Foreign firms in Vietnam want clarity, more incentives to offset GMT impacts

Foreign businesses operating in Vietnam have called on the Vietnamese authorities to issue clearer policies and consider further incentives to offset negative effects of the Global Minimum Tax (GMT) that was enacted in January.

In November 2023, Vietnam decided to join an OCED-led incentive to levy a minimum 15% tax rate on multinational companies with revenues of EUR750 million ($800 million) or more.

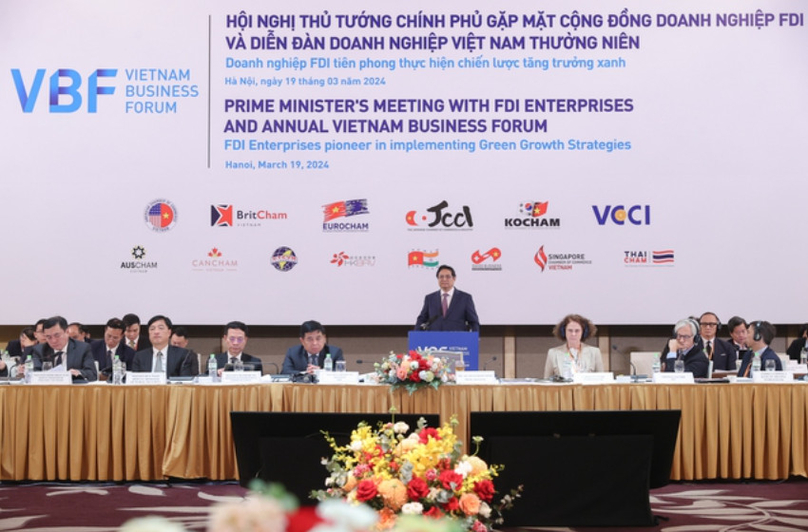

A view of the annual Vietnam Business Forum (VBF), attended by Prime Minister Pham Minh Chinh, in Hanoi, March 19, 2024. Photo courtesy of the government’s news portal.

KoCham

In its position paper sent to the annual Vietnam Business Forum (VBF) that took place in Hanoi Tuesday, the Korea Chamber of Business in Vietnam (KoCham) suggests that Vietnam takes supplementary measures when implementing the Global Minimum Tax (GMT).

With the full-scale implementation of the GMT system starting in 2024, concerns have arisen over the potential dissolution of the investment tax incentives hitherto enjoyed by foreign companies, the paper says.

The standard corporate income tax rate in Vietnam is 20%. However, for certain enterprises, the effective tax rate ranges from 5% to 10%, creating a disparity. In the event of paying taxes on the difference, the existing tax reduction benefits are offset.

A draft decree announced December 19 by Vietnam’s Ministry of Planning and Investment (MPI) outlines plans for establishing an investment support fund for the implementation of the GMT, along with the associated support benefits, support scope, and methods.

However, this has attracted criticism over ambiguity of the support criteria, making it insufficient to attract the interest and consensus of investors, the KoCham paper says.

They show concerns over the limitations on the eligibility for support as per the current draft decree, restricting it to investment amounts of $500 million or more.

“This restriction may lead to a very limited number of eligible companies, and there is a significant concern that many foreign-invested enterprises may not benefit it notes.

If investments by these companies are deterred by these measures, it could have a negative impact on the business of all vendor companies that have entered Vietnam alongside, eventually posing a potential obstacle to the expansion of foreign investment in Vietnam.

The paper requests a thorough analysis and assessment of the implications of implementing the GMT and calls for incorporation of comprehensive industry opinions into the draft decree, making adjustments and enhancements to ensure that foreign investment companies are not adversely affected.

Echoing the representative of Korean firms, the Japanese Chamber of Commerce and Industry (JCCI) in Vietnam asks for opportunities to explain the FDI perspective when Vietnam makes any changes to the tax system.

EuroCham

The European Chamber of Commerce (EuroCham) also urges the Vietnamese government to undertake a comprehensive review of the tax incentives currently in place.

This includes studying the impacts of Pillar 2 on current and future investors and considering practical and effective solutions for encouraged sectors so that adopting Pillar 2 does not create negative impacts on the investment environment while Vietnam still meets its commitments.

For example, if expenditure-based incentives were to be introduced instead of income-based ones, like tax holidays, there would be less impacts on foreign investment from Pillar 2 adoption.

In addition to encouraging investment in R&D, innovation and high-technology incentives could be targeted to support policy objectives including the promotion of green transition.

Tax revenues generated from Qualified Domestic Minimum Top-Up Tax (QDMTT) could additionally be spent on improving the overall investment environment such as infrastructure and labor force skills development.

“Pillar 2 provides a very good opportunity for Vietnam to consider tax incentive reform, and this should be done as soon as possible so as not to lose either tax revenues or foreign investment, as other countries will impose top-up taxes from 2024 and are also considering revising their tax incentive regimes in response,” EuroCham suggests.

Prime Minister Pham Minh Chinh (middle) talks with representatives of the foreign business community at the Vietnam Business Forum (VBF) in Hanoi, March 19, 2024. Photo courtesy of the government’s news portal.

VBF Tax and Customs Working Group

For its part, the VBF Tax and Customs Working Group argues that the current draft decree by the MPI has a “quite narrow” scope in terms of support recipient targets.

The draft targets enterprises with investments in high technology (those implementing investment projects in high-tech product manufacturing, high-tech enterprises, enterprises with high-tech application projects) with investments of over VND12,000 billion ($500 million) or whose annual revenue tops VND20,000 billion ($807 million).

Given these requirements, only a very small number of businesses will be eligible, failing to cover a representative portfolio of investors in the high-tech sector. This would also fail to attract strategic investors as set out in the National Assembly’s Resolution No. 110/2023/QH15 passed last November, they say.

Commenting on the inadequacy of investment support policy and what would be needed to ensure a stable business environment that will retain and attract large corporations, the VBF Tax and Customs Working Group notes:

1. The current draft decree only targets companies with investments in high-tech product manufacturing and enterprises with high-tech applications but does not include those operating in high-tech parks.

2. Companies in high-tech parks have to meet very strict conditions, one of them being that their areas of operation must belong to the list of high-tech fields in which investment and production is encouraged.

3. The current draft looks at the enterprise-level or project-level scale. However, in the high-tech sector, R&D is highly technical and its output is often applied to the manufacturing of small but critical spare parts and component. Given the in-depth application of each, Therefore, high-tech companies and projects are often small in scale.

“If we only look at the scale of each project and ignore that fact that it is actually supervised by a large corporation/investor, we will miss important strategic investors in technology.”

Currently, there are big names in technology carrying out investments and and long-term commitments in Vietnam with many subsidiaries and investment projects. The scale of investment of such corporations might reach over VND12,000 billion ($500 million) in total, but such amounts would be hard to realize for a single project. Therefore, support policies for hi-tech investors should target large corporations in terms of their total scale of investment in Vietnam as a single entity.

4. Large-scale enterprises operating in other manufacturing sectors with total investment capital of at least VND20,000 billion or $1 billion should be encouraged and supported as they involve an entire ecosystem of satellite businesses, including suppliers of components and materials, logistics companies, etc. which are all indispensable.

5. Additional corporate income tax collection under global anti-base erosion regulations poses a significant challenge to maintaining the competitiveness of Vietnam's business environment.

Therefore, in order to attract investment, the Vietnamese government would do well to learn from the experiences of other countries and come up with appropriate and competitive policies, the foreign business associations recommend.

- Read More

Construction giant Fecon starts work on Hanoi metro line, northern Vietnam rail link

Fecon, a leading Vietnamese construction group, on Friday broke ground on two major rail projects: a metro line in Hanoi and a strategic railway linking the capital city with northern localities.

Infrastructure - Sat, December 20, 2025 | 2:08 pm GMT+7

SJ Group to build smart urban area in western Hanoi to bolster Hoa Lac High-tech Park

Vietnam's leading developer SJ Group JSC is outlining plans for its over 1,200-hectare Tien Xuan Smart Urban Area project in Hanoi, which is expected to be a residential and service hub of the Hoa Lac science and technology city.

Real Estate - Sat, December 20, 2025 | 10:36 am GMT+7

Indonesia to deepen role in global semiconductor supply chain

Indonesia is rolling out efforts to identify opportunities and map its natural resources to support the semiconductor industry, as part of a broader strategy to build domestic industrial capacity.

Southeast Asia - Sat, December 20, 2025 | 9:36 am GMT+7

Indonesia to stop rice imports next year

Indonesia will not import rice for either consumption or industrial use next year, citing sufficient domestic production, according to a government official.

Southeast Asia - Sat, December 20, 2025 | 8:00 am GMT+7

Northern Vietnam port city Hai Phong charts sustainable growth path for free trade zone

The establishment of Hai Phong Free Trade Zone (FTZ) is a strategic direction that will elevate the role and position of Vietnam in general and Hai Phong in particular within the global value chain, heard a conference held in the northern port city last week.

Economy - Fri, December 19, 2025 | 8:12 pm GMT+7

Construction begins on $32.5 bln Red River Scenic Boulevard project in Hanoi

The gigantic project Red River Scenic Boulevard, with a preliminary investment of about VND855 trillion ($32.49 billion) in Phu Thuong ward, Hanoi, broke ground on Friday.

Real Estate - Fri, December 19, 2025 | 4:57 pm GMT+7

Major Vietnamese groups kick off mega projects in south-central Vietnam

Vingroup, BIN Corporation, Hoa Phat, and FPT simultaneously broke ground on large-scale projects in south-central Vietnam on Friday, raising expectations for new national growth momentum in the coming period.

Economy - Fri, December 19, 2025 | 4:36 pm GMT+7

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

The first passenger flights touched down at Long Thanh International Airport in Dong Nai province on Friday morning, marking the inaugural civil aviation operation at Vietnam’s largest airport.

Economy - Fri, December 19, 2025 | 2:07 pm GMT+7

Vingroup starts work on $35.2 bln Olympic Sports Urban Area on Hanoi outskirts

Vingroup (HoSE: VIC), Vietnam's leading private conglomerate, on Friday broke ground on its 9,171-hectare Olympic Sports Urban Area project in Hanoi, which is expected to become a new growth engine for the southern part of the capital in the next decade.

Real Estate - Fri, December 19, 2025 | 1:59 pm GMT+7

Vietnam telecom giant VNPT establishes AI company

State-owned Vietnam Posts and Telecommunications Group (VNPT) on Thursday launched subsidiary VNPT AI, aiming to bring Vietnamese AI products to international markets.

Companies - Fri, December 19, 2025 | 11:50 am GMT+7

Quang Ngai Sugar develops sugar, biomass power projects worth $179 mln in central Vietnam

Quang Ngai Sugar JSC (UPCom: QNS), a top sugar producer in Vietnam, will simultaneously hold groundbreaking or inauguration ceremonies on Friday for three projects worth over VND4.7 trillion ($178.5 million) in Gia Lai province.

Companies - Fri, December 19, 2025 | 8:05 am GMT+7

Vietnam defeat Thailand to win men’s football gold at SEA Games 33

After conceding two goals in just over 30 minutes, Vietnam reversed the situation to finally beat host nation Thailand 3-2 in the men’s football final of the 33rd SEA Games.

Travel - Thu, December 18, 2025 | 10:43 pm GMT+7

Sun Group to commence construction on 5 landmark projects worth $5.7 bln

Sun Group is scheduled to start construction of five large-scale projects across Vietnam’s three regions on Friday, with a total investment of nearly $5.7 billion.

Companies - Thu, December 18, 2025 | 8:39 pm GMT+7

Unpaid credit card balances in Singapore hit record high in 10 years

Singapore's credit card debt has exceeded SGD9.07 billion (about $7 billion) in 2025's third quarter, a 10-year high that was last seen in 2014.

Southeast Asia - Thu, December 18, 2025 | 7:54 pm GMT+7

Thailand, Japan deepen transport, infrastructure cooperation

Thai Deputy Prime Minister and Minister of Transport Phiphat Ratchakitprakarn has met with Japanese Ambassador Otaka Masato to advance cooperation in Thailand’s transportation and infrastructure projects.

Southeast Asia - Thu, December 18, 2025 | 7:50 pm GMT+7

Masan's FMCG arm MCH to list on HCMC bourse at $8 per share, valuation tops $8.6 bln

Masan Consumer Corporation (UpCoM: MCH), the fast-moving consumer goods arm of Vietnam’s Masan Group, will officially debut on the Ho Chi Minh City Stock Exchange (HoSE) on December 25, with a reference price set at VND212,800 ($8.08) per share.

Companies - Thu, December 18, 2025 | 4:57 pm GMT+7