Vietnam's seafood industry: challenges and prospects for the future

Over the past three years, the Vietnamese seafood industry has demonstrated strong resilience and adaptability despite fluctuations in global demand and, at times, challenging local conditions. The industry has opportunities but faces challenges, write Dr. Richard Ramsawak and Dr. Adeel Ahmed, economics lecturers at RMIT.

Shrimp and shrimp products are leading contributors to Vietnam's seafood export value. Photo courtesy of Vietnam News Agency.

Vietnam's total seafood exports reached $11 billion in 2022, the third highest global export value after China and Norway. The largest export markets for Vietnam’s seafood products remained the U.S, China, Japan, and South Korea.

Vietnam continues diversifying its seafood exports, with shrimp and shrimp products being the leading contributors to export value. Aquaculture production is also becoming an increasingly important component of overall seafood production. This remains a deliberate strategy by the government to reduce the over-exploitation of offshore and near shore resources and reign in quality standards. However, the production of seafood products has declined in recent years due to rising costs.

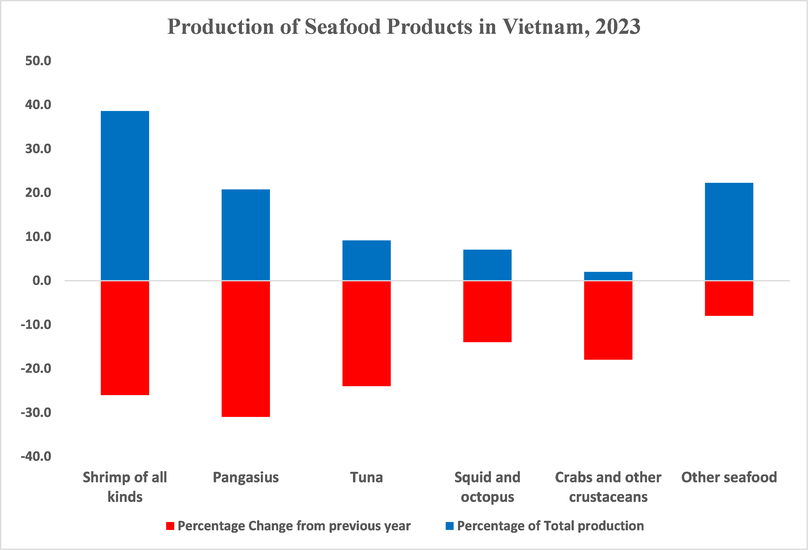

Production of seafood products in Vietnam in 2023. Source: Vietnam Association of Seafood Exporters and Producers (VASEP).

Indeed, the buoyancy witnessed in 2022 was followed by challenges in 2023. The global economic slowdown cast a shadow over the industry, impacting growth in export markets. Experts estimate that exports to the U.S. will decline by 32%, followed by China with 15%. Exports to South Korea, Japan, and the EU are also expected to decline by 10% to 20%.

The Ministry of Agriculture and Rural Development has already lowered its predictions for Vietnam's seafood exports by 5% to $9.5 billion for 2024, which is still 3% higher than in 2023. The seafood industry in Vietnam also continues to suffer from rising input and transportation costs, which continue to constrain producers' margins, and there remains an urgent need for infrastructure upgrades, particularly among fish farming communities.

Despite these challenges, the Vietnamese government, in collaboration with industry stakeholders, continues to implement measures to ensure the sustainability and competitiveness of the seafood sector. The removal of the yellow card for Illegal, Unreported, and Unregulated fishing (IUU) remains a crucial priority for the industry, which requires confronting the biggest issues of lack of traceability of seafood products, ensuring food safety is maintained throughout the seafood value chain, and implementing steps to combat illegal fishing.

As the industry addresses these obstacles, it remains integral to the nation's economic landscape, with its performance intricately tied to both domestic and global economic dynamics. Roughly 3.9 million people are working in Vietnam’s seafood industry, mostly women, so apart from its economic contribution, the industry also contributes significantly the socio-economic landscape in Vietnam.

Future prospects and opportunities

In 2024, it is forecast that seafood production and exports in Vietnam will face numerous challenges. The key factor contributing to these difficulties is global inflation, which has negatively impacted the consumption and demand for seafood worldwide. Geopolitical issues, particularly the Russia-Ukraine conflict, have further disrupted global trade, leading to increased transportation costs and input prices for aquaculture and seafood processing.

This challenging scenario is particularly significant for major export items like Vietnamese shrimp and pangasius. Intense competition is expected, resulting in a substantial increase in shrimp production (around 5.9 million tons) and subsequently lower prices. Additionally, the value addition of pangasius will pose a challenge for exporters of this product.

While the overall cycle of price decline for many aquatic species may persist until the end of the first half of 2024, there is a notable shift in consumer demand towards more affordable product segments. This shift focuses on canned fish, raw fish for processing canned fish, dried fish, and dried shrimp.

The seafood industry in Vietnam faces further obstacles in terms of market access. The persistent issue of the IUU yellow card poses a significant challenge, potentially causing a halt to EU exports due to a lack of adequate human resources and infrastructure. Simultaneously, the fast recovery of the Chinese market demand and high competition and low prices present a complex scenario for the Vietnamese seafood industry to manage. This combination of challenges creates a complex landscape for Vietnam's seafood production and exports in 2024.

Despite the numerous challenges mentioned earlier, an opportunity is also on the horizon. The inclusion of Japanese investments in seafood processing in Vietnam is anticipated to contribute to the gradual recovery of Vietnam's seafood exports in 2024, with a more positive outlook expected in the year's second half.

Through adaptation and adjustment to the market context, it is predicted that seafood businesses will play a crucial role in helping the industry's export sales recover in the coming years. This potential recovery is a ray of hope amid the Vietnamese seafood industry's complex landscape.

- Read More

Vingroup plans $38 mln bond issuance to restructure debt

Vingroup (HoSE: VIC), Vietnam’s largest listed company by market cap, plans to issue VND1 trillion ($37.91 million) in bonds via private placement as it seeks to restructure debt.

Companies - Tue, November 25, 2025 | 3:52 pm GMT+7

Vietnam gov't proposes minimum $379 mln charter capital for offshore wind developers

The Vietnamese government has proposed that offshore wind power developers have a minimum charter capital of VND10 trillion ($379 million) each, according to a draft resolution designed to ease bottlenecks in the country’s 2026-2030 energy development plan.

Energy - Tue, November 25, 2025 | 3:41 pm GMT+7

Petrovietnam arm to venture into CO2 transportation, seabed minerals, geothermal

PVEP, the upstream arm of state giant Petrovietnam, plans to expand into new fields such as CO2 transportation and disposal (carbon capture, utilization, and storage), coal gas and underground mineral research, seabed minerals, and geothermal.

Industries - Tue, November 25, 2025 | 3:08 pm GMT+7

MB successfully closes landmark $500 mln inaugural green term loan facility agreement

Military Commercial Joint Stock Bank (MB) on Monday announced the successful closing of its three-year $500 million inaugural Green Term Loan Facility Agreement, marking a significant milestone in the bank’s sustainable financing journey.

Banking - Tue, November 25, 2025 | 2:17 pm GMT+7

Impact of rising exchange rates in Vietnam

Mirae Asset Securities analysts offer an insight into the impact of rising exchange rates on companies in Vietnam in a report dated November 21.

Economy - Tue, November 25, 2025 | 1:35 pm GMT+7

Vietnam's industrial park developers post strong earnings as tenant demand rebounds

Vietnam’s industrial real estate sector is showing stronger earnings and improving demand, with foreign tenants resuming lease negotiations after U.S. tariff policies became clearer, according to a brokerage report.

Industrial real estate - Tue, November 25, 2025 | 11:07 am GMT+7

Vietnamese export stocks under the radar despite strong earnings

Investor caution over tariff risks and the slowdown of major economies has prevented Vietnamese export stocks from making a strong price recovery.

Finance - Tue, November 25, 2025 | 8:44 am GMT+7

Indonesia plans 7 initial waste-to-energy plants next year

Indonesia will start the construction of seven waste-to-energy power plants in 2026 as the first step to develop 33 such facilities by 2029.

Southeast Asia - Mon, November 24, 2025 | 9:23 pm GMT+7

Malaysia predicted to be ASEAN’s second-fastest-growing economy, after Vietnam

Malaysia is poised to become the second-fastest-growing economy in the Association of Southeast Asian Nations (ASEAN) after Vietnam, data showed.

Southeast Asia - Mon, November 24, 2025 | 9:19 pm GMT+7

Thailand SCG-backed Bien Hoa Packaging plans delisting from HCMC bourse

Bien Hoa Packaging JSC, a 57-year-old manufacturer in Vietnam, plans to scrap its public-company status and delist from the Ho Chi Minh Stock Exchange (HoSE) as its free float fell below the minimum threshold under local securities law.

Companies - Mon, November 24, 2025 | 9:06 pm GMT+7

Real estate, industrials sectors lead in October M&A value in Vietnam

Grant Thornton analysts provide an insight to capital flows, the sectors attracting investor attention, and the market dynamics influencing the merger and acquisition (M&A) landscape in Vietnam in October.

Economy - Mon, November 24, 2025 | 4:39 pm GMT+7

Tobacco giant Vinataba to sell entire stake in instant noodle maker Colusa-Miliket

State-owned Vietnam National Tobacco Corporation (Vinataba) plans to divest its entire 20% stake in Colusa-Miliket, the company behind the iconic “Miliket” (two-shrimp) instant noodle brand, seeking to raise at least VND114 billion ($4.32 million).

Companies - Mon, November 24, 2025 | 4:10 pm GMT+7

VinSpeed cannot participate in North-South high-speed rail project under PPP model: exec

Pham Nhat Vuong, founder of VinSpeed High-Speed Rail Investment and Development JSC, has mapped out a clear 30-year financing plan for the gigantic North-South high-speed rail project, said an executive at Vingroup, a VinSpeed investor.

Infrastructure - Mon, November 24, 2025 | 3:51 pm GMT+7

Delivery major Viettel Post plans $21 mln logistics center in central Vietnam

Viettel Post, the courier arm of military-run telecom giant Viettel, has completed a site survey for a planned 21-hectare logistics center in the central province of Ha Tinh, with an estimated investment of nearly VND550 billion ($20.87 million).

Industries - Mon, November 24, 2025 | 11:49 am GMT+7

Honda Mobilityland eyes 600-ha sports, entertainment, tourism complex in southern Vietnam

Honda Mobilityland Corporation, a subsidiary of Japan’s Honda Motor Co., plans to build an international circuit in Tay Ninh province, towards developing a 600-hectare sports, entertainment, and tourism complex there.

Industries - Mon, November 24, 2025 | 11:23 am GMT+7

State-controlled shipping line Vosco steps up coal trading to seek new revenue drive

Vietnam Ocean Shipping JSC (Vosco), controlled by the state-run Vietnam Maritime Corporation, is moving deeper into coal trading as the shipping line increasingly bids for large import contracts for thermal power plants, marking a push beyond its core maritime transport business.

Companies - Mon, November 24, 2025 | 8:36 am GMT+7