Vietnam's FDI inflows to remain resilient

VinaCapital’s chief economist Michael Kokalari points out reasons why Vietnam continues to be a prime destination for foreign direct investment (FDI), particularly from multinationals looking to produce for export and seeking an alternative and/or additional manufacturing base to China.

FDI is one of Vietnam's most important growth drivers, and Vietnam’s FDI inflow has benefitted more than any other country’s from the U.S.-China trade war. However, two potential risks to Vietnam’s future FDI inflow recently caught the attention of local business leaders and government policy makers:

First, Vietnam could be losing its competitiveness as an FDI destination versus India, Malaysia and/or Indonesia. Second, a new global corporate minimum tax scheme would reduce Vietnam’s relative attractiveness as an FDI destination by limiting tax incentives offered to prospective investors.

Tim Cook’s visit to India in April spawned a plethora of articles on the intentions of Apple and others to build new factories in the country. But it is important to note that most products produced in those factories will be sold on the Indian market. In short, new investments to India are not being motivated by the “China + 1” investment strategy that drove FDI inflow into Vietnam over the last decade, particularly at an accelerated pace since the start of the U.S.-China trade war.

Some observers have also noted that planned FDI into Malaysia and Indonesia surged during the last two years, while Vietnam’s registered FDI was essentially flat. However, as we discuss below, investments into Malaysia and Indonesia were largely channeled into the production of goods Vietnam does not make, including electric vehicle (EV) batteries.

Finally, Vietnam has attracted far more than its “fair” share of FDI since the U.S.-China trade war emerged in 2018, so some of Vietnam’s regional competitors for FDI inflow are now experiencing some “catch up” investments after lagging behind Vietnam in recent years. But we believe it is likely that Vietnam will continue to be the biggest beneficiary of “China + 1”- motivated investments in the years ahead for reasons discussed in the next section of this report.

Vietnam, the preferred 'China + 1' destination for multinationals

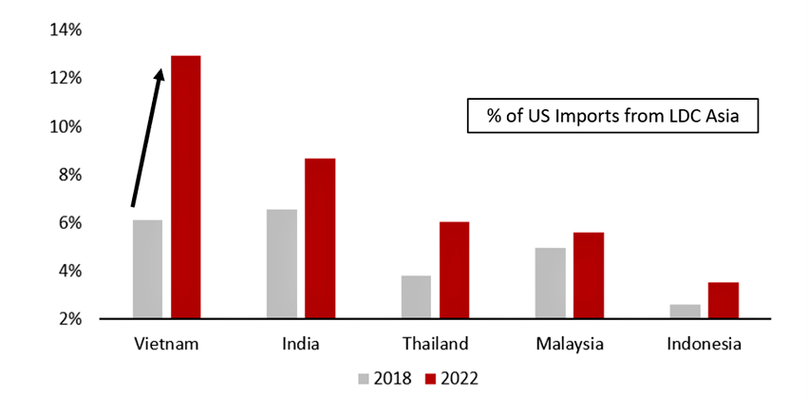

The U.S.-China trade war emerged in 2018, and from then until 2022, China’s share of exports to the U.S. plunged by about 13%, from 69% of total exports from Less Developed Countries (LDC) in Asia (including India) to 56% of LDC Asia exports to the U.S. Vietnam absorbed about half of China’s drop in export market share, increasing its own share of exports to the U.S. from 6% in 2018 to 13% in 2022.

Vietnam has benefited the most from the China-U.S. trade war

Vietnam has been the biggest beneficiary of the U.S.-China trade war because the country’s three key strengths as an FDI destination propelled investments by multinationals, which in turn drove the country’s surging exports.

First and foremost, factory wages in Vietnam are less than half those in China, while the quality of the workforce is comparable to China's according to surveys by JETRO (Japan External Trade Organization) and others. Vietnam also has close geographic proximity to the supply chains in Asia, especially for the production of high-tech products.

And finally, Vietnam benefits from the so-called “friendshoring” phenomenon in which multinational firms increasingly invest in countries that are perceived as having minimal risk of having steep tariffs put on their exports to the U.S. Vietnam’s appeal in that regard increased significantly this year in the wake of visits to the country from U.S. Secretary of State Antony Blinken as well as the biggest-ever delegation of leading U.S. firms, both of which followed a call between President Biden and Nguyen Phu Trong, Vietnam’s Party General Secretary.

India not a threat to Vietnam's FDI inflow yet

Apple’s April announcement of ambitious plans to expand its iPhone production in India generated a lot of news, but it is consistent with other multinational firms that are investing in India primarily to manufacture products to be sold to Indian consumers, which is very different than their motivation for investing in Vietnam.

Vietnam is pursuing the so-called “East Asian Development Model,” which is the same approach that the “Asian Tiger” economies used to become wealthy. This economic growth strategy is focused on manufacturing products that are exported to the U.S. and other developed countries, and multinational firms that invest in Vietnam are contributing to that endeavor; nearly all of the products they produce in Vietnam are exported, especially to the U.S., which is Vietnam’s largest export market (at over one-quarter of Vietnam’s exports).

In contrast, India is pursuing a more domestic-oriented growth strategy, so multinational firms investing in that country are seeking to profit from its rapidly growing middle class rather than as a production base from which to export. For example, Apple iPhone sales in India have exploded in recent years, as can be seen in the table below, so Apple has been pouring money into India to increase its local iPhone production capacity, which has not kept pace with local demand. Of the 7 million phones the company sold in India last year, only 6.5 million were produced locally, with the balance imported to meet demand, illustrating why Apple’s immediate motivation to invest in India is to address surging local demand.

Obstacles to export production in India

Two key issues are preventing multinational companies from aggressively investing in India to produce goods for export: workforce-related issues (including literacy) and India’s strict labor laws. For example, factories in India with more than 100 employees require government approval before laying off any employees, and India’s “Made in India” program, which was launched in 2015 to attract manufacturing FDI (partly with tax incentives) is widely recognized as having failed to attract foreign investment, partly for these reasons. These dynamics could change in the future, however, as Apple and others have been pressuring India to improve its attractiveness as an FDI destination because of their desire to diversify production out of China for geopolitical and other reasons.

Last year, Vietnam’s “Ease of Doing Business” ranking in the Economist Intelligence Unit (EIU) rating of countries around the world leaped by 12 places, which was the largest improvement in any of the 82 countries the EIU assesses; India’s ranking also increased, albeit by six places. In contrast, China’s ranking fell by 11 places, and the country now ranks below both Vietnam and India.

We do not see India threatening Vietnam’s FDI inflow and continue to believe FDI is likely to remain one of Vietnam’s key growth drivers for years to come. The current wave of new FDI announcements in India should not be viewed as taking investment away from Vietnam.

Malaysia, Indonesia benefit from EVs, cloud computing

Planned foreign investment in Malaysia and Indonesia surged at a near 65% rate and 30% rate (CAGR), respectively, over the last two years, while Vietnam’s registered FDI was essentially flat, and fell in the first four months of this year. Some observers have interpreted this to mean that multinationals may be setting up factories in Malaysia and Indonesia instead of Vietnam, but both of those countries are benefitting from a surge of investments into EV battery production, and Malaysia is attracting considerable investment into data centers that benefit from cloud computing.

For example, Tesla, BYD, and Hyundai are investing in EV battery production in Indonesia, and Samsung is investing in Malaysia. In Indonesia, such investments are motivated by an abundance of “green metals” in the country as well as the country’s strategy to encourage investment in downstream commodities industries (Indonesia banned the export of unprocessed nickel last year, for example). Malaysia is also experiencing a boom in data center and cloud computing-related investments, which grew 4,000% last year, driven by investments by Amazon Web Services, Byte Dance systems, and Bridge Data Centers.

Vietnam's high-tech foreign investments are still focused on the assembly of consumer and other electronics as the country's capabilities do not yet extend to higher value-added businesses like data centers and cloud computing. But it is important to keep in mind that Malaysia’s climb up the high-tech value chain also started with the assembly of electronic products, so Malaysia’s success can be viewed as an indicator of where Vietnam is likely to be in the future.

Global minimum tax won’t dampen Vietnam’s FDI inflow

FDI companies that invest in Vietnam typically enjoy tax breaks that may include a 0% tax rate during the initial years of their operations in Vietnam, followed by a gradual increase up to Vietnam’s full 20% corporate income tax rate over a period as long as 10 years.

In 2021, over 100 countries (including Vietnam) agreed to an OECD proposal for a global corporate minimum tax (GMT) that would impose a 15% minimum corporate tax rate on income for companies with consolidated incomes above circa $850 million, starting from 2023. The implementation of this agreement was subsequently delayed to 2024, and it is not clear yet whether the U.S., China, and India will participate in the scheme.

Vietnam has been preparing for the implementation of the new GMT system next year, and it has been reported that around 70 companies in Vietnam could see their tax rates rise if it is imposed. Some of Vietnam’s regional emerging market peers are reportedly investigating alternative schemes in which some of the additional tax revenues would be channeled into a “business support fund” that would effectively offset companies’ higher tax burdens by subsidizing some of those firms’ production costs (for example, with subsidized electricity prices, spending on the construction of a new factory, worker housing, etc.).

More importantly, low tax rates are far from the most important factor in a company’s decision about where to establish a new factory, according to surveys from the World Bank and others. Considerations like political stability, ease-of-doing-business, workforce (quality and wages), and physical infrastructure are all more important factors.

The net conclusion of all of the above is that the new GMT is unlikely to impede Vietnam’s FDI inflow given the fact that tax incentives are not the primary attraction for setting up a factory in Vietnam, and it seems likely that workarounds to the GMT are likely to be put in place, if-and-when the scheme is actually implemented.

A section of the Van Don-Mong Cai Expressway, which links the investment hub of Van Don in Quang Ninh with the northern province's Mong Cai border town. Photo courtesy of the investor Sun Group.

Conclusion

FDI has been one of Vietnam’s most important economic growth drivers over the last decade. Vietnam has significantly outperformed its regional peers in attracting FDI since the U.S.-China trade war emerged, but concerns have been raised about Vietnam’s continued competitive advantage amid growing interest in India from firms like Apple and others.

We are not overly concerned that India will affect FDI that would have otherwise poured into Vietnam for any number of reasons, but mainly because this new-found corporate interest in India is to produce for the rapidly growing local market while Vietnam is seen as a base for manufacturing for export. At this point, India is not widely considered an attractive option in the context of a “China + 1” investment strategy while Vietnam is the preferred option for most companies.

Meanwhile, the new GMT regime should have little-if-any impact on FDI into Vietnam. We believe the government will, like its peers in some regional markets, find workarounds that will essentially balance out GMT obligations.

For these and other reasons, we fully believe that Vietnam will continue to be a prime destination for FDI, particularly from multinationals looking to produce for export and seeking an alternative and/or additional manufacturing base to China, for the foreseeable future.

- Read More

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

The first passenger flights touched down at Long Thanh International Airport in Dong Nai province on Friday morning, marking the inaugural civil aviation operation at Vietnam’s largest airport.

Economy - Fri, December 19, 2025 | 2:07 pm GMT+7

Vingroup starts work on $35.2 bln Olympic Sports Urban Area on Hanoi outskirts

Vingroup (HoSE: VIC), Vietnam's leading private conglomerate, on Friday broke ground on its 9,171-hectare Olympic Sports Urban Area project in Hanoi, which is expected to become a new growth engine for the southern part of the capital in the next decade.

Real Estate - Fri, December 19, 2025 | 1:59 pm GMT+7

Vietnam telecom giant VNPT establishes AI company

State-owned Vietnam Posts and Telecommunications Group (VNPT) on Thursday launched subsidiary VNPT AI, aiming to bring Vietnamese AI products to international markets.

Companies - Fri, December 19, 2025 | 11:50 am GMT+7

Quang Ngai Sugar develops sugar, biomass power projects worth $179 mln in central Vietnam

Quang Ngai Sugar JSC (UPCom: QNS), a top sugar producer in Vietnam, will simultaneously hold groundbreaking or inauguration ceremonies on Friday for three projects worth over VND4.7 trillion ($178.5 million) in Gia Lai province.

Companies - Fri, December 19, 2025 | 8:05 am GMT+7

Vietnam defeat Thailand to win men’s football gold at SEA Games 33

After conceding two goals in just over 30 minutes, Vietnam reversed the situation to finally beat host nation Thailand 3-2 in the men’s football final of the 33rd SEA Games.

Society - Thu, December 18, 2025 | 10:43 pm GMT+7

Sun Group to commence construction on 5 landmark projects worth $5.7 bln

Sun Group is scheduled to start construction of five large-scale projects across Vietnam’s three regions on Friday, with a total investment of nearly $5.7 billion.

Companies - Thu, December 18, 2025 | 8:39 pm GMT+7

Unpaid credit card balances in Singapore hit record high in 10 years

Singapore's credit card debt has exceeded SGD9.07 billion (about $7 billion) in 2025's third quarter, a 10-year high that was last seen in 2014.

Southeast Asia - Thu, December 18, 2025 | 7:54 pm GMT+7

Thailand, Japan deepen transport, infrastructure cooperation

Thai Deputy Prime Minister and Minister of Transport Phiphat Ratchakitprakarn has met with Japanese Ambassador Otaka Masato to advance cooperation in Thailand’s transportation and infrastructure projects.

Southeast Asia - Thu, December 18, 2025 | 7:50 pm GMT+7

Masan's FMCG arm MCH to list on HCMC bourse at $8 per share, valuation tops $8.6 bln

Masan Consumer Corporation (UpCoM: MCH), the fast-moving consumer goods arm of Vietnam’s Masan Group, will officially debut on the Ho Chi Minh City Stock Exchange (HoSE) on December 25, with a reference price set at VND212,800 ($8.08) per share.

Companies - Thu, December 18, 2025 | 4:57 pm GMT+7

Sun Group-led consortium to build $616 mln Red River bridge in Hanoi

Hanoi authorities have approved a consortium led by Sun Group as the investor for the Tran Hung Dao bridge project, with a total investment estimated at VND16.27 trillion ($616.14 million).

Infrastructure - Thu, December 18, 2025 | 3:26 pm GMT+7

Shinhan Bank Vietnam accompanies SMEs in promoting cashless payments

With modern, secure and convenient payment solutions designed to meet the specific needs of businesses, particularly the SME segment, Shinhan Bank Vietnam continues to accompany enterprises in building a modern corporate image and keeping pace with the digital economy.

Banking - Thu, December 18, 2025 | 2:10 pm GMT+7

JC&C to divest 4.6% stake at Vietnam's dairy giant Vinamilk to F&N for $228 mln

Singapore-listed Jardine Cycle & Carriage Limited (JC&C) has announced the sale of more than 96 million shares, or a 4.6% stake, in Vietnam’s dairy giant Vinamilk (HoSE: VNM) to F&N Dairy Investments Pte. Ltd., part of the Fraser and Neave (F&N) group controlled by Thai billionaire Charoen Sirivadhanabhakdi.

Companies - Thu, December 18, 2025 | 1:36 pm GMT+7

Siemens to supply high-speed trains, key railway systems to Vingroup's subsidiary VinSpeed

Siemens Mobility on Wednesday signed a comprehensive strategic cooperation and high-speed railway technology transfer agreement with VinSpeed, a unit of Vietnam’s Vingroup, to supply high-speed trains and key railway systems for planned rail projects in Vietnam.

Companies - Thu, December 18, 2025 | 1:24 pm GMT+7

Hanoi administration to raise over $52 mln from Thuong Dinh Footwear divestment

Hanoi’s municipal government is set to raise nearly VND1.38 trillion ($52.35 million) from the sale of its entire 68.67% stake in Thuong Dinh Footwear Company - a major footwear producer in Vietnam, after two individual investors agreed to buy all shares on offer at a price far above market levels.

Companies - Thu, December 18, 2025 | 10:01 am GMT+7

Sony Music to acquire 49% stake at Vietnam's YeaH1 subsidiary

Sony Music Entertainment Hong Kong Ltd. will invest in a unit of YeaH1 (HoSE: YEG), a leading media entertainment technology group in Vietnam, through a private placement, acquiring a 49% stake and reducing YeaH1’s ownership to 49.88%.

Companies - Thu, December 18, 2025 | 8:34 am GMT+7

Honda Vietnam expands biz registration to cover electric vehicles, charging, battery swapping

Honda Vietnam (HVN) has formally expanded its registered business lines to include electric vehicles, charging infrastructure, and battery-swapping services, marking its most comprehensive step into the electric mobility ecosystem to date.

Companies - Wed, December 17, 2025 | 5:16 pm GMT+7

- Travel

-

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

-

Vietnam defeat Thailand to win men’s football gold at SEA Games 33

-

Which beach in Vietnam boasts the Pantone - 'color of the year 2026'?

-

Unprecedented national milestone in 65 years: Vietnam welcomes 20 millionth international visitor

-

Techcombank HCMC International Marathon affirms global standing

-

Vietnam's tour operator Vietravel announces full exit from Vietravel Airlines