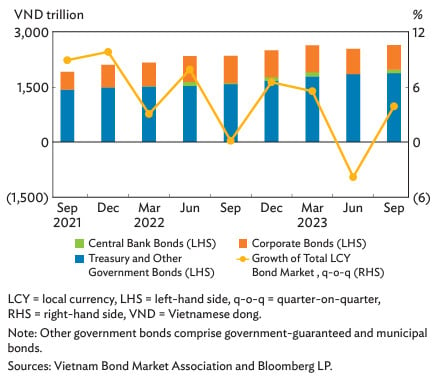

Vietnam local currency bond markets grows 3.9% in Q3, yields up

Vietnam’s local currency (LCY) bond market grew 3.9% quarter-on-quarter in the third quarter, driven by the State Bank of Vietnam (SBV) resuming issuance of treasury bills.

To mop up excess liquidity in the banking system and help stabilize the foreign exchange market, the central bank resumed its issuance of T-bills in September (VND93.8 trillion or $3.86 billion) after a break since March 2023.

The Asian Development Bank (ADB) said in its latest Asia Bond Monitor edition that Q3 growth in outstanding government bonds slowed to 1.5% quarter-on-quarter, lower than the 3.3% quarter-on-quarter growth in Q2 due to the low volume of maturities and a decline in issuance.

Despite strong issuance, corporate bonds contracted 3.1% quarter-on-quarter, given the large volume of maturities.

Composition of local currency bonds outstanding in Vietnam. Source: ADB's Asia Bond Monitor, Novemmber edition.

Meanwhile, Vietnam’s LCY government bond yields climbed across all tenors between September 1 and November 10 due to an uptick in inflation and the U.S.Federal Reserve’s decision to keep interest rates at a 22-year high, the ADB note said.

Increased issuance by corporates drove total LCY value up 144.6% quarter-on-quarter to VND198.1 trillion ($8.15 billion) in Q3/2023.

Corporate bond issuance climbed more than threefold in Q3/2023 from the previous quarter. A major factor in this growth was Vietnamese banks increasing their issuance after the government issued two circulars in April which removed some bottlenecks in debt payment rescheduling and bond repurchases.

The banking sector accounted for 59% of the total LCY corporate bonds issued in Q3, with the largest issuance coming from Asia Joint Stock Commercial Bank on aggregated debt sales of VND13.5 trillion ($556 million).

On the other hand, issuance of government bonds contracted 21.6% quarter-on-quarter with some auctions not fully awarded.

Insurance firms and banks remain the largest local currency government bond holders in Vietnam. Photo courtesy of Vietnam Finance Review

As of September, insurance firms and banks continued to hold nearly all outstanding LCY government bonds in the domestic market. Collectively, their bond holdings accounted for 99.6% of the total, up from 99.4% in the same period a year earlier.

Insurance companies remained the single-largest investor group, despite their holdings declining to 59.7% at the end of September from 60.5% a year earlier. Meanwhile, the holdings of banks increased to 39.9% from 38.9% in the same period. Securities companies and investment funds, nonresidents and other investors held a marginal aggregate share of 0.4%.

- Read More

Which beach in Vietnam boasts the Pantone - 'color of the year 2026'?

As soon as the Pantone Color Institute unveiled “Cloud Dancer” as the Color of the Year 2026, travel lovers quickly made the connection to Kem Beach – the iconic beach in Phu Quoc famed for its rare, velvety-white sand, soft and distinctive in texture.

Travel - Tue, December 16, 2025 | 8:46 pm GMT+7

Unprecedented national milestone in 65 years: Vietnam welcomes 20 millionth international visitor

From 10 million international arrivals in 2016 to 20 million in 2025, Vietnam’s tourism sector has doubled in scale in less than a decade. This historic milestone, officially recorded in Phu Quoc, reflects the exceptional growth momentum and substantial development potential of Vietnam’s tourism industry in a new phase.

Travel - Tue, December 16, 2025 | 8:28 pm GMT+7

Vietnam charges businessman ‘Shark Binh’ with additional tax evasion offence

Vietnamese police have brought additional charges against Nguyen Hoa Binh, widely known as “Shark Binh”, accusing him of tax evasion linked to the operations of fintech firm Vimo Technology JSC, authorities said on Monday.

Society - Tue, December 16, 2025 | 4:33 pm GMT+7

Vietnam blockchain firm Hyra partners with AHT Tech to expand AI capabilities

Hyra Holdings, a Vietnam-based blockchain and artificial intelligence company, has entered a strategic partnership with technology services provider AHT Tech, aiming to scale its AI ecosystem while aligning operations with international security and compliance standards.

Companies - Tue, December 16, 2025 | 3:14 pm GMT+7

Vietnam’s first LNG power plants may incur $38 mln loss in 2026: broker

Vietnam’s first LNG-to-power plants, Nhon Trach 3 and Nhon Trach 4, are expected to post a combined loss of VND1 trillion ($37.98 million) in 2026, their first full year of commercial operations, predicted Vietcap Securities.

Energy - Tue, December 16, 2025 | 3:06 pm GMT+7

Many Vietnamese stocks are trading at deeply discounted valuations: brokerage exec

Nguyen Duy Hung, chairman of Vietnam’s leading brokerage SSI Securities, said many stocks on the local market are "trading at very low valuations", as recent gains in the benchmark index have been driven by only a handful of large-cap names.

Finance - Tue, December 16, 2025 | 2:53 pm GMT+7

FPT forms specialized board to build core capabilities with expansion into rail tech

Vietnam's leading technology corporation FPT (HoSE: FPT) has set up a strategic technology steering committee, underscoring its push to master core technologies including rail-related solutions, and build a high-quality talent base to support long-term competitiveness.

Companies - Tue, December 16, 2025 | 2:05 pm GMT+7

Hanoi approves $32.5 bln Red River scenic boulevard project

Hanoi has approved a massive urban redevelopment project along the Red River which would transform the city’s riverbanks into a new ecological, economic and cultural space, local authorities said.

Real Estate - Tue, December 16, 2025 | 9:00 am GMT+7

Hanoi police extradite ‘Mr Hunter’ Le Khac Ngo back to Vietnam

Hanoi police have extradited Le Khac Ngo, known as “Mr Hunter”, from the Philippines to Vietnam, authorities said on Friday.

Society - Tue, December 16, 2025 | 8:00 am GMT+7

Malaysia eyes AI-driven energy future

Malaysia needs to modernize its power systems to build a low-carbon economy that is competitive, inclusive and resilient, said Deputy Prime Minister Datuk Seri Fadillah Yusof at the Global AI, Digital and Green Economy Summit 2025, which opened on Monday.

Southeast Asia - Mon, December 15, 2025 | 11:47 pm GMT+7

Vingroup’s mega project contributes over $1 bln in land-use fees, land lease to HCMC’s 11-month budget

A mega urban project by Vietnam’s leading private conglomerate Vingroup (HoSE: VIC) contributed VND27.36 trillion ($1.04 billion) to Ho Chi Minh City’s budget revenue in the first 11 months of this year, the local government said.

Real Estate - Mon, December 15, 2025 | 5:35 pm GMT+7

Vietnam PM says Long Thanh airport should anchor aviation-led growth

Vietnam must use the Long Thanh International Airport as a hub to develop an aviation economy and ecosystem, creating a new growth pole rather than merely operating an airport, said Prime Minister Pham Minh Chinh.

Economy - Mon, December 15, 2025 | 5:03 pm GMT+7

Vietnam introduces new policy to attract electronics 'eagles'

Vietnam’s Ministry of Science and Technology has issued a circular setting criteria for enterprises engaged in electronics manufacturing projects to qualify for tax incentives, aiming to lure more global electronics giants.

Economy - Mon, December 15, 2025 | 4:24 pm GMT+7

HCMC-based developer Phat Dat unveils six new projects in 2026 amid stock plunge

Phat Dat Real Estate Development Corporation (HoSE: PDR), a major real estate developer in Ho Chi Minh City, has announced plans to launch six new projects in 2026, setting targets of nearly VND44.85 trillion ($1.7 billion) in revenue and over VND11.81 trillion ($448.9 million) in after-tax profit for the 2026-2030 period.

Real Estate - Mon, December 15, 2025 | 2:00 pm GMT+7

Vietnam’s first LNG-fueled power plants inaugurated

Nhon Trach 3 and 4, Vietnam’s first LNG-fired power plants, were inaugurated on Sunday and are scheduled for commercial operations in early 2026.

Energy - Mon, December 15, 2025 | 11:36 am GMT+7

Vingroup to build world-class stadium in Hanoi

Vingroup (HoSE: VIC), Vietnam's biggest listed company by market cap, has proposed building a 135,000-seat stadium at its planned Olympic sports urban area in Hanoi, potentially ranking as the world’s second-largest stadium in terms of capacity.

Real Estate - Mon, December 15, 2025 | 8:00 am GMT+7

- Consulting

-

VN-Index rises 3.1% in Nov, Finnish fund PYN Elite records -5.8%

-

Mind the gap

-

The generation game: Adapting to an aging population

-

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas

-

Powering growth from within

-

Key factors helping firms export to demanding markets: DH Foods exec