New rules on foreign investors’ acquisition of shares in Vietnamese credit institutions

Vilaf lawers provide an insight into the government's new Decree 69/2025/ND-CP which amends a number of provisions of Decree 01/2014/ND-CP on foreign investors’ acquisition of shares in Vietnamese credit institutions.

An ABBank staff member receives a customer. Photo courtesy of the bank.

On March 18, 2025, the Government issued Decree No. 69/2025/ND-CP (Decree 69) to amend and supplement a number of provisions of the long-time existing Decree No. 01/2014 on foreign investors’ acquisition of shares in Vietnamese credit institutions (Decree 01).

Decree 69 introduces key changes, most notably, expanding the scope of foreign ownership limit (FOL), clarifying the share subscription methods, setting out higher FOL in distressed credit institutions and acquiring banks in special cases, or imposing stricter compliance obligations, which have the aim to align with current provisions of laws.

For ease of reference, the major implications are categorized and discussed in more detail below.

Expanding the scope of FOL

Decree 69 expands the scope of entities and individuals subject to the FOL in Vietnamese credit institutions.

For instance, it covers not only foreign organizations and individuals but also foreign-invested entities (FIEs) that are treated as same as foreign investors when making an investment, capital contribution or share acquisition in Vietnam. This change is to ensure the consistency with the Investment Law 2020 (as amended).

Additionally, Decree 69 provides some tweaks to definitions of “foreign individuals” and “foreign organizations” existing under the old Decree 01 to resolve certain ambiguities in interpretations, in particular:

(i) “foreign individual” is defined by the old Decree 01 to mean those not holding Vietnamese nationality, but according to Decree 69, “foreign individual” is defined to mean those holding foreign nationality; and

(ii) the definition of “foreign organization” has been amended by Decree 69 by way of reference to the organization(s) incorporated under foreign jurisdiction(s) and having investment business in Vietnam, while the specific types of FIEs introduced in the old Decree 01 such as closed-end funds, member-funds, and security investment companies having more than 49% foreign capital are no longer classified as “foreign organizations” under Decree 69.

Clarification on share subscription methods

The old Decree 01 provides that foreign investors are permitted to purchase shares in Vietnamese credit institutions by way of either subscribing newly issued shares or treasury shares.

Decree 69 gives more clarifications to share subscription methods for foreign investors to acquire shares in Vietnamese credit institutions, including shares offered in a public offering, shares issued to raise capital by the credit institution and/or treasury shares that the credit institution had redeemed prior to January 1, 2021.

This provision has aligned with current provisions of securities laws, which only allow a public company to sell its treasury shares redeemed prior to January 1, 2021.

FOL in Vietnamese [joint stock] credit institutions

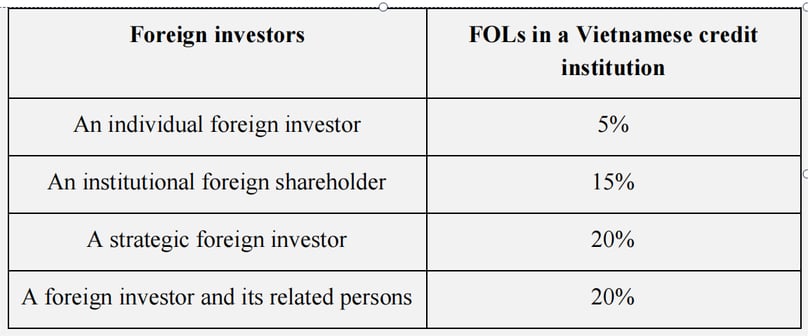

The FOLs for one foreign investor set out under the old Decree 01 remain unchanged under Decree 69, in particular:

The FOLs for all foreign investors in a Vietnamese commercial bank and a non-bank credit institution are respectively capped at 30% and 50%.

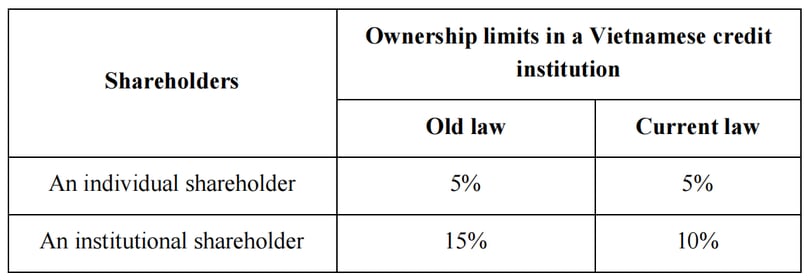

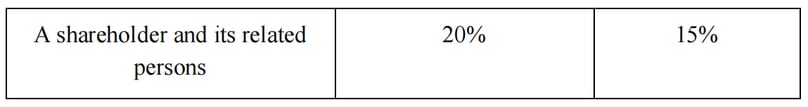

On a related note, the Law on Credit Institutions 2024 has reduced the ownership limits in Vietnamese credit institutions from July 1, 2024 as follows:

While the Law on Credit Insitutions 2024 does not distinguish “foreign shareholder” and “local shareholder” in the definition of “shareholder(s)” of a Vietnamese credit institution, Article 63.7 of the Law on Credit Institutions 2024 provides that the Government will promulgate the FOLs applicable to the foreign investors in Vietnamese credit institutions, the FOLs set out under Decree 69 (which remain unchanged from previous FOLs under the old Decree 01) would likely be treated as exceptional (i.e. higher than ownership limits applicable to foreign shareholders in Vietnamese credit institutions under the Law on Credit Institutions 2024) by way of acquisition and holding shares in Vietnamese credit institutions.

On the other hand, for distressed credit institutions and transferees of distressed credit institution (hereunder “Acquiring Bank”), Decree 69 stipulates that the above-mentioned FOLs may be exceeded. To elaborate:

(i) For distressed credit institutions: The Prime Minister may allow the FOL for an institutional foreign investor, a strategic foreign investor and all foreign investors to exceed the corresponding FOL in distressed credit institutions.

Under Decree 69, a distressed credit institution is any of the following: (a) a credit institution under special control of the State Bank of Vietnam (SBV); (b) a commercial bank subject to mandatory transfer; and (c) a credit institution rated as “weak” according to the latest ranking by SBV;

(ii) For Acquiring Bank: Decree 69 stipulates that the FOL of Acquiring Bank may exceed 30%, to a maximum of 49% of its charter capital, subjecting to the approval in the compulsory transfer plan. Once the transfer plan’s term expires, foreign investors are not allowed to purchase additional shares, until the total FOL of such Acquiring Bank drops below 30%.

Such exception, however, shall not apply to commercial banks where the State holds more than 50% of the Acquiring Bank’s charter capital.

The supplementation of such exception could provide considerable support for the transferees of mandatory transfers, while offering greater access to foreign investors. In Vietnam recent market, there are a few banks listed out below that would be eligible for such exception:

Stricter obligations towards foreign investors

Decree 69 has imposed a stricter obligation according to which, if the foreign investor (and where relevant, together with its related persons) having its ownership ratio in a Vietnamese credit institution exceeds the statutory FOLs set out under Decree 69, it will be obliged to decrease its shareholding ratio in such Vietnamese credit institution, in particular:

(i) foreign investor (and where relevant, together with its related persons) must take appropriate actions to reduce its shareholding ratio to comply with applicable FOL within six months from the relevant date of such excess; and

(ii) In case the total shareholding ratio of foreign investors in a Vietnamese credit institution exceeds the applicable FOL, the foreign investors shall not be allowed to purchase additional shares in such credit institution until such excess is resolvedto comply with applicable FOL.

- Read More

Vietnam’s tech unicorn VNG books 30% profit surge in Q3 on strong gaming business

Vietnamese tech unicorn VNG Corp (UPCoM: VNZ) posted a 30% year-on-year increase in operating profit to VND263 billion ($10 million) in Q3, supported by cost controls and strong performance in its gaming and payment businesses.

Companies - Sat, November 1, 2025 | 10:02 am GMT+7

Vietnam's e-commerce sales soars 34% in Jan-Sept on stronger demand

Sales on four e-commerce platforms in Vietnam - Shopee, TikTok Shop, Lazada, and Tiki - hit VND305.9 trillion ($11.62 billion) in the first nine months of 2025, up 34.4% year-on-year, according to new data from analytics firm Metric.

Economy - Sat, November 1, 2025 | 9:35 am GMT+7

Vietnam's famous actress Truong Ngoc Anh detained for 'property appropriation'

Truong Ngoc Anh, former chairwoman of Dat Rong Real Estate JSC and one of the most famous actresses in Vietnam, has been accused of abusing trust to appropriate thousands of taels of gold and tens of billions of dong (VND10 billion = $380,000).

Society - Fri, October 31, 2025 | 10:53 pm GMT+7

Vietnam's dairy giant Vinamilk reaps $95 mln in Q3 post-tax profit

Vinamilk recorded consolidated post-tax profit of VND2.51 trillion ($95.42 million) in Q3, up 4.5% year-on-year, according to a company release.

Companies - Fri, October 31, 2025 | 10:17 pm GMT+7

HDBank makes $563 mln pre-tax profit in 9 months

HDBank (HoSE: HDB) recorded consolidated profit before tax of VND14.8 trillion ($562.53 million) for the first nine months of the year, up 17% increase year-on-year.

Companies - Fri, October 31, 2025 | 9:42 pm GMT+7

Carlsberg Vietnam donates $57,000 to support central cities Hue, Danang after historic floods

As central Vietnam endures one of the most devastating floods in recent decades, Carlsberg Vietnam has swiftly contributed VND1.5 billion ($57,000) to support relief and recovery efforts in Hue and Danang, two localities hardest hit by the historic rainfall and landslides.

Companies - Fri, October 31, 2025 | 9:37 pm GMT+7

EVNNPT, northern Vietnam province Son La to speed up power transmission projects

Son La province will coordinate closely with National Power Transmission Corporation (EVNNPT) to accelerate construction of key power transmission projects aimed at supporting regional and local socio-economic development.

Companies - Fri, October 31, 2025 | 8:47 pm GMT+7

Vietnam needs more clean energy, highly-skilled labor to capture semiconductor investment wave: exec

Vietnam is well prepared in terms of infrastructure, but to capture the semiconductor investment wave, it must address the challenges of clean energy and highly-skilled labor, said Tran Tan Sy, deputy CEO of KN Holdings, a leading multi-sector group in Vietnam.

Industries - Fri, October 31, 2025 | 4:39 pm GMT+7

Vietnam-China joint venture breaks ground on $319 mln auto plant in northern Vietnam

Vietnamese conglomerate Geleximco Group and China’s Chery Automobile on Thursday held a groundbreaking ceremony for their GEL-O&J automobile plant in Hung Yen province.

Industries - Fri, October 31, 2025 | 3:53 pm GMT+7

MUFG Bank signs its first sustainability-linked loan deal in Vietnam’s agriculture sector

Japan's MUFG Bank, Ltd. (MUFG) has signed a sustainability-linked loan (SLL) agreement with Angimex-Kitoku, an An Giang province-based Vietnam-Japan joint venture company specializing in rice cultivation, production, and processing.

Banking - Fri, October 31, 2025 | 3:29 pm GMT+7

Vietnam, UK elevate ties to comprehensive strategic partnership, outline 6 cooperation pillars

Vietnam and the UK have established a Comprehensive Strategic Partnership, outlining six key pillars of cooperation, including economic, trade, investment, and finance collaboration.

Economy - Fri, October 31, 2025 | 1:19 pm GMT+7

Central Vietnam hub Danang seeks private investment for urban railways

With plans for 16 urban railway lines spanning over 200 kilometers, Danang is prioritizing private investment to develop a modern public transport-oriented urban model.

Infrastructure - Fri, October 31, 2025 | 12:02 pm GMT+7

FPT Retail profit more than doubles in Q3 as deposits surge

FPT Digital Retail JSC (HoSE: FRT), a subsidiary of Vietnam’s FPT Corporation, reported strong Q3 results, with net revenue rising 26.3% year-on-year to VND13,110 billion ($497.9 million) and post-tax profit up 61% to VND266 billion ($10.1 million).

Companies - Fri, October 31, 2025 | 8:57 am GMT+7

Geleximco-led consortium wins approval for $870 mln urban project in central Vietnam

A consortium led by conglomerate Geleximco Group has received approval to develop a long-delayed urban complex in Gia Lai province, with total investment capital estimated at VND21.95 trillion ($834 million).

Real Estate - Fri, October 31, 2025 | 8:26 am GMT+7

Singapore seeks 'renewable fuel', nuclear ties

Singapore must be ready to support all promising pathways, from established technologies to novel options, in its bid to transition its fossil fuel-based energy sector to one that is clean yet affordable, said Minister-in-charge of Energy and Science and Technology Tan See Leng on Monday.

Southeast Asia - Thu, October 30, 2025 | 7:41 pm GMT+7

Indonesia’s palm oil production set to rise 10% in 2025

Indonesia expects palm oil production to grow by 10% in 2025, reaching 56-57 million tons, exceeding previous forecasts, according to the Indonesian Palm Oil Association (GAPKI).

Southeast Asia - Thu, October 30, 2025 | 7:27 pm GMT+7

- Consulting

-

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas

-

Powering growth from within

-

Key factors helping firms export to demanding markets: DH Foods exec

-

Vietnam corporate earnings to be driven by credit expansion, trading activity, property recovery

-

Vietnam's International Financial Center ambition can unlock new wave of innovation

-

Vietnam’s rapid capital market reforms set to pay dividends in coming decades