While the buzz around a market upgrade is back, who is this milestone for?

A key issue for the Vietnamese stock market is the underdevelopment of the institutional investor base. The dominance of retail investors can create heightened volatility, which, in turn, reduces the incentive for high-quality companies to list on the stock exchange, writes Gary Harron, head of securities services at HSBC Vietnam.

Gary Harron, head of securities services at HSBC Vietnam. Photo courtesy of the bank.

The buzz surrounding a potential upgrade of Vietnam’s stock market is back, as participants await the interim FTSE Russell Country Classification update to see whether the country will be upgraded from a frontier to secondary Emerging market status in 2025.

When I joined HSBC Vietnam team as head of securities services in mid-2024, there was a sense of skepticism around this upgrade story among foreign clients, international brokers and other intermediaries.

While an upgrade milestone is significant, it is worth reflecting on the past decade’s journey and the current momentum behind market development.

Looking back at the market profile

The Growth Story - Vietnam's stock market expansion over the past decade has been substantial and quantified. The VN-Index has more than doubled, by 2.3 times; market capitalization surged 6.4 times; and liquidity expanded 3.8 times. The number of trading account soared 6.7 times, while the Securities trading codes (STCs) issued to foreign investors grew by 2.8 times.

In 2024 alone, the VN-Index was up 12.9%, while the market capitalization of the stock exchanges increased by 21.2%, reaching approximately 70% of GDP. Trading accounts surpassed 9 million, covering 9% of the population. Nearly 50,000 STCs have been granted to foreign investors, with 12.4% held by foreign institutional investors (FIIs). Liquidity remained strong, with an average daily trading value of VND21.1 trillion ($825.19 million), a 19.9% increase from the previous year.

Clearly, quantitative metrics and progress have not been the obstacles to an upgrade, and the growth story has been substantial.

The Reforms Story - The qualitative factors on assessing a market are harder to measure, resulting in the index providers like FTSE Russell using a range of criteria developed in conjunction with the international investor community.

The process has been transparent and well-communicated, with Vietnam on the watchlist since 2018. Recent reforms aimed at meeting upgrade criteria as well as generally improving market accessibility include the removal of prefunding requirements for equity buy trades for FIIs, streamlined market entry registration (e-STC & SWIFT messaging), a path to mandatory English disclosures for issuers with immediate adoption by the State Securities Commission (SSC), the Vietnam Securities Depository and Clearing Corporation (VSDC) and stock exchanges, improved ease of off-exchange transactions and ability for foreign investors to exercise their voting rights in public companies’ general meetings with e-voting and e-meetings.

And the reform continues. The SSC recently published a disclosure on its website, which FIIs could read in English immediately without the need for translation or using AI tools. This disclosure demonstrated Vietnam’s swift response to FTSE Russell’s feedback in February.

Of the nine specific solutions, one is already completed, four are expected to be delivered within three months, and only one – related to the strategic implementation of a Central Counterparty (CCP), the clearing mechanism for the Vietnamese stock market – is planned for beyond 2025. While the pace of market development may have had some skeptics in the international community in mid-2024, there is now a palpable sense of progress.

And, who is this for?

Although recent reforms may appear to cater primarily to FIIs, this journey benefits the capital market function for all. With almost 90% of trading activity linked to domestic retail investors, the continuous improvement in the quality of the market can reduce risk to them.

A robust regulatory framework, improved surveillance, enhanced corporate governance, better infrastructure, increased transparency and efficiency not only boost foreign investors’ confidence, but also reinforce trust among domestic investors.

A FTSE Russell market upgrade would mark a significant milestone, but the potential of the capital market function for Vietnam is arguably much greater.

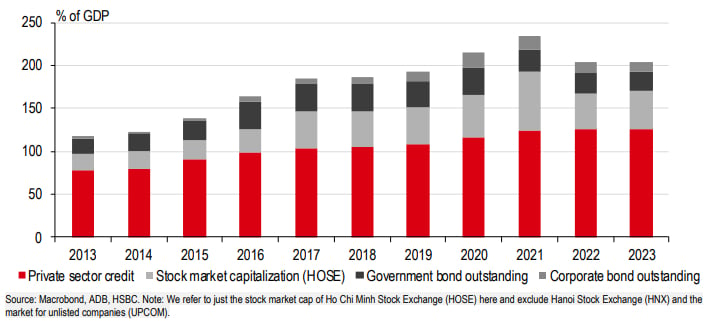

HSBC Global Research highlighted Vietnam as ASEAN’s best-performing stock market in 2024, yet, its capital market remains underdeveloped, with economic growth over past decades heavily reliant on bank credit.

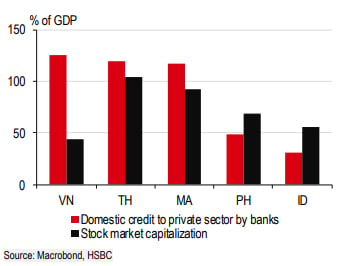

Compared to its ASEAN peers, Vietnam’s dependency on bank credit over stock market capitalization, is notable. This overreliance can amplify economic adjustments to changes in borrowing costs – seen in late 2022 when rising costs led the State Bank of Vietnam to tighten monetary policy, contracting credit growth and adversely impacting domestic sectors, particularly in banking and real estate.

The World Bank Group in August 2024 noted that Vietnam’ s capital markets have developed robustly over the past decade, catching up with peers in relative size. However, when evaluating the three functions of a capital market - raising funds, building savings, and setting prices – the report identified areas for improvement in each of these functions.

A key issue highlighted was the underdevelopment of the institutional investor base. The dominance of retail investors in the stock exchange can create heightened volatility, which, in turn, reduces the incentive for high-quality companies to list on the stock exchange, given the perceived lack of quality long-term investors, such as pension funds or institutional investors, who play a more prominent role in developed markets.

The anticipated market upgrade is expected to enhance its ability to mobilize capital, supporting economic growth. If implemented, FTSE Russell, a major index provider, estimates that an upgrade in designation could bring $6 billion or over 1% of GDP in foreign investment inflows into the country (Nikkei, 28 January 2025).

This should bring greater stability through long term institutional investors in the market, helping to address the examples of limitations outlined. A well-functioning capital market, capable of raising and efficiently allocating capital across industries, will play a significant role in Viet Nam’s GDP growth and may reduce the risks associated with an over-reliance on bank financing.

Vietnam’s economic growth has been financed primarily by an expansion in bank credit.

Vietnam’s economy leans heavily on bank lending for capital.

Celebrating in 2025?

In 2025, HSBC celebrates 155-year history in Vietnam and has been fortunate to provide custody services to the market since 2000, when it became the first foreign bank to be granted a custody license. Our team first expressed an aspiration for the market upgrade at the SSC annual market conference in 2014, and over the past decade, we have had the privilege of partnering with regulators, industry groups, professional associations and peers.

HSBC provides custody for approximately 50% of FIIs investment in Vietnam, and it is reassuring to see that our regulators actively take FII feedback on international best practice to drive market evolution. This is a well-tested approach we have witnessed in other markets that have moved through the classifications.

A potential challenge for Vietnam is that as other markets continue to compete, the standards for capital markets are constantly being raised. FTSE Russell has publicly stated at panels such as Bloomberg’s ‘Vietnam Investor Summit’ last December and recently at Vietcap’s ‘Vietnam Access Days’ investment conference in February that they do not make the decision alone but the market will. In practice, the assessment and classification are evaluated and agreed by committees and boards, currently taking place in the month of March before the Interim Review Announcement on 8 April.

While the defined minimum criteria can be fulfilled, the qualitative feedback from the international investor community may now be held to a higher standard than when some of Vietnam’s ASEAN neighbors were upgraded.

In our experience institutional clients will consistently expect developments that enable efficiency, asset safety and scalability. With these factors in mind, and improvements linked to international feedback, the market development story should remain a positive one. No matter what the result will be, HSBC Vietnam is confident the market will continue to evolve and develop, building on the success of 25 years unlocking its potential since its first trading session in July 2000, all for the benefit of Vietnam.

- Read More

Southern Vietnan port establishes strategic partnership with Japan’s Port of Kobe

Long An International Port in Vietnam’s southern province of Tay Ninh and Japan’s Port of Kobe on Monday signed an MoU establishing a strategic port partnership which is expected to boost trade flows, cut logistics costs, and deliver greater benefits to businesses across the region.

Companies - Wed, November 19, 2025 | 10:14 am GMT+7

Thaco's agri arm seeks to expand $44 mln cattle project in central Vietnam

Truong Hai Agriculture JSC (Thaco Agri), the agriculture arm of conglomerate Thaco, looks to aggressively expand its flagship cattle farming project in the central Vietnam province of Gia Lai.

Industries - Wed, November 19, 2025 | 9:56 am GMT+7

Japan food major Acecook eyes new plant in southern Vietnam

Acecook, a leading instant noodle maker with 13 plants operating in Vietnam, is studying a new project in the southern province of Tay Ninh.

Industries - Wed, November 19, 2025 | 9:39 am GMT+7

Vietnam’s largest Aeon Mall to take shape in Dong Nai province

Authorities of Dong Nai province, a manufacturing hub in southern Vietnam, on Monday awarded an investment registration certificate to Japanese-invested Aeon Mall Vietnam Co., Ltd. for its Aeon Mall Bien Hoa project.

Industries - Tue, November 18, 2025 | 8:17 pm GMT+7

Police propose prosecuting Egroup CEO Nguyen Ngoc Thuy for fraud, bribery

Vietnam’s Ministry of Public Security has proposed prosecuting Nguyen Ngoc Thuy, chairman and CEO of Hanoi-based education group Egroup, along with 28 others, for fraud to appropriate property, giving bribes, and receiving bribes.

Society - Tue, November 18, 2025 | 4:01 pm GMT+7

Singapore-backed VSIP eyes large urban-industrial complex in southern Vietnam

A consortium involving VSIP, a joint venture between local developer Becamex IDC and Singapore’s Sembcorp, plans a large-scale urban-industrial development named the "Moc Bai Xuyen A complex along the Tay Ninh-Binh Duong economic corridor in southern Vietnam.

Industrial real estate - Tue, November 18, 2025 | 2:38 pm GMT+7

Aircraft maintenance giant Haeco to set up $360 mln complex in northern Vietnam

Hong Kong-based Haeco Group, Vietnam's Sun Group, and some other partners plan to invest $360 million in an aircraft maintenance, repair and overhaul (MRO) complex at Van Don International Airport in Quang Ninh province - home to UNESCO-recognized natural heritage site Ha Long Bay.

Industries - Tue, November 18, 2025 | 2:13 pm GMT+7

Thai firm opens 20,000-sqm shopping center in central Vietnam hub

MM Mega Market Vietnam (MMVN), a subsidiary of Thailand's TCC Group, on Monday opened its MM Supercenter Danang, a 20,000 sqm commercial complex with total investment capital of $20 million, in Danang city.

Real Estate - Tue, November 18, 2025 | 12:20 pm GMT+7

Vietnam PM asks Kuwait fund to expand investment in manufacturing, logistics, renewable energy

Prime Minister Pham Minh Chinh on Monday called on the Kuwait Fund for Arab Economic Development (KFAED) to strengthen cooperation with Vietnam, particularly in the areas of industrial production, logistics, renewable energy, green economy, and the Halal ecosystem.

Economy - Tue, November 18, 2025 | 11:53 am GMT+7

Thai dairy brand Betagen to build first plant in Vietnam

Betagen, a famous Thai dairy brand, plans to build its first manufacturing plant in Vietnam, located in the southern province of Dong Nai.

Industries - Tue, November 18, 2025 | 8:49 am GMT+7

Banks dominate Vietnam's Q3 earnings season, Novaland posts biggest loss

Banks accounted for more than half of the 20 most profitable listed companies in Vietnam’s Q3/2025 earnings season, while property developer Novaland recorded the largest loss.

Finance - Tue, November 18, 2025 | 8:24 am GMT+7

Highlands Coffee posts strongest quarterly earnings in 2 years on robust same-store sales

Highlands Coffee, Vietnam’s largest coffee chain, delivered its best quarterly performance in two years, with Q3 EBITDA exceeding PHP666 million ($11.27 million), parent company Jollibee Foods Corporation (JFC) said in its latest earnings report.

Companies - Mon, November 17, 2025 | 10:21 pm GMT+7

Hong Kong firm Dynamic Invest Group acquires 5% stake in Vingroup-backed VinEnergo

VinEnergo, an energy company backed by Vingroup chairman Pham Nhat Vuong, has added a new foreign shareholder after Hong Kong–based Dynamic Invest Group Ltd. acquired a 5% stake, according to a regulatory filing on Saturday.

Companies - Mon, November 17, 2025 | 9:52 pm GMT+7

Thai giant CP’s Q3 Vietnam revenue drops 20% as hog prices slump

Thailand’s Charoen Pokphand Foods PCL (CPF) reported a sharp downturn in its Vietnam business in Q3, making the country its only major market to contract.

Companies - Mon, November 17, 2025 | 4:16 pm GMT+7

Surging demand for gas turbines tightens supply chains, extends lead times: Siemens Energy

Demand for gas turbines is rising rapidly, especially in regions with a surge in data center development, tightening supply chains and extending lead times - factors that investors must closely track during project preparation, according to Siemens Energy.

Companies - Mon, November 17, 2025 | 1:34 pm GMT+7

Novaland completes first phase of restructuring, targets 'returning to growth' from 2027

Novaland, a leading real estate developer in Vietnam, said it has completed the first phase of its multi-year restructuring plan and aims to finish the entire program by end-2026, positioning the company to return to growth from 2027.

Companies - Mon, November 17, 2025 | 12:26 pm GMT+7

- Travel

-

Impressive Standard Chartered Hanoi Marathon Heritage Race 2025

-

Nguyen Hong Hai wins 'Investors' golden heart' golf tournament 2025

-

140 players compete at “Investors’ golden heart” golf tournament

-

‘Investors’ golden heart’ golf tournament to tee off on Saturday

-

Vietnam, Hong Kong Aircraft Engineering sign deal on aircraft maintenance hub at northern airport

-

Sun Group gets nod for $375 mln inland waterway tourism project in central Vietnam