Plunge in Vietnam’s exports bottoms out

VinaCapital’s chief economist Michael Kokalari notes that Vietnam’s exports are set to recover in this year’s fourth quarter, driven primarily by a bottoming out of the U.S. inventory cycle. This rebound is likely to help lift Vietnam’s GDP.

In 2023, the biggest drag on Vietnam’s GDP growth has been a plunge in the demand for “Made in Vietnam” products. This year, Vietnam has suffered its longest streak of falling exports in more than a decade, with the country’s manufacturing output shrinking by 1% in this year’s first seven months since most products manufactured in Vietnam are sold abroad.

However, there are concrete signs that Vietnam’s exports, which dropped 10% year-on-year in the first seven months, are set to recover in Q4, driven by a bottoming out of the U.S. inventory cycle and by acceleration in multinational firms’ movement of manufacturing from China to Vietnam.

We expect a full recovery in Vietnam’s exports and manufacturing activity next year (back to 8-9% growth for manufacturing), which will in-turn drive a recovery in the country’s GDP growth from below 5% in 2023 to 6.5% in 2024 (recent government measures to support the country’s economy, including policy rate cuts, will also support Vietnam’s economic growth next year).

Finally, the export-driven recovery in Vietnam’s economy should help propel an increase in the earnings growth of the VN-Index from 6% in 2023 to over 20% in 2024, which should support the benchmark index in the months ahead.

The U.S. inventory cycle is bottoming out

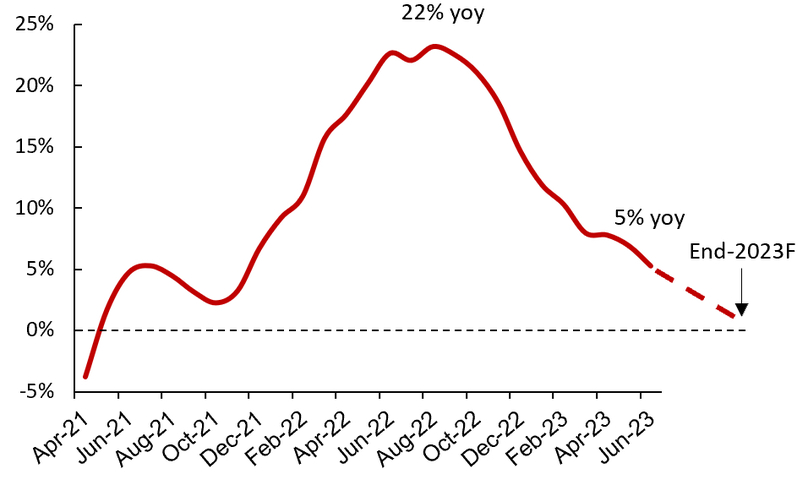

The U.S. is Vietnam’s biggest export market, accounting for about one-quarter of Vietnam’s total exports. But U.S. retailers and other consumer products companies bought too many Made in Vietnam/Made in Asia products last year in anticipation of a post-Covid re-opening boom that never came. Instead of buying more manufactured products when Covid lockdowns lifted, U.S. consumers splashed out on services like travel and going out to eat. To make matters worse, companies had “over ordered” products from factories in Asia in response to supply-chain issues and shortages, so the net result was that the inventories of companies like Walmart, Target, and Nike ballooned by over 20% year-on-year in late-2022, as can be seen below.

U.S. retailer inventories (% year-on-year).

U.S. retailers slashed orders at factories in Vietnam this year in response to their bloated inventories, which explains why Vietnam’s exports to the U.S. fell by more than 20% year-on-year in the first seven months after having surged by more than 20% in the same period last year. However, U.S. firms have been aggressively de-stocking throughout 2023 according to both the ISM and S&P Global PMI (the ISM’s Inventory Sub-Index hit a nine-year low in June and bounced slightly in July, suggesting that the rate of inventory depletion has hit bottom).

U.S. retail inventories are still up around 5% year-on-year, as can be seen above, but inventories of “Made in Vietnam” products like home electronics and garments are probably flat year-on-year according to our estimates. Last week, both Walmart and Target announced that their inventories are now down substantially year-on-year following aggressive efforts to reduce inventories throughout 2023.

All of this links closely with Vietnam’s export figures. The aggressive inventory reduction efforts of firms like Walmart and others drove the plunge in Vietnam’s exports in H1, but that destocking is now approaching its conclusion, and Vietnam’s exports to the U.S. increased by nearly 7% month-on-month in July. Consequently, the year-on-year decline in Vietnam’s exports to the U.S. improved from a 26% year-on-year drop in June to a 14% year-on-year decline in July, which helped reduce the fall in Vietnam’s total exports from 12% year-on-year in H1/2023 to 2% year-on-year in July.

Finally, in addition to a cyclical recovery in exports to the U.S., Vietnam is also benefitting from companies moving their production from China to Vietnam, which helps explain why Vietnam’s exports fell 2% year-on-year in July versus a 15% year-on-year drop in mainland China, a 16% drop in South Korea, and a 10% decline in Taiwan. All Asian exporters should be benefitting to some degree from a de-stocking-driven export recovery, but Vietnam is the only country in Asia that is also significantly benefitting from the establishment of new factories in the country. This is the fact that FDI inflows to China hit a record low in Q2.

Sustainable export rebound

We are confident that the improvement in Vietnam’s exports will accelerate as 2023 progresses based on several reliable leading indicators, including: 1) Vietnam’s import growth finally caught up to export growth on a sequential basis in July, after having lagged significantly for much of 2023 (see below), 2) the ongoing decline in export orders for Vietnam’s factories finally eased in July, and 3) firms’ inventories of raw materials increased in July for the first time since late-2022.

Vietnam’s imports have been falling faster than exports throughout 2023 (for example, exports surged 5% month-on-month in June, but imports only grew 1% month-on-month), so Vietnam’s trade surplus swelled from 0% of GDP in last year’s first seven months to 6% of GDP in this year’s same period – despite weaker demand for “Made in Vietnam” products. In the first 7 months of this year, Vietnam’s imports fell by 17%, versus the above-mentioned 10% drop in exports, because FDI firms – which account for the vast majority of imports – slashed their imports of production materials in response to their weak order books.

However, FDI firms now appear to be getting ready to ramp up their production in the lead-up to the Christmas holiday season, evidenced by the fact firms’ inventories of raw material inputs increased for the first time since late-2022, according to S&P Global, and that Vietnam’s imports and exports both grew 2% month-on-month in July.

Furthermore, the decline in firms’ export orders moderated significantly last month and factory output grew 4% month-on-month in July, both of which helped push Vietnam’s PMI up from 46.2 in June to 48.7 in July. We believe firms are ramping up their imports/purchases of raw materials in anticipation of a resurgence of factory orders later this year.

Export recovery driven by consumer electronics, followed by smartphones & garments

Over one-half of Vietnam’s exports to the U.S. are of high-tech products (i.e., consumer electronics, smartphones), and of garments and footwear, with a range of other products such as furniture and agriculture accounting for the rest

Earlier this year, global sales of personal computers were falling by more than 30% year-on-year (Vietnam’s exports of high-tech products fell by more than 10% year-on-year in the first half), but the decline in PC and consumer electronics sales has now ended according to senior Walmart executives, who noted a “modest improvement” in consumer electronics sales recently.

Consequently, Vietnam’s exports of such items surged from a 3% year-on-year decline in June to a 28% year-on-year increase in the month of July, making it the single biggest contributor to the rebound in Vietnam exports last month, and helping propel Vietnam’s exports to above $30 billion for the first time this year.

A Samsung manufacturing plant in Bac Ninh province near Hanoi, northern Vietnam. Photo courtesy of Samsung.

Next, Vietnam is the world’s second biggest smartphone exporter, so new product launches can have a major impact on exports and manufacturing activity (Samsung alone accounts for a quarter of the country’s total exports). Samsung recently announced that although its smartphone sales fell 12% year-on-year in Q2 (in line with a global drop in smartphone sales this year), it expects a rebound in H2 driven by the introduction of new phone models, especially of foldable phones.

Apple and Google also have major project launches scheduled, and although those new phones will not be made in Vietnam, many of the components used to make those new phones will be manufactured in Vietnam by Foxconn, Luxshare, Goertek, and other suppliers.

Finally, garments & footwear account for nearly 20% of Vietnam’s exports and exports of those products to the U.S. are unlikely to rebound until next year because the progress of retailers in the US destocking such products has been much slower than the progress in running down inventories of consumer electronics products.

However, garment exports to Korea and Japan soared by about 30% month-on-month in July as demand for clothing rebounded in both countries, according to local consumer sentiment surveys.

Summary

The biggest drag on Vietnam’s GDP growth this year has been a plunge in the demand for “Made in Vietnam” products, which weighed heavily on the country’s manufacturing sector this year. We see concrete signs that Vietnam’s exports are set to recover in Q4, driven primarily by a bottoming out of the US inventory cycle, but also by acceleration in the relocation of manufacturing from China to Vietnam.

This rebound is likely to help lift Vietnam’s GDP growth from below 5% in 2023 to 6.5% in 2024, which in-turn should help propel an increase in the earnings growth of the VN-Index from 6% in 2023 to over 20% in 2024, which should support the index in the months ahead.

- Read More

Impact of rising exchange rates in Vietnam

Mirae Asset Securities analysts offer an insight into the impact of rising exchange rates on companies in Vietnam in a report dated November 21.

Economy - Tue, November 25, 2025 | 1:35 pm GMT+7

Vietnam's industrial park developers post strong earnings as tenant demand rebounds

Vietnam’s industrial real estate sector is showing stronger earnings and improving demand, with foreign tenants resuming lease negotiations after U.S. tariff policies became clearer, according to a brokerage report.

Industrial real estate - Tue, November 25, 2025 | 11:07 am GMT+7

Vietnamese export stocks under the radar despite strong earnings

Investor caution over tariff risks and the slowdown of major economies has prevented Vietnamese export stocks from making a strong price recovery.

Finance - Tue, November 25, 2025 | 8:44 am GMT+7

Indonesia plans 7 initial waste-to-energy plants next year

Indonesia will start the construction of seven waste-to-energy power plants in 2026 as the first step to develop 33 such facilities by 2029.

Southeast Asia - Mon, November 24, 2025 | 9:23 pm GMT+7

Malaysia predicted to be ASEAN’s second-fastest-growing economy, after Vietnam

Malaysia is poised to become the second-fastest-growing economy in the Association of Southeast Asian Nations (ASEAN) after Vietnam, data showed.

Southeast Asia - Mon, November 24, 2025 | 9:19 pm GMT+7

Thailand SCG-backed Bien Hoa Packaging plans delisting from HCMC bourse

Bien Hoa Packaging JSC, a 57-year-old manufacturer in Vietnam, plans to scrap its public-company status and delist from the Ho Chi Minh Stock Exchange (HoSE) as its free float fell below the minimum threshold under local securities law.

Companies - Mon, November 24, 2025 | 9:06 pm GMT+7

Real estate, industrials sectors lead in October M&A value in Vietnam

Grant Thornton analysts provide an insight to capital flows, the sectors attracting investor attention, and the market dynamics influencing the merger and acquisition (M&A) landscape in Vietnam in October.

Economy - Mon, November 24, 2025 | 4:39 pm GMT+7

Tobacco giant Vinataba to sell entire stake in instant noodle maker Colusa-Miliket

State-owned Vietnam National Tobacco Corporation (Vinataba) plans to divest its entire 20% stake in Colusa-Miliket, the company behind the iconic “Miliket” (two-shrimp) instant noodle brand, seeking to raise at least VND114 billion ($4.32 million).

Companies - Mon, November 24, 2025 | 4:10 pm GMT+7

VinSpeed cannot participate in North-South high-speed rail project under PPP model: exec

Pham Nhat Vuong, founder of VinSpeed High-Speed Rail Investment and Development JSC, has mapped out a clear 30-year financing plan for the gigantic North-South high-speed rail project, said an executive at Vingroup, a VinSpeed investor.

Infrastructure - Mon, November 24, 2025 | 3:51 pm GMT+7

Delivery major Viettel Post plans $21 mln logistics center in central Vietnam

Viettel Post, the courier arm of military-run telecom giant Viettel, has completed a site survey for a planned 21-hectare logistics center in the central province of Ha Tinh, with an estimated investment of nearly VND550 billion ($20.87 million).

Industries - Mon, November 24, 2025 | 11:49 am GMT+7

Honda Mobilityland eyes 600-ha sports, entertainment, tourism complex in southern Vietnam

Honda Mobilityland Corporation, a subsidiary of Japan’s Honda Motor Co., plans to build an international circuit in Tay Ninh province, towards developing a 600-hectare sports, entertainment, and tourism complex there.

Industries - Mon, November 24, 2025 | 11:23 am GMT+7

State-controlled shipping line Vosco steps up coal trading to seek new revenue drive

Vietnam Ocean Shipping JSC (Vosco), controlled by the state-run Vietnam Maritime Corporation, is moving deeper into coal trading as the shipping line increasingly bids for large import contracts for thermal power plants, marking a push beyond its core maritime transport business.

Companies - Mon, November 24, 2025 | 8:36 am GMT+7

Vietnam SOEs need tailored mechanisms, greater autonomy to accelerate tech investment, innovation: execs

Vietnam's state-owned enterprises (SOEs) need flexible, tailored mechanisms to make rapid decisions, maintain a leading role, drive innovation, and boost competitiveness, said company executives.

Companies - Sun, November 23, 2025 | 8:16 pm GMT+7

Café Amazon retreats, Mixue scales down in Vietnam over intense competition

Vietnam’s food and beverage (F&B) sector is seeing a wave of closures and market exits as rising competition and shifting consumer preferences squeeze profit margins.

Economy - Sun, November 23, 2025 | 2:36 pm GMT+7

Vietnam Education Publishing House strengthens cooperation with Malaysia’s Pelangi Publishing Group

Vietnam Education Publishing House (VEPH) met with Malaysia’s Pelangi Publishing Group in mid November to expand professional exchange and explore deeper cooperation in educational publishing.

Companies - Sun, November 23, 2025 | 12:21 pm GMT+7

French energy giant plans $500 mln investment in green Vietnam projects

French green hydrogen infrastructure developer HDF Energy is looking to invest $500 million in potential energy and transport projects across Vietnam, particularly the southern economic hub of Ho Chi Minh City.

Energy - Sun, November 23, 2025 | 11:29 am GMT+7

- Travel

-

Impressive Standard Chartered Hanoi Marathon Heritage Race 2025

-

Nguyen Hong Hai wins 'Investors' golden heart' golf tournament 2025

-

140 players compete at “Investors’ golden heart” golf tournament

-

‘Investors’ golden heart’ golf tournament to tee off on Saturday

-

Vietnam, Hong Kong Aircraft Engineering sign deal on aircraft maintenance hub at northern airport

-

Sun Group gets nod for $375 mln inland waterway tourism project in central Vietnam