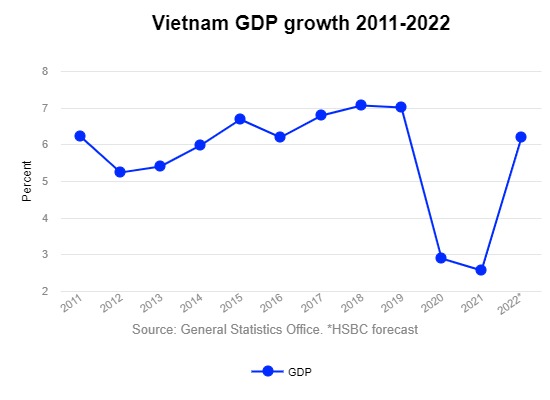

Vietnam to grow at 6.2%: HSBC

HSBC has revised down Vietnam’s GDP forecast by 0.3% to 6.2% due to impacts of the global fuel shortage.

An aerial view of Ho Chi Minh City's center. Photo by The Investor/Trong Hieu.

Surging global fuel prices have led to an increase in Vietnam's fuel expenses, negatively impacting the country’s trade balance. In March, crude oil imports more than doubled, while gasoline imports quadrupled year-on-year, the bank reported.

Vietnam may have a current account deficit for the second year in a row, albeit at a modest level of only 0.2% of GDP. The government last year posted a current account deficit of 1.1% of GDP, for the first time in four years, it said.

Given the external issues, HSBC slightly increased its forecast for the U.S. dollar/Vietnamese dong exchange rate in the short term, though the forecast by the end of the year remains at VND22,800.

The creditor pointed out that suppressed personal consumption recovery induced by rising living costs, as well as a weak labor market, have slowed retail sales growth, with only a 2.5% increase in Q1 year-on-year.

Vietnam's trade surplus in Q1 narrowed to a minimum of $800 million albeit a strong recovery in exports. Imports grew 16% and half of them were electronic components.

Despite a slight downgrade of Vietnam's GDP, HSBC believed the country remains one of the region's economies with outstanding growth this year, in line with the government’s plan of 6-6.5%.

Fitch Ratings in a release on Monday stated that it expects Vietnam’s GDP growth to accelerate to 6.1% in 2022 and 6.3% in 2023 from 2.6% in 2021, led by a recovery in domestic demand, strong exports and high FDI inflows, particularly in the manufacturing sector.

ADB in March anticipated Vietnam’s growth rate to converge to its pre-pandemic level of 6.5-7% in 2022 thanks to “fast vaccination progress, sustained global economic recovery, and certain key drivers of economic growth that include the economy’s digital transformation.” In the same month, IMF estimated the country’s economic expansion at 6.6%.

According to HSBC, Vietnam had a solid start in 2022, with GDP expanding 5.03% year-on-year in Q1, owing to a large-scale rebound.

Vietnam's General Statistics Office (GSO) data shows that the industrial sector in Q1 grew 8.36% from Q1/2021, accounting for 51.08% of the overall growth, while services climbed by 4.58% and made up 43.16%. Agriculture rose 2.45%, contributing 5.76%.

Vietnam fully reopened its market to international travelers on March 15, paving the way for tourism industry resurgence.

HSBC maintains its recently revised upwardly of 3.7% inflation forecast, which is still below the State Bank of Vietnam’s 4% target.

"Fortunately, given that food costs and price pressures induced by rising demand have been managed, Vietnam's inflation remains under control compared to other emerging economies," the report said.

However, the bank believed that the possibility of rising inflation will signal a tightened monetary policy. This explained why it raised its projection for Q3 by 50 basis points, rather than Q4 as previously forecast. Consequently, the regulatory interest rate is expected to grow to 4.5% by the end of 2022.

- Read More

What should investors reasonably expect from IPO stocks?

Experience from both Vietnam and global markets shows that initial public offering (IPO) stocks rarely deliver immediate gains. However, investors who select companies with solid fundamentals and maintain a long-term holding strategy can be rewarded for their patience.

Finance - Wed, December 24, 2025 | 10:45 am GMT+7

Vingroup completes $325 mln overseas bond issuance

Vingroup, Vietnam's biggest listed company by market capitalization, has completed its international issuance of bonds totaling $325 million, with a 5-year maturity, and listed on Austria's Vienna Stock Exchange.

Finance - Wed, December 24, 2025 | 10:17 am GMT+7

Vietnam's public investment-linked stocks seen benefiting in 2026

Capital flows in 2026 are expected to favor sectors that stand to benefit from Vietnam’s public investment drive, including infrastructure, energy, and construction, market experts said.

Finance - Wed, December 24, 2025 | 9:33 am GMT+7

High gold prices to drive prices of property, goods in Vietnam: Sunhouse chairman

In a scenario where gold prices remain elevated in Vietnam, the real estate market is likely to follow suit, pushing income levels higher and driving up prices across other goods, said Nguyen Xuan Phu, chairman of Sunhouse, a leading home appliance manufacturer, while outlining his 2026-2030 forecast.

Economy - Wed, December 24, 2025 | 8:00 am GMT+7

Malaysia’s economy grows robustly in 2025: IMF

Malaysia has shown notable resilience amid global trade tensions and policy uncertainty, with its economy growing at a healthy pace this year, supported by strong domestic consumption and investment, solid employment growth, and a global upcycle in the technology sector, according to Masahiro Nozaki, Mission Chief for Malaysia at the International Monetary Fund (IMF).

Southeast Asia - Tue, December 23, 2025 | 10:07 pm GMT+7

Indonesia to stop rice imports next year

Indonesia will not import rice for either consumption or industrial use next year, citing sufficient domestic production, according to a government official.

Southeast Asia - Tue, December 23, 2025 | 10:04 pm GMT+7

Indonesia faces challenge of balancing wages, labor costs

Indonesia plans to raise minimum wages by about 5-7% in 2026 under a new formula signed into law by President Prabowo Subianto, a move that could test the country’s cost competitiveness in Southeast Asia.

Southeast Asia - Tue, December 23, 2025 | 10:00 pm GMT+7

Philippines extends sugar import ban

The Philippine Government has decided to extend its ban on sugar imports until the end of December 2026, as domestic supply has improved.

Southeast Asia - Tue, December 23, 2025 | 9:56 pm GMT+7

Duc Giang Chemical stock comes under heavy selling pressure as bottom-fishing shares return

DGC shares of Duc Giang Chemical Group JSC (DGC) closed Tuesday at VND71,600 apiece, down 4% from Monday which saw a 6.27% increase after four sessions of sharp declines last week.

Companies - Tue, December 23, 2025 | 9:49 pm GMT+7

Hanoi clears zoning for major mall project after Aeon exit, Thaco arm steps in

Hanoi authorities have approved a detailed zoning plan for an 8.03-hectare mixed-use site in Hoang Mai district, paving the way for a shopping mall-led development after Japan’s Aeon withdrew and a unit of Vietnam’s Thaco Group moved in.

Real Estate - Tue, December 23, 2025 | 5:05 pm GMT+7

Viettel Commerce partners with China’s Dreame Technology to expand home appliance ecosystem in Vietnam

Viettel Commerce and Import-Export Co. Ltd., one of the core pillars in trade and logistics of the military-run telecom giant Viettel, has signed a strategic cooperation agreement with China-based Dreame Technology, a global high-end technology brand, in Hanoi.

Companies - Tue, December 23, 2025 | 3:38 pm GMT+7

Former LPBank chairman becomes acting Sacombank CEO

Former chairman of Vietnamese private lender LPBank Nguyen Duc Thuy on Tuesday assumed the role of acting CEO at Sacombank, immediately after completing the handover at LPBank.

Banking - Tue, December 23, 2025 | 3:30 pm GMT+7

Workforce shortages accelerate global demand for integrated facility management

Labor shortages and rising expectations for operational performance are prompting many businesses to reassess traditional management models, write Savills Vietnam analysts.

Consulting - Tue, December 23, 2025 | 3:00 pm GMT+7

Property broker Cen Land shares stabilize after ‘Shark Hung’ responds to online rumors

Shares of Cen Land (HoSE: CRE), a major Vietnamese real estate brokerage, stabilized on Tuesday morning after vice chairman Pham Thanh Hung, widely known as “Shark Hung”, spoke out to deny online rumors following a sharp sell-off in the stock on Monday.

Companies - Tue, December 23, 2025 | 11:59 am GMT+7

Party Central Committee’s 15th plenum wraps up

The 15th plenum of the 13th Party Central Committee concluded on Tuesday morning after two days of intensive working, completing all agenda items with a high degree of consensus and quality.

Politics - Tue, December 23, 2025 | 11:50 am GMT+7

Steel giant Hoa Sen sets up subsidiary in northern Vietnam

Hoa Sen Group (HoSE: HSG), one of Vietnam’s largest steel producers, has disclosed a board resolution approving the establishment of Hoa Sen Hai Phong One Member Limited Liabilities Company (HSHP), a wholly-owned subsidiary with charter capital of VND300 billion ($11.39 million).

Companies - Tue, December 23, 2025 | 11:31 am GMT+7