FDI a bright spot in Vietnam's economic picture: economist

Amid the volatile geopolitical and economic landscapes worldwide, Vietnam’s leadership has proactively pursued policies favoring innovations. As a result, the country has reaped significant achievements, with foreign direct investment (FDI) becoming a bright spot in the its socio-economic picture, writes Prof. Nguyen Mai, former Vice Chairman of the State Committee for Cooperation and Investment.

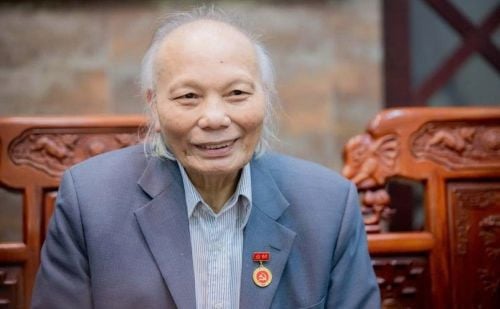

Prof. Nguyen Mai, former Vice Chairman of the State Committee for Cooperation and Investment and former chairman of the Vietnam’s Association of Foreign-Invested Enterprises (VAFIE). Photo by The Investor.

Global FDI trends

According to the United Nations Trade and Development (UNCTAD), global FDI flows declined for the second straight year in 2024 amid slipping investor confidence fueled by conflicts, trade wars among major powers, reciprocal U.S. tariffs, and disrupted supply chains. UNCTAD secretary-general Rebeca Grynspan likened geopolitical tensions and trade fragmentation to “a poison” for investor confidence.

Excluding transit economies in Europe, FDI transactions fell by 11%, prompting serious concerns about a potential stall in investment activity and its longer-term consequences. Yet, when transit hubs are included, FDI surged by 4% to reach $1.5 trillion.

Developed economies, especially Europe, saw a steep decline of 58% in FDI while North America recorded a 23% rise, led by the U.S. Southeast Asia ranked second in FDI inflows with $225 billion, and Africa recorded an impressive 75% increase.

ASEAN’s FDI momentum

Southeast Asia continued to shine as a global FDI hotspot, with inflows hitting a record $230 billion in 2023. In 2024, most FDI targeted manufacturing in areas like electric vehicles and electronics. Yun Liu of HSBC attributed the rebound in industrial production across ASEAN to a global trade slowdown in 2022-2023.

Between 2022 and September 2023, Indonesia alone attracted $94 billion, drawing heavily from mainland China, Taiwan, and the U.S., as multinational firms leveraged a “China + 1” strategy to diversify supply chains.

Analyst Stephen Bates of KPMG Singapore said ASEAN remains a major production hub for electronics and smartphones, with significant FDI from global tech firms.

Renewed investment in high-value electronics like semiconductors and screens could further spur innovation and economic growth. Digitization and climate commitments have also drawn investments into digital infrastructure - data centers, 5G networks, green buildings, and eco-friendly transport, he said.

Private market research firm Preqin reported that between 2021 and Q4/2024, ASEAN recorded 354 infrastructure deals totaling $46.3 billion, with nearly half in renewable energy. Its analyst Gerald Minjoot noted that the region’s climate pledges are fueling this trend.

Bates remarked that urbanization, rising middle-class incomes, and connectivity initiatives will keep digital and sustainable infrastructure at the center of foreign investment, with public-private partnerships playing a key role.

Notably, Vietnam led ASEAN FDI in real estate and construction from 2022 to September 2024, attracting about $8 billion thanks to political stability, robust economic growth, competitive labor costs, and expanding trade agreements, according to GlobalData.

VSIP Industrial Park in Bac Ninh province, northern Vietnam. Photo courtesy of VSIP.

Vietnam’s FDI in 2025

The government’s Resolution 226, dated August 5, 2025, targets GDP growth of 8.3-8.5% for 2025, with inflation under 4.5% and total investment up 11-12%.

In the second half of the year, the country aims to mobilize VND2,800 trillion ($162.28 billion) in investment, attract VND1,500 trillion in private capital and $18 billion in registered FDI, and disburse $16 billion in FDI and VND165 trillion from other sources.

According to the U.S. Semiconductor Industry Association (SIA), businesses and suppliers in the semiconductor supply chain are primarily concentrated in the U.S., the EU, Japan, South Korea, Taiwan, and mainland China. One of the most distinctive features of the semiconductor industry is the disparity in human and financial resources across different stages of production.

These differences allow companies to focus on the tasks they do best, while outsourcing other stages to firms that are better equipped to handle them, thereby gaining a competitive advantage.

Stages that require high intellectual capacity, such as design and R&D, are concentrated in developed countries, while labor-intensive tasks that require lower technical skills such as assembly, testing, and packaging are typically handled by other nations.

However, the SIA said this model is undergoing changes thanks to advances in packaging technology, which are creating new opportunities for businesses as demand for skilled labor in the final stages of the production chain increases.

According to the World Bank, Vietnam is among the leading countries in the field of electronic microchips, primarily involved in assembly, testing, and packaging activities, which generate relatively low added value.

With the semiconductor value chain now surpassing the $1 trillion mark, Vietnam has strong potential and is certainly not looking to miss the opportunity to expand and participate more deeply in this global value chain in the future.

Thanks to its increasingly strengthened strategic position, Vietnam has quickly become a favored destination for major players in the industry. In 2024, Vietnam’s semiconductor industry was estimated to generate $18.23 billion in revenue. By engaging in the final stages of the process, Vietnam has become known as a key service hub for major corporations such as Intel, Samsung, and Hana Micron.

As of 2023, Vietnam became the third-largest semiconductor exporter to the U.S., with exports valued at $562 million, trailing only Malaysia and Taiwan.

Vietnam still holds great potential to further establish itself as "a factory of the world." However, to escape the middle-income trap, the country must deepen its involvement in knowledge-intensive activities that yield higher added value.

Vietnam’s Semiconductor Industry Development Strategy through 2030 with a vision toward 2050 has laid out a clear roadmap for the country to become a major hub in the semiconductor field.

The government has set targets for at least 300 design enterprises, three chip manufacturing plants, and 20 packaging and testing facilities by 2050. This strategy aims to leverage Vietnam’s existing strengths while building the foundation for the country to attain a new position - one where it can master research and proactively develop the semiconductor sector.

In recent years, Vietnam has been actively working to build an attractive investment environment, where high-tech industries are seen as a key pillar in its sustainable development strategy and in enhancing global competitiveness.

Recommendations for the business community

Recognized as the core of the electronics industry, the global semiconductor sector has witnessed an annual revenue growth of 14% from 2001 to 2021.

To seize and realize future opportunities, Vietnam has developed and implemented several key initiatives, such as completing special mechanisms and policies, and synchronizing infrastructure and facilities for the semiconductor industry.

At a recent conference on human resource development for the semiconductor industry, delegates emphasized the need for Vietnam to rapidly implement these priorities.

As domestic regulations are continuously being updated to support this promising industry, Deloitte recommends that enterprises and investors closely monitor domestic developments, particularly in terms of legal and regulatory changes.

Vietnam is currently committed to the Organisation for Economic Co-operation and Development’s (OECD) Pillar Two requirements, while simultaneously developing policies to support new investors. This reflects Vietnam’s proactive approach to high-tech enterprises - those that fall under Pillar Two but are still prioritized for investment.

In parallel, efforts to review and assess laws, decrees, and circulars as well as the government’s plans to streamline and reorganize its administrative apparatus are noteworthy, with the aim of improving public sector management capacity and labor productivity.

During this period, the business community and foreign investors must continuously stay updated on new state policies and actions, while also consulting with professional advisory firms to prepare thoroughly and remain ready to capture emerging opportunities.

One of the most critical issues facing not only the semiconductor industry but the high-tech sector in general is the shortage of high-quality talent. According to Deloitte’s report on the global semiconductor talent gap, more than one million highly skilled professionals will need to be added to meet the industry’s development demands by 2030.

Currently, Vietnam has only about 5,000 semiconductor design engineers, far below the projected need of 50,000 engineers by 2030, including 15,000 specifically in semiconductor design.

Deloitte also noted that semiconductor companies must recognize that they are not only competing with each other for talent. The shortage spans across the entire the technology, media, and telecommunications (TMT) sector, where brain drain to other countries is a common challenge.

The talent landscape in the semiconductor industry has changed significantly in the past 2-3 years, as both the quantity and quality of talent and the skills required are evolving rapidly in both the short and long term.

In light of this reality, businesses need to re-evaluate their talent acquisition strategies, make the most of partnerships with educational and training institutions, and above all, clearly define their current capabilities and long-term goals.

This will enable the development of a suitable workforce strategy to build a sustainable competitive advantage in the industry.

* Prof. Nguyen Mai is also former chairman of the Vietnam’s Association of Foreign-Invested Enterprises (VAFIE).

- Read More

Vietnam’s largest Aeon Mall to take shape in Dong Nai province

Authorities of Dong Nai province, a manufacturing hub in southern Vietnam, on Monday awarded an investment registration certificate to Japanese-invested Aeon Mall Vietnam Co., Ltd. for its Aeon Mall Bien Hoa project.

Industries - Tue, November 18, 2025 | 8:17 pm GMT+7

Police propose prosecuting Egroup CEO Nguyen Ngoc Thuy for fraud, bribery

Vietnam’s Ministry of Public Security has proposed prosecuting Nguyen Ngoc Thuy, chairman and CEO of Hanoi-based education group Egroup, along with 28 others, for fraud to appropriate property, giving bribes, and receiving bribes.

Society - Tue, November 18, 2025 | 4:01 pm GMT+7

Singapore-backed VSIP eyes large urban-industrial complex in southern Vietnam

A consortium involving VSIP, a joint venture between local developer Becamex IDC and Singapore’s Sembcorp, plans a large-scale urban-industrial development named the "Moc Bai Xuyen A complex along the Tay Ninh-Binh Duong economic corridor in southern Vietnam.

Industrial real estate - Tue, November 18, 2025 | 2:38 pm GMT+7

Aircraft maintenance giant Haeco to set up $360 mln complex in northern Vietnam

Hong Kong-based Haeco Group, Vietnam's Sun Group, and some other partners plan to invest $360 million in an aircraft maintenance, repair and overhaul (MRO) complex at Van Don International Airport in Quang Ninh province - home to UNESCO-recognized natural heritage site Ha Long Bay.

Industries - Tue, November 18, 2025 | 2:13 pm GMT+7

Thai firm opens 20,000-sqm shopping center in central Vietnam hub

MM Mega Market Vietnam (MMVN), a subsidiary of Thailand's TCC Group, on Monday opened its MM Supercenter Danang, a 20,000 sqm commercial complex with total investment capital of $20 million, in Danang city.

Real Estate - Tue, November 18, 2025 | 12:20 pm GMT+7

Vietnam PM asks Kuwait fund to expand investment in manufacturing, logistics, renewable energy

Prime Minister Pham Minh Chinh on Monday called on the Kuwait Fund for Arab Economic Development (KFAED) to strengthen cooperation with Vietnam, particularly in the areas of industrial production, logistics, renewable energy, green economy, and the Halal ecosystem.

Economy - Tue, November 18, 2025 | 11:53 am GMT+7

Thai dairy brand Betagen to build first plant in Vietnam

Betagen, a famous Thai dairy brand, plans to build its first manufacturing plant in Vietnam, located in the southern province of Dong Nai.

Industries - Tue, November 18, 2025 | 8:49 am GMT+7

Banks dominate Vietnam's Q3 earnings season, Novaland posts biggest loss

Banks accounted for more than half of the 20 most profitable listed companies in Vietnam’s Q3/2025 earnings season, while property developer Novaland recorded the largest loss.

Finance - Tue, November 18, 2025 | 8:24 am GMT+7

Highlands Coffee posts strongest quarterly earnings in 2 years on robust same-store sales

Highlands Coffee, Vietnam’s largest coffee chain, delivered its best quarterly performance in two years, with Q3 EBITDA exceeding PHP666 million ($11.27 million), parent company Jollibee Foods Corporation (JFC) said in its latest earnings report.

Companies - Mon, November 17, 2025 | 10:21 pm GMT+7

Hong Kong firm Dynamic Invest Group acquires 5% stake in Vingroup-backed VinEnergo

VinEnergo, an energy company backed by Vingroup chairman Pham Nhat Vuong, has added a new foreign shareholder after Hong Kong–based Dynamic Invest Group Ltd. acquired a 5% stake, according to a regulatory filing on Saturday.

Companies - Mon, November 17, 2025 | 9:52 pm GMT+7

Thai giant CP’s Q3 Vietnam revenue drops 20% as hog prices slump

Thailand’s Charoen Pokphand Foods PCL (CPF) reported a sharp downturn in its Vietnam business in Q3, making the country its only major market to contract.

Companies - Mon, November 17, 2025 | 4:16 pm GMT+7

Surging demand for gas turbines tightens supply chains, extends lead times: Siemens Energy

Demand for gas turbines is rising rapidly, especially in regions with a surge in data center development, tightening supply chains and extending lead times - factors that investors must closely track during project preparation, according to Siemens Energy.

Companies - Mon, November 17, 2025 | 1:34 pm GMT+7

Novaland completes first phase of restructuring, targets 'returning to growth' from 2027

Novaland, a leading real estate developer in Vietnam, said it has completed the first phase of its multi-year restructuring plan and aims to finish the entire program by end-2026, positioning the company to return to growth from 2027.

Companies - Mon, November 17, 2025 | 12:26 pm GMT+7

Vietnam's property developer Regal Group to list shares on HCMC bourse in Q4

Regal Group JSC, a property developer based in the central city of Danang, has applied to list its 200 million RGG shares on the Ho Chi Minh City Stock Exchange (HoSE) in Q4/2025.

Real Estate - Mon, November 17, 2025 | 10:52 am GMT+7

Vietnam's upstream oil & gas stocks surge on project momentum, regulatory easing

Stocks of Vietnam’s upstream oil and gas companies have surged in recent weeks, boosted by rising exploration activity and new rules that accelerate project approvals, while midstream and downstream players face pressure from falling crude prices.

Companies - Mon, November 17, 2025 | 8:57 am GMT+7

Indonesia to turn Bali into Asia’s next medical tourism hotspot

Indonesia is stepping up efforts to reduce the number of citizens seeking treatment abroad and turn Bali into Asia’s leading medical tourism hotspot.

Southeast Asia - Sun, November 16, 2025 | 9:05 pm GMT+7