Collateral quality a challenge for Vietnam’s corporate bond market: broker

Among an array of challenges and risks facing Vietnam’s corporate bond market, a particularly important one is the quality of collateral, says broker VietinBank Securities.

A recent report by the firm cites data as showing about 38% of bonds issued by real estate developers in 2022 had no collateral or poor-quality collateral.

The broker has stressed this risk factor in the context of corporate bonds emerging as an important capital mobilization channel for Vietnamese enterprises in recent years alongside traditional channels like bank credit and securities.

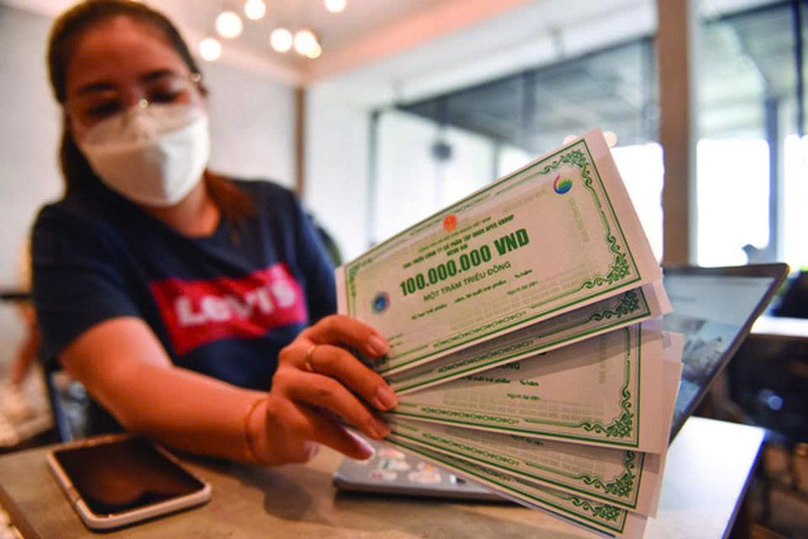

At the end of Q2/2024, there were 1,097 codes of 293 companies with a registered transaction value of about VND784.3 trillion ($31.28 billion) in the Vietnamese bond market. Photo courtesy of Hanoi Times.

Data from the Vietnam Bond Market Association (VBMA) shows that in 2023, 72 enterprises successfully issued private placement corporate bonds worth nearly VND245.9 trillion ($9.8 billion), down 35.6% year-on-year.

Since the launch of a private placement corporate bond trading platform at the Hanoi Stock Exchange on July 19, 2023, until December 25, 2023, 822 bond codes were registered for trading on the platform with total transaction value exceeding VND189 trillion ($7.54 billion), or VND1.6 trillion per session. A majority of this came from the banking group at VND138 trillion, or 73% of the total value.

Although the volume of corporate bonds issued last year fell 28.6% from 2022, this was a positive signal amid the current difficult context, the broker commented, adding that bond redemption value in 2023 hit VND215.5 trillion ($8.6 billion), up 16.8% year-on-year.

According to VietinBank Securities, the size of the Vietnamese corporate bond market is currently quite modest at just 12% of GDP as of December 2023, citing data from the HNX and the General Statistics Office. The corresponding figures are 54.3% in Malaysia, 34.3% in Singapore, and 25.5% in Thailand.

Vietnam has targeted growing this to at least 20% of GDP by 2025, with outstanding debt 47% of GDP by 2025.

In the first half of 2024, the corporate bond market remained stable with many successful issuances by enterprises. At the end of Q2, there were 1,097 bond codes of 293 companies with a registered transaction value of about VND784.3 trillion ($31.28 billion).

In H1, 41 enterprises issued private placement corporate bonds for VND110.2 trillion ($4.4 billion), of which credit institutions accounted for 63.2%, and real estate developers 28.6%. Among buyers, credit institutions made up 53.5%, securities companies 21.9% and individual investors 5.2%. About 14.5% of issued bonds had collateral and the average coupon rate of the issued bonds was 7.41% per year.

The bond redemption value hit VND59.8 trillion ($2.38 billion) in the first six months, down 39% compared to the same period in 2023.

Shortcomings, measures to overcome them

The VietinBank Securities report identifies several shortcomings and limitations in Vietnam’s corporate bond market including a lack of transparency in information from bond issuers, credit risks as a result of high interest rates, incomplete legal corridor, lack of product diversity and poor liquidity.

In order to address existing problems and systemic risks in the issuance of corporate bonds and to unlock capital flows into the market, regulators need to have initial control measures through appropriate regulations, laws and sanctions.

Strategic solutions to unleash capital sources and increase market transparency are indispensable measures.

For promoting development of the bond market and enabling enterprises repay their bond debts when due, the government issued Decree No. 08 dated March 5, 2023 allowing issuers to extend payment deadlines by a maximum of two years after the original term stated in the previously announced issuance plan.

However, since 2022, due to economic recession impacts, enterprises continue to face many difficulties and challenges in production and business activities, the report says.

Limiting maximum extension to two years may make it difficult for enterprises to find money sources or mobilize capital to ensure repayment while maintaining normal business operations.

“Therefore, to support businesses to overcome this difficult period, the government and regulators should consider extending deadlines for paying the principal when bonds are due,” the report says.

In addition to Decree 65 (issued September 16, 2022), the government can introduce some mechanisms to encourage enterprises to be proactive with information disclosure.

For instance, identifying the Top 10 enterprises every year in terms of compliance with regulations on bond issuance and information disclosure in the private placement bond market can act as an incentive.

Investors can see this ranking as one of the criteria to evaluate the transparency of issuers and level of risk for their investments

There’s a need for easily accessible and highly liquid investment products in order to promote market development and unleash capital flows, the report says, adding that increasing support for bond investment funds is another measure that can help individual investors indirectly participate in the market.

Under the Law on Personal Income Tax, income from bonds is currently taxed at 5%. The government and regulators can consider tax incentives to encourage investment in the corporate bond market.

The report also stresses the need to provide guidance and create a mechanism for credit institutions to have the right to manage collateral, especially real estate and future projects, in order to form a legal corridor to support businesses in finding partners to manage collateral.

Finally, authorities should actively promote listed bond products and introduce the benefits of listed bonds to make them more attractive to investors.

The report also recommends a focus on strengthening cooperation with international financial institutions.

- Read More

Vietnam's livestock major GreenFeed reaps $65 mln in H1 profit, outpacing major rivals

GreenFeed Vietnam, a leading livestock company in the country, posted VND1.72 trillion ($65.07 million) in H1 after-tax profit, 2.5 times higher than the same period last year.

Companies - Wed, December 3, 2025 | 9:00 pm GMT+7

Eight EVNNPT employees receive Vietnam General Confederation of Labor innovation award

The Vietnam General Confederation of Labor (VGCL) has awarded its annual Creative Labor Certificate to 24 members of Vietnam Electricity's trade union, including eight employees from subsidiary National Power Transmission Corporation (EVNNPT).

Companies - Wed, December 3, 2025 | 8:42 pm GMT+7

Profit of Samsung’s 4 major Vietnam factories up 4.5% in Jan-Sept

Four major factories of Samsung Electronics in Vietnam posted a total profit of KRW4.37 trillion ($2.98 billion) in the first nine months of 2025, up 4.51% year-on-year, according to the South Korean conglomerate’s Q3 consolidated earnings statements.

Companies - Wed, December 3, 2025 | 4:52 pm GMT+7

Vietnam approves expanded list of strategic energy projects to meet rising power demand

Prime Minister Pham Minh Chinh has approved a sweeping update to the country’s portfolio of national important and priority energy projects, marking one of the most comprehensive revisions to the sector’s development roadmap in recent years.

Energy - Wed, December 3, 2025 | 3:53 pm GMT+7

Vietnam Education Publishing House pledges $758,300 in textbooks for students in flood-hit areas

Vietnam Education Publishing House (VEPH) has pledged up to VND20 billion ($758,292) this year to provide textbooks for students in the areas stricken by typhoons, floods, and poor economic conditions.

Companies - Wed, December 3, 2025 | 12:23 pm GMT+7

International awards solidify PVI's position as top non-life insurer in Asia

PVI Insurance, the only non-life insurance company in Vietnam, has won two categories at the Insurance Asia News (IAN) Awards for Excellence 2025: General Insurer of the Year and Underwriting Initiative of the Year.

Companies - Wed, December 3, 2025 | 11:58 am GMT+7

Foxconn aims to produce unmanned aerial vehicles, Xbox consoles in northern Vietnam province Bac Ninh

Fushan Technology (Vietnam) LLC, a subsidiary of Taiwan-based electronics giant Foxconn, plans to add unmanned aerial vehicles (UAVs) and Xbox gaming consoles to its production portfolio under a VND8,354 billion ($316.74 million) project in Bac Ninh province.

Industries - Wed, December 3, 2025 | 11:24 am GMT+7

Three port majors bid for $1.8 bln Lien Chieu container terminal project

Three consortia have submitted bids for the $1.8 billion Lien Chieu container terminal project in Danang, all of them leading companies in global shipping and port operations, a local official said.

Infrastructure - Wed, December 3, 2025 | 9:04 am GMT+7

Vietnam's billionaire Pham Nhat Vuong rises to Southeast Asia’s second richest

Pham Nhat Vuong, chairman of Vingroup (HoSE: VIC), Vietnam’s largest listed company by market cap, added $1.2 billion to his net worth in a single day, bringing it to $24.7 billion, according to Forbes data as of Tuesday.

Economy - Wed, December 3, 2025 | 8:39 am GMT+7

Malaysia forecasts 4.3-4.7% economic growth in 2026

Malaysia’s economy is expected to maintain steady growth in 2026 despite persistent global uncertainties, according to economic experts.

Southeast Asia - Tue, December 2, 2025 | 9:59 pm GMT+7

Vietnam drafts rules to upgrade professional standards for securities practitioners

Vietnam’s securities regulator has proposed amendments to licensing rules aimed at improving the quality and oversight of market professionals, including shifting from paper-based to electronic practising certificates and recognizing certain international qualifications.

Finance - Tue, December 2, 2025 | 8:57 pm GMT+7

EVF General Finance JSC labor union holds congress, sets priorities for 2025-2030 term

The labor union of EVF General Finance Joint Stock Company (EVF) recently held its sixth congress for the 2025-2030 term, outlining key tasks to strengthen worker representation and support the company’s development.

Companies - Tue, December 2, 2025 | 8:15 pm GMT+7

Hoa Phat Agriculture to maintain annual cash dividends after listing

Hoa Phat Group said its agriculture arm will continue paying annual cash dividends after listing, as its investment needs through 2030 amount to only about VND1.5 trillion ($56.87 million), funded by IPO proceeds and depreciation, leaving room to distribute profits to shareholders.

Companies - Tue, December 2, 2025 | 5:41 pm GMT+7

Elon Musk company close to securing pilot licence for Starlink satellite internet services in Vietnam: official

The U.S.'s SpaceX is preparing to resubmit its application for a pilot licence to provide Starlink satellite internet services in Vietnam, after addressing several issues raised by regulators.

Industries - Tue, December 2, 2025 | 4:44 pm GMT+7

Central Vietnam province Ha Tinh seeks investors for $664 mln wind power project

Ha Tinh province authorities have begun seeking investors for the 400MW Ky Anh wind power plant, the largest of its kind in north-central Vietnam, according to their announcement.

Energy - Tue, December 2, 2025 | 3:08 pm GMT+7

Growth recorded in Vietnam's manufacturing sector despite severe typhoons, floods

Output, new orders, and employment all continued to rise in November, despite reports of disruption caused by severe typhoons which impacted supply chains and the ability of manufacturers to complete work on time, according to S&P Global.

Economy - Tue, December 2, 2025 | 11:42 am GMT+7

- Consulting

-

Mind the gap

-

The generation game: Adapting to an aging population

-

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas

-

Powering growth from within

-

Key factors helping firms export to demanding markets: DH Foods exec

-

Vietnam corporate earnings to be driven by credit expansion, trading activity, property recovery