Top Singaporean firms earn high incomes in Vietnam

Singapore is the second-biggest foreign investor in Vietnam, with over $84 billion in registered investment capital as of end-January and many prominent investors raking in high incomes.

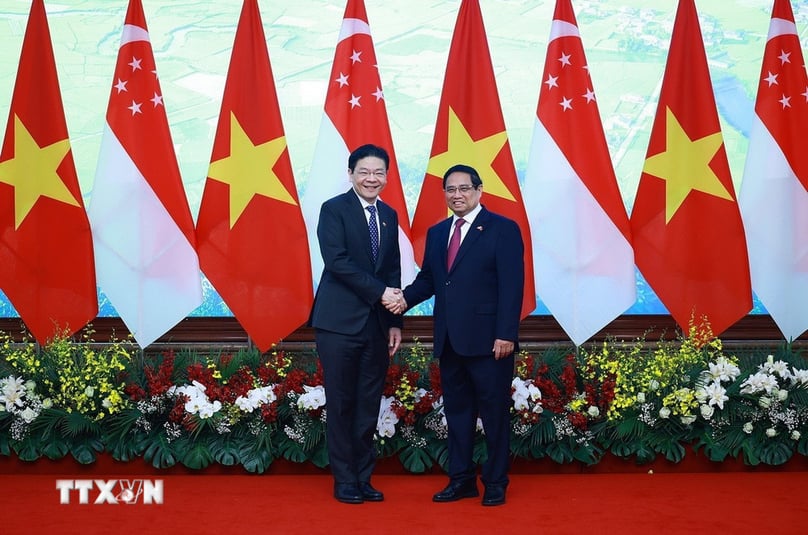

Vietnamese PM Pham Minh Chinh (right) and Singaporean PM Lawrence Wong at a meeting in Hanoi on March 26, 2025. Photo courtesy of Vietnam News Agency.

Jardine Cycle & Carriage

Jardine Cycle & Carriage (JC&C) reported a revenue of $22.3 billion in 2024 and the figure for the Vietnamese market was $103 million.

In Vietnam, JC&C holds a 26.6% stake in Vietnamese conglomerate Thaco, 10.6% in dairy giant Vinamilk, and 41.4% in Ho Chi Minh City-based utility firm Refrigeration Electrical Engineering Corporation (REE).

Regarding its operation in Vietnam last year, JC&C said it gained an income of $39 million from Thaco activities, thanks to the Vietnamese conglomerate's automobile sales going up 10%.

The income from REE fell due to unfavorable weather conditions leading to weaker performance of hydropower activities. JC&C gained dividends of $34 million from Vinamilk.

Fraser and Neave

Fraser and Neave (F&N), a Thai-Singaporean conglomerate in food, beverage, publishing, and printing, earned SGD21 million ($15.5 million) in Vietnam in the last quarter of 2024 (Q1 of fiscal year 2025).

According to F&N’s quarterly report, F&N recorded a profit before interest and tax (PBIT) of SGD91.1 million ($67.4 million) in the period, up 14% year-on-year. Vietnam accounted for 23% of the total, equivalent to SGD21 million.

F&N was originally a Singapore-based food & beverage giant. After a share swap deal in 2024 with Thailand’s giant ThaiBev, it became an entity associated with Thai billionaire Charoen Sirivadhanabhakdi.

F&N and its members now holds a 20% stake in Vietnamese dairy giant Vinamilk. F&N gained massive dividends from Vinamilk, totaling VND15 trillion ($585.6 million) since 2013.

Grab

In terms of revenue, Grab is now the biggest player in Vietnam's ride-hailing market with an income of VND4 trillion ($156.34 million) in 2023. While the firm has been recording massive losses in many years, 2023 was a milestone as it gained a profit in the year. Grab expects it would record profits from the Vietnamese market in 2024.

The Q1/2024 edition of "The Connected Consumer) report, conducted by market researcher Decision Lab, showed that Grab is the biggest ride-hailing firm in Vietnam regarding the market share.

Two major competitors are Vietnamese firms, namely Be and Green and Smart Mobility (GSM). GSM is well-known for its utilization of electric vehicles (EV) brand VinFast.

Sea Group

Sea Group, a tech giant in Southeast Asia, is popular for its Shopee e-commerce market and Garena gaming platform.

Top e-commerce sites in Vietnam, namely Shopee, TikTok Shop, Lazada, Tiki, and Sendo, earned a total revenue of VND318.9 trillion ($12.62 billion) in 2024, up 37.4% year-on-year, according to local e-commerce analyzer Metric.

Tencent-affiliated Shopee accounted for the biggest portion of 64%, according to local market analyzer Metric. Shopee was followed by TikTok Shop with 29% and Alibaba-affiliated Lazada with 6%. Tiki and Sendo, two domestic ones, accounted for the remaining 1%.

Keppel

Keppel has been investing in real estate in Vietnam for over three decades. Its portfolio in Vietnam now has 2.58 million square meters, featuring 14,023 units. As of end-2024, it launched 6,527 units and sold 4,892 units.

In late September 2024, Keppel said it would sell 70% of its stake at Saigon Sports City Limited, the operator of its 64-hectare real estate project in District 2, a prime location in Ho Chi Minh City.

Jencity Limited, a subsidiary of Keppel, is set to sell a 35% stake to HTV Dai Phuoc Company Limited and another 35% to Vinobly Investment Real Estate JSC, Keppel said.

The transaction is subject to some conditions, including regulatory approvals.

Sembcorp

Singapore’s Sembcorp and Vietnam’s Becamex will add two more Vietnam Singapore Industrial Park (VSIP) projects to its portfolio, raising the total in Vietnam to 20.

In an announcement earlier this month, Sembcorp said the two new IPs are the $88 million VSIP Nam Dinh in the northern province of Nam Dinh and the $53 million VSIP Nghe An III in the central province of Nghe An. Each project covers 180 hectares.

Vietnam Singapore Industrial Park Joint Venture Co. (VSIP), the developer of VSIP industrial parks, recorded a post-tax profit of VND1,703 billion ($66.9 million) in 2023, down 24.6% year-on-year.

Sembcorp also invests in energy in Vietnam. In August 2024, Sembcorp said its subsidiary Sembcorp Industries spent SGD174 million ($131.1 million) on the acquisitions of majority interests in three out of four renewable energy subsidiaries of Vietnamese conglomerate Gelex.

Singaporean Prime Minister Lawrence Wong is on an official visit to Vietnam from March 25-26. The trip followed the establishment of Vietnam-Singapore comprehensive strategic partnershipc earlier this month.

Vietnamese PM Pham Minh Chinh and PM Wong on Wednesday witnessed the signing of many cooperation deals between agencies and enterprises of the two countries.

- Read More

Vietnam’s benchmark VN-Index climbs above 1,700 points

VN-Index, which represents the Ho Chi Minh Stock Exchange (HoSE), rose past the 1,700-point mark in the first trading session of December, supported mainly by gains in VIC (Vingroup), VPL (Vinpearl), and VHM (Vinhomes).

Finance - Mon, December 1, 2025 | 5:13 pm GMT+7

Samsung Vietnam appoints its first Vietnamese senior executive

Samsung Vietnam has appointed Nguyen Hoang Giang as vice president of Samsung Electronics Vietnam Thai Nguyen (SEVT), marking the first time a local national has been named to such a senior leadership position at a manufacturing unit of the company in Vietnam.

Companies - Mon, December 1, 2025 | 4:30 pm GMT+7

Vietnam to apply Euro 1 emission standards to pre-1999 cars from next March

Vehicles manufactured before 1999 in Vietnam must meet Level 1 emissions standards (equivalent to Euro 1) from March 1, 2026, according to a new government decision.

Economy - Mon, December 1, 2025 | 2:55 pm GMT+7

Aeon breaks ground on $38 mln shopping mall in Vietnam's Mekong Delta province Dong Thap

Japanese-invested Aeon Vietnam on Saturday broke ground for a VND1 trillion ($37.95 million) shopping mall project in the Mekong Delta province of Dong Thap, southern Vietnam.

Industries - Mon, December 1, 2025 | 1:46 pm GMT+7

EV makers in Vietnam likely to be exempted from battery collection, recycling requirements

Manufacturers of electric vehicle batteries in Vietnam are likely to be exempted from collection and recycling responsibilities, as producers currently do not have battery waste to recycle.

Economy - Mon, December 1, 2025 | 10:14 am GMT+7

Confidence in a new cycle for Vietnam’s stock market

Financial expert Huynh Hoang Phuong believes that Vietnam’s market status upgrade from "frontier" to "second emerging", set to be effective from September 2026, will provide an important foundation for the stock market to enter a new development cycle - one filled with many opportunities but also challenges.

Finance - Mon, December 1, 2025 | 6:59 am GMT+7

Malaysia leads Southeast Asia’s digital economic growth

Malaysia is now the fastest-growing digital economy in Southeast Asia with a year-on-year increase of 19%, and on track to reach $39 billion in gross merchandise value (GMV) this year, according to the 10th edition of the e-Conomy SEA Report 2025.

Southeast Asia - Sun, November 30, 2025 | 4:19 pm GMT+7

'K-pop Father' Lee Soo-man to build $99 mln entertainment-tourism complex in central Vietnam

South Korean producer Lee Soo-man, known as the “Father of K-pop,” plans to invest nearly VND2.6 trillion ($98.62 million) in a cultural, sports, recreation, commercial and tourism complex in Gia Lai province through Blooming Sky Co., Ltd.

Real Estate - Sun, November 30, 2025 | 12:09 pm GMT+7

Thailand’s WHA seeks special mechanisms for two industrial zone projects in central Vietnam

WHA Industrial Zone Nghe An, a unit of WHA Group - Thailand's leader in fully-integrated logistics and industrial facilities solution - has submitted a proposal to Nghe An province authorities seeking to have its projects included in the list of those eligible for special mechanisms.

Industrial real estate - Sun, November 30, 2025 | 10:07 am GMT+7

Steelmaker Nam Kim to explore tin-nickel coated steel production for EV battery shells

Nam Kim Steel JSC (HoSE: NKG), a leading coated‑steel manufacturer in Vietnam, plans to research production of tin‑coated steel for the packaging industry, and tin‑nickel coated steel for electric‑vehicle battery shells, serving both domestic and export markets.

Companies - Sun, November 30, 2025 | 8:00 am GMT+7

Cutting logistics costs to global average could save $45 bln a year for Vietnam: PM

Prime Minister Pham Minh Chinh said Vietnam could save $45 billion annually if it lowers logistics costs by around 16% to match the global average.

Economy - Sat, November 29, 2025 | 6:48 pm GMT+7

Coca-Cola Beverages Vietnam loses lawsuit against local tax authority

The Ho Chi Minh City People's Court on Thursday dismissed a lawsuit filed by Coca-Cola Beverages Vietnam against the Ministry of Finance's Department of Taxation, thereby upholding the department's decision to collect back taxes and impose a fine of over VND821 billion ($31.14 million) in total.

Finance - Sat, November 29, 2025 | 2:27 pm GMT+7

Honda Vietnam rejects information Honda Mobilityland plans 600-ha tourism, entertainment, sports complex in southern Vietnam

Honda Vietnam on Friday rejected the information that Honda Mobilityland Corporation, a subsidiary of Japan’s Honda Motor Co., plans to build an international circuit in Tay Ninh province, towards developing a 600-hectare tourism, entertainment, and sports complex there.

Industries - Sat, November 29, 2025 | 10:23 am GMT+7

Vietnam's largest tungsten mine has updated planning okayed

Vietnam’s Nui Phao mine, one of the world’s largest tungsten deposits outside China, has had its updated planning approved under a decision signed by Deputy Prime Minister Tran Hong Ha.

Economy - Sat, November 29, 2025 | 9:34 am GMT+7

Foreign-backed Arque Degi to build $322 mln floating tourism-urban projects in central Vietnam

Authorities in Gia Lai province have granted an investment certificate to Arque Degi JSC to develop three floating tourism-urban projects worth a combined VND8.5 trillion ($322.42 million) in the De Gi lagoon area.

Real Estate - Sat, November 29, 2025 | 8:00 am GMT+7

Indonesia eyes trilateral data-center tie-up with Singapore, Malaysia

Indonesia is in talks with Singapore and Malaysia to develop a cross-border data-center network linked to its Green Super Grid.

Southeast Asia - Fri, November 28, 2025 | 9:57 pm GMT+7