Vietnamese approves two-year sandbox trial of P2P lending

Vietnam will roll out a two-year sandbox trial of peer-to-peer (P2P) lending, credit scoring, and data sharing via open application programming interfaces, starting July 1, according to a newly-issued government decree.

Decree 94, dated April 29, establishes a regulatory sandbox - a controlled testing mechanism - for fintech solutions in the banking industry.

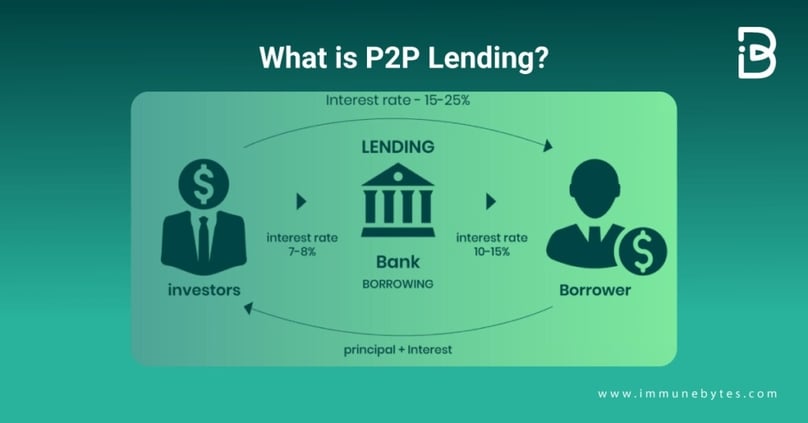

One of the fintech solutions approved for controlled trial is P2P lending that connects borrowers directly with lenders through an online platform, bypassing traditional financial institutions.

Only P2P lending companies licensed by the State Bank of Vietnam (SBV) - the central bank - will be allowed to operate. Foreign banks are excluded from participation.

Credit institutions and fintech firms can apply for the regulatory sandbox, but this does not guarantee their future compliance with business and investment regulations once formal laws are enacted.

The results of the trial will serve as the basis for regulators to research, develop, and refine the legal framework for this lending sector.

Vietnam will begin a two-year trial of peer-to-peer (P2P) lending in July 2025. Illustration courtesy of ImmuneBytes.

The latest decree also permits the trial of other fintech activities, including credit scoring and data sharing via open application programming interfaces (Open APIs).

Each fintech solution may be tested for up to two years, depending on the specific area and type of service, starting from the date the central bank issues a certificate of participation. However, the trial period may be extended in accordance with regulations.

The rollout of the fintech trial is limited to Vietnam’s territory and may not be conducted across borders.

P2P lending companies participating in the regulatory sandbox are prohibited from engaging in any business activities not specified in their participation certificate. They are also barred from providing guarantees for customer loans, acting as borrowers themselves, or offering P2P lending solutions to pawnshop businesses.

Credit institutions, foreign bank branches, and fintech companies that choose not to participate in the regulatory sandbox or have not been approved for it must operate in compliance with existing laws on enterprises and investment, and other relevant regulations, according to the decree.

Vietnam currently hosts around 100 companies operating in the P2P lending sector, many of which have foreign investment.

However, the central bank has previously flagged concerns over a lack of transparency in some agreements between participants in the lending model, as well as the absence of mechanisms to oversee the use and management of borrowed funds, which could lead to disputes.

As such, establishing principles and regulations for a controlled trial of P2P lending fintech is deemed necessary.

Alongside P2P lending, Vietnam is home to approximately 200 fintech companies, with 90% operating in the banking sector, offering services like payments, rating apps, and credit scoring.

The government said the initiative is to foster innovation and modernize the banking sector, while enabling individuals and businesses to access transparent, efficient financial services at a low cost.

It also aims to assess the costs and benefits, while mitigating risks for customers using these solutions.

According to Robocash Group, Vietnam's fintech sector is experiencing the second-fastest growth in the Association of Southeast Asian Nations (ASEAN), just behind Singapore, and is projected to reach a market value of $18 billion in 2024.

Le Thi Le Hang, chief strategy officer at SSI Securities Corporation, noted that the growth of fintech is fueled by widespread applications in financial solutions and digital assets.

Analysts predict the fintech market could grow at a rate of 25-30% annually over the next 5-10 years, driven by advancements in AI, machine learning, and increasingly borderless access.

Fintech innovation in Vietnam has already made notable strides, from digital payments and e-wallets to P2P lending platforms and purely tech-based securities firms.

- Read More

Cutting logistics costs to global average could save $45 bln a year for Vietnam: PM

Prime Minister Pham Minh Chinh said Vietnam could save $45 billion annually if it lowers logistics costs by around 16% to match the global average.

Economy - Sat, November 29, 2025 | 6:48 pm GMT+7

Coca-Cola Beverages Vietnam loses lawsuit against local tax authority

The Ho Chi Minh City People's Court on Thursday dismissed a lawsuit filed by Coca-Cola Beverages Vietnam against the Ministry of Finance's Department of Taxation, thereby upholding the department's decision to collect back taxes and impose a fine of over VND821 billion ($31.14 million) in total.

Finance - Sat, November 29, 2025 | 2:27 pm GMT+7

Honda Vietnam rejects information Honda Mobilityland plans 600-ha tourism, entertainment, sports complex in southern Vietnam

Honda Vietnam on Friday rejected the information that Honda Mobilityland Corporation, a subsidiary of Japan’s Honda Motor Co., plans to build an international circuit in Tay Ninh province, towards developing a 600-hectare tourism, entertainment, and sports complex there.

Industries - Sat, November 29, 2025 | 10:23 am GMT+7

Vietnam's largest tungsten mine has updated planning okayed

Vietnam’s Nui Phao mine, one of the world’s largest tungsten deposits outside China, has had its updated planning approved under a decision signed by Deputy Prime Minister Tran Hong Ha.

Economy - Sat, November 29, 2025 | 9:34 am GMT+7

Foreign-backed Arque Degi to build $322 mln floating tourism-urban projects in central Vietnam

Authorities in Gia Lai province have granted an investment certificate to Arque Degi JSC to develop three floating tourism-urban projects worth a combined VND8.5 trillion ($322.42 million) in the De Gi lagoon area.

Real Estate - Sat, November 29, 2025 | 8:00 am GMT+7

Indonesia eyes trilateral data-center tie-up with Singapore, Malaysia

Indonesia is in talks with Singapore and Malaysia to develop a cross-border data-center network linked to its Green Super Grid.

Southeast Asia - Fri, November 28, 2025 | 9:57 pm GMT+7

Malaysia’s export growth expected to slow in 2026

Despite Malaysia’s trade growth in October 2025 surpassing expectations, with both exports and imports reaching record levels, economists warned that the country’s export expansion may slow in 2026.

Southeast Asia - Fri, November 28, 2025 | 9:53 pm GMT+7

Singapore promotes methanol use for bunkering

The Maritime and Port Authority of Singapore (MPA) will issue licences to supply methanol as marine fuel in the Port of Singapore from January 1, 2026, following the Call for Applications launched in March 2025.

Southeast Asia - Fri, November 28, 2025 | 9:46 pm GMT+7

Vietnam's tour operator Vietravel announces full exit from Vietravel Airlines

Vietravel, one of Vietnam’s largest tour operators, will divest its entire stake in Vietravel Airlines by year-end, drawing a close to its turbulent venture into aviation during five years.

Travel - Fri, November 28, 2025 | 9:22 pm GMT+7

VinSpeed, Thaco vie for investment role in North-South high-speed railway

Several major Vietnamese companies, including Vingroup subsidiary VinSpeed and automaker Thaco, are vying for a role in Vietnam’s gigantic North-South high-speed railway project.

Infrastructure - Fri, November 28, 2025 | 5:14 pm GMT+7

Finnish fund PYN Elite raises VN-Index forecast to 3,200 points

PYN Elite (Finland), one of the largest foreign funds in the Vietnamese stock market, has revised up its forecast for the benchmark VN-Index to 3,200 points, much higher than the 1,690.99 recorded on Friday.

Finance - Fri, November 28, 2025 | 4:49 pm GMT+7

Mind the gap

Without stronger digital and physical networks, global productivity will falter at precisely the moment the world needs new engines of growth, writes Benjamin Hung, president, International, Standard Chartered.

Consulting - Fri, November 28, 2025 | 3:49 pm GMT+7

Alliance claiming $100 bln investment for trans-Vietnam high-speed railway 'uncontactable'

An alliance between Mekolor, a relatively unknown Vietnamese company, and American entity Great USA, which claimed it could mobilize $100 billion for the North-South high-speed railway project, could not be contacted, said standing Deputy Prime Minister Nguyen Hoa Binh.

Infrastructure - Fri, November 28, 2025 | 3:19 pm GMT+7

Mitsui eyes new opportunites in Vietnam's energy sector, projects related to carbon emission reduction

Mitsui & Co., Ltd. plans to expand its investment in Vietnam in the energy sector and projects related to carbon emission reduction, president and CEO Kenichi Hori told Prime Minister Pham Minh Chinh at a Thursday meeting in Hanoi.

Industries - Fri, November 28, 2025 | 2:39 pm GMT+7

Russian heavyweight Zarubezhneft seeks to build energy center in Vietnam

Zarubezhneft, a wholly state-owned oil & gas group of Russia, wants to develop an energy center in Vietnam, as it seeks to expand into other fields including energy and minerals.

Energy - Fri, November 28, 2025 | 1:08 pm GMT+7

Carlsberg Vietnam accelerates its path toward net-zero emission in production by 2028 with stronger renewable-energy commitments

As Vietnam advances toward its 2050 net-zero vision, businesses are expected to play a decisive role in enabling the country’s green transition. At the Green Economy Forum 2025, Carlsberg Vietnam shared how a long-standing FDI enterprise is reshaping its operations and energy strategy to align with Vietnam’s sustainability goals.

Companies - Fri, November 28, 2025 | 11:52 am GMT+7

- Consulting

-

Mind the gap

-

The generation game: Adapting to an aging population

-

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas

-

Powering growth from within

-

Key factors helping firms export to demanding markets: DH Foods exec

-

Vietnam corporate earnings to be driven by credit expansion, trading activity, property recovery