Vietnamese group Bamboo Capital's 2024 profit after tax up 394%

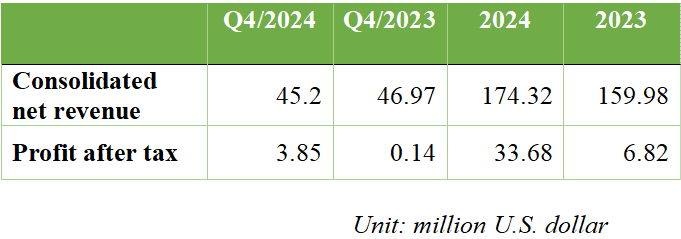

Bamboo Capital Group earned profit after tax of VND844.8 billion ($33.68 million) on consolidated net revenue of VND4,372 billion ($174.32 million) in 2024, up 393.8% and 9% year-on-year, respectively.

Renewable energy continued to be the largest contributor to Bamboo Capital Group's 2024 revenue. Photo courtesy of the company.

The results were mentioned in the group's (HoSE: BCG) financial statement for Q4/2024, released on Friday.

In the quarter, Bamboo Capital recorded net revenue of VND1,133.7 billion ($45.2 million), a slight decrease of 3.8% over the same period last year.

However, profit after tax recovered strongly year-on-year to VND96.5 billion ($3.85 million) thanks to a reduction in interest expenses of VND102.7 billion (equivalent to a drop of 25.9%) and profits from restructuring investments in affiliated companies.

Bamboo Capital Group recorded consolidated net revenue of VND4,372 billion ($174.32 million) for the whole 2024, up 9% compared to 2023.

Of which, the renewable energy segment (VND1,278 billion) accounted for 29.2%, infrastructure construction (VND989.2 billion) 22.6%, financial services (VND953.1 billion) 21.8%, real estate (VND668.7 billion) 15.3%, and manufacturing (including Nguyen Hoang Furniture and pharma subsidiary Tipharco - VND482.8 billion) 11%.

The renewable energy segment continued to be a bright spot as it maintained a stable revenue source thanks to the good performance of solar power plants.

Electricity output in 2024 of operating plants reached 749.0 million kWh, up 14.5% over the same period last year, of which the Phu My solar power plant (330 MW) contributed 488 million kWh, up 21.2% compared to 2023.

Financial services also had impressive growth, contributing 21.8% to Bamboo Capital Group's revenue. The figure for the same period in 2023 was 8.2%.

This breakthrough was mainly derived from the contribution of AAA Insurance Corporation with insurance premium revenue in 2024 reaching VND1,589.7 billion ($63.39 million), up 149.1% year-on-year.

AAA Insurance exceeded its 2024 business plan by 54.6% thanks to the strategy of expanding the multi-channel distribution network and focusing on exploiting key insurance products with large market space.

In addition, following Bamboo Capital's acquisition in Q2/2024, Tipharco contributed VND297.4 billion ($11.86 million) to the group's revenue, increasing the proportion of the group's manufacturing segment to 11% from 4% in the same period last year.

It can be said that Bamboo Capital Group's revenue came evenly from its segments which helps to increase the competitiveness and minimize market risks.

Bamboo Capital's 2024 profit after tax reached VND844.8 billion ($33.68 million), up 393.8% compared to 2023. The result largely came from a VND478.5 billion reduction in financial costs, equivalent to a 30.2% drop compared to 2023, due to BCG Energy buying back two lots of bonds worth VND2,500 billion ($99.68 million) before maturity.

This effective cost governance strategy has helped reduce debt pressure, improve the corporate financial health, and create a foundation for long-term investment plans and seizing market opportunities.

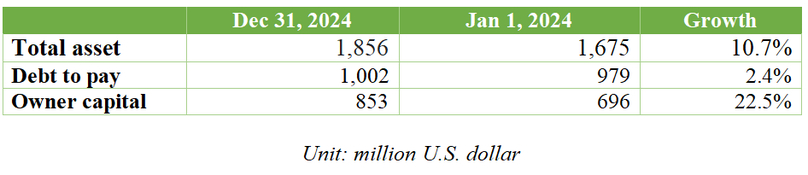

As of December 31, 2024, Bamboo Capital Group's total assets reached VND46,552.6 billion (nearly 1.86 billion), up 10.7% against the beginning of the year, thanks to the acquisition of Tipharco.

The group's equity increased sharply by 22.5%, reaching VND21,393.6 billion. Thanks to that, the debt to equity ratio continued to decrease for many consecutive years, down to 1.2 times by December 31, 2024.

According to the group's cash flow report as of December 31, 2024, net cash flow from business activities was negative VND1,804.2 billion ($71.94 million), indicating that Bamboo Capital actively promoted investment activities.

In 2024, the group expanded investment into the waste-to-power segment, and accelerated construction of real estate projects Malibu Hoi An in Quang Nam province and King Crown Infinity in Ho Chi Minh City.

Notably, net cash flow from financial activities changed from negative VND427.7 billion to positive VND2,021.1 billion ($80.59 million) at the end of Q4/2024 thanks to revenue from a public offering of shares. It showed that Bamboo Capital is actively adding capital to serve production and business activities, while maintaining its liquidity at a safe level.

Entering 2025, Bamboo Capital's renewable energy company, BCG Energy, plans to expand waste-to-power projects in many provinces and cities, accelerate wind power projects, and deploy additional types of green energy projects.

The company also plans to diversify capital sources through issuing green bonds, convertible bonds, and cooperating with reputable partners to reduce debt pressure and effectively control financial costs.

The real estate segment undertaken by BCG Land will focus on handing over the Hoi An d'Or and Malibu Hoi An projects.

The construction and infrastructure segment has a lot of room for revenue growth when it owns a backlog value of up to VND8,300 billion ($330.94 million) in 2025, and is implementing many large infrastructure projects in Dong Nai province and the River Delta region.

With a stable financial foundation, focused multi-industry business structure, and positive economic outlook, Bamboo Capital is forecast to continue recording positive results in 2025.

- Read More

Thaco's agri arm seeks to expand $44 mln cattle project in central Vietnam

Truong Hai Agriculture JSC (Thaco Agri), the agriculture arm of conglomerate Thaco, looks to aggressively expand its flagship cattle farming project in the central Vietnam province of Gia Lai.

Industries - Wed, November 19, 2025 | 9:56 am GMT+7

Japan food major Acecook eyes new plant in southern Vietnam

Acecook, a leading instant noodle maker with 13 plants operating in Vietnam, is studying a new project in the southern province of Tay Ninh.

Industries - Wed, November 19, 2025 | 9:39 am GMT+7

Vietnam’s largest Aeon Mall to take shape in Dong Nai province

Authorities of Dong Nai province, a manufacturing hub in southern Vietnam, on Monday awarded an investment registration certificate to Japanese-invested Aeon Mall Vietnam Co., Ltd. for its Aeon Mall Bien Hoa project.

Industries - Tue, November 18, 2025 | 8:17 pm GMT+7

Police propose prosecuting Egroup CEO Nguyen Ngoc Thuy for fraud, bribery

Vietnam’s Ministry of Public Security has proposed prosecuting Nguyen Ngoc Thuy, chairman and CEO of Hanoi-based education group Egroup, along with 28 others, for fraud to appropriate property, giving bribes, and receiving bribes.

Society - Tue, November 18, 2025 | 4:01 pm GMT+7

Singapore-backed VSIP eyes large urban-industrial complex in southern Vietnam

A consortium involving VSIP, a joint venture between local developer Becamex IDC and Singapore’s Sembcorp, plans a large-scale urban-industrial development named the "Moc Bai Xuyen A complex along the Tay Ninh-Binh Duong economic corridor in southern Vietnam.

Industrial real estate - Tue, November 18, 2025 | 2:38 pm GMT+7

Aircraft maintenance giant Haeco to set up $360 mln complex in northern Vietnam

Hong Kong-based Haeco Group, Vietnam's Sun Group, and some other partners plan to invest $360 million in an aircraft maintenance, repair and overhaul (MRO) complex at Van Don International Airport in Quang Ninh province - home to UNESCO-recognized natural heritage site Ha Long Bay.

Industries - Tue, November 18, 2025 | 2:13 pm GMT+7

Thai firm opens 20,000-sqm shopping center in central Vietnam hub

MM Mega Market Vietnam (MMVN), a subsidiary of Thailand's TCC Group, on Monday opened its MM Supercenter Danang, a 20,000 sqm commercial complex with total investment capital of $20 million, in Danang city.

Real Estate - Tue, November 18, 2025 | 12:20 pm GMT+7

Vietnam PM asks Kuwait fund to expand investment in manufacturing, logistics, renewable energy

Prime Minister Pham Minh Chinh on Monday called on the Kuwait Fund for Arab Economic Development (KFAED) to strengthen cooperation with Vietnam, particularly in the areas of industrial production, logistics, renewable energy, green economy, and the Halal ecosystem.

Economy - Tue, November 18, 2025 | 11:53 am GMT+7

Thai dairy brand Betagen to build first plant in Vietnam

Betagen, a famous Thai dairy brand, plans to build its first manufacturing plant in Vietnam, located in the southern province of Dong Nai.

Industries - Tue, November 18, 2025 | 8:49 am GMT+7

Banks dominate Vietnam's Q3 earnings season, Novaland posts biggest loss

Banks accounted for more than half of the 20 most profitable listed companies in Vietnam’s Q3/2025 earnings season, while property developer Novaland recorded the largest loss.

Finance - Tue, November 18, 2025 | 8:24 am GMT+7

Highlands Coffee posts strongest quarterly earnings in 2 years on robust same-store sales

Highlands Coffee, Vietnam’s largest coffee chain, delivered its best quarterly performance in two years, with Q3 EBITDA exceeding PHP666 million ($11.27 million), parent company Jollibee Foods Corporation (JFC) said in its latest earnings report.

Companies - Mon, November 17, 2025 | 10:21 pm GMT+7

Hong Kong firm Dynamic Invest Group acquires 5% stake in Vingroup-backed VinEnergo

VinEnergo, an energy company backed by Vingroup chairman Pham Nhat Vuong, has added a new foreign shareholder after Hong Kong–based Dynamic Invest Group Ltd. acquired a 5% stake, according to a regulatory filing on Saturday.

Companies - Mon, November 17, 2025 | 9:52 pm GMT+7

Thai giant CP’s Q3 Vietnam revenue drops 20% as hog prices slump

Thailand’s Charoen Pokphand Foods PCL (CPF) reported a sharp downturn in its Vietnam business in Q3, making the country its only major market to contract.

Companies - Mon, November 17, 2025 | 4:16 pm GMT+7

Surging demand for gas turbines tightens supply chains, extends lead times: Siemens Energy

Demand for gas turbines is rising rapidly, especially in regions with a surge in data center development, tightening supply chains and extending lead times - factors that investors must closely track during project preparation, according to Siemens Energy.

Companies - Mon, November 17, 2025 | 1:34 pm GMT+7

Novaland completes first phase of restructuring, targets 'returning to growth' from 2027

Novaland, a leading real estate developer in Vietnam, said it has completed the first phase of its multi-year restructuring plan and aims to finish the entire program by end-2026, positioning the company to return to growth from 2027.

Companies - Mon, November 17, 2025 | 12:26 pm GMT+7

Vietnam's property developer Regal Group to list shares on HCMC bourse in Q4

Regal Group JSC, a property developer based in the central city of Danang, has applied to list its 200 million RGG shares on the Ho Chi Minh City Stock Exchange (HoSE) in Q4/2025.

Real Estate - Mon, November 17, 2025 | 10:52 am GMT+7