New rules on securities, banking ownership limitations in Vietnam

Vilaf law firm analyzes the newly-promulgated rules related to the amendments and supplements to the Law on Securities 2019; the roadmap to ensure compliance with ownership limitations of the Law on Credit Institutions 2024; and the amendments of regulations on certificates in insurance sector.

In 2024, Vietnam’s benchmark VN-Index recorded a growth of nearly 12%. Photo by The Investor/Trong Hieu.

1. Law amending nine laws

On November 29, 2024, the National Assembly passed the Law No. 56/2024/QH15 on amendments and supplements to nine (09) laws (the Amendment to 09 Laws) including, among others, the Law on Securities 2019.

The Amendment to 09 Laws will take effect from January 1, 2025 with certain amendments effective from April 1, 2025 or January 1, 2026. Among the amendments introduced by the Amendment to 09 Laws, changes to the Law on Securities 2019 are expected to attract foreign investment to the securities market, as well as to enhance market transparency and investor protection following the uncovering of recent stock manipulation cases.

Securities market manipulation

The Amendment to 09 Laws regarding the Law on Securities 2019 adds a specific definition of “securities market manipulation” to the Law on Securities 2019, combining the existing definitions of this term from Decree No. 156/2020/ND-CP on administrative penalties for violations in the securities market and the Penal Code 2015.

In particular, any of the following activities will be considered as manipulating the securities market, which shall be prohibited:

(i) using one or more of one’s own or other’ trading accounts, or conspiring to continuously buy and sell securities to create artificial supply and demand;

(ii) trading securities without actual transfer of ownership or within a closed group of traders in an attempt to establish artificial demand and/or supply and prices;

(iii) continuously buying or selling securities in dominant volumes at market opening or closing times to manipulate securities prices;

(iv) trading securities through collusion, persuading others to continuously place buy and sell orders that significantly affect supply, demand, and securities prices, thus manipulating securities prices;

(v) directly or indirectly disseminating opinions on securities and/or issuers to influence securities prices while holding them; and

(vi) using other methods or engaging in different trading actions, or combining them with spreading false rumors or providing misleading information to the public to create artificial supply and demand and manipulate securities prices.

Professional securities investors

Under the Amendment to 09 Laws regarding the Law on Securities 2019, foreign individuals and entities are now automatically classified as “professional securities investors” (“nhà đầu tư chứng khoán chuyên nghiệp” in Vietnamese), without being subject to any additional requirements. Institutional professional securities investors will be entitled to trade all privately-placed corporate bonds.

Meanwhile, starting from January 1, 2026, individual professional securities investors will be entitled to trade privately-placed corporate bonds of which the relevant issuers (i) have been credit-rated and (ii) have provided secured assets to back the bond issuance or obtained guarantees from a credit institution.

The Amendment to 09 Laws regarding the Law on Securities 2019 introduces new provisions on the responsibilities of organizations and individuals involved in the files and reports related to securities and the securities market, expanding the scope of responsible parties compared to the existing Law on Securities 2019. These organizations and individuals include, but are not limited to, the followings:

(i) Those involved in the process of preparing files and reports related to securities and the securities market, who must be legally responsible for the legality, accuracy, truthfulness, and completeness of the documents and reports;

(ii) Those involved in certifying the files and reports, who must be legally responsible within the scope related to those documents and reports;

(iii) The consulting organization and the professionals involved in the consulting process, who must (A) act honestly, carefully, and comply fully with legal regulations in the advisory process, (B) be responsible for reviewing and verifying the information in the documents, and (C) be legally responsible within the scope of consulting related to the documents and reports; and

(iv) The auditing organization, approved auditors, and those signing the audit report or review, who must (A) comply with relevant regulations and standards, and (B) be responsible for opinions on the truthfulness and fairness of the audited reports and data.

Stricter requirements on public companies

The Amendment to the 09 Laws regarding the Law on Securities 2019 revises the definition of a “public company” under the Law on Securities 2019, which now include companies that (i) have fully-contributed charter capital and equity capital of VND30 billion ($1.19 million) or more, and (ii) with at least 10% of their voting shares held by at least 100 investors who are not major shareholders. This amendment will take effect from January 1, 2026.

For a public offering aimed at raising capital for a project by the issuing public company, the number of shares sold to investors must reach at least 70% of the total number of shares intendedly offered, unless the shares are offered to existing shareholders in proportion to their ownership. The issuing public company must have a plan to compensate for any shortfall in the expected capital to fund the project.

Applicants for an initial public offering or public company registration must provide the reports that have been audited by an independent audit organization of their full contributed charter capital up to the time of registration for the initial public offering or for the public company status.

Stricter requirements on private placement of securities

Regarding the conditions on private placement of securities, a notable restriction introduced in the Amendment to the 09 Laws regarding the Law on Securities 2019 is that the trading or transfer of privately-placed shares, privately-placed convertible bonds, and privately-placed warrants-linked bonds are restricted for a minimum of three years for strategic investors and a minimum of one year for professional securities investors from the completion date of the private placement, unless the trading or transfer occurs between professional securities investors, or is carried out pursuant to a legally effective court judgment, decision, arbitration ruling, or inheritance according to the law. Furthermore, the trading or transfer of privately-placed corporate bonds is only permissible between professional securities investors.

However, as noted above, individual professional securities investors will only be entitled to trade privately-placed corporate bonds of which the relevant issuers (i) have been credit-rated, and (ii) have provided secured assets to back the bond issuance or obtained guarantees from a credit institution. These new restrictions and conditions will take effect from January 1, 2026.

The Amendment to 09 Laws regarding the Law on Securities 2019 also stipulates that the State Securities Commission may suspend a registered private placement of securities for up to 60 days if (i) the registration dossier contains misleading information or omits critical details that could affect investment decisions and harm investors, or (ii) the distribution of securities does not comply with legal regulations. If the deficiencies that led to the suspension are not corrected within the statutory timeline, the private placement may be canceled.

2. Guiding regulations on roadmap to ensure compliance with ownership limitations of the Law on Credit Institutions 2024

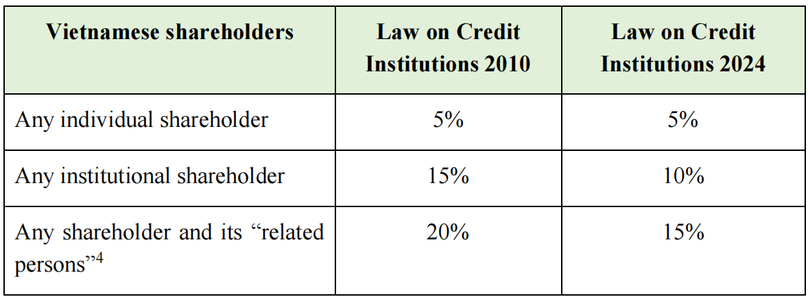

The Law on Credit Institutions 2024 (effective and replacing the Law on Credit Institutions 2010 from July 1, 2024) has lowered the maximum ownership level that Vietnamese shareholders can hold in a Vietnamese credit institution’s charter capital, as outlined in the table below.

For avoidance of doubt, as clarified in Article 63.4 of the Law on Credit Institutions 2024, the above maximum ownership level in a Vietnamese credit institution does not apply to shareholdings of foreign investors and this matter shall be governed by the specific provisions to be issued by the Government.

Consequently, Article 210.5 of the Law on Credit Institutions 2024 requires a commercial bank where the ownership of a shareholder or a shareholder together with its related parties exceeds the statutory ownership limits specified in Article 55 of the old Law on Credit Institutions 2010 (the Exceeding Banks) to develop and implement an action plan and roadmap to ensure compliance with the new ownership limits set under the new Law on Credit Institutions (as outlined in the table above) (the Compliance Roadmap).

To provide further clarification on this requirement, the State Bank of Vietnam (SBV) issued Circular No. 52/2024/TT-NHNN on November 29, 2024 (Circular 52/2024), which takes effect on January 15, 2025.

Under Circular 52/2024, the Compliance Roadmap must be formulated and implemented according to the following steps and requirements:

- The applicable Exceeding Banks (except for commercial banks allowed for early intervention or under special control) must prepare the list of shareholders and related persons whose shareholding ratios in such banks (collectively, the Exceeding Shareholders) have crossed the ownership caps under the Law on Credit Institutions 2010. The statutory cut-off date for this list is June 30, 2024.

- The applicable Exceeding Banks shall cooperate with the Exceeding Shareholders to establish the Compliance Roadmap to ensure compliance with the ownership limits outlined in Article 55 of the Law on Credit Institutions 2010 first, followed by compliance with the limits set in Article 63 of the Law on Credit Institutions 2024.The Compliance Roadmap must have the following compulsory contents: (i) the Exceeding Shareholders’ detailed information; (ii) timeline of the Compliance Roadmap, which is determined by parties but must align with the restructuring plan/scheme of the Exceeding Shareholders or other decisions/documents approved by the competent authority of the Exceeding Shareholders (if any); (iii)implementation milestones, applicable remedies and actions for the Compliance Roadmap; and (iv) Exceeding Banks’ commitments regarding cooperation and urgingthe Exceeding Shareholders to comply with the Compliance Roadmap.

- Until the completion of the Compliance Roadmap, the shareholding ratios of Exceeding Shareholders must not be increased, except in the case of receiving dividends paid in shares. Furthermore, the Exceeding Shareholders are not allowed to receive dividends paid in cash for their exceeded shares until the Compliance Roadmap is completed.

The applicable Exceeding Banks must submit the Compliance Roadmap to the SBV no later than 120 days from January 15, 2025. The Inspection Department of the SBV may, for the safety of banking system, request for adjustment to the Compliance Roadmap as submitted to the SBV. The applicable Exceeding Banks are required to report to the SBV on quarterly basis during the implementation of Compliance Roadmap.

3. Debt repayment restructuring for customers suffered from typhoon Yagi

On December 4, 2024, the SBV issued Circular No. 53/2024/TT-NHNN, which provides regulations for credit institutions and foreign bank branches to restructure debt repayment terms for customers facing difficulties due to the impact and damage caused by typhoon Yagi, as well as the floods and landslides that followed the typhoon (Circular 53/2024). Circular 53/2024 takes effect immediately upon its issuance date.

In particular, credit institutions and foreign bank branches are entitled to restructure the terms of loan principal and interest repayment if the following conditions are met:

- Eligible customers include individuals and entities that (i) are located or having investment and business activities in the 26 provinces and cities specified in Circular 53/2024, including but not limited to Hanoi, Hai Phong, Thai Binh, Quang Ninh, and (ii) are assessed by credit institutions and foreign bank branches as facing difficulties and unable to repay the principal and interest on time as per the agreed contract due to the impact of typhoon Yagi but still being capable of repaying the full principal and interest according to the restructured repayment terms.

- Eligible customers have an outstanding principal balance arising before September 7, 2024 from lending or financial leasing activities, and the principal and interest repayment obligations will be due between September 7, 2024 and December 31, 2025.

- The outstanding debt balance of a loan that has been restructured remains within the payment term or is overdue by up to 10 days from the agreed repayment due date. Credit institutions and foreign bank branches may restructure the repayment term for the outstanding balance of debts that are overdue for more than 10 days and overdue between September 7, 2024 and December 16, 2024 when implementing the first debt restructuring in accordance with Circular 53/2024.

- The final repayment date for the outstanding balance of debts having restructured repayment term shall be determined in accordance with the customer’s level of difficulty, but shall not exceed December 31, 2027. Credit institutions and foreign bank branches shall not restructure repayment terms for debts that violate legal regulations.

- The consideration of restructuring debt repayment terms shall be carried out from December 4, 2024 (i.e. Circular 53/2024 effective date) until the end of December 31, 2025, with no limit on the number of times the repayment term can be restructured.

To ensure uniform implementation across the entire system, Circular 53/2024 requires credit institutions and foreign bank branches to issue internal regulations on restructuring debt repayment terms, which contain compulsory contents outlined in Circular 53/2024, and send a copy of this internal regulations to the SBV. Furthermore, they must also send SBV the reports in prescribed forms on the implementation of debt restructuring as well as on debt classification and the provision for risks in accordance with laws.

4. Amendments of regulations on certificates in insurance sector

November 29, 2024, the Ministry of Finance (MoF) issued Circular No. 85/2024/TT-BTC (Circular 85/2024) to amend and supplement several articles of Circular No. 69/2022/TT-BTC dated November 16, 2022 of the MoF (Circular 69/2022) on certificate on insurances, insurance agent, insurance brokerage, and insurance support (collectively, the Insurance-Related Certificate). Circular 85/2024 will take effect from January 15, 2025.

One of the most notable points introduced in Circular 85/2024 is that the Vietnam Insurance Development Institute (a public service unit under the Department of Insurance Supervision and Management) shall now be responsible for organizing the examination for insurance certificates, insurance broker certificates, certificates for insurance support, as well as for conducting exams, issuing, revoking, renewing, and converting insurance agent certificates.

Specific responsibilities of the Vietnam Insurance Development Institute shall include, among others: (i) issue the Regulations for the certification examsof the Insurance-Related Certificates; (ii) develop, manage, administer, operate, maintain, and upgrade the Certificate Examination Management System; and (iii) collect, manage, and use fees for the Insurance-Related Certificates.

As compared to Circular 69/2022, Circular 85/2024 outlines clarification on which entities shall be considered as foreign insurance training institutions. To be more specific, under Circular 85/2024, a foreign insurance training institution is an entity with the function of providing insurance training and falls in one of the following cases:

- A training institution that is part of or directly under a foreign insurance regulatory and supervisory authority, or a training institution designated by the foreign insurance regulatory and supervisory authority or mandated by the laws of that country to conduct training and issue certificates in the field of insurance;

- The ASEAN Insurance Training and Research Institute (AITRI); the Actuarial Society, which is an official member of the International Actuarial Association;

- Training organizations from countries that have mutual recognition agreements for insurance certificates with Vietnam;

- Training institutions belonging to foreign insurance groups, foreign reinsurance groups, and foreign insurance brokerage groups. These institutions must have the function of providing insurance training in accordance with the laws of the country where the group is headquartered or where the insurance training institution of the group is located; and

- Other foreign insurance training institution specified at laws.

Moreover, Circular 85/2024 also revises the cases where the insurance agent certificates shall be revoked to include the following circumstances:

(i) the candidate alters, falsifies, or forges personal identification documents (Identity Card/Citizen Identification Card/Passport) when participating in the exam;

(ii) an individual asks someone else to take the exam on their behalf;

(iii) the insurance company, branch of a foreign non-life insurance company, microinsurance provider, or individual commits fraud in the process of converting the insurance agent certificate; or

(iv) the certificate is revoked at the request of a competent state authority as stipulated by law.

Within three business days from the certificate revocation date, the organization responsible for conducting the exam must notify the list and information of the revoked certificates. Individuals whose certificates are revoked under the afore-mentioned cases will not be allowed to participate in subsequent exams within 12 months from the certificate revocation date.

- Read More

Southern Vietnan port establishes strategic partnership with Japan’s Port of Kobe

Long An International Port in Vietnam’s southern province of Tay Ninh and Japan’s Port of Kobe on Monday signed an MoU establishing a strategic port partnership which is expected to boost trade flows, cut logistics costs, and deliver greater benefits to businesses across the region.

Companies - Wed, November 19, 2025 | 10:14 am GMT+7

Thaco's agri arm seeks to expand $44 mln cattle project in central Vietnam

Truong Hai Agriculture JSC (Thaco Agri), the agriculture arm of conglomerate Thaco, looks to aggressively expand its flagship cattle farming project in the central Vietnam province of Gia Lai.

Industries - Wed, November 19, 2025 | 9:56 am GMT+7

Japan food major Acecook eyes new plant in southern Vietnam

Acecook, a leading instant noodle maker with 13 plants operating in Vietnam, is studying a new project in the southern province of Tay Ninh.

Industries - Wed, November 19, 2025 | 9:39 am GMT+7

Vietnam’s largest Aeon Mall to take shape in Dong Nai province

Authorities of Dong Nai province, a manufacturing hub in southern Vietnam, on Monday awarded an investment registration certificate to Japanese-invested Aeon Mall Vietnam Co., Ltd. for its Aeon Mall Bien Hoa project.

Industries - Tue, November 18, 2025 | 8:17 pm GMT+7

Police propose prosecuting Egroup CEO Nguyen Ngoc Thuy for fraud, bribery

Vietnam’s Ministry of Public Security has proposed prosecuting Nguyen Ngoc Thuy, chairman and CEO of Hanoi-based education group Egroup, along with 28 others, for fraud to appropriate property, giving bribes, and receiving bribes.

Society - Tue, November 18, 2025 | 4:01 pm GMT+7

Singapore-backed VSIP eyes large urban-industrial complex in southern Vietnam

A consortium involving VSIP, a joint venture between local developer Becamex IDC and Singapore’s Sembcorp, plans a large-scale urban-industrial development named the "Moc Bai Xuyen A complex along the Tay Ninh-Binh Duong economic corridor in southern Vietnam.

Industrial real estate - Tue, November 18, 2025 | 2:38 pm GMT+7

Aircraft maintenance giant Haeco to set up $360 mln complex in northern Vietnam

Hong Kong-based Haeco Group, Vietnam's Sun Group, and some other partners plan to invest $360 million in an aircraft maintenance, repair and overhaul (MRO) complex at Van Don International Airport in Quang Ninh province - home to UNESCO-recognized natural heritage site Ha Long Bay.

Industries - Tue, November 18, 2025 | 2:13 pm GMT+7

Thai firm opens 20,000-sqm shopping center in central Vietnam hub

MM Mega Market Vietnam (MMVN), a subsidiary of Thailand's TCC Group, on Monday opened its MM Supercenter Danang, a 20,000 sqm commercial complex with total investment capital of $20 million, in Danang city.

Real Estate - Tue, November 18, 2025 | 12:20 pm GMT+7

Vietnam PM asks Kuwait fund to expand investment in manufacturing, logistics, renewable energy

Prime Minister Pham Minh Chinh on Monday called on the Kuwait Fund for Arab Economic Development (KFAED) to strengthen cooperation with Vietnam, particularly in the areas of industrial production, logistics, renewable energy, green economy, and the Halal ecosystem.

Economy - Tue, November 18, 2025 | 11:53 am GMT+7

Thai dairy brand Betagen to build first plant in Vietnam

Betagen, a famous Thai dairy brand, plans to build its first manufacturing plant in Vietnam, located in the southern province of Dong Nai.

Industries - Tue, November 18, 2025 | 8:49 am GMT+7

Banks dominate Vietnam's Q3 earnings season, Novaland posts biggest loss

Banks accounted for more than half of the 20 most profitable listed companies in Vietnam’s Q3/2025 earnings season, while property developer Novaland recorded the largest loss.

Finance - Tue, November 18, 2025 | 8:24 am GMT+7

Highlands Coffee posts strongest quarterly earnings in 2 years on robust same-store sales

Highlands Coffee, Vietnam’s largest coffee chain, delivered its best quarterly performance in two years, with Q3 EBITDA exceeding PHP666 million ($11.27 million), parent company Jollibee Foods Corporation (JFC) said in its latest earnings report.

Companies - Mon, November 17, 2025 | 10:21 pm GMT+7

Hong Kong firm Dynamic Invest Group acquires 5% stake in Vingroup-backed VinEnergo

VinEnergo, an energy company backed by Vingroup chairman Pham Nhat Vuong, has added a new foreign shareholder after Hong Kong–based Dynamic Invest Group Ltd. acquired a 5% stake, according to a regulatory filing on Saturday.

Companies - Mon, November 17, 2025 | 9:52 pm GMT+7

Thai giant CP’s Q3 Vietnam revenue drops 20% as hog prices slump

Thailand’s Charoen Pokphand Foods PCL (CPF) reported a sharp downturn in its Vietnam business in Q3, making the country its only major market to contract.

Companies - Mon, November 17, 2025 | 4:16 pm GMT+7

Surging demand for gas turbines tightens supply chains, extends lead times: Siemens Energy

Demand for gas turbines is rising rapidly, especially in regions with a surge in data center development, tightening supply chains and extending lead times - factors that investors must closely track during project preparation, according to Siemens Energy.

Companies - Mon, November 17, 2025 | 1:34 pm GMT+7

Novaland completes first phase of restructuring, targets 'returning to growth' from 2027

Novaland, a leading real estate developer in Vietnam, said it has completed the first phase of its multi-year restructuring plan and aims to finish the entire program by end-2026, positioning the company to return to growth from 2027.

Companies - Mon, November 17, 2025 | 12:26 pm GMT+7

- Travel

-

Impressive Standard Chartered Hanoi Marathon Heritage Race 2025

-

Nguyen Hong Hai wins 'Investors' golden heart' golf tournament 2025

-

140 players compete at “Investors’ golden heart” golf tournament

-

‘Investors’ golden heart’ golf tournament to tee off on Saturday

-

Vietnam, Hong Kong Aircraft Engineering sign deal on aircraft maintenance hub at northern airport

-

Sun Group gets nod for $375 mln inland waterway tourism project in central Vietnam