Techcombank turns 30, fetes sustained entrepreneurial spirit and constant renewal

Techcombank has always done things a bit differently, with more daring, says CEO Jens Lottner as he reflects on the Vietnamese bank’s 30-year journey and the future it envisions.

Congratulations on Techcombank's 30-year milestone. What are the salient features of this journey?

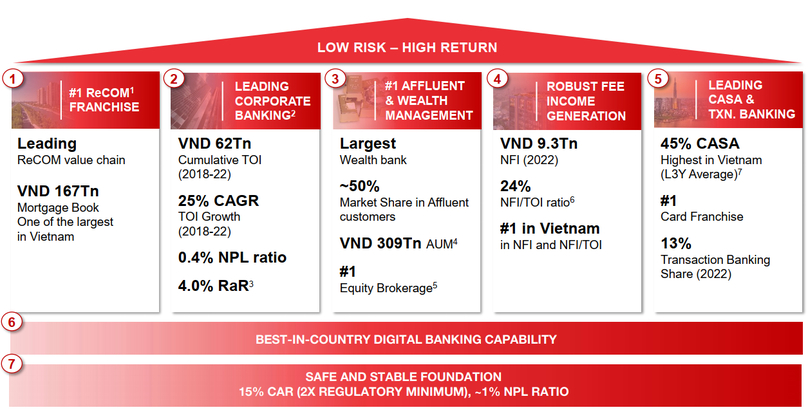

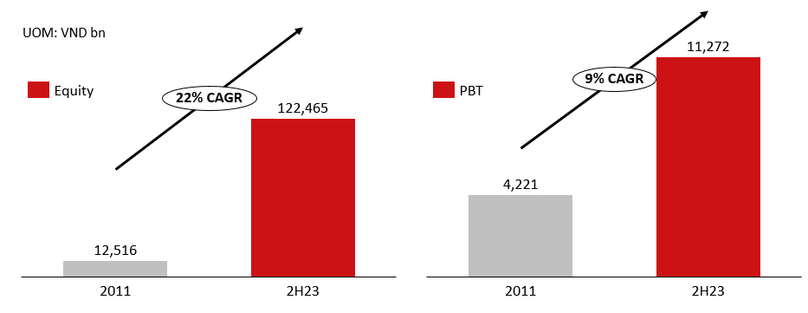

Founded with a capital of VND20 billion ($820,000), Techcombank was a very small operation, but with a very strong entrepreneurial spirit to serve Vietnam's growing private sector. Through the years, starting from $1 million, the bank has grown to around $5.3 billion in capital - one of the highest capitalized banks in the country.

What has remained consistent from the very beginning is Techcombank’s entrepreneurial spirit and culture. As Vietnam’s economy grew and became more dynamic, Techcombank was a pioneer spearheading its development.

The founding fathers of the bank came from very strong engineering backgrounds and were not traditional bankers. Therefore, as an institution, Techcombank has always used technology as an enabler and has always done things a bit differently compared to other banks.

Looking back, I think that while we are now very different as a leading bank from how we were at the start - much bigger, much stronger and definitely much more profitable - some of the core elements of technology and entrepreneurship have continued.

What were some of the most significant challenges the bank has encountered in its 30-year journey?

Around 2011 and 2013, the whole industry was quite challenged. Techcombank was probably the first to come out of that crisis, having cleaned up our credit book and being very strong on the capital side. It was a very formative experience for what you are seeing right now, and we have strong risk management capabilities and are well-capitalized as a result.

As a private bank, we are not the largest one in the country. Therefore, we need to do things a bit more daring and to break the mold on a constant basis. Whenever we think we are done, it's actually just the beginning for something new. If you worked with us, you would see that we are never content, always on the move and always trying to do something differently to meet the rapidly changing banking needs of customers as the country, the sector and people’s living standards evolve. In a way, that poses a never-ending challenge, as movement needs to be managed. But ultimately, it's part of our DNA and one of our biggest strengths.

You took over as CEO in 2020, at the onset of the pandemic and subsequent economic crisis. As you approach your fourth year with Techcombank, what do you regard as your most notable achievements?

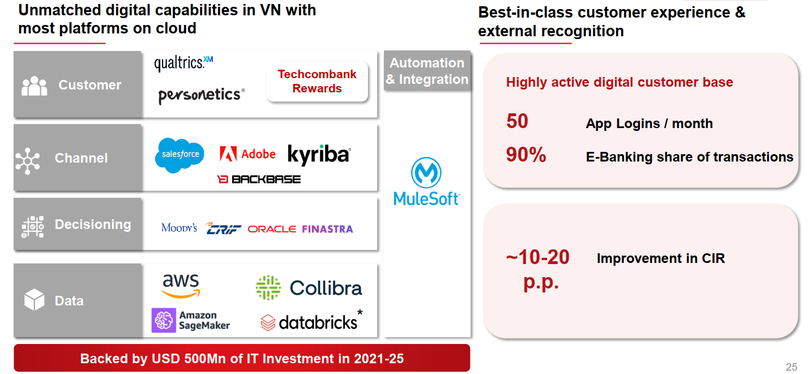

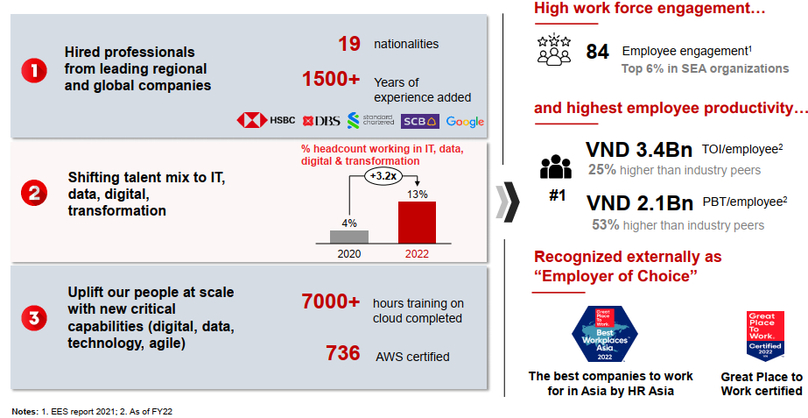

I would say one of the achievements which we accelerated over the last three years is our digital transformation. A lot of investments were made to transform the bank and its capabilities. At the same time, our customer growth has accelerated. Our aspiration is not just to be one of the largest private banks, but to shape the transformation of Vietnam’s banking industry and also become a leading bank in the region. To achieve this, we need a different technology platform and to transform into an even more digitally-enabled bank, focusing on talent, data and technology.

The bank just inaugurated two striking office buildings in Hanoi and Ho Chi Minh City. Please tell us about it.

While the buildings are very beautiful from the outside, we put in a lot of work from the inside. The aim was to create a different work experience for our employees. We tried to answer these questions: “For the workforce of the future, what is required? What do people like? What are they expecting?” For a lot of people, employment is not just about money but also the environment they work in. We put ourselves in their shoes and asked: “If we were in Silicon Valley, Singapore or London and decided to come back to Vietnam, what kind of atmosphere would we expect to find?”

Then, we gave the job to Fosters and Partners – one of the world's most renowned architecture firms who built the Apple headquarters in Cupertino. And the spectacular buildings you see now are the result.

Specifically, the headquarters in Hanoi was designed with a mindset to achieve a fusion of the old and the new, with some of the elements inspired by the city's Old Quarter. On the outside, there's a lot of brown and gold, and on the inside, you come across wooden doors and gold framing. These are typical colors and features of the Old Quarter. In particular, there is a break between the sixth floor and everything above, with the height of the sixth floor measuring the Old Quarter's usual height. On top, everything has a distinct style, building upon the foundation of the old and incorporating new elements.

As we put a lot of thought into the architectural design, it carries the message we want to convey. It's important for us to be, on the one hand, a Vietnamese bank inheriting Vietnamese cultural values, but on the other, breaking through and doing something new and innovative. These buildings are very much about customer centricity, innovation and collaboration, with all the working spaces built to accommodate agile ways of working. Our employees don't have a special seating place - they can actually work on every single floor and on every single table. In meetings, we can easily reconfigure our staff and bring people together for new teams during breakouts. And while these buildings are a lot about digital enablement and digital tools they are also built with a focus on sustainability and energy efficiency, making sure that we don't waste resources, rather make the most of them.

At the 2023 annual general meeting (AGM), Techcombank mentioned a heightened emphasis on the retail segment and reducing dependence on corporate clients. Has there been any deviation from this approach?

We are still very clear that we want to do more retail and SME lending and that we don't want to expand our corporate exposure as a proportion of the total bank-wide book. However, as we operate a need-based model and a customer-centricity approach, this may not hold in certain periods. For example, based on our quarterly analysis, we watch what is happening in the market right now. Within the retail segment, credit demand has been soft due to higher interest rates. In addition, when we looked at SMEs, manufacturing and some other areas, there was not a lot of demand for credit. Even if we had given away money at much lower rates, these companies would not have taken it.

In this environment, the big companies and corporates are usually the ones who fare better, because they have much more diversified cash flow streams. So, as we were looking to where the needs are and where the risk-adjusted returns were better, it was on the corporate side.

That being said, it doesn't mean we won't reallocate funds back into retail and focus on SMEs, which is actually our desired direction. When you examine our financial data, you'll notice that some figures, particularly on the corporate side, represent short-term working capital financing. This flexibility allows us to transition relatively quickly to other segments and sectors. So, I believe our strategy remains intact – our primary focus is still on retail. However, in the current circumstances, we might continue to emphasize corporate lending because it appears to be less risky. As the market evolves, we will gradually shift our focus back to retail and SMEs. This is rather a timing issue than a strategy issue.

Also at the 2023 AGM, the chairman of Techcombank revealed that this year might mark the conclusion of Techcombank's 10-year practice of not distributing cash dividends. Does a "dividend gift" await shareholders in celebration of the 30th anniversary?

The chairman’s directive 10 years ago was to not pay dividends for 10 years, so now is the time to revisit that. In essence, we always look at the optimization of capital and one of the key areas is to maintain a 15% Capital Adequacy Ratio (CAR), in line with prudent banking practices. In addition, we want to make sure we can continue growing at a 20% earnings growth trajectory. To date, we have maintained this through our own retained earnings with no need to tap the markets for more capital.

When we issued the policy 10 years ago, we were in a very different position. After a decade of delivering strong results, Techcombank has grown to become the No.1 private sector bank in Vietnam with a strong retail banking focus and best-in-market digital banking capabilities. Today, the bank generates over VND20 trillion ($820.2 million) profits annually, the highest amongst private sector banks in Vietnam.

Now, as we look at the bank’s earnings potential and the changes in upcoming regulations, we believe that we can maintain that trajectory of 20% earnings growth and 15% CAR even while paying regular cash dividends to reward the bank’s shareholders. As we analyze whether we can maintain such a policy for the next five to 10 years, it's important to note that we make our decision from a capital management perspective and not just as a birthday gift.

If and when the board decides there will be a change in our dividend policy, I am sure they will make the proper announcements. As of now, it seems clear that we have options.

Sustainability is becoming an increasingly important factor in the banking and finance world. Can you elaborate on Techcombank's strategy regarding sustainability and responsible banking?

When it comes to sustainability, a lot of people interpret it only as green financing or keeping climate neutral. While these are important elements, for me, creating a sustainable business means building it with a solid foundation and making sure it can last through the natural boom-bust cycles of the economy. This principle runs deep in our core.

On the business side, we try to help our customers gain clarity on what and how they can build their own sustainable companies. With the help of organizations like USAID and the ADB, we work to provide financing solutions and are committed to providing around $5 billion in financing for sustainable projects. There's probably not enough demand in the industry right now, as people still consider sustainability something that’s "nice to have," but not a must. We are shifting away from that mentality gradually, and Techcombank has built in-house capabilities to channel green financing to our customers. However, there's still more work to be done.

Internally, within our daily operations, all the rooms in our new buildings are closely monitored electrically. We have installed significant sensoring technology in our offices to optimize our energy efficiency. If there's not enough movement, lights and air conditioners will be automatically turned down. If we can keep our costs down, we will be able to provide our products and services at a better price for our customers.

Personally, I think we should not think about sustainability as a “do-good" exercise. Rather, it needs to be integrated deeply with economic sense, and increasingly, people will start to understand and internalize that concept.

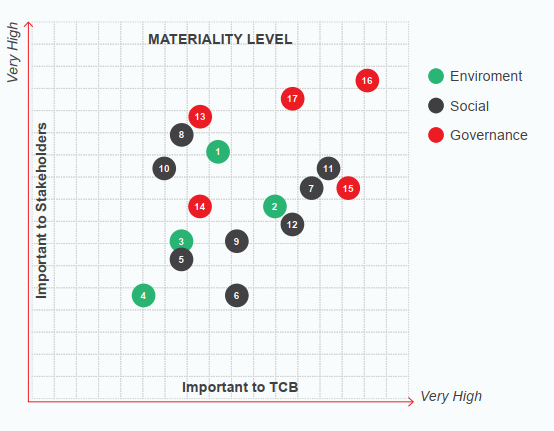

Comprehensive ESG materiality assessment conducted by Techcombank.

- Read More

Honda Vietnam expands biz registration to cover electric vehicles, charging, battery swapping

Honda Vietnam (HVN) has formally expanded its registered business lines to include electric vehicles, charging infrastructure, and battery-swapping services, marking its most comprehensive step into the electric mobility ecosystem to date.

Companies - Wed, December 17, 2025 | 5:16 pm GMT+7

Vietnam tech unicorn VNG merges two core units into AI-focused GreenNode brand

Vietnamese tech unicorn VNG (UPCoM: VNZ) has merged its cloud computing arm VNG Cloud with AI infrastructure unit GreenNode into the AI-focused GreenNode brand, marking a key step in the company’s “AI-first” strategy.

Companies - Wed, December 17, 2025 | 3:51 pm GMT+7

Becamex to inject $28 mln into VSIP Industrial Park joint venture

Becamex Group (HoSE: BCM) plans to inject an additional VND735 billion ($27.9 million) into the Vietnam-Singapore Industrial Park J.V. Co., Ltd (VSIP JV), as the leading Vietnamese developer steps up investment across its industrial property portfolio.

Companies - Wed, December 17, 2025 | 12:50 pm GMT+7

Vietnam M&A 2025: Opportunities reshaped by disciplined capital

Vietnam’s M&A activity through the first 10 months of 2025 shows a market steadily regaining balance after two volatile years, with dealmaking shaped by rising selectivity, clearer regulatory signals and the return of larger, higher-conviction transactions, write KPMG analysts.

Consulting - Wed, December 17, 2025 | 12:44 pm GMT+7

HCMC plans Cai Mep Ha free trade zone linked to deep-sea port complex

Ho Chi Minh City plans to develop the 3,800-hectare Cai Mep Ha Free Trade Zone (FTZ), linked to Vietnam’s largest deep-sea port complex, Cai Mep-Thi Vai, as it seeks to create a new engine of growth.

Economy - Wed, December 17, 2025 | 11:10 am GMT+7

Cash returns to Vietnamese stock market, but analysts urge caution

Vietnam’s stock market staged a sharp rebound on Tuesday, snapping a five-session losing streak as cash returned to the market, but analysts cautioned that short-term risks remain.

Finance - Wed, December 17, 2025 | 9:36 am GMT+7

'Passion fruit king' Nafoods expands fruit processing investment in central Vietnam

Nafoods Group, one of Vietnam’s largest passion fruit processors, has raised the total investment for its high-tech fruit processing complex in Gia Lai province to VND744 billion ($28.24 million).

Industries - Wed, December 17, 2025 | 8:56 am GMT+7

Japan's Igarashi Reizo builds $24 mln cold storage project in southern Vietnam

Igarashi Reizo, a more than 100-year-old Japanese company specializing in cold storage services, has broken ground for a cold and dry warehouse complex in Tay Ninh province.

Industries - Wed, December 17, 2025 | 8:00 am GMT+7

Which beach in Vietnam boasts the Pantone - 'color of the year 2026'?

As soon as the Pantone Color Institute unveiled “Cloud Dancer” as the Color of the Year 2026, travel lovers quickly made the connection to Kem Beach – the iconic beach in Phu Quoc famed for its rare, velvety-white sand, soft and distinctive in texture.

Travel - Tue, December 16, 2025 | 8:46 pm GMT+7

Unprecedented national milestone in 65 years: Vietnam welcomes 20 millionth international visitor

From 10 million international arrivals in 2016 to 20 million in 2025, Vietnam’s tourism sector has doubled in scale in less than a decade. This historic milestone, officially recorded in Phu Quoc, reflects the exceptional growth momentum and substantial development potential of Vietnam’s tourism industry in a new phase.

Travel - Tue, December 16, 2025 | 8:28 pm GMT+7

Vietnam charges businessman ‘Shark Binh’ with additional tax evasion offence

Vietnamese police have brought additional charges against Nguyen Hoa Binh, widely known as “Shark Binh”, accusing him of tax evasion linked to the operations of fintech firm Vimo Technology JSC, authorities said on Monday.

Society - Tue, December 16, 2025 | 4:33 pm GMT+7

Vietnam blockchain firm Hyra partners with AHT Tech to expand AI capabilities

Hyra Holdings, a Vietnam-based blockchain and artificial intelligence company, has entered a strategic partnership with technology services provider AHT Tech, aiming to scale its AI ecosystem while aligning operations with international security and compliance standards.

Companies - Tue, December 16, 2025 | 3:14 pm GMT+7

Vietnam’s first LNG power plants may incur $38 mln loss in 2026: broker

Vietnam’s first LNG-to-power plants, Nhon Trach 3 and Nhon Trach 4, are expected to post a combined loss of VND1 trillion ($37.98 million) in 2026, their first full year of commercial operations, predicted Vietcap Securities.

Energy - Tue, December 16, 2025 | 3:06 pm GMT+7

Many Vietnamese stocks are trading at deeply discounted valuations: brokerage exec

Nguyen Duy Hung, chairman of Vietnam’s leading brokerage SSI Securities, said many stocks on the local market are "trading at very low valuations", as recent gains in the benchmark index have been driven by only a handful of large-cap names.

Finance - Tue, December 16, 2025 | 2:53 pm GMT+7

FPT forms specialized board to build core capabilities with expansion into rail tech

Vietnam's leading technology corporation FPT (HoSE: FPT) has set up a strategic technology steering committee, underscoring its push to master core technologies including rail-related solutions, and build a high-quality talent base to support long-term competitiveness.

Companies - Tue, December 16, 2025 | 2:05 pm GMT+7

Hanoi approves $32.5 bln Red River scenic boulevard project

Hanoi has approved a massive urban redevelopment project along the Red River which would transform the city’s riverbanks into a new ecological, economic and cultural space, local authorities said.

Real Estate - Tue, December 16, 2025 | 9:00 am GMT+7

- Consulting

-

Vietnam M&A 2025: Opportunities reshaped by disciplined capital

-

VN-Index rises 3.1% in Nov, Finnish fund PYN Elite records -5.8%

-

Mind the gap

-

The generation game: Adapting to an aging population

-

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas

-

Powering growth from within