Vietnam’s policy rate cuts are boosting stock prices

VinaCapital’s chief economist Michael Kokalari highlights that the Vietnamese stock market is bouncing back due to more money coming in, with a sharp pick-up in earnings growth expected in 2024.

The State Bank of Vietnam (SBV) has cut policy interest rates four times this year, by 150 basis points to 4.5% for the refinancing rate, which stands in stark contrast to the US Federal Reserve, which has hiked US interest rates four times in 2023, by 100 bps to 5.5%.

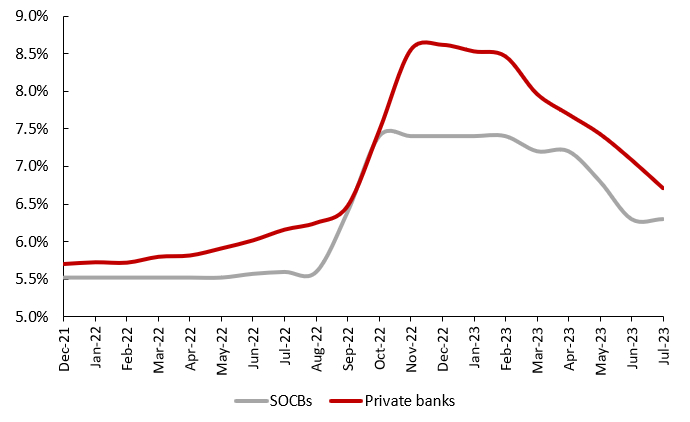

The SBV cut rates and took other measures in an effort to boost the country’s GDP growth, which plunged from 6.4% year-on-year in the first half of 2022 to just 3.7% in H1/2023. These policy rate cuts prompted local commercial banks to lower their deposit and lending rates (deposit rates are down about 150 bps year to date), which helped boost the VN-Index by over 20% year to date as of August 8.

Average 12-month deposit rates in Vietnam

We expect a sharp recovery in both GDP growth and earnings growth next year to propel stock prices even higher. That said, we do not expect the SBV’s monetary easing will have much of an impact on 2023 GDP growth because banks are currently hesitant to extend loans, which is discussed below, and because higher interest rates are not the main source of Vietnam’s slow economy this year.

This year’s economic slowdown has been largely driven by a collapse in demand for “Made in Vietnam” products, which in-turn depressed manufacturing activity (slower manufacturing accounts for most of the near 3 percentage points drop in H1 GDP growth mentioned above).

In addition, we estimate that household consumption in Vietnam, which typically grows at an 8-9% pace on an inflation-adjusted basis, is currently growing at only a circa 2-3% rate. Consumers’ concerns about Vietnam’s “frozen” real estate market and other issues depressed consumption growth, although overall consumption growth in Vietnam is being supported by a resumption of foreign tourist arrivals, which have reached nearly 70% of pre-Covid levels.

Stock prices supported by rate cuts

The SBV hiked policy interest rates twice late last year by 200 bps to support the value of the Vietnam dong. To be clear, the Fed aggressively hiked rates to tame inflation in the U.S., and those rate hikes drove a surge in the U.S. Dollar/DXY Index by nearly 20% in late 2022. In contrast, inflation in Vietnam averaged 3% last year, so the SBV’s rate hikes were specifically aimed at maintaining a stable USD/VND exchange rate.

The SBV’s rate hikes prompted local commercial banks to lift their 6-12-month deposit rates by as much as 250 bps year to date in late 2022, which was unfortunate timing because deposit rates were already being driven higher at that time by some issues in Vietnam’s corporate bond market and banking sector, and in response to tight liquidity in the banking system.

Further to that last point, credit growth in Vietnam outstripped deposit growth by about 3% percentage points a year on average over 2020-2022, pushing most banks’ loan-to-deposit ratios up to uncomfortably high levels, which in-turn prompted banks to pay higher interest rates to attract deposits.

One of the reasons that the VN-Index fell by 33% in 2022 (or 35% in USD terms) is because the very attractive levels of bank deposit rates encouraged savers to sell stocks and deposit the proceeds into banks. In late 2022, it was possible to earn double digit deposit rates for 1-year deposits at some reputable banks, although many savers opted for 6-month deposits with slightly lower rates. One of the reasons that the VN-Index is up more than 20% so far this year is because those 6-month deposits are now maturing, and interest rates have dropped, so savers are reallocating the money back into the stock market.

Finally, we mentioned Vietnam’s disappointing H1 GDP growth. We expect some improvement in H2 given various pro-growth policies by the government, including rate cuts, but also because we believe the worst for Vietnam’s economic slowdown has passed since exports and manufacturing have bottomed out.

Furthermore, we expect earnings growth in Vietnam to surge from 6% year-on year in 2023 to over 20% in 2024, so the current VN-Index market recovery, which was initially driven by lower interest rates, should be sustained by higher earnings next year.

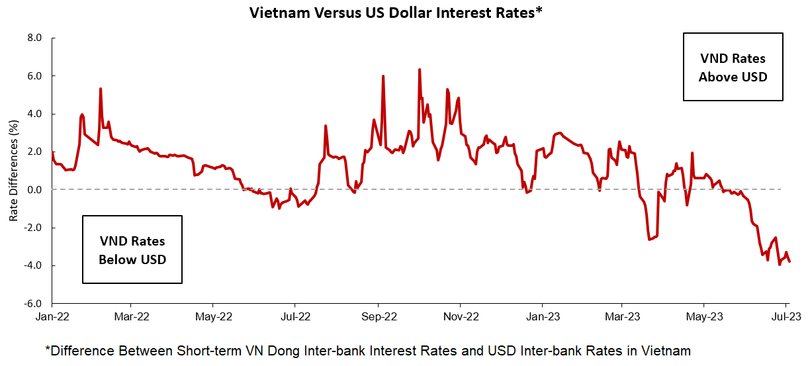

Vietnam’s trade surplus enabled rate cuts

In 2022, the U.S. Fed hiked rates by 425 bps, prompting the SBV to hike policy rates by 200 bps to defend the USD-VND exchange rate. The SBV aimed to keep short-term interbank rates in Vietnam about 200 bps above short-term USD rates at that time, and the strategy worked, as evidenced by the fact that the VN dong only depreciated by just over 3% last year, versus 4-9% depreciations for Vietnam’s regional emerging market (EM) peers.

This year, Vietnam’s government shifted to reprioritizing growth in light of the above-mentioned plunge in H1 GDP growth, resulting in Vietnam being one of the first countries in the world to cut policy rates. Furthermore, the SBV has cut rates despite the fact that the Fed is still hiking rates - and could hike rates again in September, so short-term VND interbank rates plunged to around 400 bps below USD rates, which is a record-high gap, and can be seen in the chart below.

Despite the large interest rate differential between the Vietnam dong rates and U.S. interbank rates, the value of the Vietnam dong has depreciated by less than 1% year to date, which is because the VND is being supported by a surprising surge in Vietnam’s trade surplus, from 0% of GDP in the first seven months of 2022 to 6% of GDP in the first seven months of 2023.

This surplus, coupled with FDI inflows of over 4% of GDP in the first seven months of 2023, helped support the value of the Vietnam dong, enabling the SBV to cut interest rates while maintaining a remarkably stable USD/VND exchange rate.

Impact of lower rates on stock & real estate markets

We mentioned above that the VN-Index is up more than 20% in the year to date, partly because savers have been taking money out of the bank and plowing it into the stock market as their 6-month deposits mature and because the market was oversold last year.

The increase has been driven by a 30% year-to-date surge in bank share prices and a 20% year-to-date increase in the prices of real estate stocks. The heavy weighting of these sectors in the VN-Index (at 35% and 18% respectively) means that the increase in the share prices of both sectors drove over two-thirds of the year-to-date increase in the VN-Index.

The improvement in sentiment towards bank share prices stems from investors’ reduced concerns about asset quality issues and expectations for higher credit growth in H2, prompted by lower interest rates. But it is important to note that declines in lending rates by banks are not uniform, especially given the liquidity issues mentioned above, which are particularly acute at some smaller banks.

Lower interest rates boosted sentiment in the real estate market, where transactions are starting to pick up again, partly because mortgage rates dropped more than 50 bps at many banks over the last month. We expect another 50-100bps decline in mortgage rates over the next 6-12 months and note that the improved sentiment in the real estate market has, not surprisingly, boosted the sentiment towards major real estate stocks as well as towards the beneficiaries of higher real estate development activity (i.e., construction companies, steel companies, etc.).

Conclusions

The 20% surge in the VN-Index this year has been largely driven by a circa 150bps fall in banks deposit rates. In short, savers have been taking the proceeds of their maturing 6-month deposits and putting that money into the stock market. Lower interest rates have helped improve sentiment and transaction activity in the real estate market and have led to an expectation for higher credit growth in H2.

The aggressive policy rate cuts in Vietnam come at a time when the U.S. and the EU are still raising interest rates. A widening gap between interest rates in Vietnam and in the U.S. has put some depreciation pressure on the USD/VND exchange rate, but that depreciation pressure has been mitigated by a stunning improvement in Vietnam’s trade surplus from 0% of GDP in 2022 to 6% in 2023.

Finally, we expect a sharp pick-up in earnings growth in 2024, which means that the VN-Index market recovery, which has been driven by lower interest rates in 2023, will likely be sustained by higher earnings in 2023, as well as by the market’s current, attractive level of valuation.

The VN-Index’s fiscal year 2023 P/E (price-to-earnings) ratio is currently 30% below its average over the last five years, and more than 10% below the P/E valuation of Vietnam’s regional peers.

- Read More

Vietnam's major food maker Kido delays 2024 dividend payout due to economic headwinds

Kido Group has postponed its planned cash dividend payment for 2024, citing persistent economic difficulties and the need to preserve cash flow for operations in late 2025 and early 2026.

Companies - Tue, December 23, 2025 | 8:00 am GMT+7

Petrovietnam chairman Le Manh Hung appointed acting Industry and Trade Minister

Prime Minister Pham Minh Chinh has appointed Le Manh Hung, chairman of the council of members at state-owned Petrovietnam (PVN), as acting Minister of Industry and Trade.

Economy - Mon, December 22, 2025 | 9:55 pm GMT+7

Vietnam's top non-life insurer PVI surpasses $1 bln in revenue

PVI Insurance, a leading non-life insurer in Vietnam, has surpassed $1 billion in revenue, becoming the first non-life insurance company in the country to reach this revenue scale.

Companies - Mon, December 22, 2025 | 7:30 pm GMT+7

JC&C completes sale of 4.6% Vinamilk stake to F&N for $228 mln

Singapore-listed Jardine Cycle & Carriage Limited (JC&C) has reportedly completed the sale of more than 96 million shares, equivalent to a 4.6% stake, in Vietnam’s dairy giant Vinamilk (HoSE: VNM).

Companies - Mon, December 22, 2025 | 6:50 pm GMT+7

Shares linked to ‘Shark Hung’ slide despite market rallies

Shares of Cen Land (HoSE: CRE), a major Vietnamese real estate brokerage linked to businessman Pham Thanh Hung, fell sharply on Monday, bucking a broad market rally that lifted the benchmark VN-Index to a fresh high.

Companies - Mon, December 22, 2025 | 4:17 pm GMT+7

Intel urged to expand chip packaging, testing operations in Vietnam

Vietnam has urged Intel to step up investment in semiconductor packaging and testing operations in the country, as Hanoi accelerates efforts to build a domestic chip ecosystem aligned with global supply chains.

Investing - Mon, December 22, 2025 | 3:37 pm GMT+7

Korean energy giant LS intends to inject $19.3 mln into Vietnam rare earth business

LS Eco Energy, a subsidiary of South Korea’s cable and energy giant LS Cable & System, has decided to invest KRW28.5 billion ($19.26 million) in advancing its rare earth metals business in Vietnam.

Industries - Mon, December 22, 2025 | 3:11 pm GMT+7

Vietnam's Petrosetco estimates 2025 net profit rises 46% to over $12 mln

PetroVietnam General Services Corporation (Petrosetco) expects its net profit to reach VD322 billion ($12.23 million) in 2025, up 46% year-on-year and exceeding the company's full-year target by 32%.

Companies - Mon, December 22, 2025 | 11:50 am GMT+7

Vietnam's 13th Party Central Committee convenes 15th meeting

The 15th meeting of Vietnam's 13th Party Central Committee opened in Hanoi on Monday.

Politics - Mon, December 22, 2025 | 11:13 am GMT+7

Duc Giang Chemical chairman’s family loses $129 mln in a week as shares plunge

Shares of Vietnam’s Duc Giang Chemical Group JSC (DGC) fell sharply last week (December 15-19), wiping nearly VND3.4 trillion ($129.2 million) off the stock-based wealth of the family of chairman Dao Huu Huyen.

Companies - Mon, December 22, 2025 | 6:58 am GMT+7

Vietnam launches International Financial Center, pledges 'special process' to resolve investor hurdles

Vietnam on Sunday announced the establishment of its International Financial Center (IFC), with Prime Minister Pham Minh Chinh pledging to fast-track the resolution of investor difficulties through a “special process”.

Economy - Sun, December 21, 2025 | 9:18 pm GMT+7

The new target for VN-Index is 3,200: Finnish fund PYN Elite

The earnings growth of listed companies in Vietnam will continue to support equity prices in 2026. According to the consensus forecast, a market P/E of 10.0 for 2026 looks very attractive, writes Petri Deryng, portfolio manager at Finnish fund PYN Elite.

Consulting - Sun, December 21, 2025 | 6:33 pm GMT+7

Mastering AI key to Vietnam’s leap beyond middle-income trap: FPT chairman

Mastering and innovating technology is no longer optional but the sole path for Vietnam to escape the middle-income trap and rise alongside global powers, said tech giant FPT Corporation chairman Truong Gia Binh.

Economy - Sun, December 21, 2025 | 2:33 pm GMT+7

Vietnam among world’s top 15 countries by im-export value: ministry

Vietnam’s import-export turnover is expected to reach $920 billion for the first time in 2025, placing the country among the world’s top 15 by trade value, according to the Ministry of Industry and Trade (MoIT).

Economy - Sun, December 21, 2025 | 11:07 am GMT+7

Dung Quat oil refinery operator BSR targets 187% net profit growth in 2026

Binh Son Refining and Petrochemical JSC (HoSE: BSR), operator of Dung Quat - Vietnam’s first oil refinery, expects net profit to surge in 2026, supported by stable oil price assumptions and a major investment plan to expand and upgrade its core refining assets.

Companies - Sun, December 21, 2025 | 8:00 am GMT+7

Dragon Capital-managed VEIL plans trio of 10% tender offers

Vietnam Enterprise Investments Limited (VEIL), the largest foreign-managed equity fund in Vietnam, has announced a tender offer for up to 10% of its issued share capital, with the option to conduct up to two additional tenders over the next year.

Finance - Sat, December 20, 2025 | 11:19 pm GMT+7

- Travel

-

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

-

Vietnam defeat Thailand to win men’s football gold at SEA Games 33

-

Which beach in Vietnam boasts the Pantone - 'color of the year 2026'?

-

Unprecedented national milestone in 65 years: Vietnam welcomes 20 millionth international visitor

-

Techcombank HCMC International Marathon affirms global standing

-

Vietnam's tour operator Vietravel announces full exit from Vietravel Airlines