Investment Support Fund decree to boost Vietnam's appeal as high-tech investment destination: lawyers

The Vietnamese Government recently issued Decree No. 182/2024/ND-CP, which outlines the establishment, management and use of the Investment Support Fund. The decree is expected to bolster the country's appeal as a destination for high-tech investment, especially after the application of top-up corporate income tax (CIT) under the global anti-base erosion rules from January 1, 2024, write senior partner Anh Dang and associate Chi Nguyen at Vilaf law firm.

Anh Dang, a senior partner at Vilaf law firm. Photo courtesy of the law firm.

Decree No. 182/2024/ND-CP, which offers financial supports to enterprises in high-tech industries, was issued on December 31, 2024 and came into effect from fiscal year 2024. Key highlights on the decree are discussed below.

Overview of Investment Support Fund (ISF)

ISF operates a non-profit national fund, established by the Government and managed by the Ministry of Planning and Investment. A portion of its funding originates from top-up CIT revenues under global anti-base erosion rules.

ISF provides cash subsidies in Vietnamese dong to eligible enterprises with qualified investment projects in Vietnam. There are two types of subsidies:

- Annual expense subsidies, which cover actual expenses enterprises incur in a financial year; and

- Initial investment subsidies, which cover initial investment costs enterprises incur for a project.

Enterprises may apply for only one type of subsidy. The amounts of subsidies are determined based on enterprises’ proposal, subject to relevant capped limits and fund availability. These subsidies are not be subject to CIT and may be granted for up to five years, with potential extensions approved by the Prime Minister.

Committing violations (such as subsidy fraud) under Article 4 of Decree 182 may trigger refund obligations and penalties against violating enterprises. The statute of limitations for requiring refunds and penalties from the violating enterprise is five years from the date such enterprise receives the subsidies.

Illustration courtesy of Lockheed Martin.

Annual expense subsidies

Annual expense subsidies are available to (a) high-tech enterprises; (b) enterprises having projects manufacturing high-tech products; (c) enterprises having projects applying high technologies; and (d) enterprises having R&D center projects.

Subject to the type of project that they have engaged in, these enterprises must meet the following requirements, among others, to be granted with the subsidies:

- For (a) high-tech enterprises having projects, (b) enterprises having projects manufacturing high-tech products or (c) enterprises having projects applying high technologies in the fields of chip industry, semiconductor integrated circuits, and AI database center: The relevant project must have a minimum investment capital of VND6,000 billion ($236.34 million) or a minimum annual revenue of VND10,000 billion ($393.9 million);

- For (a) high-tech enterprises having projects, (b) enterprises having projects manufacturing high-tech products or (c) enterprises having projects applying high technologies involving breakthrough high technologies and high-tech products stipulated under the List issued by the Prime Minister: No investment capital or revenue requirements;

- For (a) high-tech enterprises having projects, (b) enterprises having projects manufacturing high-tech products or (c) enterprises having projects applying high technologies in the field of integrated circuit design: No investment capital or revenue requirements. However, the relevant enterprise must have the commitment to employ at least 300 Vietnamese engineers and/or managers after five years of operation in Vietnam and annually assist Vietnam in training at least 30 high-quality Vietnamese engineers in the field of integrated circuit design;

- For (a) high-tech enterprises having projects, (b) enterprises having projects manufacturing high-tech products or (c) enterprises having projects applying high technologies in other fields: The relevant project must have a minimum investment capital of VND12,000 billion ($472.67 million) or a minimum annual revenue of VND20,000 billion ($787.79 million); and

- For (d) enterprises having R&D center projects:

The relevant project must have a minimum investment capital of VND3,000 billion ($118.17 million), in which at least VND1,000 billion must have been disbursed within three years from the issuance of Investment Policy Approval, Investment Registration Certificate or other equivalent document.

The operation of the R&D center must focus on creating high technologies in the List of high technologies prioritized for development and/or high-tech products in the List of high-tech products encouraged for development issued by the Prime Minister.

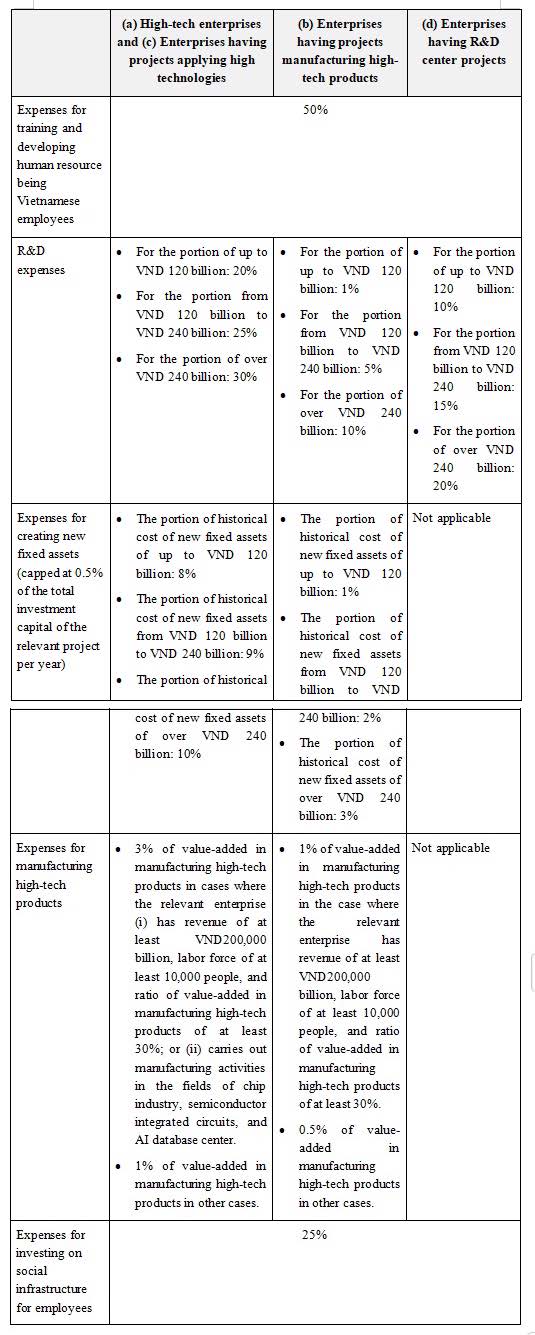

These subsidies cover six categories of expenses, including (i) expenses for training and developing human resource being Vietnamese employees; (ii) R&D expenses; (iii) expenses for creating new fixed assets; (iv) expenses for manufacturing high-tech products; (v) expenses for investing on social infrastructure for employees (i.e., social housing for employees to rent, schools, kindergartens, medical facilities, cultural facilities, sports facilities); and (vi) other expenses as determined by the Government. Each category has capped subsidy limit based on actual expenses incurred in the financial year, as demonstrated in the table below:

Initial investment subsidies

Unlike annual expense subsidies, initial investment subsidies are exclusively available to enterprises with R&D center projects in the fields of semiconductor and AI. To be granted with initial investment subsidies, these enterprises must meet the same requirements as applied to them if they wish to receive annual expenses subsidies, among others. Further, the relevant project must have a positive impact on Vietnam’s innovation ecosystem and development of breakthrough new technologies and products.

For each eligible project, the subsidy amount is capped at 50% of its initial investment expenses. Enterprises may propose to receive the subsidies as a one-off payment or an annual payment over multiple years.

Application and disbursement

Enterprises seeking subsidies from ISF for a financial year must submit their applications to the following authority before the 10th of July of the following financial year:

- For enterprises not yet operational and those applying for initial investment subsidies: Ministry of Planning and Investment;

- For enterprises having projects already in operation: Management Board of Economic Zone, Industrial Zone or High-tech Zone (if the relevant project is located within those zones) or provincial Department of Planning and Investment (if the relevant project is located outside those zones).

The applications will be evaluated and assessed by different authorities before submitted to the Government for its final approval of the total amount of subsidies by the 30th of October of the following financial year. Approved subsidies will then be disbursed by the State Treasury after necessary internal procedures are completed.

Recommendation

As applications for ISF subsidies for the 2024 financial year are due in July 2025, enterprises in high-tech industries should begin assessing their eligibility and prepare necessary documentation well ahead of the deadline. It is equally important to stay updated on any new guidance from relevant authorities to ensure their compliance and readiness. By acting early and keeping an eye on updates, businesses can maximize their chances of benefiting from ISF incentives.

- Read More

Vietnam’s realty market may soon shift from undersupply to oversupply: experts

The real estate market in Vietnam will soon face oversupply, a reversal of the supply shortage seen in recent years, according to economist Dr. Le Xuan Nghia.

Real Estate - Fri, July 4, 2025 | 11:29 am GMT+7

Vietnam’s benchmark VN-Index likely to reach 1,500 points on new US tariff: broker

The VN-Index, representing the Ho Chi Minh Stock Exchange (HoSE), may reach 1,500 points in the coming time as the tariff agreement reached with the U.S. is expected to boost investor sentiment, according to Maybank Securities Vietnam (MSVN).

Finance - Fri, July 4, 2025 | 8:38 am GMT+7

Chinese materials major Kingfa on track to complete $80 mln plant in southern Vietnam

Kingfa, China’s leading advanced materials company, on Wednesday held a topping-out ceremony for its $80 million plant in Dong Nai province, a key industrial hub in southern Vietnam.

Industries - Fri, July 4, 2025 | 8:23 am GMT+7

Vietnam's construction giant Coteccons plans $53 mln bond issue

Vietnamese construction giant Coteccons (HoSE: CTD) plans to issue bonds worth up to VND1.4 trillion ($53.45 million) to the public this year as part of its 2025 capital mobilization plan, according to a company release.

Companies - Thu, July 3, 2025 | 8:12 pm GMT+7

Over $534 mln needed for central Vietnam city’s seaport infrastructure

Hue city in central Vietnam needs about VND14.05 trillion ($534.24 million) in investment for its seaport system during the 2021-2030 span, with approximately VND12.79 trillion ($488.05 million) for wharves.

Infrastructure - Thu, July 3, 2025 | 4:24 pm GMT+7

Ca Na LNG-fueled power project in central Vietnam extends bidding deadline

The bidding deadline for the Ca Na LNG-to-power project in south-central Vietnam's Khanh Hoa province has been extended to 2 p.m. on July 19, 2025.

Energy - Thu, July 3, 2025 | 4:06 pm GMT+7

USD price in Vietnam hits new peak as US, Vietnam reach agreement on trade deal framework

Vietnamese banks on Thursday raised the USD price to the central bank-regulated ceiling of VND26,345, 3.1% higher than at the beginning of the year.

Banking - Thu, July 3, 2025 | 3:47 pm GMT+7

Vietnam inaugurates first paper-based food packaging line

The first paper-based food packaging line in Vietnam applying Tetra Recart® technology was officially inaugurated in Son La province on Wednesday by Vietnam’s leading supplier of processed food, Dong Giao Foodstuff Export JSC (Doveco), and Sweden's Tetra Pak Group.

Companies - Thu, July 3, 2025 | 2:29 pm GMT+7

Toyota nears one-millionth vehicle sold in Vietnam

Toyota Motor Vietnam (TMV) delivered over 29,000 vehicles to Vietnamese customers in the first half of 2025, a 31% increase year-on-year, according to a company release on Wednesday.

Companies - Thu, July 3, 2025 | 2:24 pm GMT+7

Vietnam’s Personal Income Tax Law overhaul expected in October

Vietnam’s Ministry of Finance is finalizing draft revisions to the Personal Income Tax (PIT) Law, for parliament approval at its session in October.

Economy - Thu, July 3, 2025 | 1:44 pm GMT+7

Apple supplier Luxshare-ICT seeks recruitment support in central Vietnam

China’s Luxshare-ICT, a supplier to Apple, has asked authorities in Nghe An province for support in tackling labor recruitment challenges.

Companies - Thu, July 3, 2025 | 12:44 pm GMT+7

US agreement on 20% tariff for goods imported from Vietnam 'a success': expert

Reaching agreement with the U.S. on 20% tariff for goods imported from Vietnam and even 40% for transshipping is a success for the Southeast Asian country, said Ho Quoc Tuan, a senior lecturer of accounting & finance at University of Bristol, the UK.

Economy - Thu, July 3, 2025 | 9:55 am GMT+7

Malaysia diversifies trade partners to stay economically resilient

Malaysia’s economy remains resilient thanks to its long-term and comprehensive economic strategy, despite geopolitical tensions in the Middle East that have raised concerns about the possible closure of the Strait of Hormuz and disruption to global energy supplies, according to the Ministry of Trade, Investment and Industry (MITI).

Southeast Asia - Thu, July 3, 2025 | 8:44 am GMT+7

Vietnam Airlines launches first direct air link between Vietnam and Italy

National-flag carrier Vietnam Airlines officially launched its first direct flight connecting Hanoi and Milan on Tuesday, establishing direct air link between Vietnam and Italy for the first time.

Travel - Thu, July 3, 2025 | 8:28 am GMT+7

Makara Capital Partners wants to mobilize $5-7 bln for investments in Vietnam: exec

Singapore's Makara Capital Partners is eyeing investment opportunities in Vietnam, including those in the biological and pharmaceutical industries and the International Financial Center project.

Economy - Thu, July 3, 2025 | 12:52 am GMT+7

Vietnam, US reach agreement on landmark trade deal framework

Vietnam's Party chief To Lam and U.S. President Donald Trump on Wednesday stated that they welcome the agreement reached by the two countries' negotiating teams on the Joint Vietnam-United States Statement on a Fair, Balanced, and Reciprocal Trade Agreement Framework.

Economy - Wed, July 2, 2025 | 11:28 pm GMT+7

- Travel

-

Indian billionaire to visit Vietnam’s Ha Long Bay with 4,500 employees

-

Vietnam in talks on visa exemptions with 15 countries to boost tourism

-

Foreign businesses in Vietnam urge relaxation of visa, work permit requirements

-

AI can be a game changer for Vietnam tourism

-

Google Doodle honors world's largest cave Son Doong

-

Vietnam allows import of Chinese aircraft under new rule