Vietnam attracts giant investments in semiconductor industry

Vietnam is drawing attention as an investment destination for global semiconductor companies while electronics makers continue to set up shop in the Southeast Asia country.

The new global production hub boasts a number of advantages including a stable political system, low labor costs, abundant human resources, and geological advantages that offer easy access to high-tech supply chains across Asia.

"We established our office to actively target the increasingly important Vietnamese market," said DS Kwak, vice chairman of Hanmi Semiconductor, a Korean semiconductor equipment company.

In early June, Hanmi Semiconductor opened a global branch office, Hanmi Vietnam, in the northern province of Bac Ninh - an upstart new production base for major global semiconductor companies.

Amkor Technology Inc., a world-leading semiconductor company headquartered in Arizona, the U.S., has so far invested $1.6 billion in Bac Ninh and is preparing to open its factory there at the end of this year, with trial operations set to start in October after construction is completed in September.

The factory will be among the biggest operated by Amkor globally and will cover around 23 hectares in the Yen Phong II-C Industrial Park.

Amkor Technology Vietnam CEO Kim Sung Hun, while speaking to Bac Ninh’s Party chief Nguyen Anh Tuan during a recent visit to the Amkor Technology Vietnam site, said that Amkor had selected the province for the mammoth project thanks to Bac Ninh's favorable investment environment, robust infrastructure, and synchronized utility networks that encompass electricity, water, and communications.

He added that Bac Ninh offers the necessary conditions to nurture talent and a highly skilled technical workforce, with positive support from the provincial leadership and local authorities.

Amkor was founded in 1968 by Korean businessman Hyang-Soo Kim. When Amkor received an investment certificate in November 2021 to build the state-of-the-art smart factory in Bac Ninh, Megan Faust, Amkor’s executive vice president and chief financial officer, said: “Our investment for the first phase of the facility is estimated to be between $200 million and $250 million, and expanding the facility in phases over time will allow us to balance utilization and profitable growth and manage expansion within a reasonable capital intensity range.”

Samsung, which is the single largest foreign investor in Vietnam to date, has invested a total of $20 billion in the country. Last year, Samsung Electronics Co. Ltd. announced a total investment plan of $2.27 billion to expand its next-generation semiconductor substrate (FC-BGA) business.

In Bac Ninh, the Korean giant has two companies - Samsung Electronics Vietnam (SEV) and Samsung Display Vietnam (SDV). It operates Samsung Electronics Vietnam Thai Nguyen (SEVT) in Thai Nguyen province, also in the north, and Samsung HCMC CE Complex (SEHC) in Ho Chi Minh City. The four Vietnam subsidiaries reported after-tax profits of KRW6,055.9 billion ($4.67 billion) in 2022, up 16.28% compared with 2021.

According to a recent report by the Bank of Korea (BOK), Vietnam is quickly becoming a significant market for South Korean semiconductor makers, who have been grappling with lackluster demand in China. As tensions between the U.S. and China accelerate, the bank emphasized the importance of diversifying export markets for industry giants like Samsung Electronics and SK Hynix.

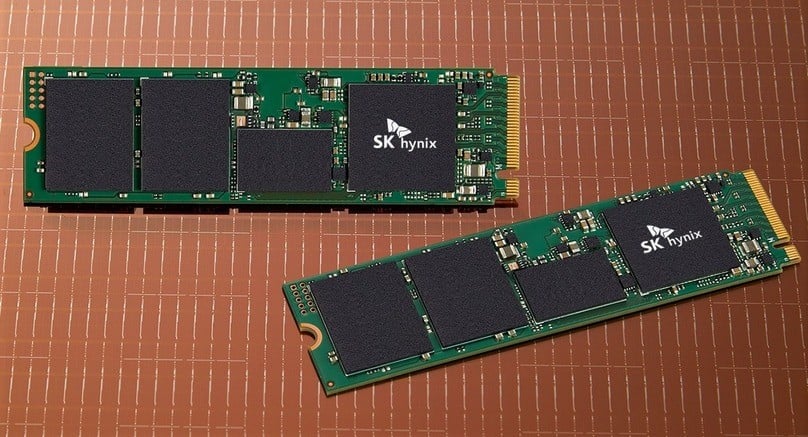

Chips made by SK Hynix, an arm of Korean leading conglomerate SK Group. Photo courtesy of SK Hynix.

The BOK underlines Vietnam’s emergence as a new source of demand for South Korean semiconductors, highlighting the Southeast Asian country’s growing status as an international hub for IT device production and potentially positioning it as an alternative to China.

Vietnam’s abundant low-wage workforce and its proximity to the Chinese market are attracting global businesses, including South Korean firms, to establish manufacturing facilities in the new global production hub, according to the BOK report.

On Monday, SKC Co., a South Korean manufacturer of advanced materials, signed a preliminary agreement with Vietnam's Hai Phong City to explore potential investment in advanced materials for semiconductors, secondary batteries, and other green sectors. SKC said it will consider ways to invest in Hai Phong, a major port city and logistics hub in the north, as a site for the Korean firm’s expansion into high-tech materials.

At present, American giant chipmaker Intel is also considering an additional investment of $1 billion from the $1.5 billion previously announced in HCMC. The HCMC chip assembly and test factory is Intel's largest production base, accounting for around 70% of its global production.

In Bac Giang province near Bac Ninh (home to Amkor’s $1.6 billion semiconductor plant), Korea’s Hana Micron Inc., a printed circuit board maker, plans to increase the number of its Vietnamese factory workers to 3,000 by 2025.

The current number of employees has not been disclosed, but it is expected to be between 300 and 400. Hana Micron is continuously increasing technology development engineers and production personnel at its Vietnamese plant, a major production base for its global outsourced semiconductor assembly and test (OSAT) facility.

Hana Micron’s main customers are Samsung Electronics and SK Hynix, which is part of Korean conglomerate SK Group, the parent corporation of SKC Co.

- Read More

Thailand’s Super Energy earns $81 mln in Jan-Sep revenue from Vietnam

Super Energy Corporation, a Thai renewable-energy developer, recorded about THB2.62 billion ($81.28 million) in revenue from its Vietnam operations in the first nine months of 2025, according to its Q3 earnings report.

Companies - Wed, November 26, 2025 | 4:51 pm GMT+7

Turning point of Vietnam's fund management industry: exec

Vietnam’s asset management industry is entering a pivotal phase as the country seeks to diversify capital flows and strengthen long-term funding, said Lu Hui Hung, CEO of Phu Hung Fund Management, citing the Ministry of Finance's recently issued Decision 3168.

Finance - Wed, November 26, 2025 | 4:42 pm GMT+7

Gelex Infrastructure okayed to launch IPO of 100 mln shares

Gelex Infrastructure JSC has received approval from the State Securities Commission of Vietnam to proceed with an initial public offering of 100 million shares, the company said.

Companies - Wed, November 26, 2025 | 3:52 pm GMT+7

Seven young PV Gas employees selected for Petrovietnam’s 'Outstanding Youth 2025' program

Seven young employees of PetroVietnam Gas (PV Gas) have been selected for Petrovietnam’s “Outstanding Youth 2025” program, an initiative aimed at identifying and developing high-potential talent across the state energy group.

Companies - Wed, November 26, 2025 | 3:01 pm GMT+7

Deep C Industrial Zones in northern Vietnam draws three new projects worth over $242 mln

Deep C Industrial Zones in Quang Ninh province has secured three new investment projects with combined registered capital of about VND6.38 trillion ($242 million), reinforcing its position as an attractive destination for manufacturing and logistics.

Industries - Wed, November 26, 2025 | 1:58 pm GMT+7

Billionaire Pham Nhat Vuong's son takes helm at VinMetal as Vingroup pledges support for loss-making steel producer Pomina

Vingroup, Vietnam's biggest listed company by market cap, said its steel subsidiary VinMetal will provide Pomina Steel with a zero-interest working capital loan for up to two years, helping the troubled steelmaker stabilize operations and restore cash flow.

Companies - Wed, November 26, 2025 | 12:38 pm GMT+7

HAGL chairman says he sold 'everything possible' to save the company

Hoang Anh Gia Lai (HAGL) has successfully restructured with its debt reduced from VND36 trillion ($1.37 billion) to over VND6 trillion ($227.5 million), now focusing on developing raw material areas to gain scale advantages.

Companies - Wed, November 26, 2025 | 8:18 am GMT+7

Vingroup subsidiary VinMetal may acquire loss-making steel producer Pomina: broker

Ho Chi Minh City Securities (HSC) analysts said a potential acquisition of steel manufacturer Pomina could be a strategic move that allows VinMetal to gain a faster foothold in the steel industry by using Pomina’s existing construction steel capacity.

Companies - Tue, November 25, 2025 | 8:05 pm GMT+7

Vingroup plans $38 mln bond issuance to restructure debt

Vingroup (HoSE: VIC), Vietnam’s largest listed company by market cap, plans to issue VND1 trillion ($37.91 million) in bonds via private placement as it seeks to restructure debt.

Companies - Tue, November 25, 2025 | 3:52 pm GMT+7

Vietnam gov't proposes minimum $379 mln charter capital for offshore wind developers

The Vietnamese government has proposed that offshore wind power developers have a minimum charter capital of VND10 trillion ($379 million) each, according to a draft resolution designed to ease bottlenecks in the country’s 2026-2030 energy development plan.

Energy - Tue, November 25, 2025 | 3:41 pm GMT+7

Petrovietnam arm to venture into CO2 transportation, seabed minerals, geothermal

PVEP, the upstream arm of state giant Petrovietnam, plans to expand into new fields such as CO2 transportation and disposal (carbon capture, utilization, and storage), coal gas and underground mineral research, seabed minerals, and geothermal.

Industries - Tue, November 25, 2025 | 3:08 pm GMT+7

MB successfully closes landmark $500 mln inaugural green term loan facility agreement

Military Commercial Joint Stock Bank (MB) on Monday announced the successful closing of its three-year $500 million inaugural Green Term Loan Facility Agreement, marking a significant milestone in the bank’s sustainable financing journey.

Banking - Tue, November 25, 2025 | 2:17 pm GMT+7

Impact of rising exchange rates in Vietnam

Mirae Asset Securities analysts offer an insight into the impact of rising exchange rates on companies in Vietnam in a report dated November 21.

Economy - Tue, November 25, 2025 | 1:35 pm GMT+7

Vietnam's industrial park developers post strong earnings as tenant demand rebounds

Vietnam’s industrial real estate sector is showing stronger earnings and improving demand, with foreign tenants resuming lease negotiations after U.S. tariff policies became clearer, according to a brokerage report.

Industrial real estate - Tue, November 25, 2025 | 11:07 am GMT+7

Vietnamese export stocks under the radar despite strong earnings

Investor caution over tariff risks and the slowdown of major economies has prevented Vietnamese export stocks from making a strong price recovery.

Finance - Tue, November 25, 2025 | 8:44 am GMT+7

Indonesia plans 7 initial waste-to-energy plants next year

Indonesia will start the construction of seven waste-to-energy power plants in 2026 as the first step to develop 33 such facilities by 2029.

Southeast Asia - Mon, November 24, 2025 | 9:23 pm GMT+7