Credit crunch impact over Vietnam stocks could ease soon

VinaCapital’s chief economist Michael Kokalari explains why the “credit crunch” concerns in Vietnam's stock market could abate soon.

November 16 was a dramatic day for the Vietnamese stock market. The VN-Index plunged by more than 4% soon after opening; but ended the day up over 3% on hopes that the “credit crunch” concerns that made Vietnam one of the worst performing markets in the world this year could be abating.

In short, the country’s real estate developers have been facing increasing difficulties accessing credit this year and concerns that this “credit crunch” among developers could spread to other sectors of the economy have pushed the VN-Index down as much as 42% in the year to date (YTD).

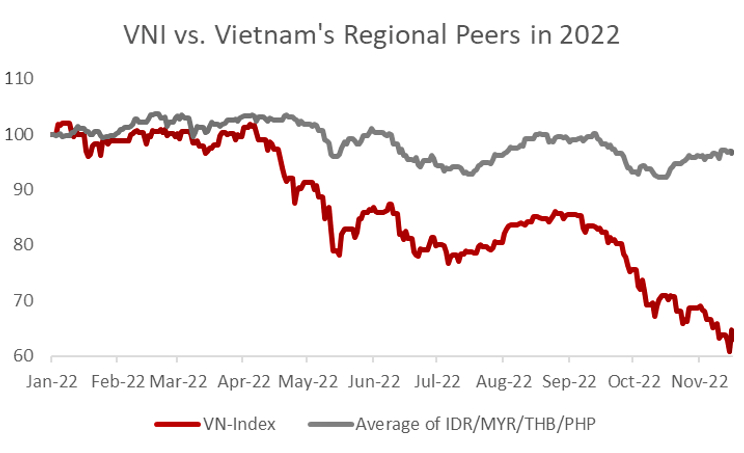

The plunge has been driven by a circa 50% YTD sell-off in real estate stocks and 40% sell-off in bank stocks, given that the combined weighting of these two sectors accounts for 55% of the index. The VN-Index dramatically underperformed the average of its regional peers’ stock markets (Indonesia/Malaysia/Thailand/Philippines), as can be seen below, owing in part to concerns about the ability of real estate developers to refinance over $5 billion of maturing debts in 2023.

We believe Vietnam’s stock market is now overestimating the impact of the recent tightening of credit conditions for the country’s real estate developers to the rest of the economy. It is important to note that real estate development contributes less than 10% of Vietnam’s GDP, in contrast to nearly 30% in China.

VinaCapital’s analysts directly canvassed several industrial companies and concluded that the current credit crunch primarily impacts real estate developers and some smaller companies. Large industrial companies (for instance, non-real estate developers) appear to continue to have access to credit - albeit at higher interest rates.

We also believe investors are overestimating how long this situation is likely to persist; and expect the government to take action to alleviate the liquidity issues that are depressing Vietnamese stock prices well in advance of the Lunar New Year holiday (at the end of January), when both economic activity and the demand for liquidity in Vietnam are elevated.

These issues are relatively straight-forward for policy makers to address, so hints from government officials about the steps they could take to alleviate the situation sent stocks soaring on November 16 and that informal guidance was followed up by the formation of a task force to address issues in the real estate sector by Vietnam’s Prime Minister later in the week.

Finally, Vietnam’s GDP is on-track to grow by 8% in 2022 and by nearly 6% in 2023, while corporate earnings are on track to grow by 17% this year and next. The combination of falling stock prices and growing earnings caused the FY22 P/E multiple for the VN-Index to plunge from above 17x at the beginning of 2022 to 9x now, and the market’s 8x FY23 P/E is 40% below the forward P/E valuation of Vietnam’s regional peers.

“Credit crunch” is not endemic

Our canvass of companies in a variety of industries leads us to believe that large, high-quality companies outside the real estate sector are not facing difficulties rolling over their outstanding debts. That said, local banks have become more selective in their lending, and the State Bank of Vietnam's (SBV) recent tightening of monetary conditions in Vietnam (it hiked policy rates by 200 bps YTD to 6%), plus its use of its FX reserves to support the value of the Vietnamese dong are both also constricting overall credit conditions.

Further to that last point, Vietnam’s outstanding credit grew by 11.4% YTD as of October 20, far outpacing system-wide bank deposit growth of 4.8% YTD, but we estimate that bank deposit growth would have been around 9% YTD were it not for the SBV expending an estimated $20 billion of its FX reserves to support the value of the VND.

Note also that the SBV assigns Vietnamese banks annual credit quotas, which equates to about 14% system-wide credit growth in 2022. The rumors that sent the market surging on November 16 included speculation that the SBV will increase banks’ credit quotas by another 2 percentage points (the 2022 credit growth quota was lifted by about 1 percentage point in October), and that the government could set up a new asset management company (AMC) to provide liquidity to the corporate bond market - which is dominated by real estate developers.

Understanding real estate developers’ credit crunch

Vietnamese real estate developers do not have access to sufficient long-term funding to support their “land banking” activities. From the time that a developer purchases a plot of raw land to the time that land has been rezoned for residential use and the final apartment building/housing units constructed generally takes five years. The raw land plot does not become “bankable” until the land has been rezoned for residential usage and project approvals have been secured.

Until proper project approvals have been secured, developers cannot use land as collateral to secure bank loans, and even when the appropriate legal documentation has been secured. First, banks generally only want to loan money out for a relatively short-time horizon (e.g., for about two years it takes to construct an apartment building). Second, the SBV recently started encouraging banks to lend directly to home purchasers (for example, mortgage lending) rather than to real estate developers. In addition, Vietnamese property developers are limited in their use of “pre-sales” funding, and can only collect payments from home buyers after the building’s foundation is laid.

The net result of all of the above, is that developers began funding their land banking via the corporate bond market in recent years, causing issuances to skyrocket from $12 billion in 2019 to $32 billion in 2021. Developers faced less restrictive covenants on bonds they issued, or they essentially disregarded the covenants (which has been the main thrust of the government’s recent regulatory crackdown on the country’s nascent bond market), primarily because many corporate bonds were sold to retail investors. Note that the bonds that retail investors bought typically have a two-three-year maturity and pay 10-12% coupons versus about 7% interest rates on 18-month bank deposits in 2021.

The first problem with this situation is that developers now face a major “Asset Liability Mismatch (ALM)” because they essentially need to re-pay/roll-over their outstanding debts every two years, but the raw land they purchased will not generate cashflows until well into the future; the history of finance is littered with examples of a modest credit tightening causing solvency problems for companies & financial institutions with ALM issues.

The second problem is that the time it takes to rezone raw land has been getting longer in recent years due to various bottlenecks in the approvals process, limiting developers’ ability to refinance their maturing corporate bonds with bank loans in a timely manner.

Finally, there are three very important points investors need to understand: First, the government could easily resolve the situation by encouraging banks to lend to real estate developers (by reducing the capital charge on loans to developers, for example). Second, the government can expedite the approval process for new projects to alleviate developers’ ALM issues. Third, demand for new housing units continues to be very strong and those units are still affordable to a wide range of middle-class buyers.

In other words, Vietnam’s real estate market is still fundamentally healthy (in stark contrast to China’s, for example), despite facing immediate liquidity issues.

Summary

Concerns about the ability of Vietnamese companies to access credit have been severely weighing on the VN-Index, but we believe Vietnam’s “credit crunch” issues are primarily contained to the real estate sector.

The demand for new housing units in Vietnam is still strong and prices are still affordable, so the prices of real estate stocks are likely to recover if-and-when the government takes action to ease credit conditions to the sector. The market recent got the first inkling that such an easing could be in the works, which sent stock prices soaring.

- Read More

Duc Giang Chemical chairman’s family loses $129 mln in a week as shares plunge

Shares of Vietnam’s Duc Giang Chemical Group JSC (DGC) fell sharply last week (December 15-19), wiping nearly VND3.4 trillion ($129.2 million) off the stock-based wealth of the family of chairman Dao Huu Huyen.

Companies - Mon, December 22, 2025 | 6:58 am GMT+7

Vietnam launches International Financial Center, pledges 'special process' to resolve investor hurdles

Vietnam on Sunday announced the establishment of its International Financial Center (IFC), with Prime Minister Pham Minh Chinh pledging to fast-track the resolution of investor difficulties through a “special process”.

Economy - Sun, December 21, 2025 | 9:18 pm GMT+7

The new target for VN-Index is 3,200: Finnish fund PYN Elite

The earnings growth of listed companies in Vietnam will continue to support equity prices in 2026. According to the consensus forecast, a market P/E of 10.0 for 2026 looks very attractive, writes Petri Deryng, portfolio manager at Finnish fund PYN Elite.

Consulting - Sun, December 21, 2025 | 6:33 pm GMT+7

Mastering AI key to Vietnam’s leap beyond middle-income trap: FPT chairman

Mastering and innovating technology is no longer optional but the sole path for Vietnam to escape the middle-income trap and rise alongside global powers, said tech giant FPT Corporation chairman Truong Gia Binh.

Economy - Sun, December 21, 2025 | 2:33 pm GMT+7

Vietnam among world’s top 15 countries by im-export value: ministry

Vietnam’s import-export turnover is expected to reach $920 billion for the first time in 2025, placing the country among the world’s top 15 by trade value, according to the Ministry of Industry and Trade (MoIT).

Economy - Sun, December 21, 2025 | 11:07 am GMT+7

Dung Quat oil refinery operator BSR targets 187% net profit growth in 2026

Binh Son Refining and Petrochemical JSC (HoSE: BSR), operator of Dung Quat - Vietnam’s first oil refinery, expects net profit to surge in 2026, supported by stable oil price assumptions and a major investment plan to expand and upgrade its core refining assets.

Companies - Sun, December 21, 2025 | 8:00 am GMT+7

Dragon Capital-managed VEIL plans trio of 10% tender offers

Vietnam Enterprise Investments Limited (VEIL), the largest foreign-managed equity fund in Vietnam, has announced a tender offer for up to 10% of its issued share capital, with the option to conduct up to two additional tenders over the next year.

Finance - Sat, December 20, 2025 | 11:19 pm GMT+7

Vingroup builds development hubs across multiple sectors

With the groundbreaking and inauguration of 11 large-scale projects on Friday, Vingroup (HoSE: VIC), Vietnam's biggest listed company by market cap, reinforces its role as a pioneering private enterprise in urban development, infrastructure, energy, and industry.

Investing - Sat, December 20, 2025 | 6:32 pm GMT+7

Kinh Bac breaks ground on $437 mln industrial park in northern Vietnam province Thai Nguyen

Kinh Bac City Development Holding Corp (HoSE: KBC) on Friday broke ground on the VND11.5 trillion ($437.06 million) Phu Binh Industrial Park project in Thai Nguyen province.

Industrial real estate - Sat, December 20, 2025 | 5:46 pm GMT+7

Construction giant Fecon starts work on Hanoi metro line, northern Vietnam rail link

Fecon, a leading Vietnamese construction group, on Friday broke ground on two major rail projects: a metro line in Hanoi and a strategic railway linking the capital city with northern localities.

Infrastructure - Sat, December 20, 2025 | 2:08 pm GMT+7

SJ Group to build smart urban area in western Hanoi to bolster Hoa Lac High-tech Park

Vietnam's leading developer SJ Group JSC is outlining plans for its over 1,200-hectare Tien Xuan Smart Urban Area project in Hanoi, which is expected to be a residential and service hub of the Hoa Lac science and technology city.

Real Estate - Sat, December 20, 2025 | 10:36 am GMT+7

Indonesia to deepen role in global semiconductor supply chain

Indonesia is rolling out efforts to identify opportunities and map its natural resources to support the semiconductor industry, as part of a broader strategy to build domestic industrial capacity.

Southeast Asia - Sat, December 20, 2025 | 9:36 am GMT+7

Indonesia to stop rice imports next year

Indonesia will not import rice for either consumption or industrial use next year, citing sufficient domestic production, according to a government official.

Southeast Asia - Sat, December 20, 2025 | 8:00 am GMT+7

Northern Vietnam port city Hai Phong charts sustainable growth path for free trade zone

The establishment of Hai Phong Free Trade Zone (FTZ) is a strategic direction that will elevate the role and position of Vietnam in general and Hai Phong in particular within the global value chain, heard a conference held in the northern port city last week.

Economy - Fri, December 19, 2025 | 8:12 pm GMT+7

Construction begins on $32.5 bln Red River Scenic Boulevard project in Hanoi

The gigantic project Red River Scenic Boulevard, with a preliminary investment of about VND855 trillion ($32.49 billion) in Phu Thuong ward, Hanoi, broke ground on Friday.

Real Estate - Fri, December 19, 2025 | 4:57 pm GMT+7

Major Vietnamese groups kick off mega projects in south-central Vietnam

Vingroup, BIN Corporation, Hoa Phat, and FPT simultaneously broke ground on large-scale projects in south-central Vietnam on Friday, raising expectations for new national growth momentum in the coming period.

Economy - Fri, December 19, 2025 | 4:36 pm GMT+7

- Travel

-

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

-

Vietnam defeat Thailand to win men’s football gold at SEA Games 33

-

Which beach in Vietnam boasts the Pantone - 'color of the year 2026'?

-

Unprecedented national milestone in 65 years: Vietnam welcomes 20 millionth international visitor

-

Techcombank HCMC International Marathon affirms global standing

-

Vietnam's tour operator Vietravel announces full exit from Vietravel Airlines