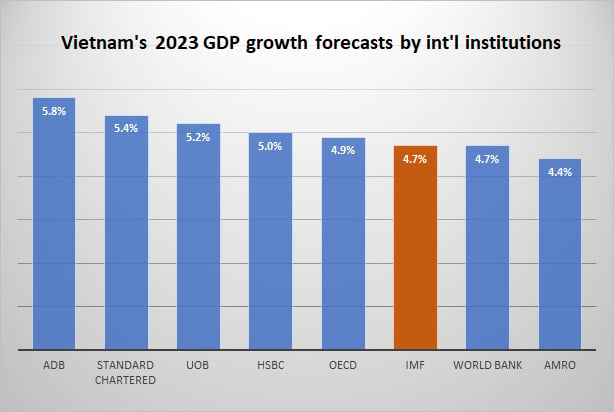

IMF retains Vietnam’s 2023 GDP growth forecast at 4.7%

The IMF has kept its 2023 GDP growth forecast for Vietnam unchanged from its April projection at 4.7%, below the government’s 6.5% target, though the country's liquidity, foreign exchange and inflationary pressures have eased.

After a weak first half, growth in 2023 is expected to accelerate in the second half, assuming that the real estate turbulence is contained, and exports and credit growth pick up gradually in the second semester and in 2024, the IMF said in their conclusions on the 2023 Article IV Consultation with Vietnam.

The IMF’s forecast is on par with the World Bank’s and lower than several other international institutions like ADB, Standard Chartered and UOB.

Chart from data collected by The Investor.

Given the opening up of the output gap, inflation is expected to end the year at 3.7%, below the 4.5% target. The current account balance will improve to a small surplus in 2023, driven partly by a rebound in tourism, says the IMF report.

Merchandise export and import volumes are expected to decline relative to 2022 due to depressed demand. The exit from the pandemic has been challenging and has left some scarring, but the economy is expected to revert to the pre-Covid growth trajectory over the medium term as reforms are implemented.

The IMF forecast Vietnam’s economic growth at 5.8% next year, and the consumer price index – a gauge for inflation – at 3.5%.

The fund noted downside risks to growth loom large. The main external risk is a deeper and more persistent weakness in external demand. While recently benefitting from some business diversion from China, Vietnam stands to lose from a slowdown in global trade due to geoeconomic fragmentation.

Domestic downside risks mostly emanate from a further deterioration of financial conditions, which could damage growth prospects over the medium term. Further energy shortages after the episodes in May-June 2023 could harm economic activity and business sentiment.

On the upside, a faster than anticipated deployment of public investment may boost growth.

IMF executive directors noted that, given ample fiscal space and limited room for monetary policy loosening, fiscal policy should take the lead in supporting economic activity if needed. They recommended strengthening the fiscal framework and budget process and increasing revenue mobilization over the medium term to support the ambitious development agenda.

Regarding the bond and real estate markets, they urged decisive steps to address remaining risks, including strengthening the insolvency framework, bolstering institutions, and increasing transparency in the corporate bond market.

- Read More

Vingroup plans $38 mln bond issuance to restructure debt

Vingroup (HoSE: VIC), Vietnam’s largest listed company by market cap, plans to issue VND1 trillion ($37.91 million) in bonds via private placement as it seeks to restructure debt.

Companies - Tue, November 25, 2025 | 3:52 pm GMT+7

Vietnam gov't proposes minimum $379 mln charter capital for offshore wind developers

The Vietnamese government has proposed that offshore wind power developers have a minimum charter capital of VND10 trillion ($379 million) each, according to a draft resolution designed to ease bottlenecks in the country’s 2026-2030 energy development plan.

Energy - Tue, November 25, 2025 | 3:41 pm GMT+7

Petrovietnam arm to venture into CO2 transportation, seabed minerals, geothermal

PVEP, the upstream arm of state giant Petrovietnam, plans to expand into new fields such as CO2 transportation and disposal (carbon capture, utilization, and storage), coal gas and underground mineral research, seabed minerals, and geothermal.

Industries - Tue, November 25, 2025 | 3:08 pm GMT+7

MB successfully closes landmark $500 mln inaugural green term loan facility agreement

Military Commercial Joint Stock Bank (MB) on Monday announced the successful closing of its three-year $500 million inaugural Green Term Loan Facility Agreement, marking a significant milestone in the bank’s sustainable financing journey.

Banking - Tue, November 25, 2025 | 2:17 pm GMT+7

Impact of rising exchange rates in Vietnam

Mirae Asset Securities analysts offer an insight into the impact of rising exchange rates on companies in Vietnam in a report dated November 21.

Economy - Tue, November 25, 2025 | 1:35 pm GMT+7

Vietnam's industrial park developers post strong earnings as tenant demand rebounds

Vietnam’s industrial real estate sector is showing stronger earnings and improving demand, with foreign tenants resuming lease negotiations after U.S. tariff policies became clearer, according to a brokerage report.

Industrial real estate - Tue, November 25, 2025 | 11:07 am GMT+7

Vietnamese export stocks under the radar despite strong earnings

Investor caution over tariff risks and the slowdown of major economies has prevented Vietnamese export stocks from making a strong price recovery.

Finance - Tue, November 25, 2025 | 8:44 am GMT+7

Indonesia plans 7 initial waste-to-energy plants next year

Indonesia will start the construction of seven waste-to-energy power plants in 2026 as the first step to develop 33 such facilities by 2029.

Southeast Asia - Mon, November 24, 2025 | 9:23 pm GMT+7

Malaysia predicted to be ASEAN’s second-fastest-growing economy, after Vietnam

Malaysia is poised to become the second-fastest-growing economy in the Association of Southeast Asian Nations (ASEAN) after Vietnam, data showed.

Southeast Asia - Mon, November 24, 2025 | 9:19 pm GMT+7

Thailand SCG-backed Bien Hoa Packaging plans delisting from HCMC bourse

Bien Hoa Packaging JSC, a 57-year-old manufacturer in Vietnam, plans to scrap its public-company status and delist from the Ho Chi Minh Stock Exchange (HoSE) as its free float fell below the minimum threshold under local securities law.

Companies - Mon, November 24, 2025 | 9:06 pm GMT+7

Real estate, industrials sectors lead in October M&A value in Vietnam

Grant Thornton analysts provide an insight to capital flows, the sectors attracting investor attention, and the market dynamics influencing the merger and acquisition (M&A) landscape in Vietnam in October.

Economy - Mon, November 24, 2025 | 4:39 pm GMT+7

Tobacco giant Vinataba to sell entire stake in instant noodle maker Colusa-Miliket

State-owned Vietnam National Tobacco Corporation (Vinataba) plans to divest its entire 20% stake in Colusa-Miliket, the company behind the iconic “Miliket” (two-shrimp) instant noodle brand, seeking to raise at least VND114 billion ($4.32 million).

Companies - Mon, November 24, 2025 | 4:10 pm GMT+7

VinSpeed cannot participate in North-South high-speed rail project under PPP model: exec

Pham Nhat Vuong, founder of VinSpeed High-Speed Rail Investment and Development JSC, has mapped out a clear 30-year financing plan for the gigantic North-South high-speed rail project, said an executive at Vingroup, a VinSpeed investor.

Infrastructure - Mon, November 24, 2025 | 3:51 pm GMT+7

Delivery major Viettel Post plans $21 mln logistics center in central Vietnam

Viettel Post, the courier arm of military-run telecom giant Viettel, has completed a site survey for a planned 21-hectare logistics center in the central province of Ha Tinh, with an estimated investment of nearly VND550 billion ($20.87 million).

Industries - Mon, November 24, 2025 | 11:49 am GMT+7

Honda Mobilityland eyes 600-ha sports, entertainment, tourism complex in southern Vietnam

Honda Mobilityland Corporation, a subsidiary of Japan’s Honda Motor Co., plans to build an international circuit in Tay Ninh province, towards developing a 600-hectare sports, entertainment, and tourism complex there.

Industries - Mon, November 24, 2025 | 11:23 am GMT+7

State-controlled shipping line Vosco steps up coal trading to seek new revenue drive

Vietnam Ocean Shipping JSC (Vosco), controlled by the state-run Vietnam Maritime Corporation, is moving deeper into coal trading as the shipping line increasingly bids for large import contracts for thermal power plants, marking a push beyond its core maritime transport business.

Companies - Mon, November 24, 2025 | 8:36 am GMT+7