Vietnam's booming logistics sector still has room for growth

VinaCapital’s chief economist Michael Kokalari explains why investors should pay close attention to various opportunities in Vietnam’s logistics industry.

Vietnam has one of the fastest-growing logistics sectors in the world, but the sector is still highly fragmented, which presents attractive investment opportunities for private equity firms and other well-capitalized investors with “on the ground” expertise helping local businesses accelerate their revenues and earnings by adopting international best practices.

The industry has grown 14-16% annually in recent years, according to the Vietnam Logistics Business Association (VLBA), and total logistics expenditures in Vietnam are equivalent to over 20% of GDP, which is among the highest in the world - because of the industry’s innumerable inefficiencies. For example, three-quarters of Vietnam's freight volume passes through just six of the country's 75 seaports.

The rapid growth of Vietnam’s logistics sector growth is sustainable because of: 1) the ongoing expansion of the country’s manufacturing sector – driven by the manufacturing of high-tech products, and 2) the continued growth of the country’s middle class.

Regarding the former, Vietnam’s manufacturing sector currently accounts for just over 20% of the country’s economy but this figure reached above 30% for other “Asian Tiger” economies. That continued FDI investment inflows – which have helped fund the build-out of Vietnam’s industrial base for – are essentially ensured for years to come, partly because Vietnam is a beneficiary of the nascent “friend-shoring” phenomenon, which we discussed in this report, and which is part-and-parcel of the broader “China + 1” effort of multinational companies to diversify some of their production outside of China (ie. to Vietnam, India, Mexico, etc.)

Finally, the ongoing growth of Vietnam’s middle class also presents numerous investment opportunities, especially in niches such as cold-chain logistics - because of greater demand for fresh food and certain perishable pharmaceutical products - and in e-commerce beneficiaries such as last-mile delivery services. Further to that last point, e-commerce in Vietnam is growing by more than 25% annually, and the Vietnamese government targets a much bigger role for e-commerce for the country’s economy going forward – which is likely to lead to a regulatory environment that is especially favorable for “last mile” and other logistics firms.

A port in the Cai Mep-Thi Vai port cluster in Ba Ria-Vung Tau province, southern Vietnam. Photo courtesy of Ba Ria-Vung Tau newspaper.

Overview of Vietnam’s logistics industry

Vietnam’s logistics industry is comprised of foreign and local firms, but local firms are essentially absent from the international shipping business (there are over 1,600 registered ships in Vietnam - but only 3% of those ships are proper container ships) - with the exception of the handling and delivery of goods overland across Vietnam’s northern border with China (although this conduit represents a small portion of the goods that flow in and out of Vietnam). The industry’s biggest challenge is increasing the quality and reliability of its services – but these problems can be addressed by replicating best practices from other logistics markets.

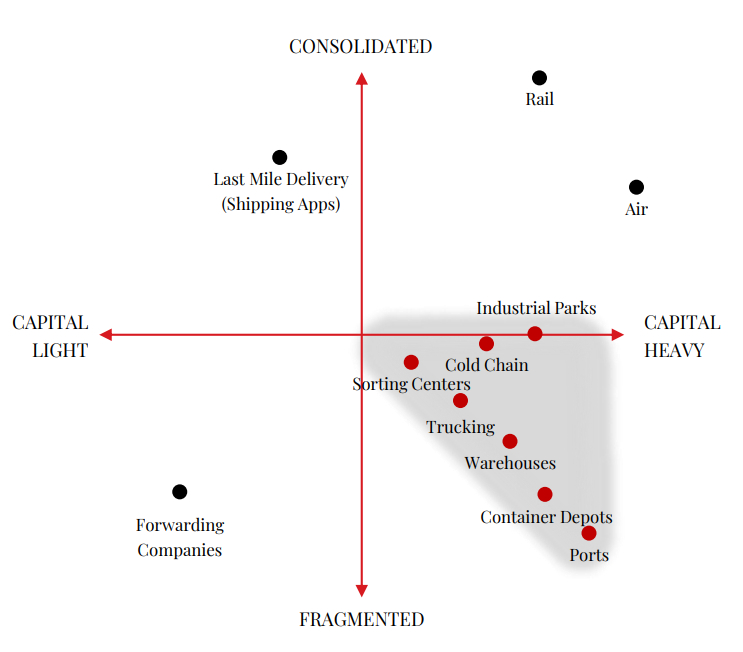

In order to analyze the investment opportunities in the sector, we’ve partitioned the industry into capital-intensive versus “capital-light” businesses, and into segments of the industry that are highly fragmented, versus those that are highly concentrated, as can be seen above, and we note that the domestic logistics industry is comprised mostly of micro-to-small companies.

The businesses in Vietnam’s logistics sector most in need of investment are those that are capital intensive, and in segments of the industry that are highly fragmented. For example, transportation firms account for about two-thirds of the total enterprises in Vietnam’s logistics industry, but over 80% of trucking firms in Vietnam have a fleet size of fewer than five trucks, and it’s estimated that for about 70% of the deliveries trucks in Vietnam make, the trucks returns to their home base empty.

Furthermore, middlemen get paid an estimated 30% commission on the final service fees that those trucking companies earn. Even in cold storage transport, which is considered to be one of the most promising segments of Vietnam’s logistics industry, and which is dominated by foreign-invested firms, is estimated that 70% of firms have less than 10 trucks.

In our view, some very compelling opportunities for local firms stem from the fact that sophisticated foreign customers are willing to pay premium prices for reliable logistics services, and that middle-class customers’ demand for products and services that entail high-quality logistics is soaring (ie. online shopping with home delivery, demand for perishable foods & medicines, etc).

Additionally, the long-term investment returns generated from those companies will be augmented by the fact that Vietnamese logistics operators that have sufficient scale and are professionally managed will experience falling costs over time, as bottlenecks stemming from Vietnam’s infrastructure and other issues are eventually addressed.

We also expect attractive investment returns for logistics firms that are beneficiaries of increased high-tech manufacturing in Vietnam and from the ongoing growth of Vietnam’s emerging middle class.

The growth of high-tech manufacturing entails increased demand for higher value-added logistics services such as bonded warehouses for the consolidation of relatively high-value goods (compared to garments & footwear, for example), before those products are exported. Also, the input materials for the production of consumer electronics are typically very valuable, so customs clearance and freight forwarding activities entailed in handling those items necessarily must be of much higher precision and specification than that entailed in handling textiles and yarn for garment production, for example.

Finally, we see three potential investment strategies: 1) invest in leading logistics companies, to aggressively grow their assets into an integrated platform that offers clients economies of scale, 2) identify particular assets which need capital for upgrading or can be re-purposed, and drive new business by increasing efficiencies, and 3) M&A / consolidation. The adoption of best international practices – such as digitization – together with capital injections are critical to all of these strategies, although capital injections are particularly essential if the investors’ strategy is to grow the capacity of the target firm – by adding more trucks, for example, or additional cranes/heavy equipment in port/warehouse businesses.

Attractive segments

One attractive niche in Vietnam’s logistics industry is the customs clearance business, in which brokers with good relationships with the proper officials can expedite the clearance of goods in and out of the country by assuring compliance with complex regulations.

Most of Vietnam’s 800+ freight forwarding companies provide customs clearance services, according to the VLBA, but we believe firms that can bundle customs clearance services as part of a “core carrier” relationship, are capable of satisfying all of the shipping/logistics needs of high tech manufacturing firms can enjoy enhanced pricing power in exchange for providing premium logistics services to those firms.

Further to that last point, high-quality logistics are essential to the handling of high-value consumer electronics items, but logistics costs account for just over 1% of the final price of those items (versus circa 30% for agriculture products like rice, for example). The combination of customers’ high sensitivity to quality, together with the low contribution of logistics services to the total costs of consumer electronics producers equates to enhanced pricing power for integrated logistics firms that are able to service the needs of those demanding customers, by providing what is known in the industry as “Third Party Logistics Services (3PL)”

The vast majority of logistics handling done by local firms in Vietnam can be characterized as “First Party Logistics (1PL)”, or “Second Party Logistics (2PL)”, which essentially facilitates the direct shipment of products from one point to another, but the global logistics industry is increasingly moving towards the so-called “3PL” model in which Logistics Service Providers (LSP), provide not only transportation & warehousing services, but additional value-added services such as inventory management, picking & packing, and RFID tracking.

The larger firms in Vietnam’s logistics industry are primarily state-owned enterprises (SOEs), so although those firms may have the financial resources to begin providing 3PL services, they typically do not have the flexibility and/or management capability.

Summary

Vietnam has one of the fastest-growing logistics sectors in the world, and that growth is expected to continue for years to come, driven by the continued expansion of the country’s manufacturing sector (especially high-tech manufacturing), and by the continued growth of the country’s middle-class, which in turn is driving high growth in the logistics-intensive e-commerce business, as well as demand for perishable food and other products.

The industry is fragmented and inefficient, which when combined with its high growth is a recipe for attractive investment returns. In our view, the most attractive businesses to invest in are those that are capital-intensive and are in particularly fragmented segments of the industry.

- Read More

Vingroup starts building mega urban project in Vietnam's Mekong Delta

Vietnam’s leading private conglomerate Vingroup on Wednesday embarked on construction of the VND28 trillion ($1.1 billion) Vinhomes Green City, the first mixed-use urban development in its ecosystem in the Mekong Delta province of Long An.

Real Estate - Wed, March 26, 2025 | 10:11 pm GMT+7

Indonesia, China cooperate in digital technology

Indonesia and China are expanding cooperation in the field of AI to promote digital transformation, especially in the fields of agriculture and smart cities.

Southeast Asia - Wed, March 26, 2025 | 10:01 pm GMT+7

Indonesia decides to join BRICS New Development Bank

Indonesian President Prabowo Subianto has announced the Government's decision to become a member of the New Development Bank (NDB), a multilateral development bank established by the five founding member states of the BRICS group.

Southeast Asia - Wed, March 26, 2025 | 9:57 pm GMT+7

Major Vietnamese broker SHS to double charter capital

Saigon-Hanoi Securities Corporation (SHS) plans to issue 894 million shares to increase its charter capital from VND8.13 trillion to VND17.07 trillion ($667.6 million), making it one of the top three securities firms in term of charter capital.

Companies - Wed, March 26, 2025 | 8:30 pm GMT+7

Elon Musk company okayed to pilot Starlink satellite internet service in Vietnam

Vietnam has allowed the U.S.'s SpaceX to pilot Starlink low-orbit satellite internet service in the country on a pilot basis until January 1, 2031.

Industries - Wed, March 26, 2025 | 5:18 pm GMT+7

Danish toymaker Lego to open $1.3 bln Vietnam plant next month

Denmark's Lego will officially open its factory in VSIP III Industrial Park in Vietnam's southern province of Binh Duong on April 9.

Industries - Wed, March 26, 2025 | 4:18 pm GMT+7

Top Singaporean firms earn high incomes in Vietnam

Singapore is the second-biggest foreign investor in Vietnam, with over $84 billion in registered investment capital as of end-January and many prominent investors raking in high incomes.

Companies - Wed, March 26, 2025 | 3:45 pm GMT+7

Vietnam, Singapore ink significant deals in Hanoi

Vietnamese Prime Minister Pham Minh Chinh and his Singaporean counterpart Lawrence Wong on Wednesday witnessed the signing of many cooperation deals between agencies and enterprises of the two countries.

Economy - Wed, March 26, 2025 | 2:51 pm GMT+7

Vietnam's major policies are reshaping economic development

Major policies are reshaping Vietnam's approach to economic development, which focuses on science, technology, and private enterprises, said a leader at the Vietnam Chamber of Commerce and Industry (VCCI).

Economy - Wed, March 26, 2025 | 12:11 pm GMT+7

PM okays over $10 bln urban area project in central Vietnam

The over VND260.3 trillion ($10.16 billion) Cam Lam New Urban Area project in the south-central province of Khanh Hoa has received in-principle approval from Prime Minister Pham Minh Chinh.

Real Estate - Wed, March 26, 2025 | 8:58 am GMT+7

S Korea's KIM Fund raises stake in Vietnam's marine transportation firm VIPCO

South Korea’s KIM Fund has increased its stake in Hai Phong city-based Vietnam Petroleum Transport JSC (VIPCO, HoSE: VIP) to 2.73%, making it the latter’s second-largest shareholder.

Companies - Wed, March 26, 2025 | 8:30 am GMT+7

Vietnam, Singapore seek cooperation chances in semiconductor industry

The Vietnam Trade Office in Singapore, in collaboration with the Singapore Semiconductor Industry Association (SSIA), organized a hybrid seminar on Monday to introduce Vietnam's potential, advantages, and development strategies for the semiconductor industry.

Southeast Asia - Tue, March 25, 2025 | 10:55 pm GMT+7

OV intellectuals in UK suggest blueprint for Vietnam’s int’l financial hub ambition

Vietnam can rise as a major international financial centre, both regionally and globally, with a strategic vision that highlights transparency, a skilled workforce, modern infrastructure, robust financial markets, and strong international branding, the Vietnam Intellectual Society in the UK and Ireland (VIS) told visiting Vietnamese Permanent Deputy Prime Minister Nguyen Hoa Binh in a recent meeting.

Southeast Asia - Tue, March 25, 2025 | 10:55 pm GMT+7

Vietnam Deputy PM discusses financial center development with ECB

Vietnam's Standing Deputy Prime Minister Nguyen Hoa Binh on Monday met with representatives of the European Central Bank (ECB) to discuss plans for the establishment of financial centers in Vietnam, as part of his working visit to Germany – the final stop in his European tour.

Southeast Asia - Tue, March 25, 2025 | 10:52 pm GMT+7

Indonesia keeps commitment on energy transition

Indonesian Coordinating Minister for Economic Affairs Airlangga Hartarto on Monday affirmed that the U.S. decision to pull out of the Just Energy Transition Partnership (JETP) will not impact the other partners' commitment to it.

Southeast Asia - Tue, March 25, 2025 | 10:35 pm GMT+7

Malaysia’s electric vehicle sales surge

Malaysia’s automotive industry is gaining momentum, with electric vehicle (EV) sales soaring over the past two years and continuing to rise in 2025, driven by both domestic and international manufacturers.

Southeast Asia - Tue, March 25, 2025 | 10:23 pm GMT+7

- Travel

-

Indian billionaire to visit Vietnam’s Ha Long Bay with 4,500 employees

-

Vietnam in talks on visa exemptions with 15 countries to boost tourism

-

Foreign businesses in Vietnam urge relaxation of visa, work permit requirements

-

AI can be a game changer for Vietnam tourism

-

Google Doodle honors world's largest cave Son Doong

-

Vietnam budget carrier Vietjet to receive Boeing 737 Max aircraft from July