Vietnam government has plan to boost economic growth

VinaCapital’s chief economist Michael Kokalari highlights a series of measures taken by the Vietnamese government to stir growth amid global economic headwinds.

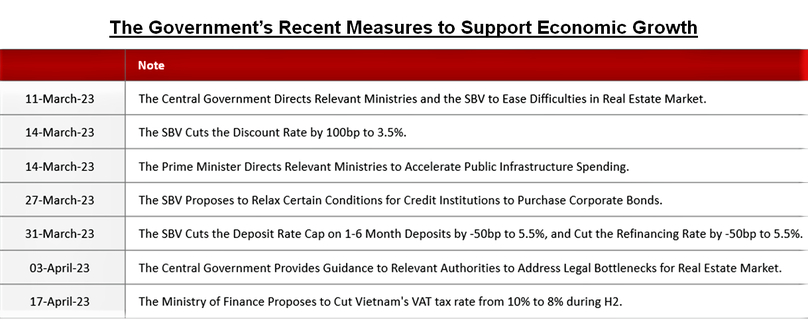

Vietnam’s GDP growth slowed from 8% in 2022 to just 3.3% in Q1/2023, prompting the government to launch several initiatives to boost the country’s growth. These include tax cuts, monetary stimulus, and administrative measures aimed at easing the current difficult conditions in the real estate market, which we discussed in our previous reports and webinars.

The details of these and other initiatives are discussed below; the key points are that the government is proactively addressing the current growth slowdown and has ample fiscal resources to counter any continued growth headwinds (Vietnam’s government debt-to-GDP ratio was just 40% at the end of 2022).

We are confident that policymakers can counter the growth slowdown, and that Vietnam’s economic growth will rebound in the second half of 2023 for reasons discussed below – although it’s unlikely that the government can achieve its 6.5% GDP growth target this year.

Stock markets typically climb in advance of economic recoveries, so the government’s mounting resolve to support economic growth, coupled with the fact Vietnamese stocks are currently trading at a near 10-year low valuation, make now an auspicious time to invest in Vietnamese stocks, in our view.

The current slowdown in Vietnam’s economic growth is being caused by a drop in demand for “Made in Vietnam” products from U.S. consumers, although orders at FDI factories in Vietnam are likely to recover in H2/2023, which should help drive an economic rebound later this year.

Manufacturing contributes nearly one-quarter of Vietnam’s GDP and output contracted slightly in Q1/2023 versus 9% growth in 2022, because most products produced in Vietnam are exported to the U.S. and other developed countries. Note that Vietnam’s international trade accounts for a higher percentage of the country’s GDP than in any other economy in modern history (excluding economies like Hong Kong and Singapore), so weaker demand in the rest of the world weighs fairly heavily on Vietnam’s economy.

Specifically, Vietnam’s exports fell 12% year-on-year in Q1, driven by a 20% drop in exports to the U.S. Meanwhile, inventories at U.S. retailers and other consumer-facing firms such as Nike and Lululemon are now contracting, which is why we expect FDI factories’ order books to start recovering later this year (inventory growth at U.S. retailers peaked at over 20% yoy in late-2022, is currently around 10%, and looks likely to fall to 0% year-on-year growth in H2, which should prompt a resumption of order growth for FDI factories in Vietnam).

Finally, domestic consumption in Vietnam continues to grow at a healthy pace and consumer confidence has remained remarkably resilient despite the steep slowdown in GDP growth.

That is partly because the number of people who are employed grew by over 2% year-on-year in Q1, which more than twice the country’s population growth rate and we estimate that wages are up over 7% year-on-year, far outpacing CPI inflation which is just over 3%.

In addition, foreign tourist arrivals rocketed to over 60% of pre-Covid levels in Q1, despite the fact that Chinese tourists have not yet returned to the country en masse - which is another reason we expect Vietnam’s economic growth to recover in H2.

Measures to support growth

This week, Vietnam’s Ministry of Finance (MoF) finalized a plan to cut Vietnam’s VAT tax rate from 10% to 8% in H2/2023, which will equate to about $1.5 billion of stimulus for Vietnam’s $450 billion economy.

The government will also allow companies and individuals 3-6-month delays in the payment of various taxes. Last month, the State Bank of Vietnam (SBV) cut policy rates in Vietnam by 50-100 basis points, including a 50 basis-point reduction in the re-financing rate (which is the most important policy rate in Vietnam) to 5.5%, and a 50 basis-point reduction in the maximum interest rates banks are allowed to pay savers on deposits of up to 6 months to 5.5%.

In addition to those concrete steps to boost growth, the government also walked back some new regulations that were introduced in late 2022 to impose stricter conditions on the issuance of corporate bonds.

Vietnam’s government also directed its ministries to address various administrative bottlenecks that are impeding real estate development and infrastructure projects. The tax cuts and policy interest rate cut are the most concrete actions the government took to support growth, but these administrative measures could potentially have a much bigger impact on economic growth.

Real estate development, which accounts for nearly 10% of Vietnam’s GDP, has essentially ground to a halt, largely because of the difficulties developers are having obtaining the approvals required to proceed with their projects. Some of the micro-level issues that the government’s recent actions seek to address include bottlenecks entailed in converting agricultural land for use in residential real estate projects and delays in the appraisal of land values for the determination of land-use/conversion fees payable to the government.

The government also launched a $5.1 billion subsidized loan package to support the development of over one million new affordable housing units (subsidized loans will be provided to both developers and home buyers via the state-owned commercial banks) and established a new working group to review and remove obstacles developers encounter in progressing their development projects.

Further to that last point, the government also established a working group to accelerate the disbursement of public investment projects this year; it aims to increase infrastructure spending by about 40% in 2023 (to $30 billion), but infrastructure spending increased by less than 20% year-on-year in Q1.

Finally, in addition to the administrative measures above, the government also provided guidance intended to make it easier for banks to restructure loans extended to real estate developers, as well as to other borrowers, although the details of these proposed forbearance measures are still being hashed out.

Monetary policy easing

The interest rates that banks pay savers in Vietnam increased by over 200 basis points in 2022 to over 8% for 12-month deposits as of end-2022, although one-year deposit rates had climbed to above 9.5% at their peak in late-2022.

This surge in deposit rates is an additional source of difficulties for the real estate market, compounding the administrative issues mentioned above that are impeding real estate development projects. Mortgage rates in Vietnam are linked to long-term deposit rates, and higher deposit rates encourage savers to park their money in the bank rather than seek out other investments (such as real estate and/or investing in the stock market).

We believe that a 200bp drop in the average level of 12-month deposit rates from the levels at the beginning of this year (to circa 6%), would help drive a recovery in Vietnam’s real estate market and would support Vietnamese businesses in general. The SBV’s 50-100bp policy rate cut has put some downward pressure on long-term deposit rates – which have fallen by about 50bps year to date – but for deposit rates to fall significantly further, liquidity in Vietnam’s banking system will need to improve significantly.

Credit growth in Vietnam has outstripped deposit growth by about 3 percentage points annually over the last year, which has pushed up banks’ loan-to-deposit ratios to unacceptably high levels and prompted banks to increase the interest rates they pay savers in order to raise deposits. The government is addressing this liquidity shortage in a few ways, the most important of which is by purchasing the U.S. dollar from commercial banks to increase its forex reserves.

We expect the SBV to purchase about $25 billion of forex reserves this year, which would inject significant liquidity into the banking system and would likely boost Vietnam’s system-wide deposit growth by 4 percentage points this year, ceteris paribus, because the central bank typically purchases USD from the country’s commercial banks with newly printed Vietnam dong.

In short, the SBV’s purchases of forex reserves, coupled with the other measures the government is taking to ease liquidity in the banking sector are even more important monetary easing measures than the SBV’s policy rate cuts last month.

Finally, we mentioned above that the SBV cut the maximum allowable interest rate on 6-month deposits by 50 basis points last month. The interest rates on short-term deposits in Vietnam had already peaked in late-2022, and the March policy rate cut will put additional downward pressure on those deposit interest rates.

Consequently, there will be many bank deposits maturing in Q2 and Q3 and savers will essentially face a choice of rolling over their deposits at lower interest rates or plowing that money into the stock market (the vast majority of time deposits in Vietnam are 3-month and 6-month deposits).

Conclusions

GDP growth in Vietnam slowed precipitously in Q1 as consumers in the U.S. and other developed markets bought fewer “Made in Vietnam” products. This was exacerbated by the ongoing slowdown in the country’s real estate market, although a rebound in foreign tourist arrivals is mitigating the negative impact of these two burdens on Vietnam’s growth this year.

The government has taken a series of initiatives to address the country’s slowing growth, the most concrete of which are tax cuts and interest rate cuts, but administrative measures that are intended to ease bottlenecks impeding real estate development and infrastructure projects could have an even bigger impact to support growth in 2023 and beyond.

The government’s initiative to address disappointing Q1 GDP growth, coupled with the fact that FDI factories’ orders are likely to accelerate in H2, leads us to expect a rebound in GDP growth in the second half of this year. The fact that stock markets tend to start climbing in advance of economic rebounds, coupled with the fact that the VN-Index is trading at around a 10-year low valuation, leads us to believe that now could be an ideal time for investors to selectively purchase Vietnamese stocks.

We are encouraged to see that foreign investors have been net buyers year to date, so there are already some investors that are recognizing the attractiveness of the current entry point for Vietnamese stocks.

- Read More

Banks dominate Vietnam's Q3 earnings season, Novaland posts biggest loss

Banks accounted for more than half of the 20 most profitable listed companies in Vietnam’s Q3/2025 earnings season, while property developer Novaland recorded the largest loss.

Finance - Tue, November 18, 2025 | 8:24 am GMT+7

Highlands Coffee posts strongest quarterly earnings in 2 years on robust same-store sales

Highlands Coffee, Vietnam’s largest coffee chain, delivered its best quarterly performance in two years, with Q3 EBITDA exceeding PHP666 million ($11.27 million), parent company Jollibee Foods Corporation (JFC) said in its latest earnings report.

Companies - Mon, November 17, 2025 | 10:21 pm GMT+7

Hong Kong firm Dynamic Invest Group acquires 5% stake in Vingroup-backed VinEnergo

VinEnergo, an energy company backed by Vingroup chairman Pham Nhat Vuong, has added a new foreign shareholder after Hong Kong–based Dynamic Invest Group Ltd. acquired a 5% stake, according to a regulatory filing on Saturday.

Companies - Mon, November 17, 2025 | 9:52 pm GMT+7

Thai giant CP’s Q3 Vietnam revenue drops 20% as hog prices slump

Thailand’s Charoen Pokphand Foods PCL (CPF) reported a sharp downturn in its Vietnam business in Q3, making the country its only major market to contract.

Companies - Mon, November 17, 2025 | 4:16 pm GMT+7

Surging demand for gas turbines tightens supply chains, extends lead times: Siemens Energy

Demand for gas turbines is rising rapidly, especially in regions with a surge in data center development, tightening supply chains and extending lead times - factors that investors must closely track during project preparation, according to Siemens Energy.

Companies - Mon, November 17, 2025 | 1:34 pm GMT+7

Novaland completes first phase of restructuring, targets 'returning to growth' from 2027

Novaland, a leading real estate developer in Vietnam, said it has completed the first phase of its multi-year restructuring plan and aims to finish the entire program by end-2026, positioning the company to return to growth from 2027.

Companies - Mon, November 17, 2025 | 12:26 pm GMT+7

Vietnam's property developer Regal Group to list shares on HCMC bourse in Q4

Regal Group JSC, a property developer based in the central city of Danang, has applied to list its 200 million RGG shares on the Ho Chi Minh City Stock Exchange (HoSE) in Q4/2025.

Real Estate - Mon, November 17, 2025 | 10:52 am GMT+7

Vietnam's upstream oil & gas stocks surge on project momentum, regulatory easing

Stocks of Vietnam’s upstream oil and gas companies have surged in recent weeks, boosted by rising exploration activity and new rules that accelerate project approvals, while midstream and downstream players face pressure from falling crude prices.

Companies - Mon, November 17, 2025 | 8:57 am GMT+7

Indonesia to turn Bali into Asia’s next medical tourism hotspot

Indonesia is stepping up efforts to reduce the number of citizens seeking treatment abroad and turn Bali into Asia’s leading medical tourism hotspot.

Southeast Asia - Sun, November 16, 2025 | 9:05 pm GMT+7

Malaysia aims to become Southeast Asia’s AI, EV hub

Malaysia is shifting into high gear as it positions itself to become Southeast Asia’s leading hub for smart, sustainable mobility, powered by breakthroughs in electric vehicles (EVs), artificial intelligence (AI), and advanced manufacturing.

Southeast Asia - Sun, November 16, 2025 | 9:00 pm GMT+7

108 foreign investors hold 26.8% stake in Vietnam's industrial giant Thaco

Vietnam’s industrial conglomerate Truong Hai Group (Thaco) has reported a charter capital of VND30.51 trillion ($1.16 billion), with domestic private capital accounting for 73.2% and 108 foreign investors holding the remaining 26.8% stake.

Companies - Sun, November 16, 2025 | 4:42 pm GMT+7

Vietnam the most important manufacturing hub of Chinese electronics giant Luxshare-ICT: exec

Major Chinese electronics manufacturer Luxshare-ICT will expand its operations in Vietnam by rolling out large science-technology and innovation projects in the northern province of Bac Ninh and other localities, its vice chairman Wang Laisheng said on Saturday.

Companies - Sun, November 16, 2025 | 2:46 pm GMT+7

Sweden’s Syre reinforces $1 bln textile recycling plant in Vietnam with Nike deal

A strategic deal with U.S. sportswear giant Nike is expected to consolidate Swedish recycling start-up Syre's plans to roll out a global network of textile-to-textile recycling facilities, beginning with a $1 billion plant in Vietnam.

Industries - Sun, November 16, 2025 | 8:00 am GMT+7

Vietnam plans roadmap to allow short selling under stock market upgrade program

Vietnam’s Ministry of Finance has outlined a plan to introduce short selling and securities lending on a controlled basis as part of its broader effort to upgrade the country’s stock market from frontier to secondary emerging status.

Finance - Sat, November 15, 2025 | 8:01 pm GMT+7

Vietnam's first LNG power plants to begin commercial operation in Nov-Dec

Nhon Trach 3 and 4, Vietnam’s first LNG-fired power plants, are expected to begin commercial operations at the end of 2025, according to authorities in the southern province of Dong Nai.

Energy - Sat, November 15, 2025 | 3:42 pm GMT+7

Central Vietnam hub pushes ahead with sea encroachment project to strongly attract FDI

A sea encroachment project in Danang will be vital to the city's strong foreign investment attraction, said Chairman of the municipal People’s Committee Pham Duc An.

Industries - Sat, November 15, 2025 | 11:44 am GMT+7

- Travel

-

Impressive Standard Chartered Hanoi Marathon Heritage Race 2025

-

Nguyen Hong Hai wins 'Investors' golden heart' golf tournament 2025

-

140 players compete at “Investors’ golden heart” golf tournament

-

‘Investors’ golden heart’ golf tournament to tee off on Saturday

-

Vietnam, Hong Kong Aircraft Engineering sign deal on aircraft maintenance hub at northern airport

-

Sun Group gets nod for $375 mln inland waterway tourism project in central Vietnam