Foreign firms in Vietnam want clarity, more incentives to offset GMT impacts

Foreign businesses operating in Vietnam have called on the Vietnamese authorities to issue clearer policies and consider further incentives to offset negative effects of the Global Minimum Tax (GMT) that was enacted in January.

In November 2023, Vietnam decided to join an OCED-led incentive to levy a minimum 15% tax rate on multinational companies with revenues of EUR750 million ($800 million) or more.

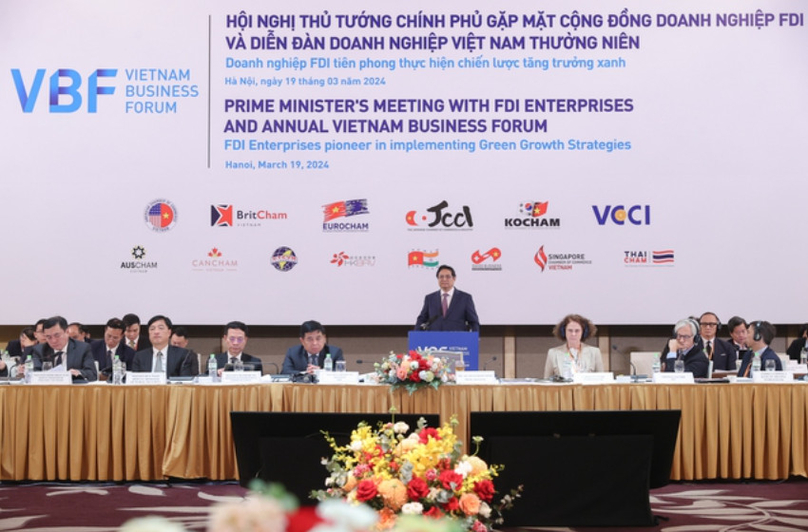

A view of the annual Vietnam Business Forum (VBF), attended by Prime Minister Pham Minh Chinh, in Hanoi, March 19, 2024. Photo courtesy of the government’s news portal.

KoCham

In its position paper sent to the annual Vietnam Business Forum (VBF) that took place in Hanoi Tuesday, the Korea Chamber of Business in Vietnam (KoCham) suggests that Vietnam takes supplementary measures when implementing the Global Minimum Tax (GMT).

With the full-scale implementation of the GMT system starting in 2024, concerns have arisen over the potential dissolution of the investment tax incentives hitherto enjoyed by foreign companies, the paper says.

The standard corporate income tax rate in Vietnam is 20%. However, for certain enterprises, the effective tax rate ranges from 5% to 10%, creating a disparity. In the event of paying taxes on the difference, the existing tax reduction benefits are offset.

A draft decree announced December 19 by Vietnam’s Ministry of Planning and Investment (MPI) outlines plans for establishing an investment support fund for the implementation of the GMT, along with the associated support benefits, support scope, and methods.

However, this has attracted criticism over ambiguity of the support criteria, making it insufficient to attract the interest and consensus of investors, the KoCham paper says.

They show concerns over the limitations on the eligibility for support as per the current draft decree, restricting it to investment amounts of $500 million or more.

“This restriction may lead to a very limited number of eligible companies, and there is a significant concern that many foreign-invested enterprises may not benefit it notes.

If investments by these companies are deterred by these measures, it could have a negative impact on the business of all vendor companies that have entered Vietnam alongside, eventually posing a potential obstacle to the expansion of foreign investment in Vietnam.

The paper requests a thorough analysis and assessment of the implications of implementing the GMT and calls for incorporation of comprehensive industry opinions into the draft decree, making adjustments and enhancements to ensure that foreign investment companies are not adversely affected.

Echoing the representative of Korean firms, the Japanese Chamber of Commerce and Industry (JCCI) in Vietnam asks for opportunities to explain the FDI perspective when Vietnam makes any changes to the tax system.

EuroCham

The European Chamber of Commerce (EuroCham) also urges the Vietnamese government to undertake a comprehensive review of the tax incentives currently in place.

This includes studying the impacts of Pillar 2 on current and future investors and considering practical and effective solutions for encouraged sectors so that adopting Pillar 2 does not create negative impacts on the investment environment while Vietnam still meets its commitments.

For example, if expenditure-based incentives were to be introduced instead of income-based ones, like tax holidays, there would be less impacts on foreign investment from Pillar 2 adoption.

In addition to encouraging investment in R&D, innovation and high-technology incentives could be targeted to support policy objectives including the promotion of green transition.

Tax revenues generated from Qualified Domestic Minimum Top-Up Tax (QDMTT) could additionally be spent on improving the overall investment environment such as infrastructure and labor force skills development.

“Pillar 2 provides a very good opportunity for Vietnam to consider tax incentive reform, and this should be done as soon as possible so as not to lose either tax revenues or foreign investment, as other countries will impose top-up taxes from 2024 and are also considering revising their tax incentive regimes in response,” EuroCham suggests.

Prime Minister Pham Minh Chinh (middle) talks with representatives of the foreign business community at the Vietnam Business Forum (VBF) in Hanoi, March 19, 2024. Photo courtesy of the government’s news portal.

VBF Tax and Customs Working Group

For its part, the VBF Tax and Customs Working Group argues that the current draft decree by the MPI has a “quite narrow” scope in terms of support recipient targets.

The draft targets enterprises with investments in high technology (those implementing investment projects in high-tech product manufacturing, high-tech enterprises, enterprises with high-tech application projects) with investments of over VND12,000 billion ($500 million) or whose annual revenue tops VND20,000 billion ($807 million).

Given these requirements, only a very small number of businesses will be eligible, failing to cover a representative portfolio of investors in the high-tech sector. This would also fail to attract strategic investors as set out in the National Assembly’s Resolution No. 110/2023/QH15 passed last November, they say.

Commenting on the inadequacy of investment support policy and what would be needed to ensure a stable business environment that will retain and attract large corporations, the VBF Tax and Customs Working Group notes:

1. The current draft decree only targets companies with investments in high-tech product manufacturing and enterprises with high-tech applications but does not include those operating in high-tech parks.

2. Companies in high-tech parks have to meet very strict conditions, one of them being that their areas of operation must belong to the list of high-tech fields in which investment and production is encouraged.

3. The current draft looks at the enterprise-level or project-level scale. However, in the high-tech sector, R&D is highly technical and its output is often applied to the manufacturing of small but critical spare parts and component. Given the in-depth application of each, Therefore, high-tech companies and projects are often small in scale.

“If we only look at the scale of each project and ignore that fact that it is actually supervised by a large corporation/investor, we will miss important strategic investors in technology.”

Currently, there are big names in technology carrying out investments and and long-term commitments in Vietnam with many subsidiaries and investment projects. The scale of investment of such corporations might reach over VND12,000 billion ($500 million) in total, but such amounts would be hard to realize for a single project. Therefore, support policies for hi-tech investors should target large corporations in terms of their total scale of investment in Vietnam as a single entity.

4. Large-scale enterprises operating in other manufacturing sectors with total investment capital of at least VND20,000 billion or $1 billion should be encouraged and supported as they involve an entire ecosystem of satellite businesses, including suppliers of components and materials, logistics companies, etc. which are all indispensable.

5. Additional corporate income tax collection under global anti-base erosion regulations poses a significant challenge to maintaining the competitiveness of Vietnam's business environment.

Therefore, in order to attract investment, the Vietnamese government would do well to learn from the experiences of other countries and come up with appropriate and competitive policies, the foreign business associations recommend.

- Read More

Maersk eyes building major container ports in Vietnam

A.P.Moller - Maersk (Maersk) is exploring investment opportunities to develop large, modern and low-carbon container ports in Vietnam.

Infrastructure - Wed, November 19, 2025 | 4:36 pm GMT+7

Taiwan semiconductor giant Panjit acquires 95% of Japan-based Torex’s Vietnam arm

Panjit International Inc, a Taiwan-listed semiconductor major, has approved the acquisition of a 95% stake in Torex Vietnam Semiconductor, a subsidiary of Japan-based Torex.

Companies - Wed, November 19, 2025 | 3:59 pm GMT+7

Vietnam PM urges Kuwait Petroleum to expand Nghi Son refinery, build bonded fuel storage facility

Prime Minister Pham Minh Chinh on Tuesday called on Kuwait Petroleum Corporation (KPC) to expand the Nghi Son oil refinery and build a bonded fuel storage facility in Vietnam.

Industries - Wed, November 19, 2025 | 3:18 pm GMT+7

Southern Vietnam port establishes strategic partnership with Japan’s Port of Kobe

Long An International Port in Vietnam’s southern province of Tay Ninh and Japan’s Port of Kobe on Monday signed an MoU establishing a strategic port partnership which is expected to boost trade flows, cut logistics costs, and deliver greater benefits to businesses across the region.

Companies - Wed, November 19, 2025 | 10:14 am GMT+7

Thaco's agri arm seeks to expand $44 mln cattle project in central Vietnam

Truong Hai Agriculture JSC (Thaco Agri), the agriculture arm of conglomerate Thaco, looks to aggressively expand its flagship cattle farming project in the central Vietnam province of Gia Lai.

Industries - Wed, November 19, 2025 | 9:56 am GMT+7

Japan food major Acecook eyes new plant in southern Vietnam

Acecook, a leading instant noodle maker with 13 plants operating in Vietnam, is studying a new project in the southern province of Tay Ninh.

Industries - Wed, November 19, 2025 | 9:39 am GMT+7

Vietnam’s largest Aeon Mall to take shape in Dong Nai province

Authorities of Dong Nai province, a manufacturing hub in southern Vietnam, on Monday awarded an investment registration certificate to Japanese-invested Aeon Mall Vietnam Co., Ltd. for its Aeon Mall Bien Hoa project.

Industries - Tue, November 18, 2025 | 8:17 pm GMT+7

Police propose prosecuting Egroup CEO Nguyen Ngoc Thuy for fraud, bribery

Vietnam’s Ministry of Public Security has proposed prosecuting Nguyen Ngoc Thuy, chairman and CEO of Hanoi-based education group Egroup, along with 28 others, for fraud to appropriate property, giving bribes, and receiving bribes.

Society - Tue, November 18, 2025 | 4:01 pm GMT+7

Singapore-backed VSIP eyes large urban-industrial complex in southern Vietnam

A consortium involving VSIP, a joint venture between local developer Becamex IDC and Singapore’s Sembcorp, plans a large-scale urban-industrial development named the "Moc Bai Xuyen A complex along the Tay Ninh-Binh Duong economic corridor in southern Vietnam.

Industrial real estate - Tue, November 18, 2025 | 2:38 pm GMT+7

Aircraft maintenance giant Haeco to set up $360 mln complex in northern Vietnam

Hong Kong-based Haeco Group, Vietnam's Sun Group, and some other partners plan to invest $360 million in an aircraft maintenance, repair and overhaul (MRO) complex at Van Don International Airport in Quang Ninh province - home to UNESCO-recognized natural heritage site Ha Long Bay.

Industries - Tue, November 18, 2025 | 2:13 pm GMT+7

Thai firm opens 20,000-sqm shopping center in central Vietnam hub

MM Mega Market Vietnam (MMVN), a subsidiary of Thailand's TCC Group, on Monday opened its MM Supercenter Danang, a 20,000 sqm commercial complex with total investment capital of $20 million, in Danang city.

Real Estate - Tue, November 18, 2025 | 12:20 pm GMT+7

Vietnam PM asks Kuwait fund to expand investment in manufacturing, logistics, renewable energy

Prime Minister Pham Minh Chinh on Monday called on the Kuwait Fund for Arab Economic Development (KFAED) to strengthen cooperation with Vietnam, particularly in the areas of industrial production, logistics, renewable energy, green economy, and the Halal ecosystem.

Economy - Tue, November 18, 2025 | 11:53 am GMT+7

Thai dairy brand Betagen to build first plant in Vietnam

Betagen, a famous Thai dairy brand, plans to build its first manufacturing plant in Vietnam, located in the southern province of Dong Nai.

Industries - Tue, November 18, 2025 | 8:49 am GMT+7

Banks dominate Vietnam's Q3 earnings season, Novaland posts biggest loss

Banks accounted for more than half of the 20 most profitable listed companies in Vietnam’s Q3/2025 earnings season, while property developer Novaland recorded the largest loss.

Finance - Tue, November 18, 2025 | 8:24 am GMT+7

Highlands Coffee posts strongest quarterly earnings in 2 years on robust same-store sales

Highlands Coffee, Vietnam’s largest coffee chain, delivered its best quarterly performance in two years, with Q3 EBITDA exceeding PHP666 million ($11.27 million), parent company Jollibee Foods Corporation (JFC) said in its latest earnings report.

Companies - Mon, November 17, 2025 | 10:21 pm GMT+7

Hong Kong firm Dynamic Invest Group acquires 5% stake in Vingroup-backed VinEnergo

VinEnergo, an energy company backed by Vingroup chairman Pham Nhat Vuong, has added a new foreign shareholder after Hong Kong–based Dynamic Invest Group Ltd. acquired a 5% stake, according to a regulatory filing on Saturday.

Companies - Mon, November 17, 2025 | 9:52 pm GMT+7