Why Vietnamese property developers are facing low liquidity amid strong housing demand

VinaCapital’s chief economist Michael Kokalari gives his insights into liquidity issues as a burden to Vietnamese real estate developers despite strong demand for new housing.

Since last year, liquidity issues have been mounting for Vietnamese real estate developers. Emerging markets are notoriously prone to real estate boom and bust cycles, characterized by overbuilding of new housing units, but Vietnam’s housing market is undersupplied; developers’ current cash flow problems were not caused by insufficient demand for their products. The demand for new housing units in Vietnam by prospective owner-occupiers vastly outstrips the annual supply of new units, and mortgage penetration in Vietnam is still modest at around 20% of the GDP.

Consequently, the primary problem developers are facing is difficulty rolling-over their outstanding debts, which they need to do in order to complete their outstanding projects and repay loans. This “liquidity gap” problem will likely be solved with government policies, but not with government money.

Furthermore, we do not expect a significant increase in bank non-performing loans (NPLs) since there is limited room for a drop in Vietnamese housing prices given the enormous discrepancy between the demand and supply of new housing units.

Understanding the problem and possible solutions

Real estate developers in Vietnam have been experiencing difficulty accessing credit for months and some are now facing difficulties refinancing their maturing bonds. The problem largely stems from difficulties developers face securing approvals for their projects because banks require proper approvals/documentation in order to extend loans collateralized by those projects.

That said: 1) some developers overextended themselves by taking on too many “high-end” development projects that are not suitable for emerging middle-class homebuyers, 2) liquidity in Vietnam’s banking system is particularly tight at present, and 3) developers are facing structural issues accessing liquidity that we discussed in this report.

Vietnamese property developers do not have access to sufficient long-term funding to support their “land banking” activities. Said differently, the raw land that developers own does not become “bankable” until that land has been rezoned for residential usage and project approvals have been secured.

In recent years, developers increasingly met their funding needs with the issuance of two-year corporate bonds that were largely purchased by retail investors as an alternative to bank deposits. However, some developers used the funds from bond issuances for purposes other than those spelled out in the bonds’ prospectuses, prompting some high-profile arrests as well as a crackdown on corporate bond issuance via the new, highly publicized Decree 65.

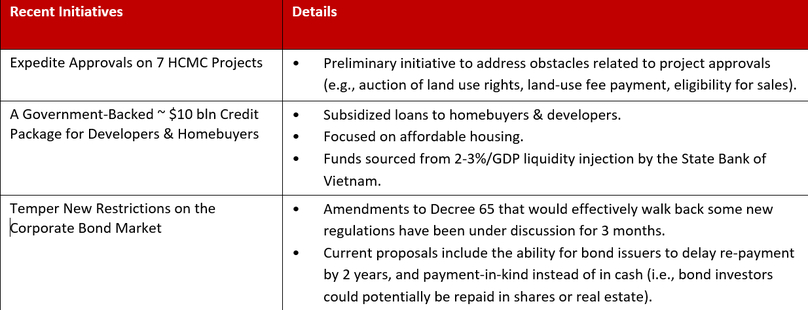

Over the last few weeks, government officials and industry executives intensified their discussions and meetings aimed at solving the issues in Vietnam’s real estate market, resulting in a range of initiatives and proposals as shown in the below table.

Two weeks ago, Prime Minister Pham Minh Chinh held a conference on the country’s real estate sector, which was focused on resolving the issues currently impeding Vietnam’s real estate development industry. This meeting was attended by civil servants from various ministries, local government officials, and senior executives from major developers and banks.

Additionally, a vice chair of HCMC People’s Committee held a widely publicized meeting to review seven HCMC projects that have been delayed due to legal approval/zoning issues, including two projects owned by Novaland.

At the first meeting, PM Chinh criticized developers for focusing on the development of high-end housing rather than on providing reasonably priced units to the market and requested government agencies “at all levels” to remove obstacles impeding the project approval process.

Most Vietnam real estate experts, including VinaCapital’s VinaLiving real estate team, believe that the slow approval process is the biggest issue currently facing the sector, but many of the country’s civil servants are reportedly wary of signing off on new projects.

Addressing developers’ liquidity issues

The possibility of two new government-backed loan packages that would each flow circa $5 billion of new credit to both developers and homebuyers was raised at the meeting led by the Prime Minister.

In our understanding, the details of these potential new loan programs are still being worked out, but the focus would be on financing the development and purchase of affordable housing, and the programs would likely be administered through state-owned commercial banks (SOCBs), with the funds ultimately provided to the SOCBs directly from Vietnam’s central bank.

Next, the government introduced new regulations on Vietnam’s corporate bond market last year that severely impeded developers’ ability to re-finance/roll-over maturing corporate bonds.

However, protracted discussions on modifications to Decree 65 that could effectively ease some of those new restrictions have progressed to the point that it now seems possible that developers will be able to repay a significant proportion of their maturing corporate bonds in the form of real estate and/or newly issued shares.

Also, the implementation of restrictions on retail investors (who were major buyers of corporate bonds) purchasing newly issued bonds may be delayed by one year.

Tight liquidity in banking system

Mortgage rates in Vietnam are currently above 12%, which is too high for some prospective home buyers, while deposit rates at private sector banks are over 8% for 1-year deposits. Investors who would typically purchase apartments to earn an investment yield are instead parking their money in bank deposit accounts.

We believe that a circa 2-percentage point decrease in 6-12 month deposit rates to ~6%, coupled with a 1-2% depreciation in the value of the Vietnamese dong, could prompt savers to move money from bank deposits into rental properties and stocks, but it may be difficult for deposits to drop much in 2023 since credit growth outpaced deposit growth by about three percentage points annually over the last three years, leaving Vietnam’s system-wide loan-to-deposit (LDR) ratio (as it would be calculated in most jurisdictions) near 100% at end-2022.

The government could help lower the system-wide LDR by injecting more liquidity into the economy by: 1) rebuilding the SBV’s FX reserves, which could inject circa $20 billion into the economy this year, 2) funding the above-mentioned circa $10 billion government-backed loan packages via the SBV’s re-financing window, and 3) the government currently has over $20 billion of undisbursed infrastructure funds sitting at the central bank and could run down some of that balance in order to meet its target of spending $30 billion on infrastructure development this year.

Finally, we expect Vietnam’s nominal GDP (i.e., including inflation) to grow by about 10% this year, which would likely result in an organic increase of circa $40 billion of bank deposits. If the government was to inject $40-50 billion of new liquidity into the country’s economy, it is likely that bank deposit growth could outpace system-wide loan growth by circa 3 percentage points, which would lead to somewhat lower deposit rates in Vietnam (i.e., 13% loan growth versus 16% deposit growth).

Conclusions

The long-term prospects for Vietnam’s real estate market remain strong. High economic growth is driving robust demand for new housing by the country’s growing cohort of emerging middle-class consumers, but the number of new units suitable for those prospective home buyers is far below demand.

Despite those favorable supply and demand dynamics, some Vietnamese real estate developers are facing liquidity challenges, primarily due to slow project approvals, so we are encouraged by the government’s recent actions to address these and other issues that developers face.

- Read More

Consortium plans $12.8 bln boulevard-landscape project in Hanoi

A consortium including Vietnam’s transport infrastructure giant Deo Ca Group has proposed developing the VND338 trillion ($12.81 billion) Red River boulevard and landscape, which could become Hanoi’s largest-ever infrastructure project.

Infrastructure - Thu, November 20, 2025 | 8:58 am GMT+7

Viettel, UAE-based EDGE partner on defense, dual-use technologies

Military-run Viettel, Vietnam’s largest telecommunications and technology group, has signed an MoU with EDGE, one of the world’s leading advanced technology and defence companies, in a move that underscores the country’s ambition to expand high-tech manufacturing.

Companies - Thu, November 20, 2025 | 8:53 am GMT+7

Maersk eyes building major container ports in Vietnam

A.P.Moller - Maersk (Maersk) is exploring investment opportunities to develop large, modern and low-carbon container ports in Vietnam.

Infrastructure - Wed, November 19, 2025 | 4:36 pm GMT+7

Taiwan semiconductor giant Panjit acquires 95% of Japan-based Torex’s Vietnam arm

Panjit International Inc, a Taiwan-listed semiconductor major, has approved the acquisition of a 95% stake in Torex Vietnam Semiconductor, a subsidiary of Japan-based Torex.

Companies - Wed, November 19, 2025 | 3:59 pm GMT+7

Vietnam PM urges Kuwait Petroleum to expand Nghi Son refinery, build bonded fuel storage facility

Prime Minister Pham Minh Chinh on Tuesday called on Kuwait Petroleum Corporation (KPC) to expand the Nghi Son oil refinery and build a bonded fuel storage facility in Vietnam.

Industries - Wed, November 19, 2025 | 3:18 pm GMT+7

Southern Vietnam port establishes strategic partnership with Japan’s Port of Kobe

Long An International Port in Vietnam’s southern province of Tay Ninh and Japan’s Port of Kobe on Monday signed an MoU establishing a strategic port partnership which is expected to boost trade flows, cut logistics costs, and deliver greater benefits to businesses across the region.

Companies - Wed, November 19, 2025 | 10:14 am GMT+7

Thaco's agri arm seeks to expand $44 mln cattle project in central Vietnam

Truong Hai Agriculture JSC (Thaco Agri), the agriculture arm of conglomerate Thaco, looks to aggressively expand its flagship cattle farming project in the central Vietnam province of Gia Lai.

Industries - Wed, November 19, 2025 | 9:56 am GMT+7

Japan food major Acecook eyes new plant in southern Vietnam

Acecook, a leading instant noodle maker with 13 plants operating in Vietnam, is studying a new project in the southern province of Tay Ninh.

Industries - Wed, November 19, 2025 | 9:39 am GMT+7

Vietnam’s largest Aeon Mall to take shape in Dong Nai province

Authorities of Dong Nai province, a manufacturing hub in southern Vietnam, on Monday awarded an investment registration certificate to Japanese-invested Aeon Mall Vietnam Co., Ltd. for its Aeon Mall Bien Hoa project.

Industries - Tue, November 18, 2025 | 8:17 pm GMT+7

Police propose prosecuting Egroup CEO Nguyen Ngoc Thuy for fraud, bribery

Vietnam’s Ministry of Public Security has proposed prosecuting Nguyen Ngoc Thuy, chairman and CEO of Hanoi-based education group Egroup, along with 28 others, for fraud to appropriate property, giving bribes, and receiving bribes.

Society - Tue, November 18, 2025 | 4:01 pm GMT+7

Singapore-backed VSIP eyes large urban-industrial complex in southern Vietnam

A consortium involving VSIP, a joint venture between local developer Becamex IDC and Singapore’s Sembcorp, plans a large-scale urban-industrial development named the "Moc Bai Xuyen A complex along the Tay Ninh-Binh Duong economic corridor in southern Vietnam.

Industrial real estate - Tue, November 18, 2025 | 2:38 pm GMT+7

Aircraft maintenance giant Haeco to set up $360 mln complex in northern Vietnam

Hong Kong-based Haeco Group, Vietnam's Sun Group, and some other partners plan to invest $360 million in an aircraft maintenance, repair and overhaul (MRO) complex at Van Don International Airport in Quang Ninh province - home to UNESCO-recognized natural heritage site Ha Long Bay.

Industries - Tue, November 18, 2025 | 2:13 pm GMT+7

Thai firm opens 20,000-sqm shopping center in central Vietnam hub

MM Mega Market Vietnam (MMVN), a subsidiary of Thailand's TCC Group, on Monday opened its MM Supercenter Danang, a 20,000 sqm commercial complex with total investment capital of $20 million, in Danang city.

Real Estate - Tue, November 18, 2025 | 12:20 pm GMT+7

Vietnam PM asks Kuwait fund to expand investment in manufacturing, logistics, renewable energy

Prime Minister Pham Minh Chinh on Monday called on the Kuwait Fund for Arab Economic Development (KFAED) to strengthen cooperation with Vietnam, particularly in the areas of industrial production, logistics, renewable energy, green economy, and the Halal ecosystem.

Economy - Tue, November 18, 2025 | 11:53 am GMT+7

Thai dairy brand Betagen to build first plant in Vietnam

Betagen, a famous Thai dairy brand, plans to build its first manufacturing plant in Vietnam, located in the southern province of Dong Nai.

Industries - Tue, November 18, 2025 | 8:49 am GMT+7

Banks dominate Vietnam's Q3 earnings season, Novaland posts biggest loss

Banks accounted for more than half of the 20 most profitable listed companies in Vietnam’s Q3/2025 earnings season, while property developer Novaland recorded the largest loss.

Finance - Tue, November 18, 2025 | 8:24 am GMT+7

- Travel

-

Impressive Standard Chartered Hanoi Marathon Heritage Race 2025

-

Nguyen Hong Hai wins 'Investors' golden heart' golf tournament 2025

-

140 players compete at “Investors’ golden heart” golf tournament

-

‘Investors’ golden heart’ golf tournament to tee off on Saturday

-

Vietnam, Hong Kong Aircraft Engineering sign deal on aircraft maintenance hub at northern airport

-

Sun Group gets nod for $375 mln inland waterway tourism project in central Vietnam