Legal framework lacking for new-style resort real estate

Vietnam’s new-style tourism and resort real estate segment does not have a legal framework to follow, wrote Prof. Dr. Dang Hung Vo, former Deputy Minister of Natural Resources and Environment.

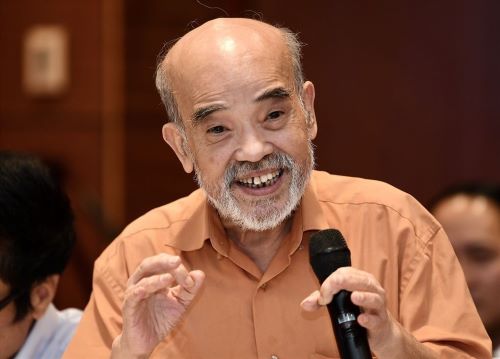

Prof. Dr. Dang Hung Vo. Photo courtesy of Labor newspaper.

Professional property developers have taken the initiative to switch from residential real estate to new-style tourism and resort real estate.

For old-style tourism and resort real estate, developers invested in a hotel, resort or amusement park. Meanwhile, the new-style sector features multiple functions and developers can sell each part of the project to individual investors.

The first sector has a full legal framework stated in the Land Law 2013 and the Law on Real Estate Business 2014, but the second does not.

For example, a multi-storey building or multiple real estate units, some of which are used for handicraft production, some for business and service purposes, and some for living. So should it be classed as residential, production or business land?

On the other hand, the current law only allows housing projects for sale in the form of future-formed housing, so can multi-purpose projects sell future-formed real estate?

The new-style tourism and resort real estate segment has developed in the absence of a legal framework.

Development of such projects is based only on "vague" verbal commitments between provincial authorities and project developers, and between project developers and individual investors who have purchased real estate units.

Regarding operational methods, individual investors entrust project developers to exploit their real estate units for profits as committed. Projects that want to attract individual investors must commit to high profits. In fact, the committed profits vary from 8%, 10% and 15% per year. However, an 8% profit is difficult to fulfill in the first few years of operation.

When this investment "movement" thrived, developers often took the benefit of selling future-formed properties of this project to pay for the individual investor profit of the previous projects. When new-style tourism and resort real estate projects revealed disadvantages that gradually caused illiquidity, individual investors "turned their backs" and did not invest in this segment anymore.

The collapse of the mega Cocobay project in the central city of Danang was the first fragment of this segment. Since then, a series of other projects have fallen into illiquidity and could no longer continue, highlighting the "uncertain" development of the new-style tourism and resort real estate market.

The Covid-19 tragedy hit the tourism market and the tourism and resort real estate market. When the pandemic was under control, the difficulties facing the new-style tourism and resort real estate segment reappeared, and there is still no reasonable legal framework to support its development.

- Read More

Vietnam's major food maker Kido delays 2024 dividend payout due to economic headwinds

Kido Group has postponed its planned cash dividend payment for 2024, citing persistent economic difficulties and the need to preserve cash flow for operations in late 2025 and early 2026.

Companies - Tue, December 23, 2025 | 8:00 am GMT+7

Petrovietnam chairman Le Manh Hung appointed acting Industry and Trade Minister

Prime Minister Pham Minh Chinh has appointed Le Manh Hung, chairman of the council of members at state-owned Petrovietnam (PVN), as acting Minister of Industry and Trade.

Economy - Mon, December 22, 2025 | 9:55 pm GMT+7

Vietnam's top non-life insurer PVI surpasses $1 bln in revenue

PVI Insurance, a leading non-life insurer in Vietnam, has surpassed $1 billion in revenue, becoming the first non-life insurance company in the country to reach this revenue scale.

Companies - Mon, December 22, 2025 | 7:30 pm GMT+7

JC&C completes sale of 4.6% Vinamilk stake to F&N for $228 mln

Singapore-listed Jardine Cycle & Carriage Limited (JC&C) has reportedly completed the sale of more than 96 million shares, equivalent to a 4.6% stake, in Vietnam’s dairy giant Vinamilk (HoSE: VNM).

Companies - Mon, December 22, 2025 | 6:50 pm GMT+7

Shares linked to ‘Shark Hung’ slide despite market rallies

Shares of Cen Land (HoSE: CRE), a major Vietnamese real estate brokerage linked to businessman Pham Thanh Hung, fell sharply on Monday, bucking a broad market rally that lifted the benchmark VN-Index to a fresh high.

Companies - Mon, December 22, 2025 | 4:17 pm GMT+7

Intel urged to expand chip packaging, testing operations in Vietnam

Vietnam has urged Intel to step up investment in semiconductor packaging and testing operations in the country, as Hanoi accelerates efforts to build a domestic chip ecosystem aligned with global supply chains.

Investing - Mon, December 22, 2025 | 3:37 pm GMT+7

Korean energy giant LS intends to inject $19.3 mln into Vietnam rare earth business

LS Eco Energy, a subsidiary of South Korea’s cable and energy giant LS Cable & System, has decided to invest KRW28.5 billion ($19.26 million) in advancing its rare earth metals business in Vietnam.

Industries - Mon, December 22, 2025 | 3:11 pm GMT+7

Vietnam's Petrosetco estimates 2025 net profit rises 46% to over $12 mln

PetroVietnam General Services Corporation (Petrosetco) expects its net profit to reach VD322 billion ($12.23 million) in 2025, up 46% year-on-year and exceeding the company's full-year target by 32%.

Companies - Mon, December 22, 2025 | 11:50 am GMT+7

Vietnam's 13th Party Central Committee convenes 15th meeting

The 15th meeting of Vietnam's 13th Party Central Committee opened in Hanoi on Monday.

Politics - Mon, December 22, 2025 | 11:13 am GMT+7

Duc Giang Chemical chairman’s family loses $129 mln in a week as shares plunge

Shares of Vietnam’s Duc Giang Chemical Group JSC (DGC) fell sharply last week (December 15-19), wiping nearly VND3.4 trillion ($129.2 million) off the stock-based wealth of the family of chairman Dao Huu Huyen.

Companies - Mon, December 22, 2025 | 6:58 am GMT+7

Vietnam launches International Financial Center, pledges 'special process' to resolve investor hurdles

Vietnam on Sunday announced the establishment of its International Financial Center (IFC), with Prime Minister Pham Minh Chinh pledging to fast-track the resolution of investor difficulties through a “special process”.

Economy - Sun, December 21, 2025 | 9:18 pm GMT+7

The new target for VN-Index is 3,200: Finnish fund PYN Elite

The earnings growth of listed companies in Vietnam will continue to support equity prices in 2026. According to the consensus forecast, a market P/E of 10.0 for 2026 looks very attractive, writes Petri Deryng, portfolio manager at Finnish fund PYN Elite.

Consulting - Sun, December 21, 2025 | 6:33 pm GMT+7

Mastering AI key to Vietnam’s leap beyond middle-income trap: FPT chairman

Mastering and innovating technology is no longer optional but the sole path for Vietnam to escape the middle-income trap and rise alongside global powers, said tech giant FPT Corporation chairman Truong Gia Binh.

Economy - Sun, December 21, 2025 | 2:33 pm GMT+7

Vietnam among world’s top 15 countries by im-export value: ministry

Vietnam’s import-export turnover is expected to reach $920 billion for the first time in 2025, placing the country among the world’s top 15 by trade value, according to the Ministry of Industry and Trade (MoIT).

Economy - Sun, December 21, 2025 | 11:07 am GMT+7

Dung Quat oil refinery operator BSR targets 187% net profit growth in 2026

Binh Son Refining and Petrochemical JSC (HoSE: BSR), operator of Dung Quat - Vietnam’s first oil refinery, expects net profit to surge in 2026, supported by stable oil price assumptions and a major investment plan to expand and upgrade its core refining assets.

Companies - Sun, December 21, 2025 | 8:00 am GMT+7

Dragon Capital-managed VEIL plans trio of 10% tender offers

Vietnam Enterprise Investments Limited (VEIL), the largest foreign-managed equity fund in Vietnam, has announced a tender offer for up to 10% of its issued share capital, with the option to conduct up to two additional tenders over the next year.

Finance - Sat, December 20, 2025 | 11:19 pm GMT+7