Vietnam 10th largest consumer market by 2030: HSBC

Vietnam will become the 10th largest consumer market in the world by 2030, with its speed of growth the fourth highest, according to an HSBC report released Tuesday.

A customer shopping at Lotte Mart in District 7, HCMC, September 2021. Photo courtesy of Laborer newspaper.

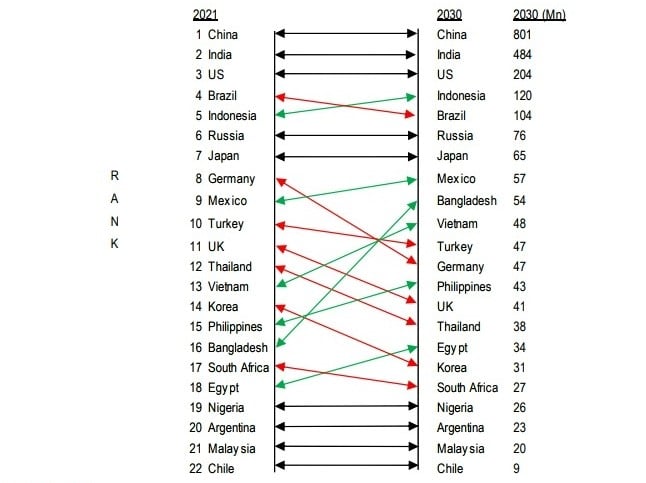

By the end of this decade, Indonesia will overtake Brazil as the fourth-largest consumer market after China, India and the U.S. From the fifth to eighth will be Brazil, Russia, Japan and Mexico, the bank noted in a report named Asia's shoppers in 2030.

Bangladesh will rank ninth globally, Vietnam tenth, followed by Turkey, Germany, the Philippines, the UK and Thailand from 11th to 15th, respectively.

HSBC charter shows consumer markets ranking by 2030.

The fastest-growing market will be Bangladesh, which will overtake Germany and the UK by 2030, according to the report.

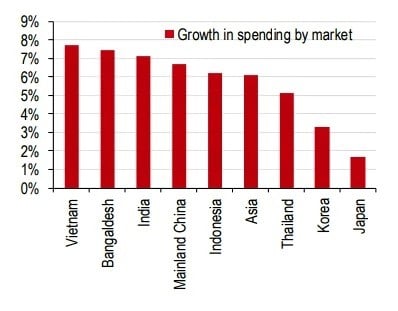

In terms of growth pace, second to Bangladesh will be India, followed by the Philippines, Vietnam and Indonesia.

Vietnam, Bangladesh, and India are expected to see the biggest increases in consumer spending in the decade 2021-2030. A rise of around 7.8% is estimated for Vietnam, 7.4% for Bangladesh, and slightly higher than 7% for India.

HSBC charter shows top consumer spending increases in 2021-2030.

Over the next few decades, the world, Asia in particular, will undergo significant demographic shifts. Asia will become considerably older, wealthier and households will continue to get smaller. These changes will result in significant shifts in spending patterns across Asia, the report says.

In India’s case, the number of people who spend $2-20 a day is falling sharply, while that of those spending $21-50 is rising rapidly.

In China, more people are moving into the upper income bracket, which are people spending over $111 per day. By 2050, these high-end spenders will account for more than 35% of the total population.

In short, it is not the “rising middle class” but Asia’s “upper-middle class” that will be transforming consumer markets, the report adds.

- Read More

Honda Vietnam expands biz registration to cover electric vehicles, charging, battery swapping

Honda Vietnam (HVN) has formally expanded its registered business lines to include electric vehicles, charging infrastructure, and battery-swapping services, marking its most comprehensive step into the electric mobility ecosystem to date.

Companies - Wed, December 17, 2025 | 5:16 pm GMT+7

Vietnam tech unicorn VNG merges two core units into AI-focused GreenNode brand

Vietnamese tech unicorn VNG (UPCoM: VNZ) has merged its cloud computing arm VNG Cloud with AI infrastructure unit GreenNode into the AI-focused GreenNode brand, marking a key step in the company’s “AI-first” strategy.

Companies - Wed, December 17, 2025 | 3:51 pm GMT+7

Becamex to inject $28 mln into VSIP Industrial Park joint venture

Becamex Group (HoSE: BCM) plans to inject an additional VND735 billion ($27.9 million) into the Vietnam-Singapore Industrial Park J.V. Co., Ltd (VSIP JV), as the leading Vietnamese developer steps up investment across its industrial property portfolio.

Companies - Wed, December 17, 2025 | 12:50 pm GMT+7

Vietnam M&A 2025: Opportunities reshaped by disciplined capital

Vietnam’s M&A activity through the first 10 months of 2025 shows a market steadily regaining balance after two volatile years, with dealmaking shaped by rising selectivity, clearer regulatory signals and the return of larger, higher-conviction transactions, write KPMG analysts.

Consulting - Wed, December 17, 2025 | 12:44 pm GMT+7

HCMC plans Cai Mep Ha free trade zone linked to deep-sea port complex

Ho Chi Minh City plans to develop the 3,800-hectare Cai Mep Ha Free Trade Zone (FTZ), linked to Vietnam’s largest deep-sea port complex, Cai Mep-Thi Vai, as it seeks to create a new engine of growth.

Economy - Wed, December 17, 2025 | 11:10 am GMT+7

Cash returns to Vietnamese stock market, but analysts urge caution

Vietnam’s stock market staged a sharp rebound on Tuesday, snapping a five-session losing streak as cash returned to the market, but analysts cautioned that short-term risks remain.

Finance - Wed, December 17, 2025 | 9:36 am GMT+7

'Passion fruit king' Nafoods expands fruit processing investment in central Vietnam

Nafoods Group, one of Vietnam’s largest passion fruit processors, has raised the total investment for its high-tech fruit processing complex in Gia Lai province to VND744 billion ($28.24 million).

Industries - Wed, December 17, 2025 | 8:56 am GMT+7

Japan's Igarashi Reizo builds $24 mln cold storage project in southern Vietnam

Igarashi Reizo, a more than 100-year-old Japanese company specializing in cold storage services, has broken ground for a cold and dry warehouse complex in Tay Ninh province.

Industries - Wed, December 17, 2025 | 8:00 am GMT+7

Which beach in Vietnam boasts the Pantone - 'color of the year 2026'?

As soon as the Pantone Color Institute unveiled “Cloud Dancer” as the Color of the Year 2026, travel lovers quickly made the connection to Kem Beach – the iconic beach in Phu Quoc famed for its rare, velvety-white sand, soft and distinctive in texture.

Travel - Tue, December 16, 2025 | 8:46 pm GMT+7

Unprecedented national milestone in 65 years: Vietnam welcomes 20 millionth international visitor

From 10 million international arrivals in 2016 to 20 million in 2025, Vietnam’s tourism sector has doubled in scale in less than a decade. This historic milestone, officially recorded in Phu Quoc, reflects the exceptional growth momentum and substantial development potential of Vietnam’s tourism industry in a new phase.

Travel - Tue, December 16, 2025 | 8:28 pm GMT+7

Vietnam charges businessman ‘Shark Binh’ with additional tax evasion offence

Vietnamese police have brought additional charges against Nguyen Hoa Binh, widely known as “Shark Binh”, accusing him of tax evasion linked to the operations of fintech firm Vimo Technology JSC, authorities said on Monday.

Society - Tue, December 16, 2025 | 4:33 pm GMT+7

Vietnam blockchain firm Hyra partners with AHT Tech to expand AI capabilities

Hyra Holdings, a Vietnam-based blockchain and artificial intelligence company, has entered a strategic partnership with technology services provider AHT Tech, aiming to scale its AI ecosystem while aligning operations with international security and compliance standards.

Companies - Tue, December 16, 2025 | 3:14 pm GMT+7

Vietnam’s first LNG power plants may incur $38 mln loss in 2026: broker

Vietnam’s first LNG-to-power plants, Nhon Trach 3 and Nhon Trach 4, are expected to post a combined loss of VND1 trillion ($37.98 million) in 2026, their first full year of commercial operations, predicted Vietcap Securities.

Energy - Tue, December 16, 2025 | 3:06 pm GMT+7

Many Vietnamese stocks are trading at deeply discounted valuations: brokerage exec

Nguyen Duy Hung, chairman of Vietnam’s leading brokerage SSI Securities, said many stocks on the local market are "trading at very low valuations", as recent gains in the benchmark index have been driven by only a handful of large-cap names.

Finance - Tue, December 16, 2025 | 2:53 pm GMT+7

FPT forms specialized board to build core capabilities with expansion into rail tech

Vietnam's leading technology corporation FPT (HoSE: FPT) has set up a strategic technology steering committee, underscoring its push to master core technologies including rail-related solutions, and build a high-quality talent base to support long-term competitiveness.

Companies - Tue, December 16, 2025 | 2:05 pm GMT+7

Hanoi approves $32.5 bln Red River scenic boulevard project

Hanoi has approved a massive urban redevelopment project along the Red River which would transform the city’s riverbanks into a new ecological, economic and cultural space, local authorities said.

Real Estate - Tue, December 16, 2025 | 9:00 am GMT+7