China’s re-opening will only modestly boost Vietnam’s 2023 GDP growth

VinaCapital’s chief economist Michael Kokalari explains why the Vietnamese economy would not see a major impact from China’s 2023 re-opening.

China is Vietnam’s biggest trading partner, and investors, policymakers, and others have asked about the impact that China dropping its “Zero Covid” restrictions will have on Vietnam. There was some initial uncertainty, and even skepticism, about how quickly China would remove its Covid restrictions after the December 7 announcements from key government officials.

Last week, China dropped many Covid testing requirements, scrapped contact tracing, and essentially stopped reporting Covid case numbers. Meanwhile, China’s Central Economic Work Conference (CEWC) reiterated the government’s commitment to an “overall improvement” of, and “reasonable growth” for China’s economy next year.

Given all of the above, a consensus is now forming that China’s domestic consumption growth will surge from about 0% in 2022 to about 7% year-on-year in 2023, and that China’s energy usage will grow by about 10% next year.

Consequently, investors and others are enquiring about how Vietnam might benefit from a resumption of Chinese consumption growth, although concerns are also mounting about the possibility that China’s reopening will exacerbate inflation, both in Vietnam and globally.

We expect China’s re-opening to boost Vietnam’s GDP growth by over 2 percentage points next year, driven by the full resumption of Chinese tourist arrivals in the second half of 2023 (note that Vietnam Airlines resumed some flights to China on December 9 and that Chinese visitors accounted for one-third of Vietnam’s total tourist arrivals, pre-Covid).

We also anticipate modest inflation pressures from China’s re-opening next year and note that inflation pressures in the rest of the world have clearly peaked and are now abating. Finally, while the most important impact of China’s re-opening on Vietnam is a likely full resumption of Chinese tourist arrivals in the second half of 2023, the most immediate impact has been an improvement in the sentiment towards the Vietnamese dong.

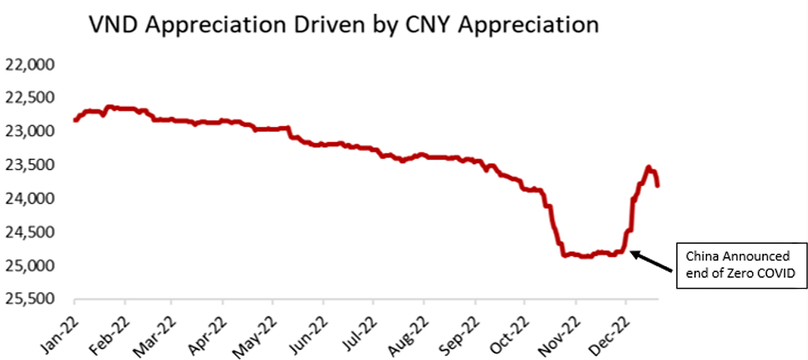

The value of the dong appreciated by over 5% during the last week in November and the first week in December (which was the time frame that encompassed China’s December 7 zero-Covid policy shift), driven by a circa 5% appreciation in the value of China’s currency over those two weeks.

The dong had depreciated by as much as 9% in mid-November due to this year’s surge in the value of the US dollar, so the dollar’s recent, modest decline also helped ease depreciation pressure on the dong, but the surge in the value of China’s currency was the primary factor the drove the rebound in the value of the dong that can be seen in the chart above.

Further to that last point, the value of the US dollar/DXY Index was essentially unchanged during the above-mentioned two weeks, and some fairly negative news about Vietnam’s trade balance and balance of payments came out during those two weeks, both of which make it clear that it was the appreciation in the value of the renminbi (CNY) that drove the appreciation of the dong.

It’s not obvious from an economic point-of-view why the recent appreciation in the CNY prompted an appreciation in the dong; Vietnam has a consistent 17%/GDP trade deficit with China, and an appreciation in China’s currency versus the dong exacerbates Vietnam’s trade deficit with China in the short-term via the so-called “J-Curve Effect”.

That said, market sentiment often overwhelms economic factors in FX markets, and the positive sentiment that China’s re-opening spawned led to a sharp appreciation in both the value of the CNY and the value of the dong. The opposite occurred in August 2015, when the sudden 3% depreciation in the value of China’s currency triggered an immediate 3% depreciation in the value of the dong, despite Vietnam benefitting from China’s depreciation.

We expected a similar sentiment phenomenon to boost the VN-Index, but we observe that China’s stock market achieved only a modest bounce in response to the government lifting its Covid restrictions and that Vietnamese investors are currently, primarily focused on various domestic issues that have impacted the market this year.

Impact on GDP growth

China is Vietnam’s largest trading partner, but Vietnam’s exposure to China’s domestic economy is quite modest, resulting in Vietnam’s GDP growth not being significantly hindered by Chinese Covid restrictions that impacted as much as one-quarter of that country’s economy this year.

Vietnam’s export growth to China was nearly flat in the first nine months of 2022, but only 14% of Vietnam’s exports are sold to China, so Vietnam’s GDP soared 8.8% year-on-year despite China’s lockdowns, in part because exports to the U.S. and the EU, which account for nearly one-half of Vietnam’s total exports, grew by 25% year-on-year in the first nine months of the year.

Furthermore, most of Vietnam’s exports to and imports from China are of production inputs and/or other intermediate goods entailed in the manufacture of electronics and garments accounting for two-thirds of the trade between the two countries. Some Vietnamese companies will benefit from China’s reopening, such as those that sell seafood and other agricultural products, but exports of products that are ultimately consumed by Chinese customers only account for around 5% of Vietnam’s total exports.

Effect on tourism, FDI

Foreign tourism contributed about 10% of Vietnam’s GDP pre-Covid, and foreign tourist arrivals are on track to reach 25% of pre-Covid levels this year.

We expect the number of foreign tourists will climb above 50% of pre-Covid levels in 2023 based on the assumption that Chinese tourist arrivals fully recover in the second half of next year. However, the pace of recent developments in China points to a possible faster full resumption of Chinese tourist arrivals, which could lead to an even larger contribution to Vietnam’s GDP growth next year than we currently expect.

We are aware of the concerns some investors have that the re-opening of China’s economy could detract from Vietnam’s appeal as a destination for FDI investment.

We see no possibility of this happening given that China has irrevocably damaged its appeal as an investment destination for multinational firms, and U.S.-China trade tensions have dramatically escalated this year.

Concerns about China’s increasingly erratic policy pronouncements are well publicized but we would emphasize that Chinese authorities held steadfast to the country’s “zero-Covid” policy for years and then abruptly dropped the policy, following what amounted to a one-day warning, when the Politburo announced its desire to “push for an overall improvement in the economy.”

U.S.-China trade tensions prompted multinational manufacturers to re-locate production facilities from China to Vietnam, or to set up new factories in Vietnam instead of China, evidenced by the fact that Vietnam’s trade surplus with the US tripled (from $25 billion in the first nine months of 2018 to $75 billion in the first nine months of 2022) while its trade deficit with China widened (from $19 billion to $52 billion over that same time period).

The Biden administration dramatically escalated trade tensions with China this year by announcing what amounts to an indefinite extension of Trump’s tariffs on imports from China, and with other severe measures, including a prohibition for US persons to work at some chip factories located in China.

Readers should also recall that there were already strong structural factors prompting FDI inflows to Vietnam before U.S.-China trade tensions emerged. Factory wages in Vietnam are around two-thirds below those in China, but the quality of Vietnam’s workforce is comparable to that of China according to surveys by the Japan External Trade Organization and others. Also, Japan and South Korea, which account for over half of Vietnam’s FDI inflows, both face serious demographic and intractable economic issues that compel companies in both countries to invest abroad.

China’s re-opening is expected to put upward pressure on food prices in Vietnam. Photo courtesy of Industry & Trade newspaper.

Impact on inflation

Many economists believe China’s re-opening could fuel global inflation, but there is no concrete consensus that China’s re-opening will do so.

Some analysts argue that a resumption of Chinese production could help further ease the supply chain tensions that account for about half of the current US inflation rate, according to economists at the US Federal Reserve.

We expect China’s re-opening to put upward pressure on food and energy prices in Vietnam (which account for nearly half of the CPI basket) and note that some well-placed Chinese economists expect a 20% increase in Chinese pork prices next year, for example.

In the past, surges in Chinese food prices understandably drove Vietnamese food prices higher given the geographic proximity of the two countries, but there are some factors that are likely to limit the surge in China’s inflation rate (including food price inflation) in the first half of 2023.

First, China’s mandatory government lockdowns appear to be giving way to voluntary lockdowns in the country’s cities (which account for about 80% of the country’s consumption) because of widespread concerns among the population about contracting Covid at a time when the country’s hospitals are likely to be overwhelmed.

Consequently, economic activity and price pressures in China are both likely to get worse before bottoming out sometime in Q1. Epidemiologists at the University of Hong Kong expect China’s Covid wave to peak around late January.

Finally, China’s reopening boom will not be as powerful as the reopening in the U.S. and Europe because unlike the governments in much of the developed world, China did not over-stimulate its economy with freshly printed money and direct stimulus payments to individuals. Consequently, China’s money supply growth, which fuels consumer price inflation, remained modest through Covid, and there is less “pent up savings” in China to drive a surge in the country’s consumption and consumer prices.

Conclusion

Analysts and economists generally believe that China dropping its Covid restrictions will have a major impact on the economies of countries in Asia and around the world next year. We expect China's reopening will have a bigger impact on the economies of other ASEAN countries than it will on Vietnam due to those countries’ greater exposure to China’s domestic economy.

The most immediate impact of China’s scrapping of its Covid restrictions has been a circa 5% appreciation in the value of the dong, driven by a 5% appreciation in the value of China’s currency.

That said, the major benefit that Vietnam will accrue from China’s re-opening is likely to be a circa 2 percentage point boost to GDP growth next year driven by a resumption of Chinese tourist arrivals.

Finally, China’s re-opening is likely to cause some upward inflationary pressure in Vietnam, the impact could be mitigated by several factors, including a more prolonged reopening compared to the U.S. and Europe, as well as less pent-up savings and demand in China compared to the U.S. and EU.

- Read More

Maersk eyes building major container ports in Vietnam

A.P.Moller - Maersk (Maersk) is exploring investment opportunities to develop large, modern and low-carbon container ports in Vietnam.

Infrastructure - Wed, November 19, 2025 | 4:36 pm GMT+7

Taiwan semiconductor giant Panjit acquires 95% of Japan-based Torex’s Vietnam arm

Panjit International Inc, a Taiwan-listed semiconductor major, has approved the acquisition of a 95% stake in Torex Vietnam Semiconductor, a subsidiary of Japan-based Torex.

Companies - Wed, November 19, 2025 | 3:59 pm GMT+7

Vietnam PM urges Kuwait Petroleum to expand Nghi Son refinery, build bonded fuel storage facility

Prime Minister Pham Minh Chinh on Tuesday called on Kuwait Petroleum Corporation (KPC) to expand the Nghi Son oil refinery and build a bonded fuel storage facility in Vietnam.

Industries - Wed, November 19, 2025 | 3:18 pm GMT+7

Southern Vietnam port establishes strategic partnership with Japan’s Port of Kobe

Long An International Port in Vietnam’s southern province of Tay Ninh and Japan’s Port of Kobe on Monday signed an MoU establishing a strategic port partnership which is expected to boost trade flows, cut logistics costs, and deliver greater benefits to businesses across the region.

Companies - Wed, November 19, 2025 | 10:14 am GMT+7

Thaco's agri arm seeks to expand $44 mln cattle project in central Vietnam

Truong Hai Agriculture JSC (Thaco Agri), the agriculture arm of conglomerate Thaco, looks to aggressively expand its flagship cattle farming project in the central Vietnam province of Gia Lai.

Industries - Wed, November 19, 2025 | 9:56 am GMT+7

Japan food major Acecook eyes new plant in southern Vietnam

Acecook, a leading instant noodle maker with 13 plants operating in Vietnam, is studying a new project in the southern province of Tay Ninh.

Industries - Wed, November 19, 2025 | 9:39 am GMT+7

Vietnam’s largest Aeon Mall to take shape in Dong Nai province

Authorities of Dong Nai province, a manufacturing hub in southern Vietnam, on Monday awarded an investment registration certificate to Japanese-invested Aeon Mall Vietnam Co., Ltd. for its Aeon Mall Bien Hoa project.

Industries - Tue, November 18, 2025 | 8:17 pm GMT+7

Police propose prosecuting Egroup CEO Nguyen Ngoc Thuy for fraud, bribery

Vietnam’s Ministry of Public Security has proposed prosecuting Nguyen Ngoc Thuy, chairman and CEO of Hanoi-based education group Egroup, along with 28 others, for fraud to appropriate property, giving bribes, and receiving bribes.

Society - Tue, November 18, 2025 | 4:01 pm GMT+7

Singapore-backed VSIP eyes large urban-industrial complex in southern Vietnam

A consortium involving VSIP, a joint venture between local developer Becamex IDC and Singapore’s Sembcorp, plans a large-scale urban-industrial development named the "Moc Bai Xuyen A complex along the Tay Ninh-Binh Duong economic corridor in southern Vietnam.

Industrial real estate - Tue, November 18, 2025 | 2:38 pm GMT+7

Aircraft maintenance giant Haeco to set up $360 mln complex in northern Vietnam

Hong Kong-based Haeco Group, Vietnam's Sun Group, and some other partners plan to invest $360 million in an aircraft maintenance, repair and overhaul (MRO) complex at Van Don International Airport in Quang Ninh province - home to UNESCO-recognized natural heritage site Ha Long Bay.

Industries - Tue, November 18, 2025 | 2:13 pm GMT+7

Thai firm opens 20,000-sqm shopping center in central Vietnam hub

MM Mega Market Vietnam (MMVN), a subsidiary of Thailand's TCC Group, on Monday opened its MM Supercenter Danang, a 20,000 sqm commercial complex with total investment capital of $20 million, in Danang city.

Real Estate - Tue, November 18, 2025 | 12:20 pm GMT+7

Vietnam PM asks Kuwait fund to expand investment in manufacturing, logistics, renewable energy

Prime Minister Pham Minh Chinh on Monday called on the Kuwait Fund for Arab Economic Development (KFAED) to strengthen cooperation with Vietnam, particularly in the areas of industrial production, logistics, renewable energy, green economy, and the Halal ecosystem.

Economy - Tue, November 18, 2025 | 11:53 am GMT+7

Thai dairy brand Betagen to build first plant in Vietnam

Betagen, a famous Thai dairy brand, plans to build its first manufacturing plant in Vietnam, located in the southern province of Dong Nai.

Industries - Tue, November 18, 2025 | 8:49 am GMT+7

Banks dominate Vietnam's Q3 earnings season, Novaland posts biggest loss

Banks accounted for more than half of the 20 most profitable listed companies in Vietnam’s Q3/2025 earnings season, while property developer Novaland recorded the largest loss.

Finance - Tue, November 18, 2025 | 8:24 am GMT+7

Highlands Coffee posts strongest quarterly earnings in 2 years on robust same-store sales

Highlands Coffee, Vietnam’s largest coffee chain, delivered its best quarterly performance in two years, with Q3 EBITDA exceeding PHP666 million ($11.27 million), parent company Jollibee Foods Corporation (JFC) said in its latest earnings report.

Companies - Mon, November 17, 2025 | 10:21 pm GMT+7

Hong Kong firm Dynamic Invest Group acquires 5% stake in Vingroup-backed VinEnergo

VinEnergo, an energy company backed by Vingroup chairman Pham Nhat Vuong, has added a new foreign shareholder after Hong Kong–based Dynamic Invest Group Ltd. acquired a 5% stake, according to a regulatory filing on Saturday.

Companies - Mon, November 17, 2025 | 9:52 pm GMT+7

- Travel

-

Impressive Standard Chartered Hanoi Marathon Heritage Race 2025

-

Nguyen Hong Hai wins 'Investors' golden heart' golf tournament 2025

-

140 players compete at “Investors’ golden heart” golf tournament

-

‘Investors’ golden heart’ golf tournament to tee off on Saturday

-

Vietnam, Hong Kong Aircraft Engineering sign deal on aircraft maintenance hub at northern airport

-

Sun Group gets nod for $375 mln inland waterway tourism project in central Vietnam