Retail investors allowed to purchase Vietnam corporate bonds via private placements

Retail professional investors are now permitted to purchase corporate bonds in Vietnam via private placements, provided that issuers have credit ratings, collateral, or payment guarantees.

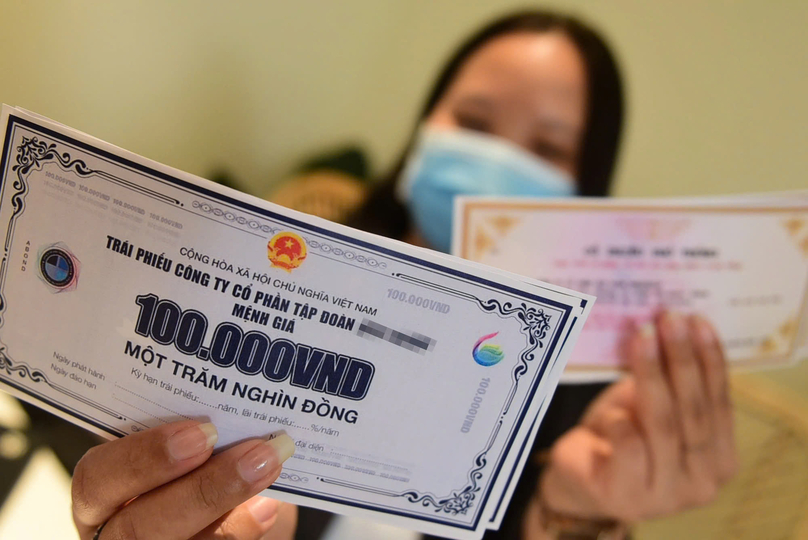

Corporate bonds worth VND54.4 trillion ($2.15 billion) will mature by the end of 2024. Photo courtesy of Tuoi tre (Youth) newspaper.

Under the amended Securities Law, passed on Friday by the National Assembly - the country's legislature, individual investors can participate in the purchase, trading, and transfer of private placement corporate bonds.

However, only "professional investors" - defined as individuals with financial capability or professional expertise in securities - will be eligible to engage in this market segment.

Specifically, these individuals must either hold a portfolio with a minimum value of VND2 billion ($79,020) in listed or registered securities or have taxable income of at least VND1 billion in the most recent year.

The new law tightens the criteria regarding the period of being an investor and the frequency of trading. Notably, the law stipulates that foreign individuals and institutions are also considered "professional investors".

Previously, the government had proposed restricting private placement bond market participation to only institutional investors, with individual investors gaining access through investment funds. The rationale behind this proposal was the high-risk nature of privately placed bonds, particularly those issued by unlisted companies.

While some countries do not ban individual professional investors from entering this market, transactions are generally conducted between professional institutions such as securities firms, investment funds, and banks. Retail investors typically refrain from direct involvement in this market due to limitations in risk management and resources.

At that time, several organizations voiced concerns that limiting individual investors' participation could hinder the development of the private placement corporate bond market, potentially leading to market stagnation or disruption.

In response, the Ministry of Finance stated that the revised Securities Law would respect the investment rights of retail investors, and as such, would not propose amendments to their right to participate in this market.

The corporate bond market experienced rapid growth from 2017 to 2021 but has slowed significantly since late 2022, following a scandal related to the Saigon Commercial Bank (SCB) and real estate developer Van Thinh Phat Group.

This event led to a loss of investor confidence, with bondholders demanding early redemption of their bonds. As a result, many companies have faced challenges in issuing new bonds, delayed repayments, and negotiated on extending bond repayment deadlines with bondholders.

There have been signs of recovery in bond issuance by companies since late 2023. According to FiinRatings, a credit rating agency under Vietnamese firm Fiingroup, the total value of corporate bonds issued in the first 10 months of 2023 reached nearly VND348 trillion ($13.73 billion), a 60% increase year-on-year.

However, FiinRatings said there is a great pressure regarding corporate bonds maturing by the end of 2024, amounting to VND54.4 trillion ($2.15 billion), with over VND43 trillion in December alone. The real estate and manufacturing sectors are expected to be the hardest hit, it noted.

FiinRatings estimated that around VND10 trillion ($394.5 million) in bond principal may be at risk of delayed repayment in the final months of 2024, particularly from a few real estate companies with poor financial standing.

- Read More

Market watchdog conference in central Vietnam offers insight into amended securities law

A conference recently held by the State Securities Commission (SSC) in Danang briefed companies and market participants in central Vietnam on amendments to the Securities Law and guiding documents, as part of the authority's 2025 legal dissemination plan.

Finance - Sat, November 22, 2025 | 9:48 pm GMT+7

Central Retail incurs 6% drop in Jan-Sept revenue from Vietnam

Thailand’s top retailer Central Retail posted revenues of nearly THB35.48 billion ($1.09 billion) in Vietnam in the first nine months of this year, down 6.6% year-on-year due to exchange rate fluctuations.

Companies - Sat, November 22, 2025 | 3:32 pm GMT+7

Young leadership mindset drives SHB bank's next growth phase: exec

Young leadership would play a pivotal role as Vietnamese businesses navigate digital transformation and rising global competition, said Do Quang Vinh, vice chairman cum deputy CEO of Saigon-Hanoi Commercial Joint Stock Bank (SHB).

Banking - Sat, November 22, 2025 | 3:23 pm GMT+7

Stock market regulator holds final round of ESG-focused corporate governance contest in Hanoi

The final round of the “Vietnam ESG Challenge 2025”, a competition aimed at promoting sustainable development, modern corporate governance, and social responsibility among Vietnamese university students, took place in Hanoi on Monday.

Finance - Sat, November 22, 2025 | 10:16 am GMT+7

IFC, Vietnam's EVNNPT discuss investment in power transmission projects

Vietnam's National Power Transmission Corporation (EVNNPT) and the International Finance Corporation (IFC), a member of the World Bank Group, have discussed issues related to potential cooperation and investment in power transmission projects under the Power Development Plan VIII (PDP VIII).

Companies - Sat, November 22, 2025 | 9:23 am GMT+7

Earnings strength meets market consolidation

Global appetite for emerging markets is still cautious, constrained by high returns in developed markets amid geopolitical uncertainty, while pressure on the Vietnamese dong has been compounded by seasonal FDI profit repatriation, writes Minh Dang, head of research at Dragon Capital.

Economy - Sat, November 22, 2025 | 8:00 am GMT+7

Phat Dat pursues HCMC housing project after a decade as it restructures property portfolio

Phat Dat Real Estate Development Corp (PDR) has moved to acquire a 50% stake in AKYN Investment Trading Service JSC as part of efforts to revive a long-delayed residential project in central Ho Chi Minh City, the company said in a board resolution. Financial terms were not disclosed.

Real Estate - Fri, November 21, 2025 | 9:30 pm GMT+7

F88 wins dual workplace awards for 2025

Vietnam’s consumer finance major F88 has been named one of "Vietnam Best Places to Work" and a “Happiness at Work” enterprise for 2025.

Companies - Fri, November 21, 2025 | 4:07 pm GMT+7

European IP developer CTP plans large industrial-logistics project in northern Vietnam port city

CTP, a Dutch-led industrial park developer headquartered in the Czech Republic, is exploring a large integrated complex combining seaports, an airport, logistics facilities and industrial parks in the northern port city of Hai Phong.

Infrastructure - Fri, November 21, 2025 | 3:24 pm GMT+7

Vingroup to build $334 mln international port in central Vietnam

Vietnam's leading private conglomerate Vingroup will develop a modern, large-scale international port named Son Duong at the Vung Ang Economic Zone in Ha Tinh province.

Infrastructure - Fri, November 21, 2025 | 3:10 pm GMT+7

HCMC ready to operate International Financial Center: city authorities

Ho Chi Minh City has completed preparations across infrastructure, spatial planning, digital systems, organizational apparatus, and human resources to ensure Vietnam's International Financial Center can begin operating immediately after the Government issues its guiding decrees.

Economy - Fri, November 21, 2025 | 2:11 pm GMT+7

Hoa Phat Agriculture valued at over $450 mln ahead of IPO, ranking 2nd in Vietnam's livestock industry

Hoa Phat Agriculture Development JSC (HPA) has been valued at more than $450 million based on its newly announced IPO price, making it the second-largest company in Vietnam’s livestock industry after Masan MeatLife.

Companies - Fri, November 21, 2025 | 11:26 am GMT+7

Vietnam leads ASEAN in consumer optimism: UOB

Vietnam continues to lead the region in consumer optimism, driven by positive economic outlook and confidence in personal finances, according to the sixth edition of the ASEAN Consumer Sentiment Study (ACSS). UOB analysts offer an insight into their findings.

Economy - Fri, November 21, 2025 | 9:01 am GMT+7

MBBank partners with Visa, Kotra to launch new MB Visa Hi BIZ corporate card

MBBank (MB) on Wednesday launched a new version of its MB Visa Hi BIZ corporate card, offering enhanced spending management tools and cross-border payment capabilities through partnerships with Visa and South Korea’s trade promotion agency Kotra.

Banking - Thu, November 20, 2025 | 9:38 pm GMT+7

Germany looks to Vietnam's largest tungsten mine for critical mineral supply diversification

Germany is turning its attention to Vietnam’s Nui Phao mine, one of the world’s largest tungsten deposits outside China, as part of efforts to diversify supplies of strategic minerals.

Industries - Thu, November 20, 2025 | 5:27 pm GMT+7

Vietnam's tech firms should pursue end-to-end product strategy, avoid ‘halfway’ innovation: minister

Vietnamese technology firm ought to pursue a product-driven strategy and sustain long-term global ambitions, said Minister of Science and Technology Nguyen Manh Hung.

Economy - Thu, November 20, 2025 | 5:23 pm GMT+7

- Consulting

-

The generation game: Adapting to an aging population

-

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas

-

Powering growth from within

-

Key factors helping firms export to demanding markets: DH Foods exec

-

Vietnam corporate earnings to be driven by credit expansion, trading activity, property recovery

-

Vietnam's International Financial Center ambition can unlock new wave of innovation