Vietnam's 2025 GDP to grow 6.5% on robust infrastructure investment, consumer spending recovery: VinaCapital

Domestic factors, including a ramp-up in Government infrastructure spending, a revival of the real estate market, and a recovery of consumer spending, will help sustain Vietnam's GDP growth at a circa 6.5% pace next year, in-line with the National Assembly’s official target and with 2024 GDP growth, write Michael Kokalari, chief economist at VinaCapital.

Michael Kokalari, chief economist at VinaCapital. Photo courtesy of the company.

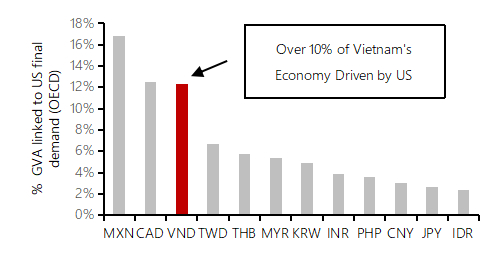

The strong US economy supported Vietnam’s GDP growth in 2024, but domestic factors will drive the economy in 2025 because Vietnam’s economic prosperity is closely linked to the U.S. and export growth to the U.S. is set to slow next year for a variety of reasons.

Vietnam’s Government is planning policy measures that should mitigate the impact of that slowdown, but drastic measures will be needed to achieve the Government’s increasingly ambitious 2025 GDP growth targets (some officials have mentioned figures as high as 8%).

These three key points will help investors better understand Vietnam’s economy and stock market in 2025:

Domestic factors will determine 2025 GDP growth.

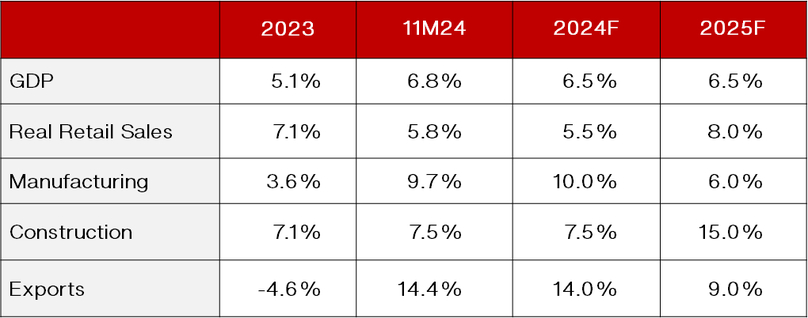

Vietnam’s exports to the US surged this year, as did foreign tourist arrivals, but the growth of both is set to slow dramatically next year. Many analysts underestimate how much slower export growth will weigh on Vietnam’s 2025 GDP growth, but Government initiatives and improving consumer sentiment could help sustain 6.5-7% growth next year.

The government is in the Driver’s seat.

Government officials recently announced multiple measures to boost Vietnam’s economy, including increased infrastructure spending and serious structural reforms. These measures will certainly boost long-term GDP growth but may not be sufficient to offset slower export growth next year – which means more drastic measures may be required to meet growth targets.

Vietnam’s “Trump risk” is overstated.

Vietnam and Mexico were the biggest winners during Trump’s first administration. We see minimal risk that Trump’s tariff policies will derail Vietnam’s growing economy – in sharp contrast to claims published in some newspaper articles since his election - but Vietnam has the third-largest trade surplus with the US. Vietnam will need to take urgent steps to reduce the country’s trade surplus with the US to avoid being targeted by Trump at some point.

Next, the VN-Index is up 12.1% year-to-date (as of 18 December 2024), despite record selling by foreign investors, which was partly prompted by a near 5% year-to-date depreciation in the Vietnamese dong. The resilience of Vietnam’s stock market despite nearly $4 billion of net foreign selling, coupled with a very attractive valuation (12x forward P/E versus ~17% expected EPS growth) means that the VN-Index would not need much of a catalyst to continue climbing next year. However, 2025 could be a “roller coaster year” for both the stock market and economy.

Concerns related to Trump’s tariffs, combined with slower export and GDP growth, could weigh on the VN-Index, and on the value of the Vietnamese dong in the first half of 2025. In the second half of the year, Vietnam’s GDP growth should accelerate if-and-when the Government takes aggressive actions to support the economy, and USD-VND depreciation pressures should ease along with concerns about Trump’s impact on Vietnam.

Vietnam is the third closest linked to the U.S. and has the third biggest trade surplus with the U.S.

Domestic factors will drive Vietnam’s economy In 2025

Vietnam’s economy is closely linked to the U.S. Exports to the U.S. surged by well over 20% this year (versus a circa 10% drop in 2023), which is the main factor supporting Vietnam's 2024 GDP growth. That surge was in-turn driven by a 40% jump in exports of electronics and other high-tech products to the U.S. However, we expect the extraordinary increase in exports to the U.S. to moderate next year partly because the U.S. economy is likely headed for a “soft landing” economic slowdown.

Additional reasons to expect slower export growth next year are related to the U.S. inventory re-stocking cycle that we discussed in our Looking Ahead at 2024 report (in which we made the non-consensus call that Vietnam’s manufacturing output and exports to the U.S. would surge this year).

Furthermore, exports across Asia are currently being boosted by “pull-forward” demand in the lead-up to Trump taking office – that will lead to lower demand next year. Consequently, Vietnam’s manufacturing output growth will likely drop next year, since most products produced here are sold to overseas customers.

That said, we do not expect Vietnam’s exports and/or manufacturing output to actually shrink next year because a steady inflow of FDI ensures that more factories begin producing (and exporting) products in Vietnam every year.

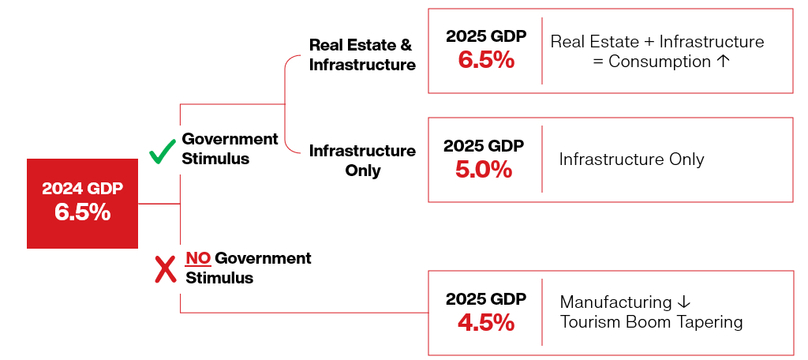

Also, despite the expected slowdown in manufacturing output growth next year, we expect Vietnam to achieve 6.5% GDP growth in 2025 because we expect the composition of the growth to transition to more domestically driven factors next year, as can be seen in the table above.

Weak sentiment among Vietnamese consumers weighed on the country’s economic growth in 2023 and 2024, although it has improved somewhat as this year progressed, according to local consumer research firms such as Cimigo and InFocus Mekong Research.

Real retail sales growth (i.e., stripping out the impact of inflation) is about 6% this year, which lags below the 8-9% growth rate that is typical in Vietnam. Furthermore, about half of that 6% figure is attributable to the continued recovery of foreign tourist arrivals from 70% of pre-Covid levels in 2023 to 100% in 2024.

Consumption accounts for over 60% of Vietnam’s economy (vs ~25% for manufacturing), so healthier consumption growth would easily compensate for slower growth in exports/manufacturing/tourist arrivals next year.

Vietnam’s Government has indicated that it will increase infrastructure spending in 2025, and hopes are high that this and other measures will also make consumers more confident to increase their spending. We anticipate a pickup in consumer spending next year for a different reason: we expect Vietnam’s Government to take significant steps to unfreeze the real estate market.

We believe that a recovering real estate market would have a far greater impact on both consumer sentiment than increased infrastructure spending. A modest increase in infrastructure spending, which accounts for ~6%/GDP, in-and-of itself would not be sufficient to significantly boost Vietnam’s economy.

However, the combination of faster progress on projects like HCMC’s new airport and Hanoi’s new ring roads, coupled with a real estate market revival, would probably make consumers feel more confident to spend money because of the “wealth effect” linked to the value of the property that many (most?) middle-income Vietnamese consumers own.

We mapped out our expectations for 2025 GDP growth in the diagram above: 1) if the Government does nothing to offset slower exports to the U.S. next year, 2) if the Government only boosts infrastructure spending in response to slowing demand for “Made in Vietnam” products (which we do not believe would be sufficient to improve consumer confidence), and 3) if the Government were to both boost the real estate market and infrastructure spending, which we believe would make local consumers sufficiently confident to spend money.

Further to that last point, Government officials announced increasingly aggressive GDP growth targets in recent weeks. We are reassured by their ambitious goals because of our view that decisive actions will be needed to offset the impact of an expected drop in export growth to the US next year.

However, initiatives such as extending Vietnam’s VAT tax cut from 10% to 8% for another six months or plans to streamline the Government’s operations (see below) are either too modest to have any real impact on 2025 growth or will eventually become powerful drivers that boost Vietnam’s long-term growth potential but will not boost GDP growth in 2025.

Finally, it is possible that 2025 will be somewhat volatile for Vietnam’s economy and stock market. In the first half of 2025, falling export growth will likely deal a bigger blow to Vietnam’s GDP growth than many economists expect. That dip would probably prompt aggressive Government actions to support the economy, especially in light of the very ambitious GDP growth targets.

The net result could be subdued growth at the beginning of 2025, followed by a strong acceleration towards the end of 2025. All of that said, “It’s tough to make predictions, especially about the future,” as famed American baseball player Yogi Berra once said.

The Government is in the driver’s seat for 2025

Vietnam’s national assembly set a 2025 GDP growth target of 6.5-7% on November 12, after which various senior Government officials announced even more ambitious growth goals and vowed that the Government will take aggressive actions to ensure that Vietnam achieves those ambitious goals. As stated above, we believe concrete measures will be required to offset the expected drags on 2025 GDP growth.

We expect manufacturing growth to drop from 10% this year to 6% next year, which would knock about 1% pt off Vietnam’s GDP growth (manufacturing is ~25%/GDP growth) and we expect the growth of foreign tourist arrivals to fall from 40% this year to 15% next year, which will knock more than 1.5% pts off GDP growth (foreign tourism is ~8%/GDP). Various Government officials have guided to expect a ramp-up of infrastructure spending to support 2025 GDP growth and strengthen the country’s long-term growth prospects.

Based on communications from Government officials and others, it seems likely that the Government’s infrastructure spending will grow by 15-20% in 2025 to ~$31 billion (or ~6%/GDP) on projects such as completing another 1,000 km of highways, completing the first phase of HCMC’s new airport, and expanding the two current airports in HCMC and Hanoi.

However, that 15-20% growth would equate to an additional ~$5 billion of spending (or to about ~1%/GDP), which would not be sufficient to offset the hit from slower manufacturing and tourism growth outlined above, so additional measures will be required to sustain Vietnam’s rapid GDP growth next year.

Measures to boost Vietnam’s long-term GDP growth

In the short-term, it is possible that Vietnam’s Government could spend even more on infrastructure development, given its healthy finances (Government debt is below 40%/GDP), and we expect the Government to take concrete steps to support the real estate market next year; we already see some promising signs on the latter.

The slow zoning and approvals process is the biggest impediment to ramping up real estate development, but we are hearing anecdotal evidence that some project approvals are now being expedited (i.e., some projects which used to take 6-9 months to be approved are now being approved in as little as three months).

In addition to those and other modest measures to boost Vietnam’s short-term growth, the Government is taking some serious steps to boost the country’s long-term GDP growth. These measures include structural reforms, some of which will come into effect next year and could help thaw the real estate market and improve Vietnam’s ease-of-doing business rankings. Plans have also been announced to merge five Government ministries and numerous Government agencies in order to streamline the Government’s operations

We are enthused by these and other recently announced initiatives, such as plans to build a high-speed rail line that would span the length of the country. However, these measures will have no effect on GDP growth in 2025, and this report is focused on Vietnam’s economy and stock market next year.

Likewise, the Government has taken some encouraging steps to support Vietnam’s long-term economic growth by realizing the country’s high potential in semiconductors and AI. We plan to publish reports on both of these topics in the months ahead.

Vietnam’s “Trump risk” is overstated

Donald Trump’s election has spawned excess pessimism about the potential impact of his policies on Vietnam from some reporters in the international media. In reality, Vietnam is unlikely to be targeted by the U.S. because it is useful to the U.S. to achieve its own geopolitical and other goals (we discussed the potential impact of Trump on Vietnam in more detail in three reports we published since the election).

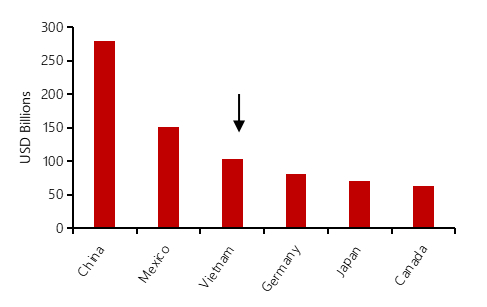

Furthermore, if Trump were to impose 5-10% blanket tariffs on all countries’ (ex-China) exports to the U.S, Vietnam would still retain its advantages in attracting FDI into the manufacturing sector. That said, Vietnam has the third-largest trade surplus with the US, which is a cause for concern.

Trump recently announced his intention to impose 25% tariffs on Canada and Mexico, plus to add an additional 10% tariffs on China’s exports to the U.S. That announcement, coupled with Vietnam’s $100 billion trade surplus with the U.S, has prompted fears that Vietnam could be targeted next, but the currency markets give strong hints of what actually comes next.

The Mexican Peso depreciated by more than 20% against the US dollar in the lead-up and immediate aftermath of the election, versus 2% year-to-date and 6% year-to-date depreciations respectively for the Chinese yuan and Canadian dollar after Trump’s recent tariff announcement.

The message of the market is clear: Mexico is the target and traders expect Canada, China, and Vietnam to negotiate deals with the Trump administration to avoid crippling tariffs on their exports to the U.S. (the USD-VND exchange rate did not move after Trump’s latest tariff announcement).

All of that said, China’s annual FDI into Vietnam essentially doubled over the last three years, making China the biggest FDI investor into Vietnam, which could attract the scrutiny of US officials at some point (although we expect newly registered FDI in Vietnam will fall next year due to uncertainties about Trump’s tariffs on Vietnam).

Why Trump likely won’t target Vietnam

Trump’s primary stated objectives (as relates to Vietnam) include re-shoring manufacturing jobs back to the US and shrinking America’s trade deficit. Regarding the latter, after the election Vietnamese Government officials announced intentions to shrink the trade surplus by buying LNG and aircraft from the U.S. (energy industry insiders told us Vietnam could quickly start importing ~$30 billion a year worth of LNG from the U.S. by using Floating Storage and Regasification Units).

Regarding re-shoring, wages in the U.S. are too high and the supply of skilled workers is too low to cost effectively produce “Made in Vietnam” products in the US. Bloomberg interviewed a U.S. manufacturing executive in a recent article on this topic who lamented "Toolmakers are a lost art. It’s going to take a long time for us to rebuild that level of skill [in the US]".

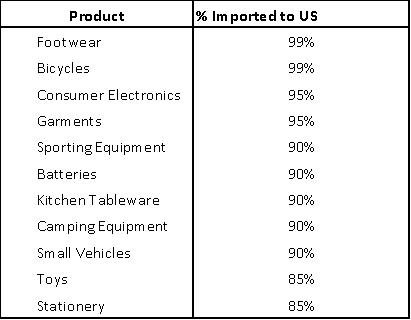

The table below, which is a small sample of consumer products that the U.S. imports, is an indication of how much the production of products that are consumed in the U.S. has been outsourced to other countries – and how difficult it would be to re-shore the production of those products.

Source: FDRA, FRED U.S. Database, VinaCapital analysis.

Republicans and Democrats alike are both concerned about the transhipment of “Made in China” products to the U.S. via Mexico and/or Vietnam to skirt U.S. tariffs on Chinese products. A bipartisan group of U.S. Senators implored President Biden to “address China’s rampant exploitation of Mexico as an intermediary for the transshipment of goods” in September.

In contrast, only about 2% of Vietnam’s exports to the U.S. are transshipments of Chinese products, according to research from Harvard University, and we expect close cooperation between Vietnam Customs officials and US technical experts to address that re-routing issue.

Finally, U.S. business and consumer confidence surged after Trump was elected, which should ultimately boost U.S. demand for “Made in Vietnam” products. Consumer confidence in the U.S. experienced its biggest post-election bounce since Bill Clinton was elected. That said, it will take some time for that elation to translate into increased exports from Vietnam to the U.S., so this will probably be a story for 2026.

Another volatile year for the Vietnamese dong

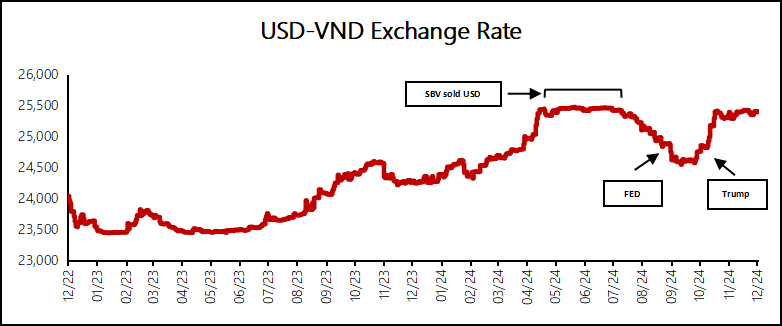

The USD-VND exchange rate has been very volatile over last three years, primarily because the Fed initiated one of its rapidest-ever rate hiking cycles starting from early-2022, and then began cutting rates in September 2024, although Vietnam-specific dynamics also affected the dong.

The State Bank of Vietnam (SBV) cut interest rates in Vietnam during H1/2023 as the U.S. Fed was hiking rates, which resulted in a record-high gap between short-term VND and USD interest rates (VND rates were more than 500 bps below USD rates at that time), putting enormous depreciation pressures on the dong in H2/2023.

This year, the VND had depreciated by nearly 5% year-to-date in May, driven by a near 4% year-to-date increase in the US Dollar/DXY Index (owing to “sticky” U.S. inflation and waning Fed rate cut expectations) and driven by political concerns in Vietnam. The SBV responded to VND depreciation by tightening monetary policy and selling around $6 billion of its FX reserves, reportedly reducing the SBV’s total reserves to around $87 billion, which is less than three months’ worth of imports.

In recent months, the USD-VND exchange rate has “whipsawed” by appreciating in anticipation of the Fed’s September 2024 rate cut, but then depreciating in the anticipation of Donald Trump’s election (the DXY Index surged ~7% in the lead-up and immediate aftermath of the US presidential election because tariffs push up the value of the U.S. Dollar). We expect 2025 will see some fluctuations for the Vietnamese dong, but the USD-VND exchange rate will ultimately end next year with a manageable 3% depreciation against the US dollar.

Two Vietnam-specific factors will impact the dong in 2025: 1) Vietnam’s FX reserves are currently below three months’ worth of imports, and 2) Vietnam’s ~6%/GDP trade surplus is set to shrink. Regarding #1, central banks generally hold a minimum of three months of FX reserves (insufficient FX reserves would inhibit the SBV from selling U.S. dollars to defend the dong, for example). We mentioned above that the Vietnamese dong appreciated versus the USD in the lead-up to the Fed’s September rate cut. However, the USD-VND exchange rate appreciated by less than its Asean EM peers from July to September due to the SBV’s insufficient FX reserves.

Regarding Vietnam’s trade surplus, FDI factories depleted their inventories of production inputs over the last two years. That depletion boosted Vietnam’s trade surplus (~6%/GDP in both years) because the vast majority of those production inputs are imported and then used to produce products that are exported.

FDI firms are now importing more inputs to re-stock their inventories, so Vietnam’s import growth is now outpacing export growth (circa 16% import growth vs 14% export growth). We expect that differential to widen next year, which would shrink Vietnam’s trade surplus.

The dollar and the dong

Our prediction that the VND will depreciate 3% next year is predicated on our expectation that the U.S. Dollar/DXY Index will finish 2025 nearly unchanged (the DXY is the single biggest factor driving the USD-VND exchange rate). However, 2025 is likely to be a very volatile year for the U.S. dollar, partly because U.S. inflation was always going to rebound in early 2025 for a variety of reasons, irrespective of who won the presidential election. The market is pricing in two more Fed rate cuts next year, but we would not be surprised if the Fed does not cut rates at all next year, which would push the USD higher.

Furthermore, about two-thirds of the tariffs that the U.S. imposes on other countries ultimately get reflected in a higher value of the US dollar. That implies the U.S. dollar will continue to appreciate if Trump follows through with his plans to impose tariffs on Canada/Mexico/China, but incoming Treasury Secretary Scott Bessent and others also guided that the Trump administration intends to use tariffs as a negotiation tool to push down the value of the U.S. dollar via a so-called “Plaza Accord 2.0” international agreement.

The Vietnamese dong, Chinese yuan and VN-Index

Many analysts mistakenly believe that a significant depreciation in the USD-CNY exchange rate would be very negative for Vietnam’s economy and would put significant depreciation pressure on the VND. However, a 10-25% depreciation of the CNY against the VND would not derail Vietnam’s export competitiveness because factory wages in Vietnam are less than half those in China.

It would however lower Vietnamese production costs because Vietnam imports over a third of its production inputs from China. That said, movements in the CNY have a major sentiment impact on both the USD-VND exchange rate and on the VN-Index.

Finally, movements in the USD also have a major impact on investor sentiment towards the VN-Index, but unlike fluctuations in China’s currency, the link between the USD-VND exchange rate and the VN-Index is rooted in economic logic. The SBV typically tightens monetary policy whenever the VND depreciates by more than 3% year-to-date, which reduces local liquidity available to buy stocks. Also, VND depreciation tends to trigger foreign outflows from the stock market, as it has this year – which is discussed in the next section of this report.

The Stock market in 2025

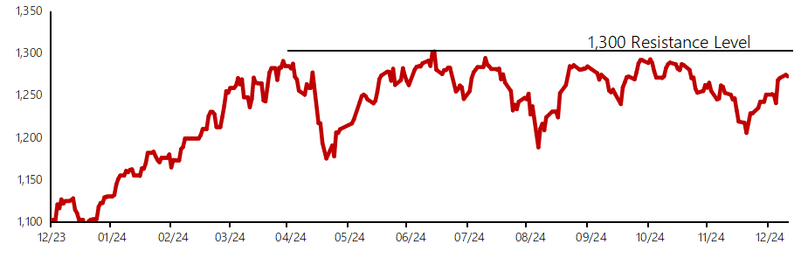

The VN-Index (VNI) is up 12.1% year-to-date in VND terms as of December 18, 2024. The index surged at the beginning of the year, driven by record-low deposit rates (following four rate cuts last year), driven by recovering corporate earnings, and supported by attractive valuations.

However, VND depreciation and other factors prompted foreigners to sell $3.6 billion of Vietnamese stocks this year (following $940 million of outflows last year) depressing foreign ownership of Vietnam equities to a record-low of below 17%.

We expect foreign money to return to Vietnam’s stock market next year once it becomes apparent that Trump is not going to target Vietnam, driven in part by an acceleration in earnings growth of listed companies from 13% in 2024 to 17% in 2025. Furthermore, the market’s valuation remains attractive at a 12x forward P/E, which is 1 standard deviation below the VN-Index’s 10-year average and 20% below the valuation of Vietnam’s regional peers Malaysia, Thailand, Indonesia, and the Philippines.

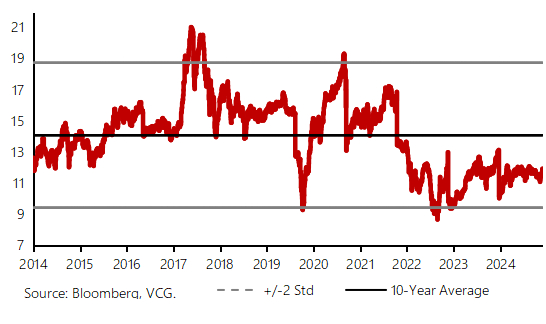

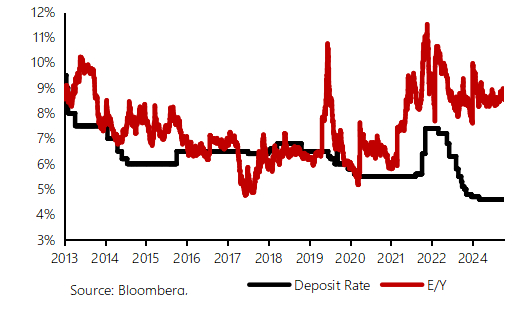

Valuation is also attractive on a PEG ratio basis at ~0.7x as well as when comparing the “earnings yield” of the VN-Index (i.e., the inverse of the VN-Index’s 12x P/E ratio) to the 12-month deposit rates that banks pay (note that we have made an adjustment to the so-called “Fed model” that Warren Buffet and others follow closely in order to make it work for Vietnam’s stock market by replacing 10-year government bond yields with bank deposit rates).

VN-Index 12M P/E Forward (x) VN-Index’s earnings yield vs. 12M deposit rates

Next, the earnings growth acceleration we expect in 2025 is partly predicated on our expectation for a recovery in the residential real estate sector next year (from 9% “core” earnings growth in 2024 to 20% in 2025), which in-turn should also help support a pick-up in banks’ earnings - because mortgage lending should accelerate along with real estate development activity. The banking sector’s heavy weight in the VN-Index means that even a modest pick-up in earnings growth (from 14% in 2024 to 17% in 2025) meaningfully boosts the total earnings growth of the VN-Index.

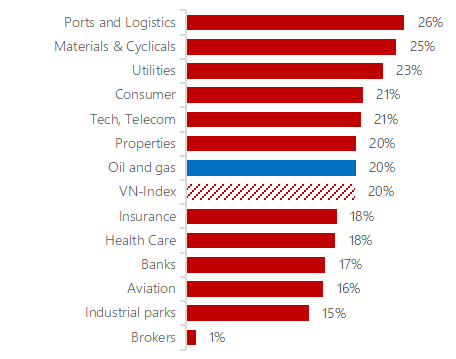

The chart below summarizes our “core” earnings growth expectations by sector (ie. stripping out extraordinary items). The wide variations in sector performance below give ample opportunities to active investors to beat the market with savvy stock selection.

Sector weight (%) core earnings growth in 2025 by sector

Next, investor sentiment is currently being boosted by growing expectations that Vietnam will be upgraded from a Frontier to an Emerging Market by FTSE in 2026, as Vietnam now meets nearly all of FTSE's criteria to be considered an EM market- following recent administrative reforms that bring the stock market’s functioning closer in-line with international standards. Sentiment is also being supported by optimism about Government announcements of planned measures to boost Vietnam’s GDP growth in 2025 and beyond as discussed above.

With respect to the potential “Trump Risk” mentioned earlier in this report, although we do not think there is a risk that Trump will derail Vietnam’s economic growth, he could have a major impact on stock market sentiment in Vietnam and the rest of Asia.

We are particularly concerned about proposed U.S. legislation to revoke China’s Permanent Normal Trade Relations (PNTR) status, which would be a major escalation in the U.S.-China trade war that would rattle Asian markets. Also, it is likely that the value of the U.S. dollar will initially surge in early-2025, which would depress Asian stock markets, but then fall back later in the year for reasons discussed above.

Stock and sector selection drives performance

Outperforming the VN-Index entails savvy stock selection. Our preferred sectors to own in 2025 include: real estate, banks, consumer goods, materials, and IT.

Residential real estate

Pre-sales of new housing units are up around 40% in 2024, which should translate to 20% sector-wide earnings growth next year. The demand for new housing products in Vietnam outstrips supply by a factor of 2:1 and we are hopeful that recent legal reforms will expedite project approvals going forward – which would in-turn drive developers’ earnings for years to come.

In the short term, demand for mid-tier products (circa $1,500-2,000 /sqm) is especially strong, and there is considerable anecdotal evidence of a likely, continued surge in real estate development (many architects in Vietnam are the busiest they have been for years).

Banks

We expect sector-wide earnings growth to pick-up from 14% in 2024 to 17% in 2025, driven by lower credit costs. Deposit rates are likely to increase 50-100 bps next year because loan growth is outpacing deposit growth this year - prompting banks to scramble to raise deposits.

However, we expect stable NIM’s next year because lending is increasingly being driven by high-margin mortgages, and infrastructure loans. Sector-wide valuation remains very cheap at 1.3x Forward P/B versus 17% expected ROE, which is nearly 2 standard deviations below the five-year, sector-wide mean P/B.

Consumer goods

Consumer sentiment in Vietnam has been picking up as 2024 progress and we expect a full recovery to 8-9% real retail sales growth next year (in-line with Vietnam’s long-term average growth), which should boost revenues of consumer facing firms. We also expect sales of discretionary products such as smartphones and laptops to outpace overall retail sales next year; consumers typically replace such products after 3-4 years, and the previous sales peak was in 2021 during Covid.

Materials and cyclicals

We expect steel consumption in Vietnam to grow 10% in 2025, driven by the nascent recovery of real estate construction and by an expected 15-20% increase in public infrastructure construction next year, which help drive 25% sector-wide earnings grow in 2025.

Information technology

We expect the earnings growth of FPT, which dominates Vietnam’s IT sector, to remain at around 20% in 2025, driven by the ~30% growth in its software outsourcing revenue. FPT benefits from the continued robust growth in global IT spending and is well positioned to capture rising demand for AI-related services particularly given the company’s close relationship with Nvidia.

Finally, the long-term growth prospects of the logistics and industrial park sectors also remain very attractive. Vietnam’s ongoing industrialization will almost certainly continue for years to come, driving demand in both sectors. Vietnam’s rapidly growing middle class will also continue driving the rapid growth of ecommerce in Vietnam, which in turn will drive demand for “last mile” services and cold-chain logistics in Vietnam.

Conclusions

The surge in Vietnam’s exports to the U.S. that supported Vietnam’s GDP growth this year is likely to moderate next year, but we expect domestic factors, including a ramp-up in Government infrastructure spending, a revival of the real estate market, and a recovery of consumer spending, to help sustain GDP growth at a circa 6.5% pace next year, in-line with the National Assembly’s official target and with 2024 GDP growth.

- Read More

Singapore’s Platinum Victory seeks to raise stake in Vietnam’s REE to nearly 45%

Singaporean fund Platinum Victory Pte. Ltd. has registered to buy another 16.8 million shares in Ho Chi Minh City-based utility firm Refrigeration Electrical Engineering Corporation (REE), aiming to increase its ownership to nearly 45%.

Finance - Sun, December 22, 2024 | 9:29 am GMT+7

1.8 km road connecting Lach Huyen Port terminals to be built in northern Vietnam

The Hai Phong Economic Zone Management Board has taken a significant step forward in enhancing infrastructure around Lach Huyen Port by establishing a council to appraise the environmental impact assessment for the road connecting terminals No. 3 to No. 6.

Economy - Sun, December 22, 2024 | 8:00 am GMT+7

Hanoi TikToker internationally wanted for involving in multi-billion-dollar scam

Hanoi police have issued an international arrest warrant for Le Khac Ngo, known as "Mr. Hunter," a key accomplice in a recently-dismantled massive foreign exchange and securities fraud ring.

Society - Sat, December 21, 2024 | 10:57 pm GMT+7

Unlocking Phu Quoc’s potential to become the 'Hawaii of the East'

Leading global tourism companies have remarked that Phu Quoc has "yet to receive the recognition it deserves," despite its impressive and unexpected growth rate.

Travel - Sat, December 21, 2024 | 7:20 pm GMT+7

Thai central bank maintains policy interest rate at 2.25%

The Thai Chamber of Commerce (TCC) has said it backs the decision by the Bank of Thailand, the country's central bank, to maintain the policy interest rate at 2.25%, considering the move as suitable for a reviving economy.

Southeast Asia - Sat, December 21, 2024 | 5:43 pm GMT+7

Vietnam's military-run tech giant Viettel strikes big deals at international defence expo

Subsidiaries of Military Industry and Telecommunications Group (Viettel) signed a string of significant contracts with major global partners during the first two days of the Vietnam International Defence Expo 2024 in Hanoi.

Companies - Sat, December 21, 2024 | 5:36 pm GMT+7

Taiwan’s Wistron acquires 37ha land lot in northern Vietnam for expansion

Taiwan-headquartered Wistron, a top electronics provider and an Apple supplier, will further its investment in Vietnam’s northern province of Ha Nam by acquiring another 37.1-hectare land lot.

Companies - Sat, December 21, 2024 | 2:08 pm GMT+7

VAFIE seeks to promote sci-tech development, intellectual property policies

The Vietnam’s Association of Foreign Invested Enterprises (VAFIE) aims to enhance policies for the development of science, technology, and intellectual property, creating a more conducive investment environment.

Companies - Sat, December 21, 2024 | 1:59 pm GMT+7

Vietnamese dong likely to depreciate 3% in 2025: VinaCapital

The Vietnamese dong is likely to depreciate 3% in 2025 on anticipation that the US Dollar/DXY Index will finish 2025 nearly unchanged, says Michael Kokalari, chief economist at Vietnam's leading fund manager VinaCapital.

Economy - Sat, December 21, 2024 | 11:23 am GMT+7

First luxury railway journey across Vietnam features Indochine architecture

PYS Travel has launched the first luxury railway journey across Vietnam named Sjourney, marking a new milestone in the railway tourism sector.

Travel - Sat, December 21, 2024 | 10:09 am GMT+7

Vietnam among 40 most beautiful countries: US publication

Vietnam has secured the 36th position in the ranking of the 40 most beautiful countries in 2024 in a testament to its undeniable charm and appeal, according to US News & World Report.

Travel - Sat, December 21, 2024 | 10:04 am GMT+7

Foxconn to invest $16 mln more in Vietnam’s Quang Ninh province

Competition Team Technology (Vietnam) Company Limited, a subsidiary of Foxconn, will invest an extra $16 million in its “S- Vietnam” project in the northern coastal province of Quang Ninh.

Industries - Sat, December 21, 2024 | 9:53 am GMT+7

Vietnam’s small- and medium-sized businesses embrace digitization to weather global expansion risks: survey

While global expansion remains a key priority for the country's small- and medium-sized businesses (SMBs), achieving this goal requires overcoming challenges by leveraging the right talent and advanced technologies, including AI, according to Payoneer’s findings.

Companies - Sat, December 21, 2024 | 7:56 am GMT+7

Vietnam tax authorities collect $169 mln from delinquent taxpayers through exit bans

Vietnam's tax authorities have collected about VND4.3 trillion ($169 million) from 6,500 delinquent taxpayers through exit ban measures so far this year, nearly five times the amount reported in the middle of the year.

Finance - Fri, December 20, 2024 | 10:29 pm GMT+7

French, Chinese EV manufacturers to invest in Indonesia

Three global electric vehicle (EV) manufacturers - France’s Citroen and China’s BYD and AION - have committed to establishing EV manufacturing plants in Indonesia, Minister of Industry Agus Gumiwang Kartasasmita has announced.

Southeast Asia - Fri, December 20, 2024 | 6:42 pm GMT+7

- Travel

-

Indian billionaire to visit Vietnam’s Ha Long Bay with 4,500 employees

-

Vietnam in talks on visa exemptions with 15 countries to boost tourism

-

Foreign businesses in Vietnam urge relaxation of visa, work permit requirements

-

AI can be a game changer for Vietnam tourism

-

Google Doodle honors world's largest cave Son Doong

-

Four Vietnam airports to suspend operations as typhoon 'strongest in a decade' approaches