Apartment prices in Hanoi rise for 20 consecutive quarters, ease in HCMC

The average primary prices of apartments in Hanoi have increased for 20 consecutive quarters amid scant supply while those in Ho Chi Minh City have cooled down, according to the latest Savills Vietnam report.

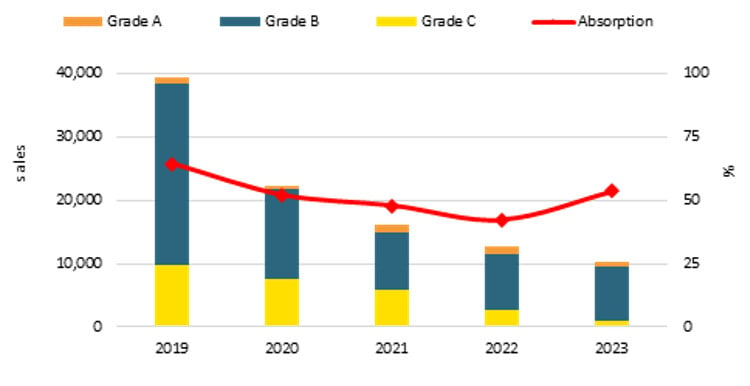

Primary asking prices of VND58 million ($2,363)/m2 net sellable area (NSA) in the fourth quarter of last year increased 7% quarter-on-quarter and 12% year-on-year.

The primary apartment stock of 11,911 apartments in Hanoi dropped 40% quarter-on-quarter and 41% year-on-year.

Hanoi apartment performance. Source: Savills Vietnam.

There is a disconnect between demand and supply in Hanoi, especially for affordable properties, explained Do Thu Hang, senior director of advisory services at Savills Hanoi, adding metro lines and ring roads will accelerate decentralization when completed.

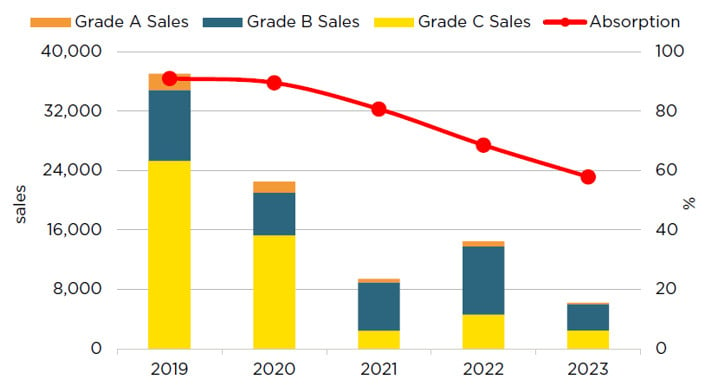

In contrast, primary apartment prices in Ho Chi Minh City in Q4/2023 returned to the 2020 level at VND69 million ($2,810)/m2 NSA, down 36% quarter-on-quarter and 45% year-on-year.

Primary stock in the city has trended downwards since 2017. In Q4/2023, primary stock of 7,600 units was stable quarter-on-quarter but dropped 5% year-on-year.

Ho Chi Minh City apartment performance. Source: Savills Vietnam.

Residential stock in HCMC is in incredibly short supply, especially considering that the city’s population exceeds 10 million, Giang Huynh, head of research and S22M noted.

According to Savills Q4/2024 apartment market report, in HCMC, apartment returns have softened for five years, however, they remain above deposit interest rates. As such, apartments continue to be a profitable investment channel, said Giang.

A similar tendency has been observed in the residential market by CBRE Vietnam, another foreign-invested real estate services firm.

In 2023, both Hanoi and HCMC experienced the lowest number of new apartments in the past 10 years. In Hanoi, nearly 10,300 condominiums and 2,600 landed property units were launched last year, down 32% and 84% year-on-year, respectively.

In HCMC, there was a more modest new supply with nearly 8,700 condominiums and only 30 new landed property units launched, representing a decline of 54% and 98%, respectively, compared to 2022.

However, there was an improvement in the number of newly launched units in the latter half of 2023 compared to the first half, particularly a significant increase of over 60% in the Hanoi condominium market and an 11% increase in HCMC.

Mega-urban projects in the west and east of Hanoi and in the east of HCMC continued to dominate the market with the highest share of new supply in both cities, contributing more than 60% of new supply in Hanoi and nearly 80% in HCMC.

Primary selling prices of condos in both cities remained high, especially in Hanoi, with primary prices recording a rapid price growth mainly due to the large quantity of new supply in the high-end segment. The number of high-end condominium units accounted for 75% in Hanoi and 84% in HCMC of 2023’s total new launches.

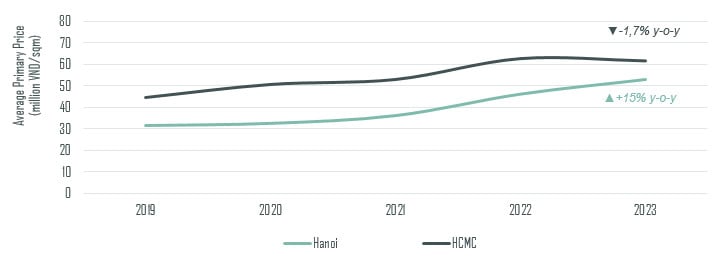

Average primary prices in Hanoi and HCMC in $/sqm (excluding VAT and maintenance fees, quoted on NSA). Source: CBRE Research, Q4/2023.

On the other hand, the mid-end segment, with selling prices more budget-friendly to the majority of the population, accounted for only a small proportion, while the affordable segment has completely disappeared in both markets in the past few years.

“In 2023, we observed a reversal in the trend between the Hanoi and HCMC residential markets, with the Hanoi market now following a similar trajectory to that of HCMC about three years ago," said Dung Duong, executive director of CBRE Vietnam. Particularly, at the end of 2023, the average primary selling price in Hanoi reached VND53 million ($2,159)/sqm (excluding VAT and maintenance fees), up 4.6% quarter-on-quarter and 14.6% year-on-year. This was the primary price recorded in HCMC during the 2020-2021 period.

On the contrary, primary prices for condos in HCMC levelled off at around VND61 million ($2,485)/sqm in 2023, down 1.7% year-on-year. During 2023, high-end supply located far from the city center and mid-end supply were higher than the previous year.

In the secondary market, selling prices of condos in Hanoi and HCMC went on opposite trends. Secondary prices in Hanoi in Q4/2023 continued to increase from the previous quarter, reaching around VND33 million/sqm, up 5% year-on-year. Limited new supply an newly launched projects setting high prices contributed to boosting the demand in the secondary condominium market in Hanoi.

In contrast, secondary prices in HCMC recorded VND45 million/sqm for the condominium market and VND140 million/sqm for the landed property market on average, down 5% and 2% year-on-year, respectively. During 2023, the secondary market in HCMC went through several price adjustments, yet the price fall gradually slowed towards the last quarter.

Landed property in Hanoi experienced the same trend, with a gradual decrease in the number of distressed sales in the secondary market since the second half of the year, resulting in a slowdown in price declines towards the end of the year. In Q4/2023, the average secondary price of landed property in Hanoi reached nearly VND157 million/sqm, down 5% year-on-year.

A corner of Hanoi. Photo courtesy of VietNamNet.

In terms of absorption rate, Hanoi and HCMC recorded more than 22,000 residential units sold (including both condos and landed properties) in 2023, representing only half of the units sold in 2022.

However, there was an improvement in the absorption rate in the second half of 2023, thanks to the proactive efforts of developers. These efforts included implementing preferential sales policies such as extended payment schedules and discounts of up to 40% for early payment.

Additionally, positive macro factors such as declining interest rates have contributed to improved sentiment among home buyers. As a result, the number of residential units sold in the last two quarters of the year helped to increase the sold units by more than 60% in Hanoi and they doubled in HCMC compared to the first half of the year.

CBRE Vietnam expects an increase in new supply in both cities in 2024. In Hanoi, the market is expected to welcome nearly 16,000 condos and more than 6,000 landed property units, mostly from mega-urban projects in the west and east.

Meanwhile, HCMC expects new supply of over 9,000 condos and 1,000 landed properties in 2024. In the short term, new supply is still limited, while demand remains high, causing selling prices to maintain a high level.

“The policy interest rate is on the stabilizing track, and there are upcoming approvals and amendments to policy and legal frameworks that will contribute to increased synchronization and consistency for the real estate environment. These factors will increase buyer sentiment and facilitate market recovery in 2024,” commented Dung Duong from CBRE.

- Read More

Vietnam parliament okays appointing 2 new Deputy Prime Ministers

Vietnam's legislature has approved Prime Minister Pham Minh Chinh's proposal to appoint Ho Quoc Dung, former Party chief of Gia Lai province, as Deputy Prime Minister, while Pham Thi Thanh Tra, a Party Central Committee member, became the country's first female Deputy Prime Minister.

Politics - Sat, October 25, 2025 | 6:32 pm GMT+7

Foxconn unit ShunYun injects extra $15 mln into northern Vietnam subsidiary

ShunYun Technology Co., a subsidiary of Taiwanese electronics giant Foxconn, has announced an additional $15 million investment into its Vietnamese arm in the northern province of Bac Ninh, according to a filing with the Taiwan Stock Exchange.

Industries - Sat, October 25, 2025 | 4:57 pm GMT+7

DNP Water, Samsung E&A launch $69 mln inter-regional water project in Vietnam’s Mekong Delta

A subsidiary of Vietnam’s water supplier DNP Water and South Korea’s Samsung E&A have broken ground on a VND1.82 trillion ($69.2 million) inter-regional raw water infrastructure project in the Mekong Delta, marking a major step toward improving the region’s water security.

Infrastructure - Sat, October 25, 2025 | 4:50 pm GMT+7

Vietnam’s bond market heats up as major corporates return

Vietnam’s corporate bond market is regaining momentum as large conglomerates join banks and brokerages in successful issuances.

Finance - Sat, October 25, 2025 | 9:33 am GMT+7

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas

If managed well, urban decentralization and multi-center development can ease housing pressures in central HCMC and usher in a more balanced growth phase for the southern region's residential market, write Avison Young Vietnam analysts.

Real Estate - Sat, October 25, 2025 | 8:00 am GMT+7

Chinese firm proposes its 3rd waste-to-power plant in Vietnam

China’s EverBright Environment has proposed investing about VND1.6 trillion ($60.82 million) in a waste-to-energy plant in the central province of Quang Tri.

Energy - Fri, October 24, 2025 | 8:45 pm GMT+7

Mega golf-commercial-urban complex proposed for southern Vietnam city Can Tho

Vietnam Royal Investment Group JSC has proposed developing a 766-hectare golf-service-commercial-urban complex in the Mekong Delta city of Can Tho.

Real Estate - Fri, October 24, 2025 | 4:31 pm GMT+7

Sumitomo makes first hydropower investment in Vietnam

Sumitomo Corporation has made its first hydropower investment in Vietnam by acquiring a 49% stake in Mekong Electric Power Engineering and Development JSC which owns the 48 MW Dak Di 1 & 2 run-of-river hydropower project in Danang city.

Energy - Fri, October 24, 2025 | 3:42 pm GMT+7

Investors urge Vietnam to fix legal hurdles to LNG power projects

A group of investors in Vietnam’s gas-fired power sector has urged the country's parliament to address regulatory gaps that have stalled multi-billion-dollar LNG and domestic gas-fueled power projects, warning that delays could derail the country’s energy transition targets.

Energy - Fri, October 24, 2025 | 2:12 pm GMT+7

Central Vietnam province Gia Lai okays 3 large-scale wind power projects

Gia Lai province has granted in-principle approvals to three large-scale wind power projects with total registered capital mounting to VND19.35 trillion ($734.9 million).

Energy - Fri, October 24, 2025 | 12:01 pm GMT+7

HCMC pushes for early investment in Thu Thiem-Long Thanh railway project

The Ho Chi Minh City People’s Committee has emphasized the need for early investment and operation of a railway connecting Thu Thiem in the metropolis with Long Thanh International Airport in neighboring Dong Nai province.

Infrastructure - Fri, October 24, 2025 | 10:49 am GMT+7

Vietnam to let foreign investors place orders directly via global brokers

Vietnam plans to allow foreign investors to place orders directly through global brokerage firms, a move aimed at easing access to its stock market after a long-awaited upgrade to "secondary emerging" market status, a top regulator said.

Finance - Fri, October 24, 2025 | 8:28 am GMT+7

Vietnam business lobby urges easing of football betting limits

Vietnam’s leading business lobby VCCI has called on the government to sharply ease limits on international football betting and relax foreign ownership rules to make the industry more appealing to investors.

Finance - Thu, October 23, 2025 | 9:30 pm GMT+7

Powering growth from within

The development of a strong domestic private sector is essential for building a resilient, independent, and self-reliant economy that is less dependent on state-owned enterprises or foreign investment, writes Tim Evans, CEO of HSBC Vietnam.

Economy - Thu, October 23, 2025 | 9:09 pm GMT+7

Vietnam's stock market regulator appoints 2 new vice chairpersons

The State Securities Commission of Vietnam (SSC) has appointed Nguyen Hoang Duong and Le Thi Viet Nga as its new vice chairpersons.

Finance - Thu, October 23, 2025 | 4:14 pm GMT+7

Vinhomes chairman appointed CEO of VinSpeed

Pham Thieu Hoa, chairman of Vinhomes, has been appointed CEO of VinSpeed, a newly established company specializing in railway construction.

Companies - Thu, October 23, 2025 | 3:40 pm GMT+7