EuroCham Vietnam's quarterly business confidence index rises for third time in a row

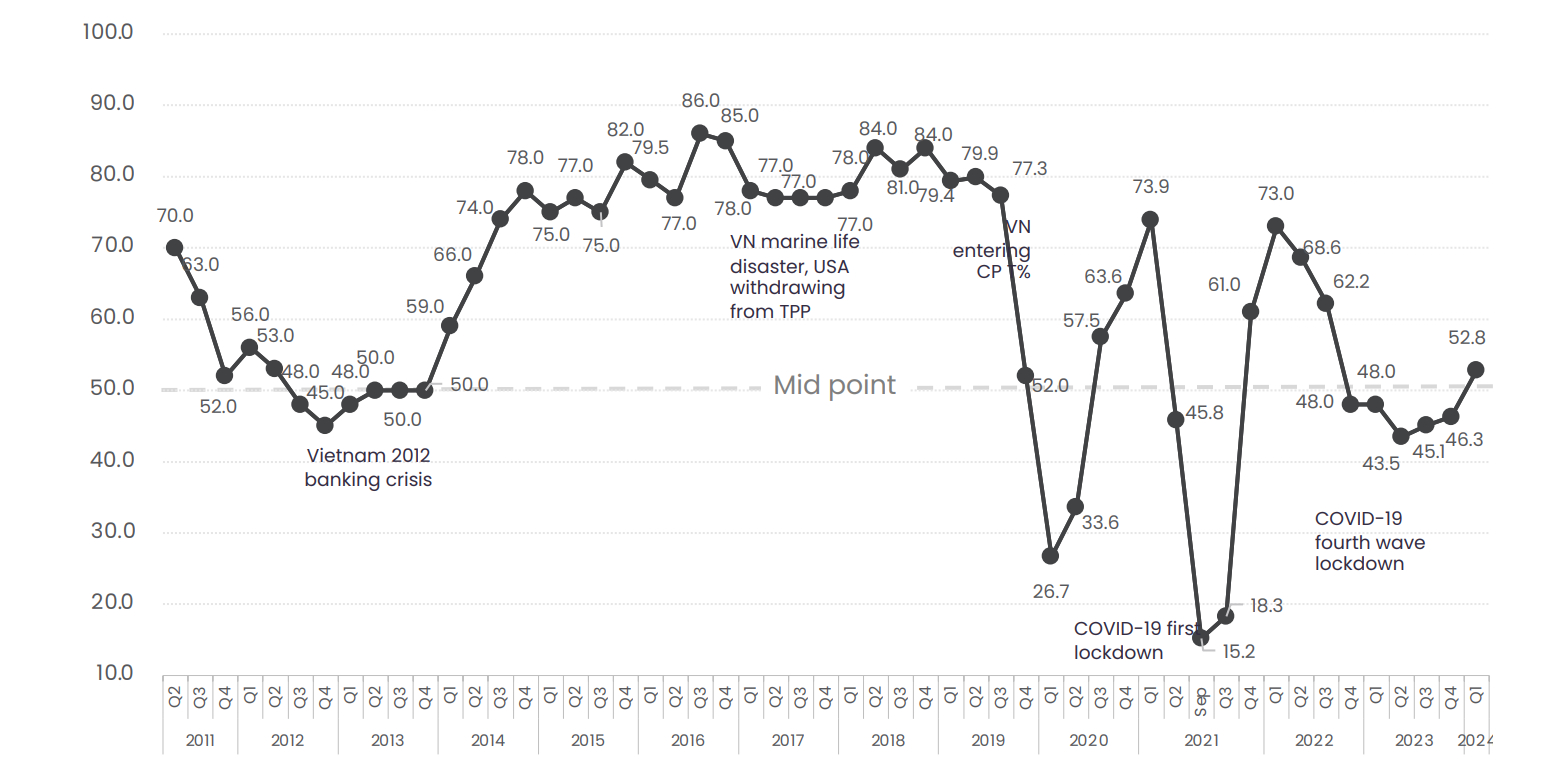

EuroCham’s Business Confidence Index (BCI) for Vietnam rose for the third time in a row to 52.8 in the first quarter of 2024, the highest level since Q3/2022, which indicates optimism in the national economy.

The index, reflecting the business sentiment of 1,400 European companies operating in Vietnam, fell from 73 in Q1/2022 to 68.6 in Q2/2022, 62.2 in Q3/2022, 48 in Q4/2022, 48 in Q1/2023, 43.5 in Q2/2023. Since then, the index has improved to 45.1 in Q3/2023, 46.3 in Q4/2023, and 52.8 in Q1/2024.

EuroCham’s Business Confidence Index (BCI) for Vietnam through the years. Photo courtesy of EuroCham.

From Q4/2023 to Q1/2024, the ratio of businesses expressing optimism in the economic outlook increased by six percentage points from 39% to 45%, while pessimism correspondingly decreased by eight percentage points (from 18% to 10%).

Regarding positivity in the economy, EuroCham’s survey noted macroeconomic factors as the biggest contributor, with 48% of survey respondents giving “good” or “excellent” answers. They include sub-factors such as a rebound of the economy, improved consumer spending, a sales boost during Tet (Lunar New Year holiday), and higher demand for services.

Other key factors were government policies with 20%, which include higher public investment and supportive monetary/fiscal policies; and business performance with 13%, including fulfilling or breaking sales targets and team performance.

On the negative side, EuroCham also stressed macroeconomic factors as the largest impacts, with 41% of surveyed businesses answering “not good” or “very poor.” They include sub-factors of the real estate market crash, the global economic situation, and geopolitical tensions.

Other factors were industry-specific challenges, especially the construction and renewable energy industries, with 24%; government policies and regulations, such as lack of regulator progress and investment restrictions, with 18%; and labor issues and visa difficulties, with 10%.

For the business outlook in Q2/2024, 4% expected “very poor” outcomes, 21% “not good”, 41% “neutral”, 33% “good”, and 1% with “excellent”. The 33% portion of “good” clarified “We will start to see demand for Vietnamese goods increasing, plus the impact of new volumes coming from previous year(s) FDI going live.”

For the five-year outlook (long-term), 53% gave “somewhat optimistic” responses, 18% with “very optimistic”, and 15% with “neutral”. The rest said “somewhat pessimistic” and “very pessimistic”.

While optimism remains high, businesses face regulatory hurdles in Vietnam that hinder market entry and long-term investment. EuroCham pointed out a key concern of “administrative burdens” with over half of respondents citing this issue. Other issues included “unclear regulations” with 36%; “permit and license difficulties” with 28% experiencing costly delays in obtaining approvals; and “work visa barriers" with 26% saying restrictive rules stifle skills transfer and discourage foreign expertise and capital.

To attract more foreign investment, businesses suggested “simplifying administration” with 37% of respondents, “strengthening the legal framework” with 34%, and “enhancing infrastructure” with 28%.

“This positive trend underscores the European business community’s view of Vietnam as a dynamic market with promising growth prospects,” said EuroCham chairman Dominik Meichle. “The index once again rising above the 50 threshold reaffirms the country’s growing appeal. Continued efforts to enhance stability and predictability will further strengthen Vietnam’s global competitiveness and unlock its full potential,” the executive added.

“Vietnam has tremendous economic potential, and addressing regulatory challenges is key to fully realizing it,” said Meichle. “Streamlining procedures and establishing more transparent regulations will empower both Vietnamese and foreign businesses to succeed. This will position Vietnam as a leading investment destination in the region, benefiting domestic businesses, attracting international capital, and strengthening economic partnerships,” he added.

“Vietnam has tremendous economic potential, and addressing regulatory challenges is key to fully realizing it,” said Meichle. “Streamlining procedures and establishing more transparent regulations will empower both Vietnamese and foreign businesses to succeed. This will position Vietnam as a leading investment destination in the region, benefiting domestic businesses, attracting international capital, and strengthening economic partnerships,” he added.

- Read More

Vietnam’s largest listed firm to double charter capital

Vingroup, the biggest company by market capitalization on Vietnam's bourses, said it will double its charter capital to more than VND77 trillion ($2.92 billion) after issuing nearly 3.9 billion bonus shares to existing shareholders at a 1:1 ratio.

Companies - Thu, November 20, 2025 | 11:50 am GMT+7

Consortium plans $12.8 bln boulevard-landscape project in Hanoi

A consortium including Vietnam’s transport infrastructure giant Deo Ca Group has proposed developing the VND338 trillion ($12.81 billion) Red River boulevard and landscape, which could become Hanoi’s largest-ever infrastructure project.

Infrastructure - Thu, November 20, 2025 | 8:58 am GMT+7

Viettel, UAE-based EDGE partner on defense, dual-use technologies

Military-run Viettel, Vietnam’s largest telecommunications and technology group, has signed an MoU with EDGE, one of the world’s leading advanced technology and defence companies, in a move that underscores the country’s ambition to expand high-tech manufacturing.

Companies - Thu, November 20, 2025 | 8:53 am GMT+7

Maersk eyes building major container ports in Vietnam

A.P.Moller - Maersk (Maersk) is exploring investment opportunities to develop large, modern and low-carbon container ports in Vietnam.

Infrastructure - Wed, November 19, 2025 | 4:36 pm GMT+7

Taiwan semiconductor giant Panjit acquires 95% of Japan-based Torex’s Vietnam arm

Panjit International Inc, a Taiwan-listed semiconductor major, has approved the acquisition of a 95% stake in Torex Vietnam Semiconductor, a subsidiary of Japan-based Torex.

Companies - Wed, November 19, 2025 | 3:59 pm GMT+7

Vietnam PM urges Kuwait Petroleum to expand Nghi Son refinery, build bonded fuel storage facility

Prime Minister Pham Minh Chinh on Tuesday called on Kuwait Petroleum Corporation (KPC) to expand the Nghi Son oil refinery and build a bonded fuel storage facility in Vietnam.

Industries - Wed, November 19, 2025 | 3:18 pm GMT+7

Southern Vietnam port establishes strategic partnership with Japan’s Port of Kobe

Long An International Port in Vietnam’s southern province of Tay Ninh and Japan’s Port of Kobe on Monday signed an MoU establishing a strategic port partnership which is expected to boost trade flows, cut logistics costs, and deliver greater benefits to businesses across the region.

Companies - Wed, November 19, 2025 | 10:14 am GMT+7

Thaco's agri arm seeks to expand $44 mln cattle project in central Vietnam

Truong Hai Agriculture JSC (Thaco Agri), the agriculture arm of conglomerate Thaco, looks to aggressively expand its flagship cattle farming project in the central Vietnam province of Gia Lai.

Industries - Wed, November 19, 2025 | 9:56 am GMT+7

Japan food major Acecook eyes new plant in southern Vietnam

Acecook, a leading instant noodle maker with 13 plants operating in Vietnam, is studying a new project in the southern province of Tay Ninh.

Industries - Wed, November 19, 2025 | 9:39 am GMT+7

Vietnam’s largest Aeon Mall to take shape in Dong Nai province

Authorities of Dong Nai province, a manufacturing hub in southern Vietnam, on Monday awarded an investment registration certificate to Japanese-invested Aeon Mall Vietnam Co., Ltd. for its Aeon Mall Bien Hoa project.

Industries - Tue, November 18, 2025 | 8:17 pm GMT+7

Police propose prosecuting Egroup CEO Nguyen Ngoc Thuy for fraud, bribery

Vietnam’s Ministry of Public Security has proposed prosecuting Nguyen Ngoc Thuy, chairman and CEO of Hanoi-based education group Egroup, along with 28 others, for fraud to appropriate property, giving bribes, and receiving bribes.

Society - Tue, November 18, 2025 | 4:01 pm GMT+7

Singapore-backed VSIP eyes large urban-industrial complex in southern Vietnam

A consortium involving VSIP, a joint venture between local developer Becamex IDC and Singapore’s Sembcorp, plans a large-scale urban-industrial development named the "Moc Bai Xuyen A complex along the Tay Ninh-Binh Duong economic corridor in southern Vietnam.

Industrial real estate - Tue, November 18, 2025 | 2:38 pm GMT+7

Aircraft maintenance giant Haeco to set up $360 mln complex in northern Vietnam

Hong Kong-based Haeco Group, Vietnam's Sun Group, and some other partners plan to invest $360 million in an aircraft maintenance, repair and overhaul (MRO) complex at Van Don International Airport in Quang Ninh province - home to UNESCO-recognized natural heritage site Ha Long Bay.

Industries - Tue, November 18, 2025 | 2:13 pm GMT+7

Thai firm opens 20,000-sqm shopping center in central Vietnam hub

MM Mega Market Vietnam (MMVN), a subsidiary of Thailand's TCC Group, on Monday opened its MM Supercenter Danang, a 20,000 sqm commercial complex with total investment capital of $20 million, in Danang city.

Real Estate - Tue, November 18, 2025 | 12:20 pm GMT+7

Vietnam PM asks Kuwait fund to expand investment in manufacturing, logistics, renewable energy

Prime Minister Pham Minh Chinh on Monday called on the Kuwait Fund for Arab Economic Development (KFAED) to strengthen cooperation with Vietnam, particularly in the areas of industrial production, logistics, renewable energy, green economy, and the Halal ecosystem.

Economy - Tue, November 18, 2025 | 11:53 am GMT+7

Thai dairy brand Betagen to build first plant in Vietnam

Betagen, a famous Thai dairy brand, plans to build its first manufacturing plant in Vietnam, located in the southern province of Dong Nai.

Industries - Tue, November 18, 2025 | 8:49 am GMT+7