Vietnam economy back on long-term growth trajectory

VinaCapital’s chief economist Michael Kokalari explains why Vietnam’s economy is expected to expand 6% this year, lower than the 8.02% recorded last year.

Vietnam’s economy and stock market are expected to “normalize” this year as the country’s economy returns to its long-term growth trajectory now that the post-pandemic re-opening boom has subsided.

We expect Vietnam’s economy and stock market to “normalize” this year. The economy is returning to its long-term growth trajectory now that the post-Covid re-opening boom has finished, and recent market action suggests that the bear market which wiped 33% off the VN-Index last year (or 35% in USD terms), despite Vietnam’s fastest GDP growth in 25 years, is ending now.

In 2023, we expect:

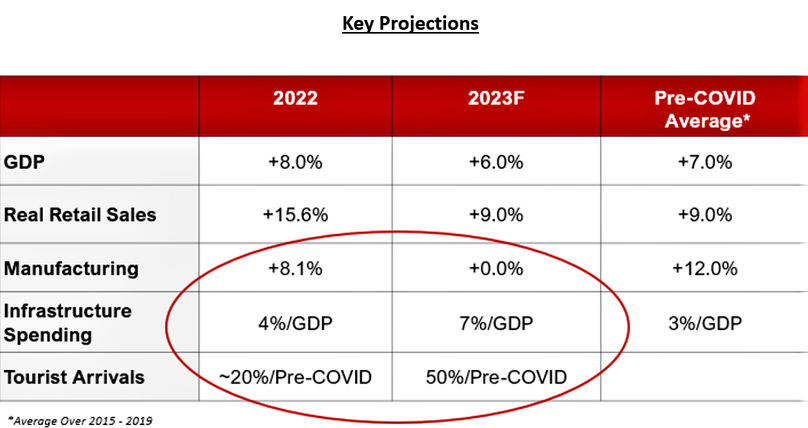

- GDP growth to slow from 8% last year to 6% this year, weighed down by the slowing demand for “Made in Vietnam” products from consumers in the US/EU, but supported by the continued resumption of foreign tourist arrivals in Vietnam, especially in light of China’s recent re-opening, and supported by a surge in the Government’s infrastructure spending.

- The stock market to rebound, as the global and domestic factors that weighed on the market last year get resolved. Specifically, global inflation pressures are easing, and we expect Vietnam’s Government to address concerns about the ability of local corporations to re-finance $5 billion of maturing corporate bonds this year, which was one of the main factors that weighed on the VN-Index last year.

- The continuation of long-term growth drivers, including continued FDI inflows, which will benefit from an intensification of US-China trade tensions last year, and urbanization and demographics, both of which help fuel the continued growth of Vietnam’s emerging middle class and domestic consumption.

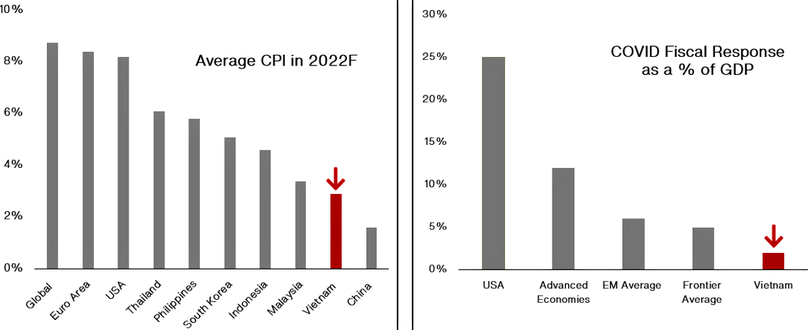

In addition to the above, we expect Vietnam’s macro economy to remain stable this year. The value of the Vietnamese dong depreciated by 3% in 2022 versus 7% depreciation for Vietnam’s regional emerging market peers, and we expect 2-3% appreciation this year. Vietnam’s CPI inflation rate averaged 3% in 2022 versus much higher inflation in most other developed market/emerging market countries in the world, but we expect that figure to tick up to 4% in 2023, largely because China’s re-opening is likely to put some upward pressure on food and energy prices in Vietnam.

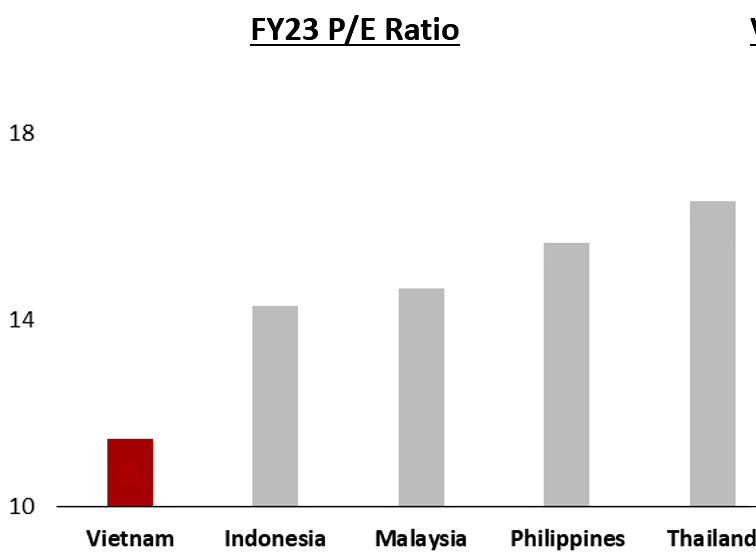

Finally, the consensus expectation is that the VN-Index will increase by over 20% this year, which would imply a normalization of the stock market’s valuation. Further to that last point, the VN-Index was trading at a circa 2-standard deviation discount to its own average P/E (price-to-earnings) ratio over the last five years in late 2022, and Vietnam’s stock market is currently trading at a considerable valuation discount to its regional peer stock markets (Thailand/ /Malaysia/Indonesia/Philippines) as can be seen above.

Vietnam’s GDP growth to slow in 2023

We expect Vietnam's GDP growth to slow from 8% in 2022 to 6% in 2023 because:

- Vietnam’s post-pandemic re-opening boom is now finished, and the demand for “Made in Vietnam” products is slowing precipitously, along with the global economy, but

- China’s reopening boom will support Vietnam's economy in 2H23 (Covid cases in China are likely to peak within the next 1-2 months) by boosting foreign tourism in Vietnam, and

- The Vietnamese Government’s planned circa 50% increase in infrastructure spending would increase spending from 4% of GDP in 2022 to 7% of GDP in 2023.

Vietnam’s GDP grew at its fastest pace in 25 years in 2022, driven by the post-pandemic consumption boom, during which Vietnamese consumers enthusiastically engaged in “revenge spending” and foreign tourists started to return to Vietnam. Consumption accounts for nearly two-thirds of Vietnam’s GDP, and retail sales (which are a good proxy for domestic consumption) grew on a month-on-month basis throughout most of 2022.

However, this sequential growth tapered off towards the end of the year and retail sales climbed back above pre-COVID levels for the first time in late 2022 as the re-opening boom ran its course. In contrast, foreign tourist arrivals accelerated dramatically in 2H22, but only reached about 20% of pre-COVID levels last year, so we expect tourist arrivals to continue accelerating, driven by China’s re-opening, and reach 50% of pre-Covid levels in 2023.

Finally, Vietnam’s economy will take a big hit from the slow-down in the global economy (driven by central bank rate hikes/monetary tightening) since manufacturing contributes about one-quarter of Vietnam’s GDP and Vietnam’s exports equate to over 90% of GDP. However, we believe that the government aims to offset some of the drag on the country’s economy with a big infrastructure spending push, which is discussed below.

Slowing US/global growth to weigh on Vietnam

Vietnam’s manufacturing sector made a big contribution to the country's economy in 2020 and 2021 because the demand from consumers in the US and EU for so-called “stay at home goods” kept Vietnamese workers busy.

Manufacturing remained remarkably resilient in the first half of last year, but growth peaked in the middle of 2022 and deteriorated throughout 2H22 as demand slowed dramatically; by the end of last year, output, employment, and orders at Vietnam’s factories were all falling fairly sharply.

Inventories at retailers and other consumer-facing firms in the US like Nike and Lululemon reportedly swelled by about 20% in 2022, which led to a decrease in Vietnam’s export orders in late-2022, and to a record-high 13% month-on-month drop in US consumer goods imports in November. In December, Vietnam’s exports fell 14% year-on-year while the exports of both China and Korea fell by about 10% y-o-y.

We do not expect factory export orders to recover until the second half of 2023, because it is likely that it will take at least six months for retailers in the US and EU to work off their excess inventories. In addition, home sales in the US are currently falling at a faster rate than during the 2008 global financial crisis (US home-sales are falling at a record-pace: -35% y-o-y versus -31% y-o-y at the worst point during the global financial crisis), which will reduce demand for furniture and other household products made in Vietnam.

Finally, the lagged effect of last year’s rate hikes by the US Fed and the European Central Bank (ECB) will continue to slow the economies of the US and Europe this year, and these two economies collectively account for nearly half of Vietnam’s total exports.

China’s re-opening to offset falling demand for “Made in Vietnam” products

We expect Chinese tourist arrivals to fully recover in the second half of 2023, and for the number of foreign tourists visiting Vietnam to increase from about 20% of pre-Covid levels in 2022 to 50% in 2023. Chinese tourists previously accounted for one-third of Vietnam’s total tourists, pre-Covid (i.e., a recovery of ⅓ of Vietnam’s tourist arrivals for ½ of the year would equate to an additional ~20% of tourist arrivals in 2023).

Foreign tourism previously contributed about 10% to Vietnam’s GDP, so we estimate that the partial resumption of foreign tourists added about 0.2% percentage points to Vietnam’s GDP growth last year. The continued rebound of Vietnam’s foreign tourist arrivals is likely to boost Vietnam’s GDP growth rate by more than 0.2% percentage points this year, which would more-than-offset the drop in manufacturing.

Further to that last point, note that Goldman Sachs expects the resumption of Chinese tourists to boost Thailand’s 2023 GDP growth by 0.3% percentage points as can be seen in the chart below on the left, which is a good reality-check for our 0.2% percentage points estimate for Vietnam, given that tourism contributes about 50% more to Thailand’s GDP than to Vietnam’s.

Finally, China’s re-opening boom will have some other positive impacts on Vietnam’s economy, but a full resumption of Chinese tourist arrivals in the second half of 2023 would be the biggest benefit to Vietnam from China dropping its “Zero Covid” policy.

Some observers have mistakenly assumed that Vietnam’s economy would accrue other, additional major benefits from China’s re-opening since China is Vietnam’s biggest trading partner and second biggest export market. However, while some individual industries in Vietnam will benefit tremendously from China’s re-opening (for example, exporters of products like fruit and seafood), Vietnam has a large trade deficit with China. Accordingly, an increase in Chinese domestic demand will only modestly benefit Vietnam.

Infrastructure development to support GDP growth

Vietnam’s Government aims to increase infrastructure spending from 4% of GDP in 2022 to 7% of GDP in 2023, which would help support the country’s long-term economic growth. This new infrastructure is needed to help ensure that FDI continues to flow into Vietnam for years to come, and the projects would also more-than-offset the drag on Vietnam’s economy from the slowdown in manufacturing. The government targets a circa 50% surge in infrastructure spending this year, from around $20 billion in 2022 to above $30 billion in 2023, versus circa $16 billion of average annual infrastructure spending over the last five years (including in 2022).

The government reportedly has nearly $40 billion of undisbursed funds deposited in banks, most of which was earmarked for infrastructure projects in past years but did not get spent due to various administrative/ bureaucratic issues; it clearly has the financial wherewithal to achieve its spending goals this year. Regarding those administrative bottlenecks, the Government announced Decree 1513 on December 15, 2022 which is intended to expedite progress on several projects, including the long-overdue North-South highway. The decree explicitly stipulates about $15 billion of spending that “must” happen in 2023.

Finally, Vietnam's government debt-to-GDP ratio is below 40%, which is very low compared to most emerging market and developing market countries around the world, partly because Vietnam spent less than 2% of GDP on Covid aid versus 6% on average in emerging markets, which is highlighted below in the discussion about inflation in Vietnam.

Continued FDI inflows

Vietnam’s main appeal as a destination for FDI stems from the fact that factory wages are about one-third of those in China, and the quality of the workforce is comparable to that of China, according to surveys by Jetro and others. Vietnam’s close geographic proximity to Asia’s supply chains, especially in the high-tech industry, is another factor. In recent years, an increasing number of multinational firms started diversifying their manufacturing outside of China for a variety of reasons, including China’s Zero-Covid policy and the US-China trade war.

In 2022, the Biden administration dramatically escalated the US-China trade war with its passage of the “Chips and Science Act” and by signaling its intention to keep Trump’s China tariffs in place indefinitely, evidenced by US Trade Representative (USTR) Katherine Tai’s assertion that the tariffs would stay in place “until the day that China chooses a path to have its economy operate more like ours”.

That escalation of trade tensions, coupled with China’s “Zero-Covid” policy, helps explain why Samsung (which is already Vietnam's single largest foreign investor) announced that it will start producing semiconductor parts in the country and Apple announced that it will begin producing Apple Watches and MacBooks in Vietnam, which will be the first time these products will be made outside of China. Apple has “big plans for Vietnam” according to insiders, who also noted that the Apple Watch is particularly complicated to manufacture because of the challenge of squeezing so many components into such a small case.

The net result of all of the above is that FDI inflows increased by another 14% in 2022 to $22 billion (or 6% of GDP) and we expect a similar magnitude of inflows this year.

Continued macro-economic stability

Inflation in Vietnam averaged 3.2% in 2022, which is much lower than inflation in most of the world’s other countries, as can be seen in the chart below on the left. One reason inflation was lower than in most developed market countries is that Vietnam’s Government did not print and spend enormous sums of money to support its economy during COVID, as can be seen in the chart below on the right; Vietnam spent less than 2%/GDP on COVID aid versus 6% on average in emerging market countries.

In addition to the points above, note that although Vietnam is nearly energy self-sufficient, the country imports around 3-4% of GDP worth of energy, so while the increase in global energy prices put some upward pressure on overall consumer price inflation in Vietnam, the impact was only modest.

That said, petrol prices in Vietnam are in-line with world/fair market prices, but Vietnam’s electricity distribution monopoly Electricity Vietnam (EVN) was slow to raise retail electricity prices in response to rising global energy prices. Consequently, electricity prices in Vietnam are likely to rise 5-10% this year, which, when combined with inflationary pressures resulting from China’s re-opening, explains why we expect it likely that Vietnam’s average CPI inflation rate will tick up from 3% in 2022 to 4% in 2023.

Rebound in Vietnam dong

The value of the VND depreciated by 3% in 2022 vs. 7% average depreciation for Vietnam’s regional emerging market peers last year, and we expect the VND to appreciate by 2-3% in 2023. The dong had depreciated by as much as 9% in early November (versus a 12% average depreciation for regional peers), driven by a near 20% surge in the value of the US Dollar/DXY Index.

The State Bank of Vietnam is widely thought to have spent about $20 billion of its FX reserves defending the VND last year, although the actual level of the SBV’s FX reserves is not officially disclosed. In addition, the SBV hiked policy rates by 100 basis points in both September and October, which raised Vietnam’s policy rate from 4% to 6%, in order to defend the VND (recall from above the inflation in Vietnam averaged 3% last year, so these rate hikes were done to protect the VND, rather than to combat inflation).

The SBV’s actions shored up confidence in the VND, and two additional developments also helped boost the value of the VND by 5% from early November to end-December:

- The value of the US Dollar/DXY index fell by 5% in November for reasons related to the US economy (the value of the USD ended up falling by 9% from its peak level until the end of December - but still ended the year up 8%).

- The value of the Chinese Yuan appreciated by about 5% driven by the December 5th announcement that China would drop its “Zero COVID” policy, which boosted sentiment towards the VND.

VN-Index’s bear market is ending

The VN-Index fell 33% in 2022 (or 35% in USD terms), so the market’s FY22 P/E ratio fell from 20x at end-2021 to 12x at end-2022 (earning per share, or EPS, grew by an estimated 5% last year).

Last year’s drop in the VNI, despite Vietnam’s fastest economic growth in 25 years, was driven by three negative factors:

- Weak global stock markets (including a 20% drop in the S&P500 last year) due to aggressive interest rate hikes by the Fed and other central banks.

- A surge in the value of the US dollar by as much as 20% in late-2022 (a higher dollar is bad for EM stock markets).

- Domestic issues, including three high-profile arrests and the Government’s regulatory crackdown that impacted the corporate bond market as well as certain real estate developers.

We believe that the bear market that ravished Vietnam’s stock market last year is now over and note that the consensus expects the VN-Index to climb by over 20%, with the rebound essentially attributable to improvements in both the domestic and international factors that weighed on the market last year. Specifically:

- Global inflation pressures are now abating, which means that the aggressive central bank rate hikes that depressed both developed and emerging market stock markets last year will likely end soon.

- We expect the Government to take steps to ease the liquidity issues currently impacting Vietnam’s corporate bond market, which would result in a resumption of Vietnamese companies’ ability to refinance their maturing debts.

In our view, instilling confidence back into the Vietnamese stock market will be a drawn-out process, but the market’s attractive valuation and solid earnings growth prospects probably explain why foreign investors purchased $1.1 billion worth of Vietnamese stocks in the last two months of 2022. They were also net buyers of Vietnam’s stock market for full-year 2022, the first time since 2019 (the consensus expects 7% earnings growth for the VN-Index in 2023, according to Bloomberg).

Investment themes and sectors

VinaCapital’s research team continues to favor the domestic consumption, infrastructure and FDI investment themes in 2023 and added lower interest rate beneficiaries and consolidation as two new themes for this year.

Regarding domestic consumption, the growth of Vietnam’s middle-class is driving reliable growth in the demand for products and services those consumers desire, which benefits consumer discretionary companies. The increased wealth of those consumers also benefits financial services companies because the demand for mortgages, credit cards, and other consumer finance/consumer credit products grows along with their wealth, as does the desire of those consumers to save money and purchase investment products.

Aviation companies in Vietnam also benefit from the continued growth of the country’s emerging middle class because of the desire of newly affluent consumers to travel domestically and abroad, and China's reopening will also boost the demand for aviation services.

Infrastructure development has been a consistent investment theme in Vietnam for years, although the Government’s expected surge in infrastructure investment this year has made us especially optimistic about the prospects for companies that are beneficiaries of increased infrastructure development, including building materials companies and aviation firms that would benefit from the construction of new airports.

Next, FDI Inflows have been one of Vietnam’s primary growth drivers in recent years, and as mentioned above, FDI inflows grew 14% last year and are likely to grow by a similar magnitude this year as more-and-more factories relocate from China to set up in Vietnam. Those inflows also directly benefit industrial park developers, ports, and real estate developers that have projects in close proximity to FDI-funded factories.

Next, interest rates in Vietnam are likely to decline as 2022 progresses because the value of the VND has started appreciating and is likely to continue appreciating (recall from above that the main reason Vietnam’s central bank hiked policy interest rates was to defend the value of the VND) and because global inflationary pressures are easing. Lower interest rates should benefit brokers, real estate, and companies with high debt levels, although lower rates may reduce the earnings of banks and companies with significant cash balances.

Finally, a tougher operating environment in Vietnam may spur some consolidation among the country’s banks, consumer companies, and real estate developers and/or consolidation of individual real estate development projects.

Conclusions

We expect Vietnam’s economy and stock market to “normalize” this year as the country’s economy is returning to its long-term growth trajectory now that the post-Covid re-opening boom has finished, while the bear market of 2022 appears to be ending as evidenced by a resumption of foreign inflows to the stock market.

GDP growth is likely to decelerate from 8% in 2022 to 6% in 2023, partly because the slowing global economy will weigh on Vietnam’s exports and manufacturing sector, but China’s re-opening is likely to boost Vietnam’s GDP growth by 0.2% percentage points via increased foreign tourism, and Vietnam’s Government guided that it aims to increase infrastructure spending from around 4% of GDP in 2022 to 7% of GDP (or circa $30 billion) in 2023.

The fact that Vietnam’s economy will have forces pushing its economic growth higher this year and weighing on its GDP growth means that some companies’ earnings will be stronger, while others may suffer more due to the global slowdown.

In this kind of environment, we expect to see more performance dispersion among and within sectors and an active approach to Vietnamese equities with high active shares should deliver a better outcome.

This was also the case in 2022 - albeit with different factors at play - when all of VinaCapital’s offshore funds outperformed the VN-Index by more than 10%pts (note that those funds also outperformed the VN-Index on a 3-year and 5-year horizon).

- Read More

Vietnam among world’s top 15 countries by im-export value: ministry

Vietnam’s import-export turnover is expected to reach $920 billion for the first time in 2025, placing the country among the world’s top 15 by trade value, according to the Ministry of Industry and Trade (MoIT).

Economy - Sun, December 21, 2025 | 11:07 am GMT+7

Dung Quat oil refinery operator BSR targets 187% net profit growth in 2026

Binh Son Refining and Petrochemical JSC (HoSE: BSR), operator of Dung Quat - Vietnam’s first oil refinery, expects net profit to surge in 2026, supported by stable oil price assumptions and a major investment plan to expand and upgrade its core refining assets.

Companies - Sun, December 21, 2025 | 8:00 am GMT+7

Dragon Capital-managed VEIL plans trio of 10% tender offers

Vietnam Enterprise Investments Limited (VEIL), the largest foreign-managed equity fund in Vietnam, has announced a tender offer for up to 10% of its issued share capital, with the option to conduct up to two additional tenders over the next year.

Finance - Sat, December 20, 2025 | 11:19 pm GMT+7

Vingroup builds development hubs across multiple sectors

With the groundbreaking and inauguration of 11 large-scale projects on Friday, Vingroup (HoSE: VIC), Vietnam's biggest listed company by market cap, reinforces its role as a pioneering private enterprise in urban development, infrastructure, energy, and industry.

Investing - Sat, December 20, 2025 | 6:32 pm GMT+7

Kinh Bac breaks ground on $437 mln industrial park in northern Vietnam province Thai Nguyen

Kinh Bac City Development Holding Corp (HoSE: KBC) on Friday broke ground on the VND11.5 trillion ($437.06 million) Phu Binh Industrial Park project in Thai Nguyen province.

Industrial real estate - Sat, December 20, 2025 | 5:46 pm GMT+7

Construction giant Fecon starts work on Hanoi metro line, northern Vietnam rail link

Fecon, a leading Vietnamese construction group, on Friday broke ground on two major rail projects: a metro line in Hanoi and a strategic railway linking the capital city with northern localities.

Infrastructure - Sat, December 20, 2025 | 2:08 pm GMT+7

SJ Group to build smart urban area in western Hanoi to bolster Hoa Lac High-tech Park

Vietnam's leading developer SJ Group JSC is outlining plans for its over 1,200-hectare Tien Xuan Smart Urban Area project in Hanoi, which is expected to be a residential and service hub of the Hoa Lac science and technology city.

Real Estate - Sat, December 20, 2025 | 10:36 am GMT+7

Indonesia to deepen role in global semiconductor supply chain

Indonesia is rolling out efforts to identify opportunities and map its natural resources to support the semiconductor industry, as part of a broader strategy to build domestic industrial capacity.

Southeast Asia - Sat, December 20, 2025 | 9:36 am GMT+7

Indonesia to stop rice imports next year

Indonesia will not import rice for either consumption or industrial use next year, citing sufficient domestic production, according to a government official.

Southeast Asia - Sat, December 20, 2025 | 8:00 am GMT+7

Northern Vietnam port city Hai Phong charts sustainable growth path for free trade zone

The establishment of Hai Phong Free Trade Zone (FTZ) is a strategic direction that will elevate the role and position of Vietnam in general and Hai Phong in particular within the global value chain, heard a conference held in the northern port city last week.

Economy - Fri, December 19, 2025 | 8:12 pm GMT+7

Construction begins on $32.5 bln Red River Scenic Boulevard project in Hanoi

The gigantic project Red River Scenic Boulevard, with a preliminary investment of about VND855 trillion ($32.49 billion) in Phu Thuong ward, Hanoi, broke ground on Friday.

Real Estate - Fri, December 19, 2025 | 4:57 pm GMT+7

Major Vietnamese groups kick off mega projects in south-central Vietnam

Vingroup, BIN Corporation, Hoa Phat, and FPT simultaneously broke ground on large-scale projects in south-central Vietnam on Friday, raising expectations for new national growth momentum in the coming period.

Economy - Fri, December 19, 2025 | 4:36 pm GMT+7

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

The first passenger flights touched down at Long Thanh International Airport in Dong Nai province on Friday morning, marking the inaugural civil aviation operation at Vietnam’s largest airport.

Economy - Fri, December 19, 2025 | 2:07 pm GMT+7

Vingroup starts work on $35.2 bln Olympic Sports Urban Area on Hanoi outskirts

Vingroup (HoSE: VIC), Vietnam's leading private conglomerate, on Friday broke ground on its 9,171-hectare Olympic Sports Urban Area project in Hanoi, which is expected to become a new growth engine for the southern part of the capital in the next decade.

Real Estate - Fri, December 19, 2025 | 1:59 pm GMT+7

Vietnam telecom giant VNPT establishes AI company

State-owned Vietnam Posts and Telecommunications Group (VNPT) on Thursday launched subsidiary VNPT AI, aiming to bring Vietnamese AI products to international markets.

Companies - Fri, December 19, 2025 | 11:50 am GMT+7

Quang Ngai Sugar develops sugar, biomass power projects worth $179 mln in central Vietnam

Quang Ngai Sugar JSC (UPCom: QNS), a top sugar producer in Vietnam, will simultaneously hold groundbreaking or inauguration ceremonies on Friday for three projects worth over VND4.7 trillion ($178.5 million) in Gia Lai province.

Companies - Fri, December 19, 2025 | 8:05 am GMT+7

- Travel

-

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

-

Vietnam defeat Thailand to win men’s football gold at SEA Games 33

-

Which beach in Vietnam boasts the Pantone - 'color of the year 2026'?

-

Unprecedented national milestone in 65 years: Vietnam welcomes 20 millionth international visitor

-

Techcombank HCMC International Marathon affirms global standing

-

Vietnam's tour operator Vietravel announces full exit from Vietravel Airlines