Little 'Silicon Valley Bank risk' in Vietnam

VinaCapital’s chief economist Michael Kokalari explains why there is no substantial risk to Vietnam’s stock market and economy from the current U.S. banking crisis, thus maintaining the group’s forecast of a 6% growth rate for Vietnam this year, unchanged from its prior prediction.

The sudden collapse of Silicon Valley Bank (SVB) in the U.S., plus concerns about a possible contagion to banks in Europe, prompted several investors to ask what impact SVB’s collapse could have on Vietnam - and if banks in Vietnam have any latent risks on their balance sheets comparable to the risks that brought down SVB.

We expect the SVB collapse in-and-of-itself will actually end up being neutral for Vietnam’s stock market and economy, which is counterintuitive given that the U.S. is Vietnam’s largest export market. Furthermore, we see no substantial risk that the dynamics which negatively impacted SVB and certain other regional U.S. banks could significantly impact the profitability and/or solvency of banks in Vietnam.

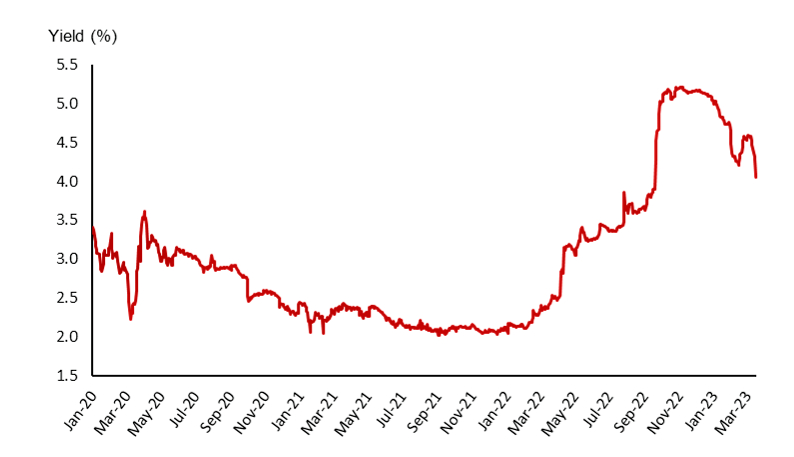

Further to that last point, it was widely reported that latent losses on SVB’s securities portfolio coupled with a drop in deposits at the bank were the main factors that led to its rapid insolvency. Vietnamese banks also hold government bonds on their balance sheets (as do banks in most countries but note there are no mortgage-backed securities in Vietnam), and the prices of 10-year Vietnam government bonds (VGBs) have dropped by around 15 percentage points since mid-2021, as yields surged - although VGB yields have clearly peaked, which can be seen in the chart below.

10-year Vietnam government bond yield

However, holdings of VGBs only account for about 6% of listed banks’ total assets and “held-to-maturity” (HTM) securities account for less than 2% of total assets. This is much lower than the 5-10% levels typical for U.S. regional banks, and far below the ~45% of SVB’s assets that were securities held on its balance sheet on an HTM basis (making SVB an extreme outlier compared to other U.S. regional banks).

Said differently, the rise in Vietnamese government bond yields probably generated over $3 billion of unrealized losses among Vietnam’s listed banks, which is equivalent to just over 5% of their combined Tier I equity; no banks stand out as being particularly exposed as having large, likely losses versus their net equity.

Also, although SVB reportedly had a circa $15 billion unrealized loss on its securities portfolio (which more than wiped out its $12 billion of equity capital), the actual catalyst for SVB’s demise was a drop in deposits that forced the bank to realize/crystalize the losses on its securities portfolio. This dynamic is also unlikely in Vietnam.

Specifically, the drop in Silicon Valley Bank’s deposits prompted it to sell treasury bonds and mortgage-backed securities (MBS) in order to raise cash to give its depositors, which realized/crystalized the bank’s losses on its securities portfolio. However, in Vietnam, the government always ensured that depositors were made whole during past banking crises, despite the fact that deposit insurance in Vietnam only explicitly covers about $5,000 of losses.

Consequently, Vietnamese depositors are not strongly incentivized to aggressively withdraw their money when a bank encounters difficulties in Vietnam, because of the tacit understanding that the government would protect depositors in the event of a bank collapse.

The net result of all of the above is that the risk of an SVB-style bank collapse in Vietnam is very low, both because the catalyst that prompted the SVB situation is not present (i.e., depositors are not incentivized to withdraw their money from banks in times of crisis) and because the unrealized losses on Vietnamese banks’ securities portfolios are not large enough to significantly impact their profitability and/or solvency.

Benign Impact of SVB & Credit Suisse on Vietnam

The Silicon Valley Bank collapse is unlikely to have any significant impact on Vietnam’s economy, despite the fact that the U.S. is Vietnam’s biggest export market, and it has a trade surplus with the U.S. equivalent to about 20% of Vietnam’s GDP. Exports to the U.S. had already been slowing prior to the SVB collapse, and we do not believe the bank’s collapse will exacerbate that slowdown since the decline in Vietnam’s exports to the U.S. is primarily attributable to the fact that the inventories of major U.S. retailers and other consumer-facing firms such as Nike, etc. rose by about 20% last year. Accordingly, the demand for “Made in Vietnam” products was already unlikely to recover until the second half of this year, irrespective of developments in the U.S. banking sector.

That said, the U.S. government’s response to the SVB collapse prompted a plunge in U.S. interest rates and rate hike expectations, which in turn helped facilitate an unexpected 100-basic point policy rate cut in Vietnam earlier this week. We are not U.S. economists, but it is clear that the “Bank Term Funding Program (BTFP)” launched in response to the SVB collapse will probably entail significant new U.S. dollar liquidity creation, which would in-turn continue to put downward pressure on U.S. interest rates as well as on the value of the U.S. dollar in the months ahead.

A decline in U.S./global interest rates and a weaker U.S. dollar would lead to an improvement in the liquidity of Vietnamese banks as well as lower interest rates in Vietnam for the reasons discussed below, and as evidenced by the above-mentioned policy interest rate cut in Vietnam this week.

Finally, the news that Credit Suisse is also facing severe liquidity issues - which will also be solved by Switzerland’s central bank providing liquidity to that bank - also put significant downward pressure on global interest rates. This will ultimately result in more liquidity flowing into the global economy, which should indirectly benefit Vietnam’s economy and stock market.

Silicon Valley Bank & Credit Suisse help Vietnam cut rates

The State Bank of Vietnam hiked policy rates in September 2022 and October 2022 to support the value of the Vietnamese dong, and the central bank had also been aggressively draining liquidity out of Vietnam’s money market in recent weeks by issuing T-Bills in order to ensure that dong interbank interest rates remain comfortably above USD interest rates.

However, the value of the dong has appreciated by about 1% over the last two weeks, including a notable appreciation immediately after the U.S. government’s bailout of Silicon Valley Bank’s depositors last weekend. This appreciation, coupled with a decline in 2-year US Treasury yields of more than 100bps over the last week, enabled Vietnam’s central bank to guide VND interest rates lower.

Specifically, the central bank cut Vietnam’s discount rate, which is one of the country’s key policy interest rates, by 100bps to 3.5%, and the central bank stopped aggressively draining money out of the money market. The former move was largely symbolic, but the latter helped drive a 1 percentage point drop in interbank interest rates, to below 5%.

To be clear, a policy rate cut is always a significant event in any country, but Vietnam has a few key interest rates, the most important of which is probably the so-called re-financing rate, which remained unchanged this week at 6%, as did the cap on short-term deposit rates Vietnamese banks are allowed to offer to their customers.

One of the most important reasons that we expect the Silicon Valley Bank and Credit Suisse sagas should end up being benign for Vietnam is because both are likely to lead to a strengthening of the dong against the value of the dollar, which in turn will enable the central bank to re-accumulate a significant amount of FX reserves this year. This would inject significant dong liquidity into the economy because the central bank usually accumulates FX reserves via “unsterilized” interventions in the FX market, which entails an increase in a country’s monetary base.

The caveat to this benign outlook is that markets are likely to be quite volatile in the weeks ahead and the value of the dollar is currently being boosted by “safe haven” buying of the dollar - as is typical in times of crisis. However, the markets are likely to calm down as market participants come to believe in policymakers’ resolve to prevent systemic issues in the banking system, after which we expect the precipitous decline in U.S./global interest rates to support a strengthening of the dong, enabling the central bank to re-accumulate FX reserves this year.

Conclusions

Global stock markets are likely to remain volatile in the weeks ahead, in the aftermath of the Silicon Valley Bank collapse and the bail-out of Credit Suisse by the Swiss National Bank. However, we still expect Vietnam’s economy to grow by 6% this year (unchanged from our prior forecast), partly because we had already factored in a slowdown in the demand for “Made in Vietnam” products by consumers in the U.S. and the EU, and we expect that slowing demand to be largely offset by a rebound in foreign tourist arrivals to Vietnam.

Importantly, in recent months global stock markets have been anticipating that a “Fed Pivot”, or reversal of some of the U.S. Federal Reserve’s recent, aggressive rate hikes would boost risk assets, including the value of developing markets’ currencies. As the Fed pivots, this should allow the Vietnamese central bank and commercial banks to lower interest rates, which would in turn make the stock market more attractive for local and international investors.

- Read More

Vingroup's hospitality arm appoints new CEO

Vinpearl Joint Stock Company, a leading investor and operator of resorts and theme parks in Vietnam, has appointed Ngo Thi Huong as its new CEO, starting from Friday.

Companies - Sat, December 27, 2025 | 9:02 pm GMT+7

Advisory council recommends Vietnamese government not expand monetary policy in 2026, exercise more caution

Vietnam’s National Financial and Monetary Policy Advisory Council has recommended that the Government refrain from expanding monetary policy in 2026, adopt a more cautious approach, and coordinate monetary and fiscal policies in a balanced manner.

Consulting - Sat, December 27, 2025 | 4:01 pm GMT+7

Nguyen Thanh Phuong exits BVBank board, leads strategy board

Nguyen Thanh Phuong will step down from the board of directors at Vietnam’s private lender BVBank (BVB) for the 2025-2030 term, as decided at an extraordinary shareholders’ meeting on Friday.

Banking - Sat, December 27, 2025 | 12:03 pm GMT+7

PV Gas plans over $3.8 bln investment for 2026-2030, eyes LNG infrastructure, M&A as priorities

PV Gas, the investor of Thi Vai LNG terminal in Ho Chi Minh City, plans to invest more than VND100 trillion ($3.8 billion) in the 2026-2030 period, with LNG infrastructure and mergers and acquisitions (M&A) among its strategic priorities, said parent company Petrovietnam.

Industries - Sat, December 27, 2025 | 10:32 am GMT+7

HCMC proposes adding 5 metro lines connecting Long Thanh airport, Binh Duong, Vung Tau

The Ho Chi Minh City People’s Committee has proposed adding five metro lines to the appendix of the parliamentary Resolution No. 188 on piloting special mechanisms and policies to develop the urban railway network in Hanoi and HCMC.

Infrastructure - Sat, December 27, 2025 | 8:00 am GMT+7

Thaco enlarges charter capital by one-third ahead of Vingroup’s exit from high-speed rail bid

Vietnamese conglomerate Thaco Group has increased its charter capital by a third, just one day before rival Vingroup announced its withdrawal from the planned North-South high-speed railway project.

Companies - Fri, December 26, 2025 | 5:11 pm GMT+7

Le Ngoc Son appointed as Petrovietnam chairman

Petrovietnam's (PVN) CEO Le Ngoc Son has been appointed chairman of the state-owned group's members’ council.

Companies - Fri, December 26, 2025 | 4:54 pm GMT+7

Vietnamese fast food consumers spend average $5.5 per visit, chicken meals dominate

Vietnamese consumers are spending an average of VND144,500 ($5.5) per receipt at major fast-food chains, according to a December report by market research firm Q&Me.

Society - Fri, December 26, 2025 | 2:53 pm GMT+7

The aviation ecosystem game: Can Sun Group win?

Phu Quoc holds a rare advantage in having established a relatively comprehensive aviation ecosystem, comprising the expanded Phu Quoc International Airport and an airline bearing the island’s name – Sun PhuQuoc Airways.

Companies - Fri, December 26, 2025 | 2:44 pm GMT+7

Vingroup units, Idico sign strategic deal on clean energy, green transport

Four arms of Vingroup (HoSE: VIC) on Thursday signed a strategic cooperation agreement with major industrial park developer Idico, targeting clean energy supply and electrification of transport across the latter’s industrial zones.

Companies - Fri, December 26, 2025 | 2:19 pm GMT+7

Fueling Vietnam’s growth

Vietnam is heavily investing in large-scale, long-term projects in energy and infrastructure sectors which require billions of dollars far more than can be easily raised through internal business profits or tight domestic loans, writes Tim Evans, CEO, HSBC Vietnam.

Economy - Fri, December 26, 2025 | 1:38 pm GMT+7

Visa, Sun Group partner to empower personalized, data-driven tourism

Sun Group last Saturday signed a comprehensive strategic partnership with Visa to elevate the travel experience of international visitors to Vietnam through digital innovation, seamless cashless payments, and data-driven marketing solutions.

Companies - Fri, December 26, 2025 | 12:21 pm GMT+7

Sun Group proposes master plan for northern Vietnam's Ban Gioc waterfall tourist area

Vietnam’s leading real estate developer Sun Group on Thursday presented its master plan for the Ban Gioc Waterfall Tourist Area in the northern mountainous border province of Cao Bang to local authorities for the first time.

Real Estate - Fri, December 26, 2025 | 11:41 am GMT+7

Macro conditions open room for Vietnam's property market to enter new cycle: economist

Vietnam’s macroeconomic conditions are creating room for the property market to enter a new growth cycle, as legal reforms and public investment accelerate while financial risks remain largely contained, said Can Van Luc, chief economist at state-controlled BIDV bank.

Real Estate - Fri, December 26, 2025 | 10:00 am GMT+7

Indonesia, US eye deal on tariff exemptions for palm oil, coffee

Indonesia and the U.S. have agreed on all substantial issues for a tariff deal, paving the way for the signing of an agreement by Indonesian Prabowo Subianto and U.S. President Donald Trump at the end of January.

Southeast Asia - Fri, December 26, 2025 | 8:05 am GMT+7

Indonesia's rice stock set to hit record in 2025

Indonesian Minister of Agriculture Andi Amran Sulaiman said on December 22 that the government's rice reserve (CBP) is projected to reach 3.5 million tons by the end of 2025, marking the highest level since the country’s independence.

Southeast Asia - Fri, December 26, 2025 | 8:00 am GMT+7

- Travel

-

Sun Group proposes master plan for northern Vietnam's Ban Gioc waterfall tourist area

-

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

-

Vietnam defeat Thailand to win men’s football gold at SEA Games 33

-

Which beach in Vietnam boasts the Pantone - 'color of the year 2026'?

-

Unprecedented national milestone in 65 years: Vietnam welcomes 20 millionth international visitor

-

Techcombank HCMC International Marathon affirms global standing