HCMC bourse leaders complicit with FLC chairman appropriating $146 mln

Former chairman of the Ho Chi Minh City Stock Exchange (HoSE) Tran Dac Sinh and three other officials helped then chairman of real estate developer FLC Group Trinh Van Quyet to list shares on the bourse, appropriating VND3.6 trillion ($146 million) from investors.

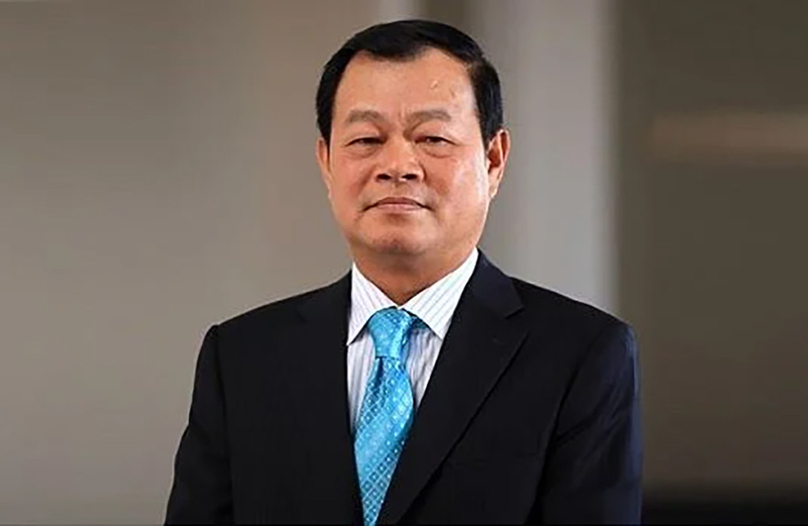

Tran Dac Sinh, former chairman of the Ho Chi Minh City Stock Exchange (HoSE). Photo courtesy of the exchange.

The Ministry of Public Security’s investigation agency (C01) on Saturday issued a conclusion on their extended probe into the stock manipulation and asset appropriation case involving Quyet.

Accordingly, the agency proposed prosecuting four former HoSE officials, including former chairman Tran Dac Sinh; Le Hai Tra, former board member, permanent deputy general director and independent member of the Listing Council; Tran Tuan Vu, former deputy general director and vice chairman of the council; and Le Thi Tuyet Hang, member of the council.

The four were charged with abusing power while performing duties per Clause 3, Article 356 of the Penal Code.

Three others were accused of intentionally publishing false information or concealing information related to securities activities, in line with Clause 2, Article 209 of the Penal Code.

They are Le Cong Dien, head of the Public Company Supervision Department under the State Securities Commission (SSC); Duong Van Thanh, general director of the SSC’s Vietnam Securities Depository (VSD); and Pham Minh Trung, head of the VSD’s securities registration division.

Trinh Van Quyet and seven others were investigated for stock market manipulation and fraudulent appropriation of assets; while 13 were charged with stock market manipulation and 22 with fraudulent appropriation of assets.

According to the conclusion, Faros Construction JSC, a member of the FLC ecosystem, was formerly a loss-making company. Quyet directed his subordinates to acquire stakes and changed its name multiple times. After many years of almost inactivity, in April 2014, the company began constructing real estate projects invested by FLC Group.

With the aim of appropriating money from investors, from April 2014 to September 2016, Quyet directed his subordinates to conduct procedures to increase FLC Faros’s charter capital from VND1.5 billion to VND4.3 trillion ($174.5 million).

Faros then requested the registration of a stock listing of 430 million ROS shares on the HoSE to sell to investors. During this process, Quyet was aided by the four HoSE officials.

After receiving the application to list Faros shares, Sinh as HoSE chairman acknowledged that the company was not eligible for listing as the audit reports on its 2014 and 2015 financial situations noted that "there is not enough basis to determine the actual amount of contributed capital".

However, due to his personal relationship and repeated requests for help from Quyet and Doan Van Phuong, former CEO of FLC Group, Sinh helped to list Faros. He repeatedly directed his subordinates Tra, Vu and Hang to create favorable conditions for Faros’s listing as soon as possible.

According to the HoSE’s operating regulations, the appraisal and approval of stock listings are not under the authority of the board of directors. However, in August 2016, when Faros had not yet provided full documents, Sinh directed the board office to make a written notice requesting the Listing Council to report on the appraisal results.

Sinh and the board members approved the listing and signed a resolution saying the profile met the listing conditions. With Sinh's continuous directions, Faros's stock was approved for listing on the HoSE as ROS, with par value of VND10,000 ($0.41 according to the current exchange rate) per share.

As Sinh's subordinate, Tra was responsible for directly researching and evaluating listing applications to give an independent opinion on stock listing approval.

When researching and evaluating Faros's listing registration application, Tra knew clearly the company’s violations mentioned in the financial audit reports. He then twice consulted the members of the Listing Council and they all agreed that the conditions were not met, requiring Faros to submit an explanatory report.

However, on receiving the report, Tra and the Listing Council members "agreed immediately" although they had not studied it.

At the investigation agency, Tra admitted that this was "due to his relations with Quyet and Phuong". "At that time I thought that the listing approval would help Faros attract capital from investors in the market and the HoSE gain revenue from collecting listing fees and securities transaction fees, thereby enhancing my personal reputation," he said.

Le Hai Tra, former general director of the Ho Chi Minh Stock Exchange. Photo courtesy of Thanh Nien (Young People) newspaper.

Dien, in his role as head of the Public Company Supervision Department, discovered insufficient basis to determine contributed capital when evaluating Faros's application.

However, he signed a document approving the application and then published it in the media. Later, Faros was successfully listed on the HoSE with charter capital of VND4.3 trillion ($174.5 million).

Dien admitted that because Faros was a large company and Quyet "had many relationships with leaders at all levels and owned a company specializing in legal consultancy", he was afraid of being affected.

During the appraisal, he requested Faros to provide more evidence, but the company complained twice that he "performed his task beyond authority and caused difficulties for the business". Dien claimed that because he was afraid that his job would be affected, Dien committed the mistake although he “knew it was wrong".

In August 2016, Faros was accepted by the Vietnam Securities Depository Center to register 430 million ROS shares with par value VND10,000. One month later, ROS officially listed on the HoSE with a reference price of VND10,500 per share.

After ROS's listing, Quyet continued to instruct his subordinates to use tricks to increase Faros’s charter capital to VND5.6 trillion ($227.3 million). In fact, all of this was "pie in the sky" to attract investors, increasing the value of the ticker.

For the purpose of appropriating investors' money, from September 2016 to March 2022, Quyet directed his younger sister Trinh Thi Minh Hue to sell nearly 400 million shares to more than 30,400 investors for VND4.8 trillion ($194.8 million).

According to the investigation conclusion, Quyet appropriated VND3.6 trillion ($146 million) from investors and used it for a variety of purposes.

- Read More

Thai dairy brand Betagen to build first plant in Vietnam

Betagen, a famous Thai dairy brand, plans to build its first manufacturing plant in Vietnam, located in the southern province of Dong Nai.

Industries - Tue, November 18, 2025 | 8:49 am GMT+7

Banks dominate Vietnam's Q3 earnings season, Novaland posts biggest loss

Banks accounted for more than half of the 20 most profitable listed companies in Vietnam’s Q3/2025 earnings season, while property developer Novaland recorded the largest loss.

Finance - Tue, November 18, 2025 | 8:24 am GMT+7

Highlands Coffee posts strongest quarterly earnings in 2 years on robust same-store sales

Highlands Coffee, Vietnam’s largest coffee chain, delivered its best quarterly performance in two years, with Q3 EBITDA exceeding PHP666 million ($11.27 million), parent company Jollibee Foods Corporation (JFC) said in its latest earnings report.

Companies - Mon, November 17, 2025 | 10:21 pm GMT+7

Hong Kong firm Dynamic Invest Group acquires 5% stake in Vingroup-backed VinEnergo

VinEnergo, an energy company backed by Vingroup chairman Pham Nhat Vuong, has added a new foreign shareholder after Hong Kong–based Dynamic Invest Group Ltd. acquired a 5% stake, according to a regulatory filing on Saturday.

Companies - Mon, November 17, 2025 | 9:52 pm GMT+7

Thai giant CP’s Q3 Vietnam revenue drops 20% as hog prices slump

Thailand’s Charoen Pokphand Foods PCL (CPF) reported a sharp downturn in its Vietnam business in Q3, making the country its only major market to contract.

Companies - Mon, November 17, 2025 | 4:16 pm GMT+7

Surging demand for gas turbines tightens supply chains, extends lead times: Siemens Energy

Demand for gas turbines is rising rapidly, especially in regions with a surge in data center development, tightening supply chains and extending lead times - factors that investors must closely track during project preparation, according to Siemens Energy.

Companies - Mon, November 17, 2025 | 1:34 pm GMT+7

Novaland completes first phase of restructuring, targets 'returning to growth' from 2027

Novaland, a leading real estate developer in Vietnam, said it has completed the first phase of its multi-year restructuring plan and aims to finish the entire program by end-2026, positioning the company to return to growth from 2027.

Companies - Mon, November 17, 2025 | 12:26 pm GMT+7

Vietnam's property developer Regal Group to list shares on HCMC bourse in Q4

Regal Group JSC, a property developer based in the central city of Danang, has applied to list its 200 million RGG shares on the Ho Chi Minh City Stock Exchange (HoSE) in Q4/2025.

Real Estate - Mon, November 17, 2025 | 10:52 am GMT+7

Vietnam's upstream oil & gas stocks surge on project momentum, regulatory easing

Stocks of Vietnam’s upstream oil and gas companies have surged in recent weeks, boosted by rising exploration activity and new rules that accelerate project approvals, while midstream and downstream players face pressure from falling crude prices.

Companies - Mon, November 17, 2025 | 8:57 am GMT+7

Indonesia to turn Bali into Asia’s next medical tourism hotspot

Indonesia is stepping up efforts to reduce the number of citizens seeking treatment abroad and turn Bali into Asia’s leading medical tourism hotspot.

Southeast Asia - Sun, November 16, 2025 | 9:05 pm GMT+7

Malaysia aims to become Southeast Asia’s AI, EV hub

Malaysia is shifting into high gear as it positions itself to become Southeast Asia’s leading hub for smart, sustainable mobility, powered by breakthroughs in electric vehicles (EVs), artificial intelligence (AI), and advanced manufacturing.

Southeast Asia - Sun, November 16, 2025 | 9:00 pm GMT+7

108 foreign investors hold 26.8% stake in Vietnam's industrial giant Thaco

Vietnam’s industrial conglomerate Truong Hai Group (Thaco) has reported a charter capital of VND30.51 trillion ($1.16 billion), with domestic private capital accounting for 73.2% and 108 foreign investors holding the remaining 26.8% stake.

Companies - Sun, November 16, 2025 | 4:42 pm GMT+7

Vietnam the most important manufacturing hub of Chinese electronics giant Luxshare-ICT: exec

Major Chinese electronics manufacturer Luxshare-ICT will expand its operations in Vietnam by rolling out large science-technology and innovation projects in the northern province of Bac Ninh and other localities, its vice chairman Wang Laisheng said on Saturday.

Companies - Sun, November 16, 2025 | 2:46 pm GMT+7

Sweden’s Syre reinforces $1 bln textile recycling plant in Vietnam with Nike deal

A strategic deal with U.S. sportswear giant Nike is expected to consolidate Swedish recycling start-up Syre's plans to roll out a global network of textile-to-textile recycling facilities, beginning with a $1 billion plant in Vietnam.

Industries - Sun, November 16, 2025 | 8:00 am GMT+7

Vietnam plans roadmap to allow short selling under stock market upgrade program

Vietnam’s Ministry of Finance has outlined a plan to introduce short selling and securities lending on a controlled basis as part of its broader effort to upgrade the country’s stock market from frontier to secondary emerging status.

Finance - Sat, November 15, 2025 | 8:01 pm GMT+7

Vietnam's first LNG power plants to begin commercial operation in Nov-Dec

Nhon Trach 3 and 4, Vietnam’s first LNG-fired power plants, are expected to begin commercial operations at the end of 2025, according to authorities in the southern province of Dong Nai.

Energy - Sat, November 15, 2025 | 3:42 pm GMT+7