Liechtenstein-domiciled Lumen Vietnam Fund sees NAV up 6.73%

The Lumen Vietnam Fund, an open-end investment fund incorporated in Liechtenstein, reported a performance of 4.49% from May 1-16 in U.S. dollars, bringing its year-to-date to 6.73%.

For comparison reasons, the MSCI Frontier Markets Index was positive at 2.7% month to date and yielded +1.6% year to date in the same period, according to VietNam Holding Asset Management (VNHAM), the advisor of the fund.

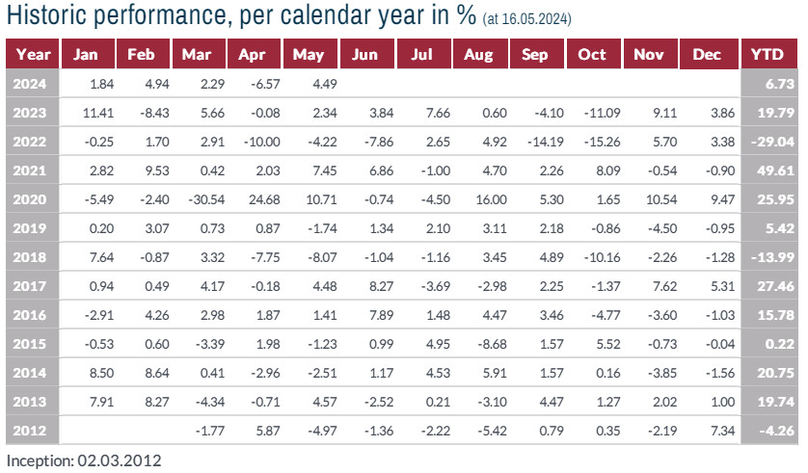

Lumen Vietnam Fund's performance. Source: VietNam Holding Asset Management (VNHAM).

As of May 16, the fund’s net asset value (NAV) was $317.36 million.

In the first half of May 2024, the Lumen Vietnam Fund attributed its performance to its strategic allocation in small- and mid-cap stocks and stock picking in various sectors, including consumer discretionary, industrials, energy, information technology, materials, and consumer staples.

The 10 largest invested companies are FPT Corp (FPT), Vinamilk (VNM), Masan Group (MSN), Mobile World (MWG), Petrolimex (PLX), Sacombank (STB), Hoa Phat Group (HPG), VietinBank (CTG), Baoviet Holdings (BVH), and Vincom Retail (VRE), all listed on the Ho Chi Minh Stock Exchange. They account for a combined 44.6% of the fund’s NAV.

In terms of sectors, financials account for the largest weight, at 20.73%, followed by liquidity (18.15%), consumer (non-cyclical, 13.2%), and real estate (11.97%).

As of May 16, equities made up 81.85% of the fund’s NAV and cash the rest at 18.15%.

In its monthly report, VNHAM forecasts banking earnings to grow 12-16% year-on-year in 2024, driven by 12-14% credit growth and a slight improvement in both net interest margin (NIM) and provision expense.

The headquarters of VietinBank, part of Lumen Vietnam Fund's portfolio, in Hanoi. Photo courtesy of Vietnam News Agency.

Banking earnings are forecast to increase single-digit quarter-on-quarter on the back of stronger credit growth and NIM improvement, implying earnings growth of 15-20% year-on-year in Q2/2024 and Q3/2024, and given the low base of 2023.

Regarding the real estate market, VNHAM anticipates that this year will continue to experience limited supply in the residential property sector, mainly due to supply-side factors.

The land bank for the affordable segment, which is expected to recover first, remains limited. Meanwhile, inventories in other segments, such as hospitality and high-end properties, have struggled to attract buyers. The mismatch between supply and demand is still happening, but is expected to be softer than last year.

It expects most companies to register positive earnings growth in 2024, primarily due to the low base of 2023. However, these earnings will still be modest compared with last year, indicating a gradual recovery in the property market.

- Read More

Real estate, industrials sectors lead in October M&A value in Vietnam

Grant Thornton analysts provide an insight to capital flows, the sectors attracting investor attention, and the market dynamics influencing the merger and acquisition (M&A) landscape in Vietnam in October.

Economy - Mon, November 24, 2025 | 4:39 pm GMT+7

Tobacco giant Vinataba to sell entire stake in instant noodle maker Colusa-Miliket

State-owned Vietnam National Tobacco Corporation (Vinataba) plans to divest its entire 20% stake in Colusa-Miliket, the company behind the iconic “Miliket” (two-shrimp) instant noodle brand, seeking to raise at least VND114 billion ($4.32 million).

Companies - Mon, November 24, 2025 | 4:10 pm GMT+7

VinSpeed cannot participate in North-South high-speed rail project under PPP model: exec

Pham Nhat Vuong, founder of VinSpeed High-Speed Rail Investment and Development JSC, has mapped out a clear 30-year financing plan for the gigantic North-South high-speed rail project, said an executive at Vingroup, a VinSpeed investor.

Infrastructure - Mon, November 24, 2025 | 3:51 pm GMT+7

Delivery major Viettel Post plans $21 mln logistics center in central Vietnam

Viettel Post, the courier arm of military-run telecom giant Viettel, has completed a site survey for a planned 21-hectare logistics center in the central province of Ha Tinh, with an estimated investment of nearly VND550 billion ($20.87 million).

Industries - Mon, November 24, 2025 | 11:49 am GMT+7

Honda Mobilityland eyes 600-ha sports, entertainment, tourism complex in southern Vietnam

Honda Mobilityland Corporation, a subsidiary of Japan’s Honda Motor Co., plans to build an international circuit in Tay Ninh province, towards developing a 600-hectare sports, entertainment, and tourism complex there.

Industries - Mon, November 24, 2025 | 11:23 am GMT+7

State-controlled shipping line Vosco steps up coal trading to seek new revenue drive

Vietnam Ocean Shipping JSC (Vosco), controlled by the state-run Vietnam Maritime Corporation, is moving deeper into coal trading as the shipping line increasingly bids for large import contracts for thermal power plants, marking a push beyond its core maritime transport business.

Companies - Mon, November 24, 2025 | 8:36 am GMT+7

Vietnam SOEs need tailored mechanisms, greater autonomy to accelerate tech investment, innovation: execs

Vietnam's state-owned enterprises (SOEs) need flexible, tailored mechanisms to make rapid decisions, maintain a leading role, drive innovation, and boost competitiveness, said company executives.

Companies - Sun, November 23, 2025 | 8:16 pm GMT+7

Café Amazon retreats, Mixue scales down in Vietnam over intense competition

Vietnam’s food and beverage (F&B) sector is seeing a wave of closures and market exits as rising competition and shifting consumer preferences squeeze profit margins.

Economy - Sun, November 23, 2025 | 2:36 pm GMT+7

Vietnam Education Publishing House strengthens cooperation with Malaysia’s Pelangi Publishing Group

Vietnam Education Publishing House (VEPH) met with Malaysia’s Pelangi Publishing Group in mid November to expand professional exchange and explore deeper cooperation in educational publishing.

Companies - Sun, November 23, 2025 | 12:21 pm GMT+7

French energy giant plans $500 mln investment in green Vietnam projects

French green hydrogen infrastructure developer HDF Energy is looking to invest $500 million in potential energy and transport projects across Vietnam, particularly the southern economic hub of Ho Chi Minh City.

Energy - Sun, November 23, 2025 | 11:29 am GMT+7

Vincom Retail estimated to book $72 mln profit from Hanoi mall sale: broker

Vincom Retail (HoSE: VRE), Vietnam’s leading retail property developer, is set to record an estimated VND1.9 trillion ($72 million) in profit after completing the divestment of its entire equity interest in a Hanoi project last month, according to a report by BSC Securities.

Real Estate - Sun, November 23, 2025 | 8:00 am GMT+7

Market watchdog conference in central Vietnam offers insight into amended securities law

A conference recently held by the State Securities Commission (SSC) in Danang briefed companies and market participants in central Vietnam on amendments to the Securities Law and guiding documents, as part of the authority's 2025 legal dissemination plan.

Finance - Sat, November 22, 2025 | 9:48 pm GMT+7

Central Retail incurs 6% drop in Jan-Sept revenue from Vietnam

Thailand’s top retailer Central Retail posted revenues of nearly THB35.48 billion ($1.09 billion) in Vietnam in the first nine months of this year, down 6.6% year-on-year due to exchange rate fluctuations.

Companies - Sat, November 22, 2025 | 3:32 pm GMT+7

Young leadership mindset drives SHB bank's next growth phase: exec

Young leadership would play a pivotal role as Vietnamese businesses navigate digital transformation and rising global competition, said Do Quang Vinh, vice chairman cum deputy CEO of Saigon-Hanoi Commercial Joint Stock Bank (SHB).

Banking - Sat, November 22, 2025 | 3:23 pm GMT+7

Stock market regulator holds final round of ESG-focused corporate governance contest in Hanoi

The final round of the “Vietnam ESG Challenge 2025”, a competition aimed at promoting sustainable development, modern corporate governance, and social responsibility among Vietnamese university students, took place in Hanoi on Monday.

Finance - Sat, November 22, 2025 | 10:16 am GMT+7

IFC, Vietnam's EVNNPT discuss investment in power transmission projects

Vietnam's National Power Transmission Corporation (EVNNPT) and the International Finance Corporation (IFC), a member of the World Bank Group, have discussed issues related to potential cooperation and investment in power transmission projects under the Power Development Plan VIII (PDP VIII).

Companies - Sat, November 22, 2025 | 9:23 am GMT+7

- Consulting

-

The generation game: Adapting to an aging population

-

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas

-

Powering growth from within

-

Key factors helping firms export to demanding markets: DH Foods exec

-

Vietnam corporate earnings to be driven by credit expansion, trading activity, property recovery

-

Vietnam's International Financial Center ambition can unlock new wave of innovation