | 12:26 pm GMT+7