Vietnam rises as global production hub on improving fundamentals: HSBC

Vietnam’s status as a rising global production hub is not only due to geopolitical factors but also thanks to its improving fundamentals, write HSBC analysts in the bank's report "Vietnam at a glance - Let’s talk capital".

Danang Port in Danang city, central Vietnam. Photo courtesy of KVN Logistics.

An underdeveloped capital market

Despite being the best stock market performer in ASEAN last year, Vietnam’s capital market remains underdeveloped. Over the past decades, Vietnam’s economic growth has been heavily driven by bank credit. However, a large dependency on credit can lead to amplifying economic adjustments in adverse conditions. While there has been a push to develop Vietnam’s capital market, structural challenges persist, including transaction and infrastructure-related hurdles, as well as relatively less corporate transparency and disclosures.

Clearing the hurdles

Fortunately, changes are underway. Vietnam has scrapped the pre-funding requirement for stock market transactions, clearing a significant criterion to upgrade its designation from a frontier market to an emerging market. Meanwhile, reforms to improve transparency and information disclosures to accommodate a global investor base while expanding the domestic investor base are also encouraging.

January data: Tet (Lunar New Year holiday) distortions

Do not let Tet distortions disguise Vietnam’s January economic performance. While exports fell in January, the moderate decline primarily reflects the timing distortions of Tet, as factories were closed for longer holidays in January.

Tariff continues to be buzz word, but it is too early to draw implications, given a large degree of uncertainty persists for ASEAN and Vietnam. In addition, inflation may look concerning, as inflation accelerated to 3.6% year-on-year. However, we believe there are few reasons to be worried about the inflation path, as upside risks may prove to be seasonal.

Let’s talk capital

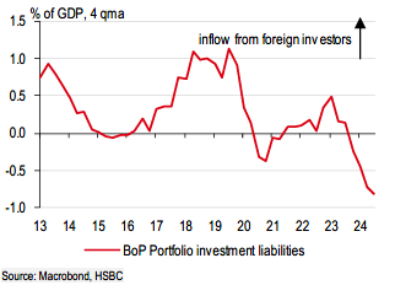

For all the talk of investments in Vietnam, one must not forget about its budding capital markets. In fact, Vietnam was the best stock market performer in Southeast Asia in 2024. However, recent quarters have also seen some pullback in portfolio investment flows from foreign investors as the chart below shows.

Albeit small in size, there have been recent outflows from foreign portfolio investor.

Albeit mostly driven by macro developments, this nevertheless poses the question: are there roadblocks inhibiting foreign interest and participation in Vietnam’s stock market? And indeed, structural challenges persist: transaction and infrastructure-related hurdles, relatively less corporate transparency and disclosures, to name a few.

But changes are underway. Effective November 2024, Vietnam has scrapped the pre-funding requirement for stock market transactions, clearing a significant criterion to upgrade its designation from a frontier market to an emerging market, potentially later this year.

Vietnam has been on the watchlist since 2018. If implemented, FTSE Russell, a major index provider, estimates that an upgrade in designation could bring $6 billion or over 1% of GDP in foreign investment inflows into the country (Nikkei, January 28, 2025).

After facing numerous delays, an upgrade in the trading infrastructure is also looming, with authorities aiming and pushing to implement the KRX system this year (Theinvestor, December 18, 2024).

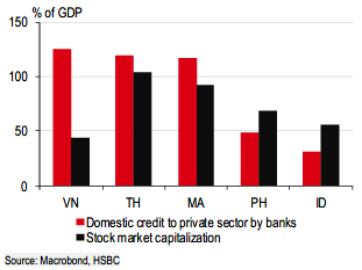

Such focus is particularly significant for Vietnam, which has lagged ASEAN peers in terms of stock market development. In contrast, bank lending has grown substantially relative to the size of its economy, indicating that credit primarily supported the high growth trend observed over the years.

Vietnam’s economy leans heavily on bank lending for capital.

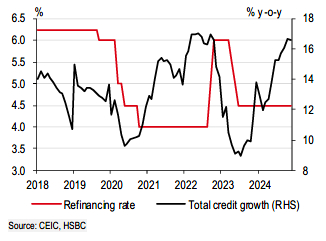

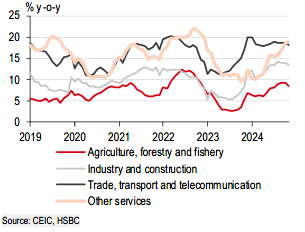

However, a large dependency on credit can lead to amplifying economic adjustments in an adverse manner, such as when borrowing costs rose in late 2022. When the economy experienced acute inflation shortly after the pandemic and the State Bank of Vietnam (SBV) responded accordingly by tightening monetary policy, credit growth slowed sharply as pressures flowed across many areas in the domestic sector, particularly in banking and real estate, which is included under other services.

The economy is highly sensitive to changes in financial conditions.

Credit growth slowed, particularly in services, in 2023.

In this context, developments to improve capital markets should not only be seen as catching up to market peers but also in terms of diversifying and expanding capital mobilization channels to build financial resilience.

Despite the stock market being larger in size relative to its bond market, actual capital raised in the equity market only amounted to about 10% of funds raised in the corporate bond market through 2019-23 (World Bank, 23 August 2024).

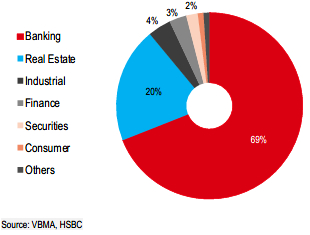

The dominant presence of the banking sector is also reflected in these markets, of which the banking sector traditionally and continues to encompass the majority of corporate bond issuances. Other sectors, such as manufacturing and retail, evidently face greater challenges in accessing sources of funding other than bank credit, potentially limiting an efficient allocation of capital and constraining activity.

Corporate bond issuance by sector in 2024.

Fortunately, the government has been taking steps to address various challenges and risks surrounding capital markets. Following the challenging market environment for corporate bonds in late 2022, the authorities have introduced more safeguards to allay investor concerns, such as allowing only professional investors to participate in the trading of corporate bonds via private placement (Theinvestor, November 29, 2024).

Meanwhile, structural reforms to improve transparency and information disclosure to accommodate a global investor base are also underway. In comparison to other ASEAN peers that have already adopted International Financial Reporting Standards (IFRS), not all corporations in Vietnam have shifted from Vietnam Accounting Standards (VAS) and adopted IFRS yet, leading to valuation differences. Encouragingly, 2025 is reportedly a key year in the transition plan set forth by the government, as IFRS adoption shifts from being voluntary to compulsory for public companies from this year onward.

Introducing more transparency has also been the case in other areas of the economy, such as the real estate market. Regulatory changes in the 2024 Land Law, 2023 Housing Law, and 2023 Real Estate Business Law have supported newly registered FDI to flow into the sector, registering $4 billion in 2024, up from $1 billion in 2023. Notable changes, such as land prices better reflecting market values, easing land-related rights for overseas Vietnamese, and more stringent information disclosure by real estate businesses, will continue to support a recovery in sentiment.

Beyond increasing foreign participation in capital markets, expanding and diversifying the domestic investor base will be key in helping to sustainably achieve the official targets of a stock market capitalization of 120% and corporate bonds outstanding of 25% of GDP, respectively, by 2030.

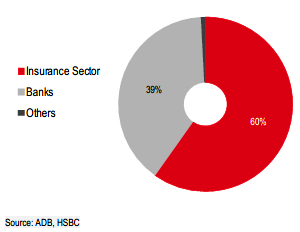

Indeed, the presence of institutional investors in both spaces has notable room to grow. For instance, Vietnam’s social security fund (VSS), which is estimated to hold more than 10% of GDP in assets, is currently not allowed to invest in domestic equities and corporate bonds (World Bank, August 23, 2024). Driven in part by the lack of investment choices, this has led the VSS to purchase government bonds, with the fund and banks effectively owning the government bond market and distorting price signalling. Activity in Vietnam’s capital markets therefore has significant potential to grow, with the potential stock market upgrade just the start.

Ownership composition of government bonds as of Q3/2024.

January at a glance

Tet arrived not only early this year, in January, but also brought a nine-day holiday, two days more than last year. Therefore, this affected monthly data readings as workers headed back home to celebrate the holiday.

Not surprisingly, retail sales rose 10% year-on-year, with both goods and services posting strong year-on-year growth. That said, the consumption trend suggests that Vietnamese consumer spending has more room to recover, as retail sales were still 8% below what trend growth would suggest. We wait for February’s data to adjust for Tet distortions for a clearer insight on the domestic demand’s recovery trajectory.

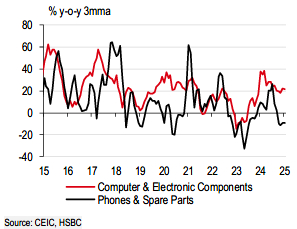

On the external side, January trade data came in weak as factories closed for the holiday, at first glance. That said, after accounting for the Tet distortions, an export decline of 4.3% year-on-year in January is rather moderate. One interesting observation is the ongoing divergence in electronics shipments. For the past months, phone exports were main drags, but computer electronics shipments were a strong boost to export growth. Similarly, this is also the trend observed in imports, as Vietnam’s manufacturing is rather import-intensive. As imports fell 2.6% year-on-year, January saw a rather generous trade surplus of over $3 billion, against an average of $2 billion in 2024.

The divergence in electronics exports continues.

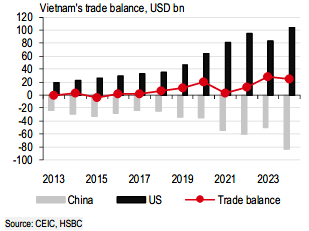

Despite starting 2025 on a not-so-bad footing, tariff risks nonetheless cloud trade prospects. As we have discussed extensively in prior research, Vietnam has the highest tariff risk in ASEAN, given its large trade surplus with the U.S. That said, there remains a large degree of uncertainty. Given the U.S.’s recent move to grant a 30-day delay each to Canada and Mexico, tariffs are up on the table for negotiations, and decisions could change overnight.

Vietnam’s trade surplus with the US exceeded US100bn in 2024.

The question for China vis-à-vis its Asian peers is different. For China, the direction is easier to predict but not the magnitude. However, for other Asian economies, in particular ASEAN countries, the question is whether tariff risks will materialize. Zooming out of the tariff risks, the other question worth considering is: how many companies are willing to move supply chains, which is both time and investment-consuming, given short-term factors? Vietnam’s status as a rising global production hub is not only due to geopolitical factors but also thanks to its improving fundamentals.

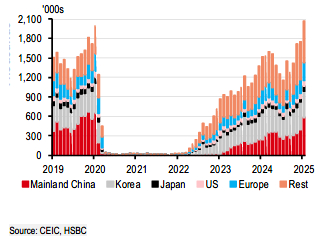

Unlike trade uncertainty, Vietnam’s attractiveness as a tourism destination has certainly increased. Its tourism sector broke a monthly record of welcoming more than two million international visitors, jumping close to 40% year-on-year. In particular, the number of mainland Chinese tourists has more than doubled compared to January 2024, narrowing the gap with its pre- pandemic high from 36% in 2024 to only 10% in January 2025.

Foreign tourists to Vietnam reached a record high of over 2 million in January.

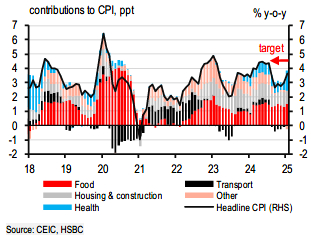

Meanwhile, inflation accelerated 1% month-on-month in January. This translated into a year-on-year print of 3.6%, exceeding market expectations (HSBC: 3%; Bloomberg: 3.1%). The upside surprise was primarily driven by high food (particularly pork) prices and medical costs (9.5% month-on-month). While it is worth keeping a close eye on inflation, we do not think this is concerning as both factors are likely to be seasonal or one-off.

Inflation accelerated to 3.6% in January, driven by food and health costs.

- Read More

Southern Vietnan port establishes strategic partnership with Japan’s Port of Kobe

Long An International Port in Vietnam’s southern province of Tay Ninh and Japan’s Port of Kobe on Monday signed an MoU establishing a strategic port partnership which is expected to boost trade flows, cut logistics costs, and deliver greater benefits to businesses across the region.

Companies - Wed, November 19, 2025 | 10:14 am GMT+7

Thaco's agri arm seeks to expand $44 mln cattle project in central Vietnam

Truong Hai Agriculture JSC (Thaco Agri), the agriculture arm of conglomerate Thaco, looks to aggressively expand its flagship cattle farming project in the central Vietnam province of Gia Lai.

Industries - Wed, November 19, 2025 | 9:56 am GMT+7

Japan food major Acecook eyes new plant in southern Vietnam

Acecook, a leading instant noodle maker with 13 plants operating in Vietnam, is studying a new project in the southern province of Tay Ninh.

Industries - Wed, November 19, 2025 | 9:39 am GMT+7

Vietnam’s largest Aeon Mall to take shape in Dong Nai province

Authorities of Dong Nai province, a manufacturing hub in southern Vietnam, on Monday awarded an investment registration certificate to Japanese-invested Aeon Mall Vietnam Co., Ltd. for its Aeon Mall Bien Hoa project.

Industries - Tue, November 18, 2025 | 8:17 pm GMT+7

Police propose prosecuting Egroup CEO Nguyen Ngoc Thuy for fraud, bribery

Vietnam’s Ministry of Public Security has proposed prosecuting Nguyen Ngoc Thuy, chairman and CEO of Hanoi-based education group Egroup, along with 28 others, for fraud to appropriate property, giving bribes, and receiving bribes.

Society - Tue, November 18, 2025 | 4:01 pm GMT+7

Singapore-backed VSIP eyes large urban-industrial complex in southern Vietnam

A consortium involving VSIP, a joint venture between local developer Becamex IDC and Singapore’s Sembcorp, plans a large-scale urban-industrial development named the "Moc Bai Xuyen A complex along the Tay Ninh-Binh Duong economic corridor in southern Vietnam.

Industrial real estate - Tue, November 18, 2025 | 2:38 pm GMT+7

Aircraft maintenance giant Haeco to set up $360 mln complex in northern Vietnam

Hong Kong-based Haeco Group, Vietnam's Sun Group, and some other partners plan to invest $360 million in an aircraft maintenance, repair and overhaul (MRO) complex at Van Don International Airport in Quang Ninh province - home to UNESCO-recognized natural heritage site Ha Long Bay.

Industries - Tue, November 18, 2025 | 2:13 pm GMT+7

Thai firm opens 20,000-sqm shopping center in central Vietnam hub

MM Mega Market Vietnam (MMVN), a subsidiary of Thailand's TCC Group, on Monday opened its MM Supercenter Danang, a 20,000 sqm commercial complex with total investment capital of $20 million, in Danang city.

Real Estate - Tue, November 18, 2025 | 12:20 pm GMT+7

Vietnam PM asks Kuwait fund to expand investment in manufacturing, logistics, renewable energy

Prime Minister Pham Minh Chinh on Monday called on the Kuwait Fund for Arab Economic Development (KFAED) to strengthen cooperation with Vietnam, particularly in the areas of industrial production, logistics, renewable energy, green economy, and the Halal ecosystem.

Economy - Tue, November 18, 2025 | 11:53 am GMT+7

Thai dairy brand Betagen to build first plant in Vietnam

Betagen, a famous Thai dairy brand, plans to build its first manufacturing plant in Vietnam, located in the southern province of Dong Nai.

Industries - Tue, November 18, 2025 | 8:49 am GMT+7

Banks dominate Vietnam's Q3 earnings season, Novaland posts biggest loss

Banks accounted for more than half of the 20 most profitable listed companies in Vietnam’s Q3/2025 earnings season, while property developer Novaland recorded the largest loss.

Finance - Tue, November 18, 2025 | 8:24 am GMT+7

Highlands Coffee posts strongest quarterly earnings in 2 years on robust same-store sales

Highlands Coffee, Vietnam’s largest coffee chain, delivered its best quarterly performance in two years, with Q3 EBITDA exceeding PHP666 million ($11.27 million), parent company Jollibee Foods Corporation (JFC) said in its latest earnings report.

Companies - Mon, November 17, 2025 | 10:21 pm GMT+7

Hong Kong firm Dynamic Invest Group acquires 5% stake in Vingroup-backed VinEnergo

VinEnergo, an energy company backed by Vingroup chairman Pham Nhat Vuong, has added a new foreign shareholder after Hong Kong–based Dynamic Invest Group Ltd. acquired a 5% stake, according to a regulatory filing on Saturday.

Companies - Mon, November 17, 2025 | 9:52 pm GMT+7

Thai giant CP’s Q3 Vietnam revenue drops 20% as hog prices slump

Thailand’s Charoen Pokphand Foods PCL (CPF) reported a sharp downturn in its Vietnam business in Q3, making the country its only major market to contract.

Companies - Mon, November 17, 2025 | 4:16 pm GMT+7

Surging demand for gas turbines tightens supply chains, extends lead times: Siemens Energy

Demand for gas turbines is rising rapidly, especially in regions with a surge in data center development, tightening supply chains and extending lead times - factors that investors must closely track during project preparation, according to Siemens Energy.

Companies - Mon, November 17, 2025 | 1:34 pm GMT+7

Novaland completes first phase of restructuring, targets 'returning to growth' from 2027

Novaland, a leading real estate developer in Vietnam, said it has completed the first phase of its multi-year restructuring plan and aims to finish the entire program by end-2026, positioning the company to return to growth from 2027.

Companies - Mon, November 17, 2025 | 12:26 pm GMT+7

- Travel

-

Impressive Standard Chartered Hanoi Marathon Heritage Race 2025

-

Nguyen Hong Hai wins 'Investors' golden heart' golf tournament 2025

-

140 players compete at “Investors’ golden heart” golf tournament

-

‘Investors’ golden heart’ golf tournament to tee off on Saturday

-

Vietnam, Hong Kong Aircraft Engineering sign deal on aircraft maintenance hub at northern airport

-

Sun Group gets nod for $375 mln inland waterway tourism project in central Vietnam